- WORLD EDITIONAustraliaNorth AmericaWorld

November 19, 2023

Charger Metals NL (ASX: CHR, ‘Charger’ or ‘the Company’) is pleased to announce it has entered into a binding farm-in agreement with Rio Tinto Exploration Pty Ltd (“RTX”), a wholly-owned subsidiary of Rio Tinto Limited (ASX:RIO) for its Lake Johnston Lithium Project in the Yilgarn of Western Australia (RTX Agreement).

- Charger has entered into a binding agreement with Lithium Australia Limited (ASX: LIT) to purchase their minority interest in the Lake Johnston Lithium Project for $2 million to increase Charger’s interest to 100% (LIT Agreement)1.

- Simultaneously, Rio Tinto Exploration Pty Ltd (“RTX”), a wholly-owned subsidiary of Rio Tinto Limited (ASX: RIO), has signed a binding farm-in agreement for the Lake Johnston Lithium Project (RTX Agreement)1:

- RTX to pay Charger $500,000 and invest $1.2 million in Charger prior to commencement of farm-in;

- RTX to spend minimum $3 million exploration expenditure over the first 12 months;

- RTX can earn 51% by sole funding $10 million in exploration expenditure and paying Charger minimum further cash payments of $1.5 million;

- RTX can earn 75% by sole funding $40 million in exploration expenditure or completing a Definitive Feasibility Study.

- The RTX deal reaffirms the prospectivity of the Lake Johnston Lithium Project and its potential to host a large-scale lithium deposit.

Charger is also pleased to announce it has simultaneously entered into a binding agreement with Lithium Australia Limited (ASX:LIT) to purchase their minority interest in the Lake Johnston Lithium Project moving the Company to a 100% beneficial ownership (LIT Agreement), subject to shareholder approval, other third party approvals and the RTX Agreement.

Charger’s Managing Director, Aidan Platel, commented:

