January 19, 2022

Lithium Power International Limited (ASX: LPI) (“LPI” or the “Company”) through its Joint Venture (“JV”) Company, Minera Salar Blanco S.A. (“MSB”), is pleased to provide details of the updated Definitive Feasibility Study (DFS) for its Maricunga Stage One lithium brine project in northern Chile. The study confirms that Maricunga Stage One could be one of the world’s lowest-cost producers of lithium carbonate, with a solid ESG strategy to support a sustainable future.

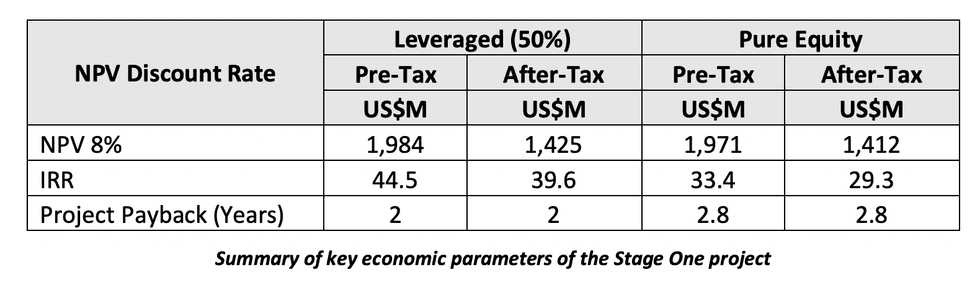

- Maricunga Stage One DFS delivers US$1.4B NPV (after tax) at an 8% discountrate

- An IRR of 39.6% and a 2-year paybackperiod

- OPEX of US$3,718 per tonne of LCEproduced

- Annual EBITDA ofUS$324M

- Direct development cost US$419M, Indirect cost US$145M and Contingency US$62M for a total project CAPEX ofUS$626M

- 15,200 tonnes of LCE per annum over 20years

Highlights:

- The updated Maricunga Stage One Lithium Brine project’s Definitive Feasibility Study(DFS) supports 15,200 tonnes per annum production of lithium carbonate (LCE) for 20 years.

- ProjectNPV1 (leveragedbasis)ofUS$1.425B(aftertax)at8%discountrate,providinganIRR of 39.6% and a 2-year payback. Estimated steady-state annual EBITDA ofUS$324M.

- Project operating cost places Maricunga among the most efficient producers with an OPEX of US$3,718 per tonne not including credit from potassium chloride (KCl) by-product. KCI production was not considered in theDFS.

- Project direct development cost estimated at US$419M, indirect costs at US$145M and contingency costs at US$62M to provide a total project CAPEX ofUS$626M.

- Exceptional ESG profile aims to achieve carbon neutrality once operation beds down, setting new standards for social relationships. Certification process led by Deloitte will continue during upcoming years as the project advances.

- Project infrastructure including water rights have been secured by long term contracts during project construction and operation. Access to the National Power Grid has been granted, ensuring future power supply including an important component of renewable energy.

- Revised DFS completed by Tier-1 engineering consultancy Worley to international standards, with cost inputs from EPC contractors to provide greater certainty on cost estimates. The Resource and Reserve estimates were prepared by Atacama Water.

- Preliminary indications of interest received from international and Chilean financial institutions and private funds for debt financing and future equity financing of the project. Finance process will continue in coming months.

- Updating of the EPC proposals will commence during Q1. Final Investment Decision expected for 2022, with construction to start immediately after

The Company intends to host a webinar on the 21st of January at 10:30am AEDT. Zoom Webinar, details to be provided upon registration. To register your interest for the webinar please click through to the link below:

https://janemorganmanagement-au.zoom.us/webinar/re...

Click here for the full ASX Release

This article includes content from Lithium Power International, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LPI:AU

Sign up to get your FREE

Lithium Power International Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 December 2021

Lithium Power International

A Pure-Play Mining Company Developing Multiple Lithium Mines

A Pure-Play Mining Company Developing Multiple Lithium Mines Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Sign up to get your FREE

Lithium Power International Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00