CMC Metals Ltd. (TSXV:CMB)(Frankfurt:ZM5P)(OTC PINK:CMCXF) ("CMC" or the "Company") is pleased to announce that Intelligent Exploration ("IE') has completed a detailed interpretation of the SkyTEM airborne geophysical survey that recommends drill testing of Targets T-1 and T-4 at its flagship Silver Hart Project, south-central Yukon. Dr. Chris Hale and John Gilliatt of IE have recommended an initial 5,000-meter drill program to provide up to three drill holes on sections spaced 100 meters apart over each conductor

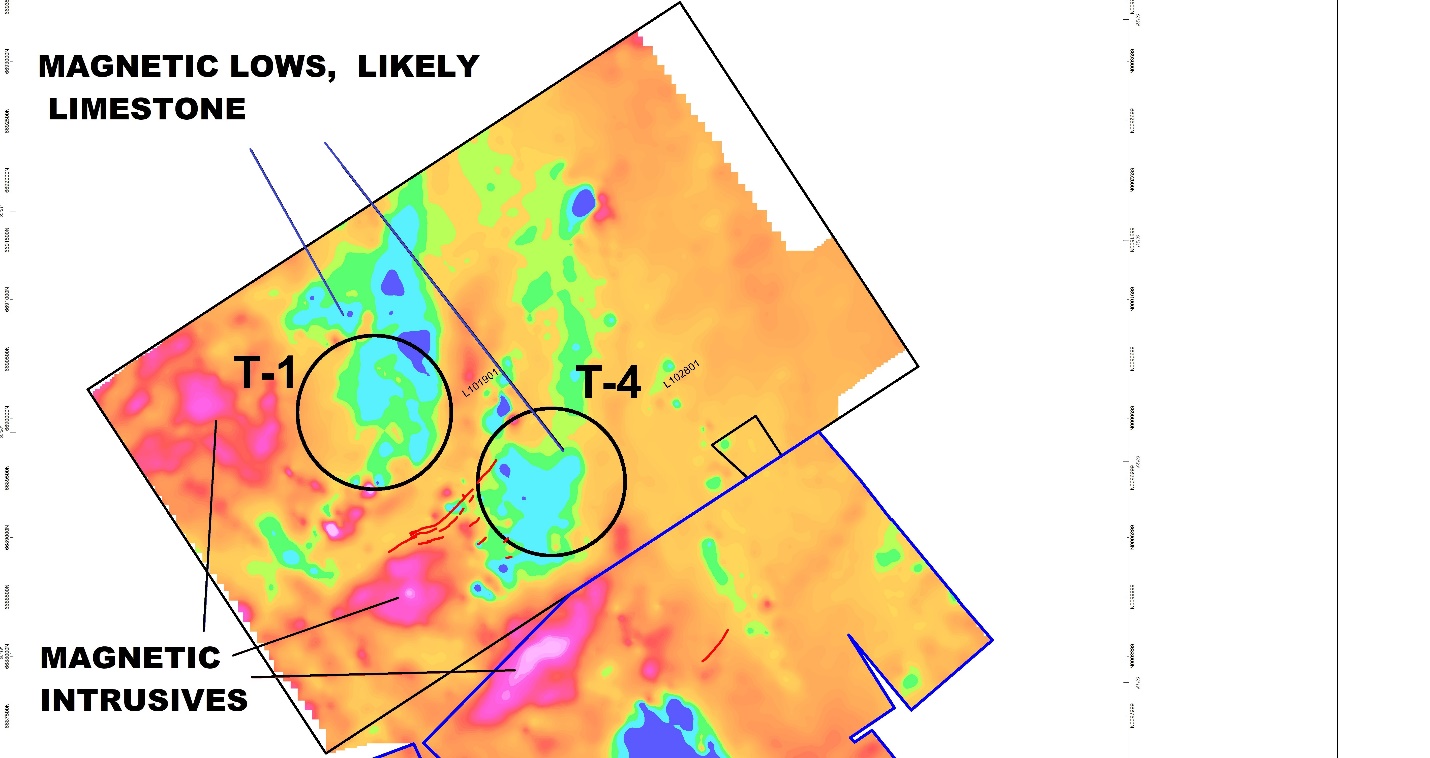

Figure 1: Total Magnetic Intensity ("TMI") Map: The magnetic data divide the Silver Hart and Blue Heaven properties into areas of higher TMI (likely underlain by intrusive rocks - Cassiar Batholith) and low TMI (indicated by green and blue colors - likely sedimentary rocks. Note that that SkyTEM Targets T-1 and T-4 occur within the lower TMI areas (sedimentary domains), at or near the Batholith contact.