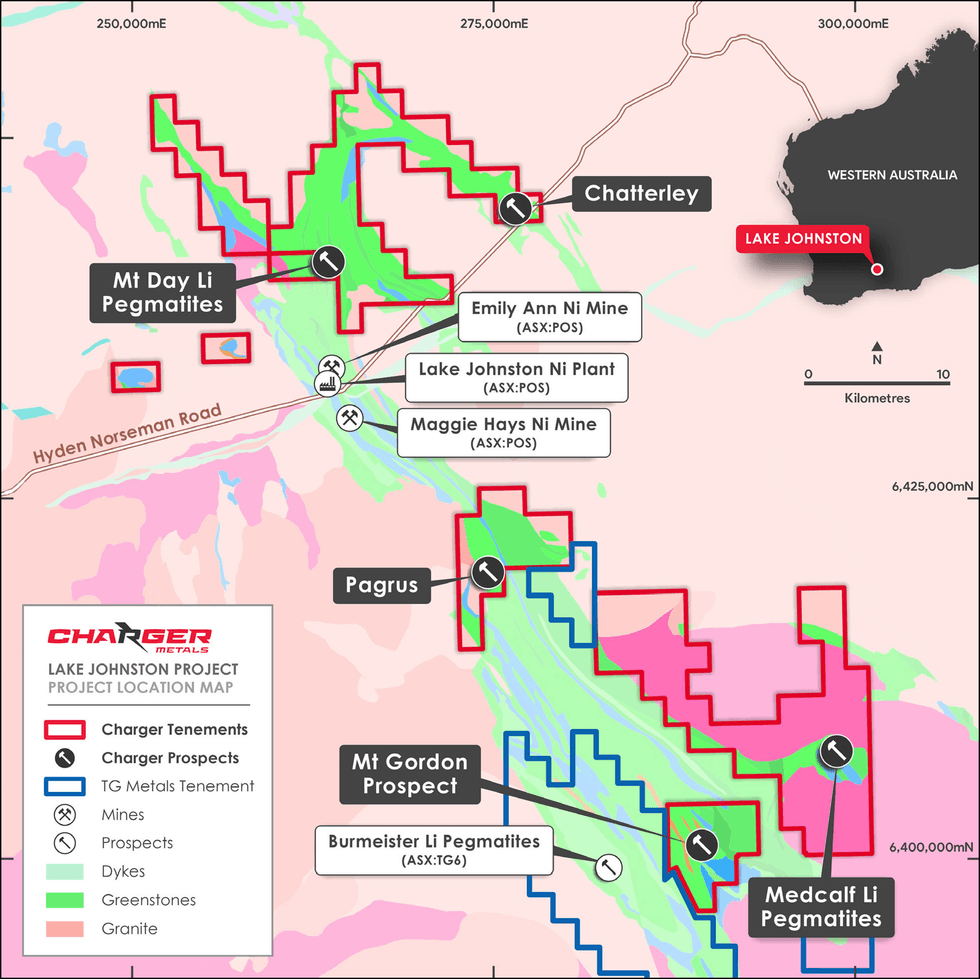

“The Rio Tinto Exploration farm-in agreement is an excellent result for Charger and its shareholders and reaffirms our belief that the Lake Johnston Project has potential to host a large-scale lithium deposit. The planned significant investment by RTX will allow thorough systematic exploration over all of the project tenure, with initial exploration focused on fast-tracking the Medcalf Spodumene Prospect as well as progressing the Mt Day and Mt Gordon lithium prospects.”

Charger’s Chairman, Adrian Griffin, commented:

“The Rio Tinto Exploration farm-in agreement will see them potentially spending up to $42.5 million to earn up to a 75% interest in the Lake Johnston Project. The largely unexplored Lake Johnston Greenstone belt now hosts multiple spodumene discoveries and with the recent focus and increasing exploration activity could evolve into a prominent lithium province.”

