September 05, 2024

Drill intersection grades up 3.05m @ 9.0% Sb

Tartana Minerals Limited (ASX: TAT) (the Company), is pleased to advise that it has upgraded its Nightflower Exploration Target after reviewing its earlier estimation in light of the recent increases in the Antimony price. Nightflower is a high grade silver – lead deposit with, previously overlooked, significant Antimony credits.

Highlights:

- Nightflower project is a high grade silver deposit with historically impressive intersections from past drilling including 9 m @ 506g/t Silver (>16 oz/t), 12.6% Lead, and 1.46% Zinc.1

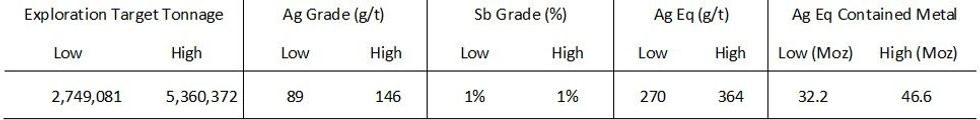

- An Exploration Target range reported on 6 June 2022 has now been substantially upgraded to 2.75 Mt @ 364 g/t Ag Eq for 32 Moz Ag Eq to 5.36 Mt @ 270 g/t Ag Eq for 47 Moz Ag Eq. The Exploration Target is conceptual in nature only and there is no guarantee that further exploration will define a resource.

- Antimony has contributed to the Exploration Target, however, recent significant increases in the Antimony price due to China's export restrictions have improved the project’s economics.

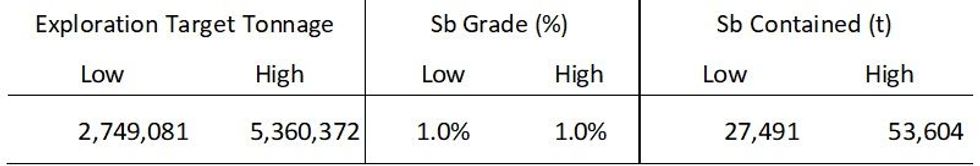

- Historical drilling results indicate Antimony grades up 3.05m @ 9.0% Sb, 24.0% Pb, 10.5% Zn, 14.9 oz/t Ag, and 0.38% Cu (Hole NF72DD11), although the Exploration Target is based on a 1% Sb grade.

- Drilling is now being planned to test the target and upgrade previously identified mineralisation to JORC 2012 reporting standards.

In mid-August China, the world’s largest producer of Antimony – producing 83,000t in 2023 (USGS) - accounting for 48% of the world’s supply, will be restricting Antimony exports from 21 September 2024. Consequently, the Antimony price has significantly increased and is currently trading at US$24,500/tonne (Argus Metals, Antimony ingot min 99.65% fob China).

The revised Exploration Target is summarised in Figure 1, incorporating the original tonnages from the 6 June 2022 announcement with revisions to the grade range, detailed later in this report.

The estimated Antimony content range within the Exploration Target is summarized in Figure 2 below.

Tartana Minerals Managing Director, Stephen Bartrop, commented:

“Significant increases in our Exploration Target, Antimony prices, and consequently the economics of the project underpins the importance of the Nightflower project. With production at the Tartana mine site reaching steady state, this opportunity is only more significant. Further this represents only one target (The Digger Lode mineralisation) and excludes the prospectivity of the adjacent Terrace lode and a possible further discovery.”

Nightflower Silver Project History

The Nightflower project is located 40 km north of Chillagoe in Far North Queensland. It covers a substantial part of the northern Featherbed Volcanic Group and the underlying and surrounding Hodgkinson Formation.

It was discovered as a high grade silver deposit in 1923 and was visited by the Queensland Premier in October 1923. On the Premier’s return to Brisbane he reported that the ore at Nightflower was very rich and a truck-load treated at Chillagoe gave about 30% of lead and 40 ounces of silver to the ton (Source: Qld Govt Mining Journal Vol XXIV, Oct 1923).

Click here for the Corporate Presentation & Webinar

Click here for the full ASX Release

This article includes content from Tartana Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TAT:AU

The Conversation (0)

12 August 2025

Financing Update and AGM Date

Tartana Minerals (TAT:AU) has announced Financing Update and AGM DateDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Tartana Minerals (TAT:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

13 May 2025

Director led financing and change of Chairman

Tartana Minerals (TAT:AU) has announced Director led financing and change of ChairmanDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Tartana Minerals (TAT:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

24 April 2025

Beefwood Project Clarification and Drilling Update

Tartana Minerals (TAT:AU) has announced Beefwood Project Clarification and Drilling UpdateDownload the PDF here. Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00