Highlights and key conclusions of the report include:

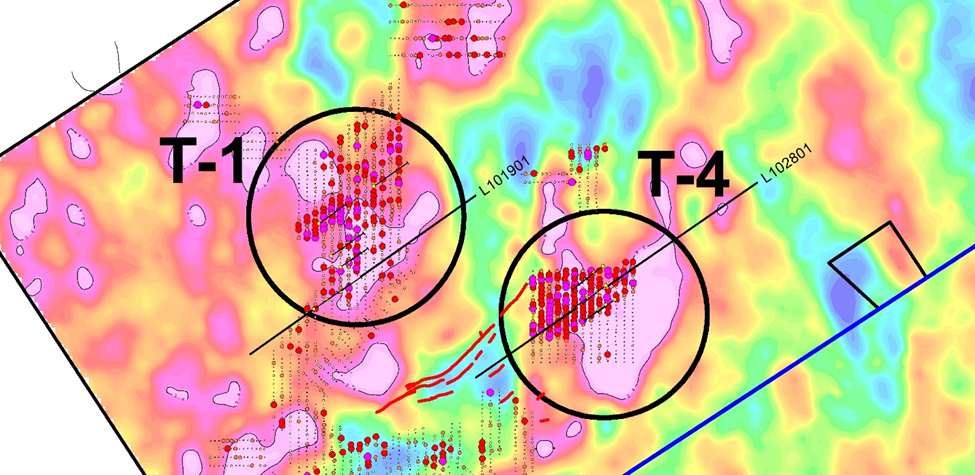

- Both targets appear as distinct conductive bodies within sedimentary rocks, close to the contact with the Cassiar Batholith. They coincide with significant silver-lead-zinc anomalies;

- Both targets are in close proximity to the Main Zone vein system which has been the focus of exploration on the property to date. These veins potentially represent a feeder system for skarn and or carbonate replacement ("CRD") deposits;

- The conductive zone T-1 has been interpreted to dip moderately towards the southwest for up to 1,100 meters, with a thickness of up to 250 meters, and a strike extent of up to 800 meters (see Figure 6 attached). In many places it is near surface, possibly providing an explanation for the very strong silver anomalies in that area; and,

- The conductive zone T-4 has been interpreted to have a more consistent, shallow to moderate dip to the northeast, becoming sub-horizontal below 200 meters depth. It is interpreted to extend to ~600 meters down dip, with a thickness of up to 150 meters and a strike extent over 400 meters. This area is located immediately northeast of the mineralized vein system of the Main Zone and north of an area where mineralized showings have been exposed in trenches.