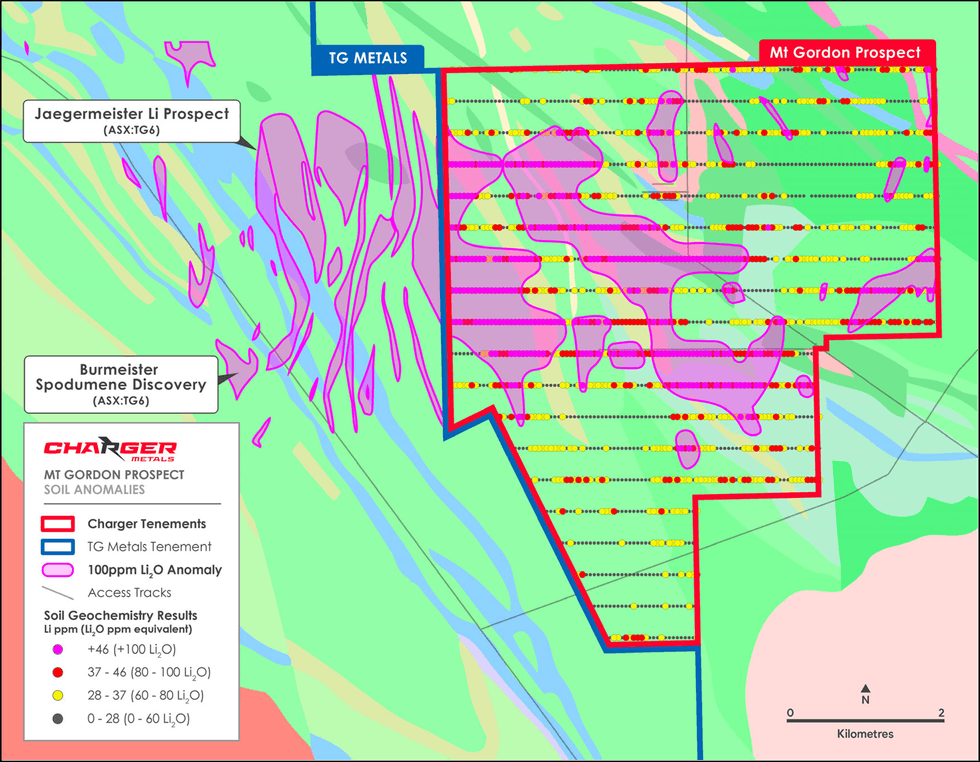

TG Metals has conducted infill and extensional soil sampling (400m x 50m spacing) over the area immediately east of their recent discovery of a spodumene rich pegmatite at Burmeister (TG6 ASX announcements of 30 October 2023 and 13 November 2023). The results have defined a new area of lithium-in-soils anomalism, identified as the Jaegermeister Prospect, which extends to Charger’s 100% owned Mt Gordon lithium prospect (see Figure 3).

About the Lake Johnston Lithium Project

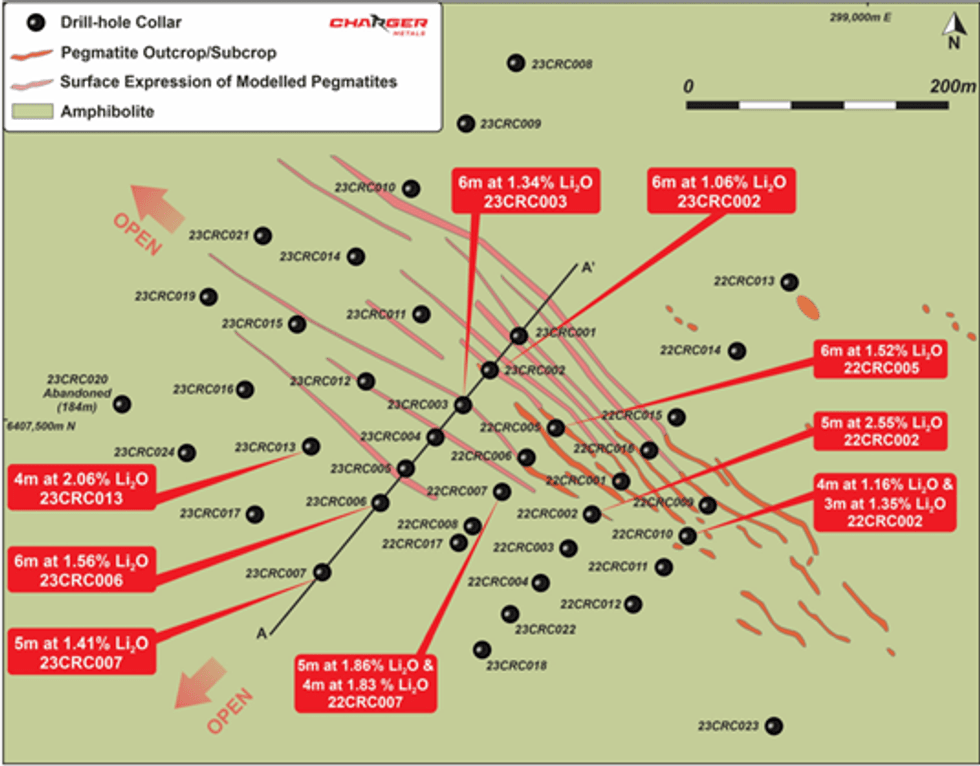

The Lake Johnston Lithium Project is located 450km east of Perth, Western Australia. Lithium prospects occur within a 50km long corridor along the southern and western margin of the Lake Johnston granite batholith. Key target areas include the Medcalf Spodumene Prospect, the Mt Gordon Lithium Prospect and much of the Mount Day LCT pegmatite field, prospective for lithium and tantalum minerals.

The Lake Johnston Lithium Project is located approximately 70km east of the large Earl Grey (Mt Holland) Lithium Project which is under development by Covalent Lithium Pty Ltd (manager of a joint venture between subsidiaries of Sociedad Química y Minera de Chile S.A. and Wesfarmers Limited). Mt Holland is understood to be one of the largest hard-rock lithium projects in Australia with Ore Reserves for the Earl Grey Deposit estimated at 189 Mt at 1.5% Li2O.4

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CHR:AU

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00