June 16, 2024

Sarama Resources Ltd. (“Sarama” or the “Company”) (ASX:SRR, TSX- V:SWA) is pleased to present its investor presentation.

INVESTMENT HIGHLIGHTS

50KM UNEXPLORED GREENSTONE BELT IN WA + 0.5M OZ OF GOLD IN WEST AFRICA

Sarama has signed a Non-Binding MOU1 to acquire the Cosmo Newbery Project, highlights include:

- Project situated on one of the last unexplored greenstone belts in Western Australia

- Tenure is contiguous over 583km2 and covers the entire +50 km of greenstone belt

- The belt has seen virtually no modern exploration and no drilling of merit

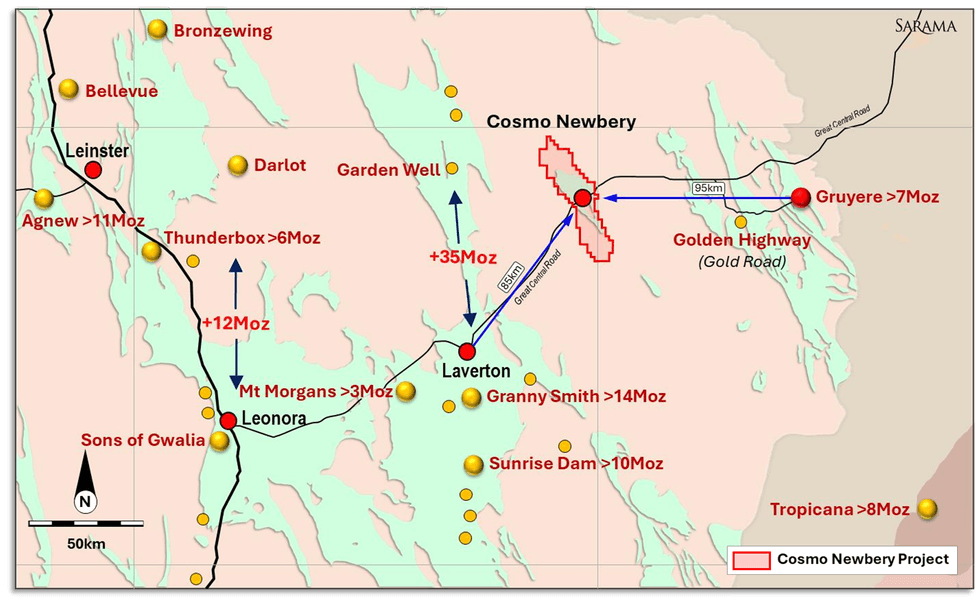

- Located 95km west of +7Moz Gruyere (Gold Road) and 85km northeast of Laverton

- Documented historical gold workings (discovered in 1890’s)

- Reserve since 1980 but Land access now obtained, easy access via Great Central Road

Material additional value includes:

- Burkina Faso gold assets including 100% owned, 0.5Moz (Inf) Bondi Gold Deposit2

- Significant arbitration claim3

COSMO NEWBERY PROJECT LOCATION

LOOKING FOR GOLD IN AN AREA SURROUNDED BY GOLD

EXPLORATION OPPORTUNITY

LARGE AND PROSPECTIVE SYSTEM WITH MULTIPLE TARGETS TO BE TESTED

- Cosmo Newbery greenstone belt has clear gold showings and strong geological and structural similarities to the adjacent Dorothy Hills greenstone belt which hosts the +7Moz Gruyere gold deposit

- Project is underlain by prospective volcanic and volcano-sediment rocks with localised intrusives, however is mostly under shallow cover and has seen little to no significant exploration

- A major regional fault/shear system extends for over 50km through the Project

- The fault/shear system combined with granite-greenstone rocks has the potential to provide requisite fluid pathways and favorable host rocks that are amenable to gold mineralization

- Historic, small-scale mining east of this regional system indicates gold deposition in the immediate area

- Soil geochemical and geophysical surveys identified numerous exploration targets for gold and nickel-cobalt

- Currently 8 areas of interest & 17 specific interpreted targets for follow up

This article includes content from Sarama Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SRR:AU

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 November 2025

Sarama Resources

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim.

Promising new gold projects in Western Australia, plus a large fully funded arbitration claim. Keep Reading...

14 August 2025

Q2 2025 Interim Financial Statements

Sarama Resources (SRR:AU) has announced Q2 2025 Interim Financial StatementsDownload the PDF here. Keep Reading...

04 August 2025

Sarama Provides Update on Arbitration Proceedings

Sarama Resources (SRR:AU) has announced Sarama Provides Update on Arbitration ProceedingsDownload the PDF here. Keep Reading...

09 July 2025

Completion of Tranche 1 Equity Placement & Cleansing Notice

Sarama Resources (SRR:AU) has announced Completion of Tranche 1 Equity Placement & Cleansing NoticeDownload the PDF here. Keep Reading...

29 June 2025

A$2.7m Equity Placement to Fund Laverton Drilling Campaign

Sarama Resources (SRR:AU) has announced A$2.7m Equity Placement to Fund Laverton Drilling CampaignDownload the PDF here. Keep Reading...

25 June 2025

Trading Halt

Sarama Resources (SRR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

3h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

7h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

23 February

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Sarama Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00