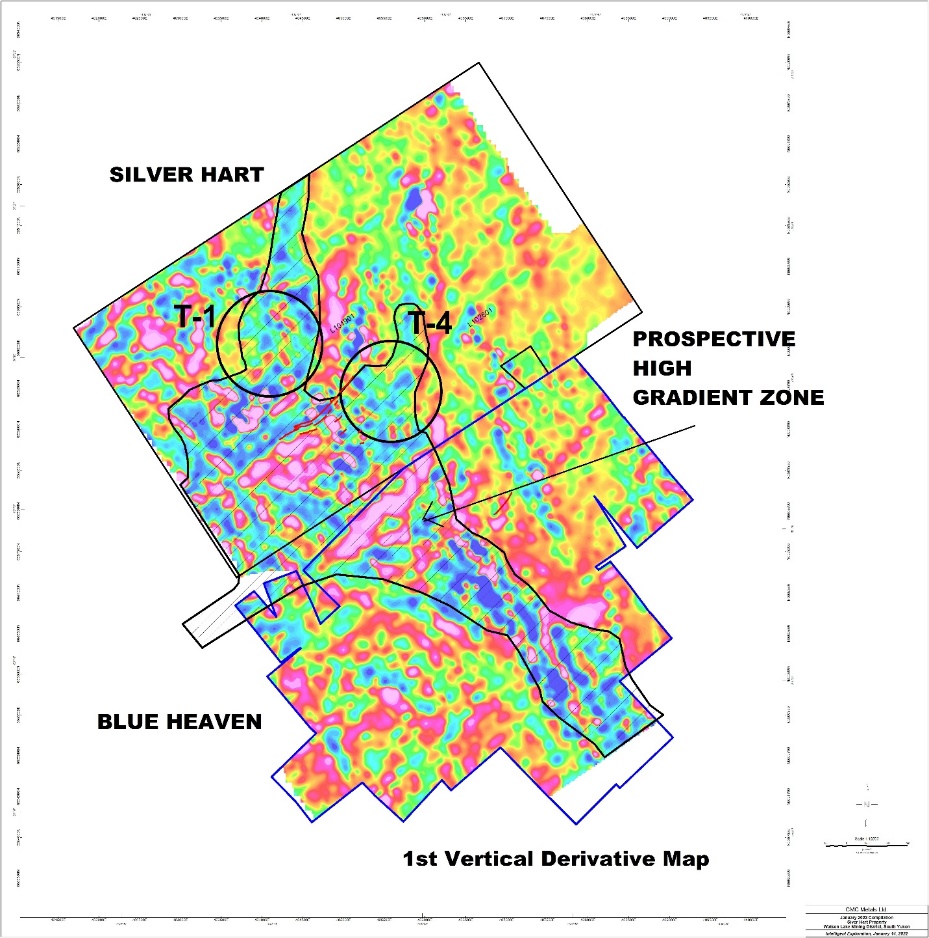

Figure 2: The highly prospective area within the Silver Hart and Blue Heaven claims is outlined. It represents a significant corridor of rapidly changing magnetic gradients running in a NNW-SSE direction that signifies the contact between intrusive rocks of the Cassiar Batholith (i.e, the "heat source) with sedimentary sequences that are most prospective for skarn and/or carbonate replacement deposits (After Hale and Gilliatt, 2022).

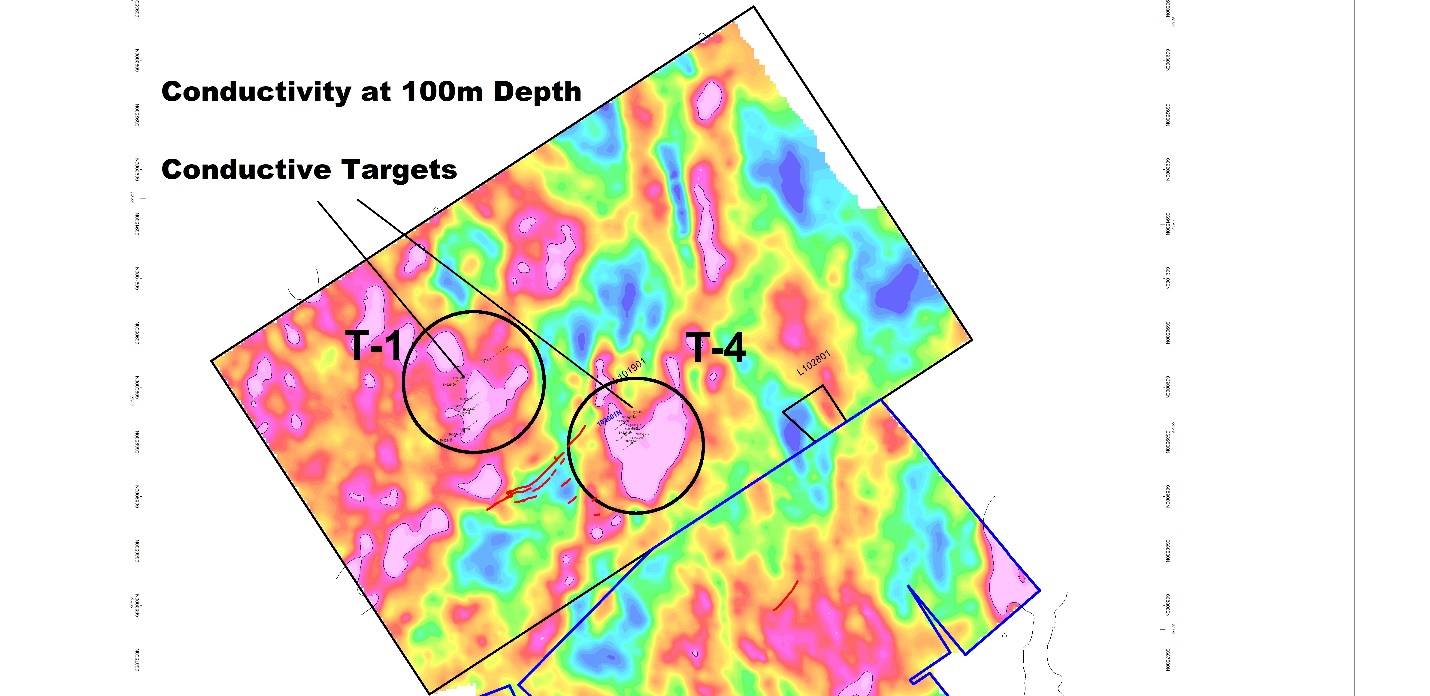

IE also noted that the accompanying magnetic survey was especially effective in distinguishing intrusive rocks of the Cassiar Batholith. These have a higher magnetic susceptibility than the comparatively non-magnetic sedimentary rocks that potentially host skarn and/or CRD deposits (see Figure 1). Magnetic gradient data have also identified a significant area of high prospectivity that extends from the Silver Hart property southeastwards onto the Blue Heaven claims (see Figure 2). The SkyTEM electromagnetic data show several large conductive areas including the T-1 and T-4 targets. Moderate, laterally extensive conductivity targets at shallow depths appear to be hosted within sedimentary rocks, adjacent to the Cassiar Batholith (see Figure 3). A series of figures is presented with this release to highlight the proposed exploration approach at Silver Hart for the 2022 exploration season.

