- 10m at 1.7% CuEq, including 0.7m at 18.2% CuEq

- 20.6m at 0.9% CuEq supergene chalcocite, including 8.5m at 1.3% CuEq

- Copper-tin mineralization increasing in the west and down dip

- Exploration accelerating in Al Andaluz

Pan Global Resources Inc. (TSXV: PGZ) (OTC Pink: PGNRF) ("Pan Global" or the "Company") is pleased to announce new high-grade copper and tin intercepts as drilling continues at the La Romana open pit copper target at the Escacena Project in the Iberian Pyrite Belt, southern Spain. Exploration has also commenced on the recently granted Al Andaluz Investigation (Exploration) Permit immediately to the east of La Romana within the Escacena Project area. The La Romana target is located less than 6 km from the former Aznalcollar open pit mine and approximately 15km west of the Las Cruces copper mine.

Tim Moody, Pan Global President and CEO states: "The latest results include the highest copper assay ever reported at La Romana with 16.8% Cu or 18.2% Cu equivalent (CuEq) over 0.7m within a 10m wide interval averaging 1.7% CuEq. The results add copper and tin mineralization near-surface in the west and downdip on several sections which confirms the deposit remains wide open in several areas. Results are awaited for several new holes, including in the far west where the copper and tin mineralization appears to be increasing towards the La Romana mine workings."

Mr. Moody added: "In addition to the ongoing drilling at La Romana, ground geophysics has already commenced in the adjacent Al Andaluz permit area with a second gravity survey crew being added to accelerate the program."

Highlights include:

- 10m at 1.7% CuEq (1.5% Cu, 6.5g/t Ag, 0.01% Co) from 111m in LRD85, including

- 0.7m at 18.2% CuEq (16.8% Cu, 0.03% Sn, 60.1g/t Ag, 0.08% Co, 0.12g/t Au)

- 20.6m at 0.9% CuEq (0.5% Cu, 0.10% Sn, 1.3g/t Ag; chalcocite) from 20.4m in LRD76, including

- 8.5m at 1.3% CuEq (0.7% Cu, 0.20% Sn, 1.6g/t Ag, 0.01% Co)

- 20m at 0.7% CuEq (0.5% Cu, 0.04% Sn, 2.9g/t Ag) from 115m in LRD86, including

- 9.8m at 1.1% CuEq (0.9% Cu, 0.04% Sn, 4.6g/t Ag)

- 27.1m at 0.5% CuEq (0.4% Cu, 0.04% Sn, 1.1g/t Ag; chalcocite) from 29m in LRD81, including

- 4.3m at 1.2% CuEq (1.0% Cu, 0.04% Sn, 2.5g/t Ag) and 1.8m at 1.8% CuEq (1.6% Cu, 0.02% Sn, 6g/t Ag, 0.01% Co)

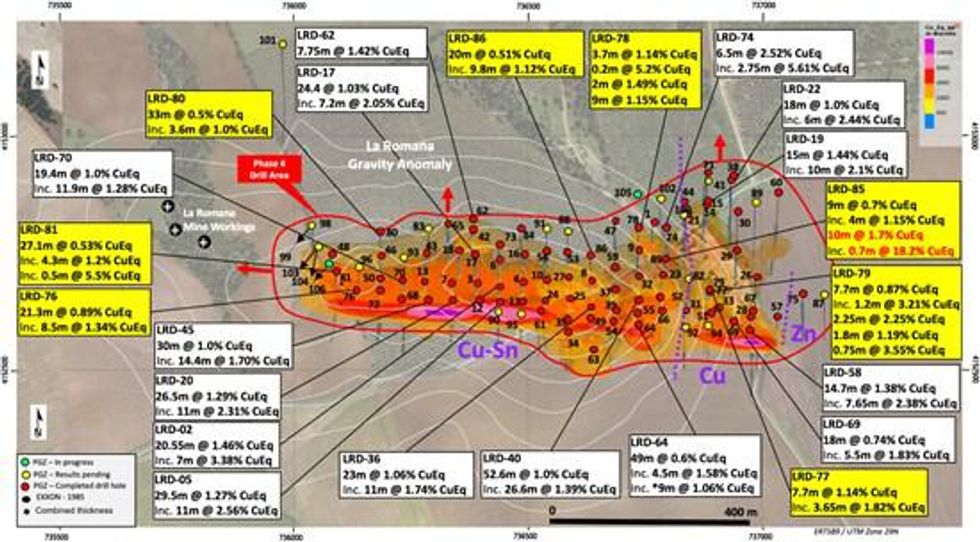

Figure 1 - La Romana geophysics targets and drill hole locations with selected highlights. Newly reported drill holes are highlighted in yellow.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/5190/105819_405c3096b4de9ae4_001full.jpg

