November 18, 2022

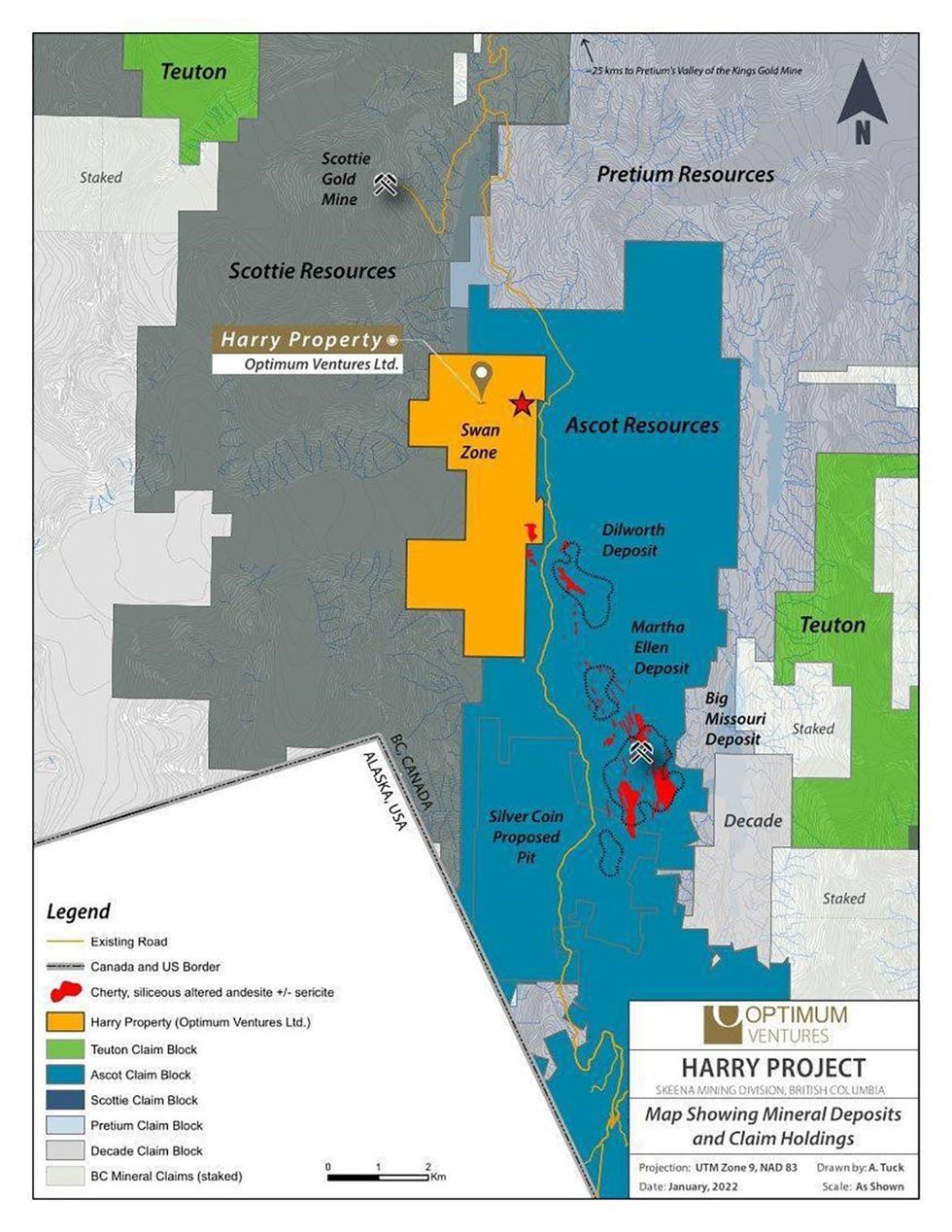

Optimum Ventures (TSXV:OPV, Frankfurt:41Q, OTC:OPVLF) focuses on its high-grade gold asset in the prolific Golden Triangle. The company’s flagship asset, the Harry property, is located between two large mineralized systems: sulphurets hydrothermal system (SHS) and premiere hydrothermal system. An experienced management team and board of directors lead Optimum Ventures toward bringing the asset to production.

The Harry property has surface samples with high-grade assays reaching upwards of 285.4 g/t gold and 1,949 g/t silver. An exploratory drill program at the property was recently completed by the company in 2022. Two notable drill holes produced up to 3.10 g/t gold, 690.1 g/t silver, and an additional 1,833 g/t silver equivalents.

Company Highlights

- Optimum Ventures is an exploration and development mining company focusing on its high-grade gold asset within the famed Golden Triangle in British Columbia.

- The Golden Triangle is globally recognized as one of the most prolific gold-producing regions in the world.

- The company’s flagship Harry property is ideally located between two major mineralized systems and has already produced high-grade gold and silver assays, including up to 3.10 g/t gold, 690.1 g/t silver, and an additional 1,833 g/t silver equivalents.

- Optimum Ventures has an option agreement with Teuton to acquire an 80 percent interest in the property and enter into a JV agreement.

- An experienced management team led by Andy Bowering, who was instrumental in numerous discoveries including the Silver Coin deposit with Ascot Resources (TSX:AOT)

This Optimum Ventures profile is part of a paid investor education campaign.*

OPV:CA

The Conversation (0)

30 May 2023

Optimum Ventures

Exploring High-grade Gold in Renowned Golden Triangle

Exploring High-grade Gold in Renowned Golden Triangle Keep Reading...

8h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

13h

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

15h

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

15h

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

16h

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00