Figure 3: Laterally extensive, moderate conductivity areas are shown as reddish anomalies. They are significant in size and occur within the Silver Hart and Blue Heaven claims. It is important to note that these conductivity areas are adjacent to the contact between the sedimentary sequences and the Cassiar Batholith (i.e, the "heat source") providing a prospective setting for skarn and/or carbonate replacement ("CRD) deposits.

Mr. John Bossio, Chairman noted, "The 2021 exploration program has identified great new targets to expand on our known high-grade mineralization. We are very pleased with the work completed by IE as it gives us a high level of confidence to proceed with our drill program at Silver Hart this summer."

Mr. Kevin Brewer, President and CEO notes, "The potential for skarn and carbonate replacement deposits at Silver Hart has been noted by geologists since the mid 1980's. For the first time we have identified large conductors with coincident soil geochemical anomalies. Our exploration strategy can evolve to pursue the potentially larger deposits these reflect, in addition to the numerous targets for high grade silver-lead zinc veins that remain. We are excited by the compelling case that our technical team has presented to drill the T-1 and T-4 targets this season."

Figure 4: Soil Anomalies Over Proposed Drill Targets: Significant silver anomalies have been identified from soil geochemistry survey efforts in the vicinity of the T-1 and T-4 targets at Silver Hart. Strong to very strong silver anomalies (>500ppb) are represented by the purple, red and orange dots and are associated with each of these targets. The proposed drill plan over the T1 and T4 Conductors is indicated along with the location of sample cross sections indicated in Figures 5 and 6. Note that the Main Zone vein traces, which have been the focus of exploration to date, are indicated by the red lines. The veins are proximal to the conductors and may represent "feeders". The significant scale of the current targets is evident.

Figure 5: A section of the proposed drill plan on the T1 Conductor providing a perspective of the proposed drilling approach and testing of the conductor.

Figure 6: A section of the proposed drill plan on the T4 Conductor providing a perspective of the proposed drilling approach and testing of the conductor.

Qualified Person

Kevin Brewer, a registered professional geoscientist, is the Company's President and CEO, and Qualified Person (as defined by National Instrument 43-101). He has given his approval of the technical information pertaining reported herein. The Company is committed to meeting the highest standards of integrity, transparency and consistency in reporting technical content, including geological reporting, geophysical investigations, environmental and baseline studies, engineering studies, metallurgical testing, assaying and all other technical data.

About CMC Metals Ltd.

CMC Metals Ltd. is a growth stage exploration company focused on opportunities for high grade polymetallic deposits in Yukon, British Columbia and Newfoundland. Our polymetallic silver-lead-zinc CRD prospects include the Silver Hart Deposit and Blue Heaven claims (the "Silver Hart Project") and Rancheria South, Amy and Silverknife claims (the "Rancheria South Project"). Our polymetallic projects with potential for copper-silver-gold and other metals include Logjam (Yukon), Bridal Veil, Terra Nova and Rodney Pond all of which are in Newfoundland.

On behalf of the Board:

"John Bossio"

John Bossio, Chairman

CMC Metals Ltd.

For Further Information and Investor Inquiries:

Kevin Brewer, P. Geo., MBA, B.Sc. (Hons), Dip. Mine Eng.

President, CEO and Director

Tel: (604) 670-0019

kbrewer80@hotmail.com

Suite 615-800 West Pender St.

Vancouver, BC

V6C 2V6

To be added to CMC's news distribution list, please send an email to info@cmcmetals.ca or contact Mr. Kevin Brewer at 604-670-0019.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

"This news release may contain certain statements that constitute "forward-looking information" within the meaning of applicable securities law, including without limitation, statements that address the timing and content of upcoming work programs, geological interpretations, receipt of property titles and exploitation activities and developments. In this release disclosure regarding the potential to undertake future exploration work comprise forward looking statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks, including the ability of the Company to raise the funds necessary to fund its projects, to carry out the work and, accordingly, may not occur as described herein or at all. Actual results may differ materially from those currently anticipated in such statements. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, the impact of the constantly evolving COVID-19 pandemic crisis and continued availability of capital and financing and general economic, market or business conditions. Readers are referred to the Company's filings with the Canadian securities regulators for information on these and other risk factors, available at www.sedar.com. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements. The forward-looking statements included in this news release are made as of the date hereof and the Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable securities legislation."

SOURCE: CMC Metals Ltd.

View source version on accesswire.com:

https://www.accesswire.com/689239/Positive-Geophysical-Survey-Results-at-Silver-Hart-are-Integrated-into-the-Design-of-the-2022-Drill-Program