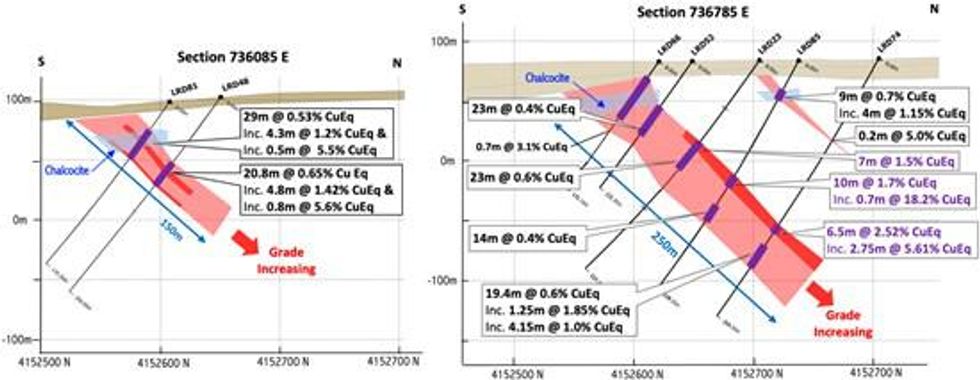

Figure 2 - Summary drill hole cross sections with new drill holes LRD81 (Section 736085 E) and LRD85 (Section 736785 E), showing grades increasing downdip

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/5190/105819_405c3096b4de9ae4_002full.jpg

Drill results

The latest drill results are from eight holes in the Phase 4 drill program at the La Romana discovery. Drill holes LRD 76 and 78 targeted near-surface mineralization in the west. Holes LRD 78, 80 and 86 tested down-dip extensions. Holes 77, 79 and 85 aimed to close a gap in the drilling in the east.

Drill hole locations are shown in Figure 1 and summary cross sections with holes LRD81 to LRD85 are provided in Figure 2 above.

Drill hole collar information is provided in Table 1 below. Assay results are summarized in Table 2. The drill holes were all inclined towards the south and all reported drill intervals are approximately true widths except for hole LRD79 where true width is estimated at approx. 95% of the reported intervals.

Table 1 Escacena Project, La Romana drill hole collar information (Total 1621.15m)

| Hole ID | Easting1 | Northing1 | Azimuth (º) | Dip (º) | Depth (m) |

| LRD76 | 736135 | 4152667 | 180 | -55 | 119.2 |

| LRD77 | 736884 | 4152670 | 180 | -70 | 173.15 |

| LRD78 | 736736 | 4152808 | 180 | -60 | 268.4 |

| LRD79 | 736885 | 4152671 | 180 | -90 | 214.55 |

| LRD80 | 736184 | 4152798 | 180 | -55 | 211.9 |

| LRD81 | 736089 | 4152708 | 180 | -55 | 170.2 |

| LRD85 | 736794 | 4152738 | 180 | -62 | 224.55 |

| LRD86 | 736634 | 4152744 | 180 | -60 | 239.2 |

1Coordinates are in ERTS89 datum UTM29N

Table 2 - Escacena Project, La Romana drill results summary

| Hole | Fr | To | Int | CuEq1 | Cu | Sn | Ag | Co | Au | Pb | Zn | |

| m | % | % | ppm | g/t | ppm | g/t | ppm | ppm | ||||

| LRD76 | 13.00 | 43.00 | 30.00 | 0.73 | 0.46 | 735 | 1.3 | 66 | 0.01 | 21 | 118 | |

| 20.40 | 41.00 | 20.60 | 0.90 | 0.54 | 1013 | 1.5 | 77 | 0.01 | 14 | 115 | ||

| 32.50 | 41.00 | 8.50 | 1.34 | 0.68 | 2012 | 1.6 | 102 | 0.01 | 13 | 146 | ||

| 37.00 | 41.00 | 4.00 | 1.85 | 1.17 | 2002 | 2.4 | 101 | 0.01 | 16 | 215 | ||

| LRD77 | 61.30 | 64.00 | 2.70 | 1.12 | 0.95 | 31 | 5.9 | 117 | 0.03 | 60 | 310 | |

| 73.90 | 74.60 | 0.70 | 3.08 | 2.78 | 68 | 13.1 | 145 | 0.04 | 412 | 706 | ||

| 98.50 | 106.20 | 7.70 | 1.14 | 1.01 | 38 | 3.5 | 110 | 0.02 | 29 | 180 | ||

| 102.55 | 106.20 | 3.65 | 1.82 | 1.63 | 45 | 5.7 | 160 | 0.02 | 36 | 163 | ||

| LRD78 | 21.00 | 32.00 | 11.00 | 0.18 | ||||||||

| 156.60 | 163.30 | 6.70 | 0.83 | 0.74 | 37 | 2.7 | 72 | 0.01 | 28 | 125 | ||

| 156.60 | 160.30 | 3.70 | 1.14 | 1.02 | 37 | 3.6 | 89 | 0.02 | 42 | 158 | ||

| 163.10 | 163.30 | 0.20 | 5.20 | 4.76 | 134 | 19.9 | 244 | 0.03 | 54 | 171 | ||

| 184.00 | 200.00 | 16.00 | 0.49 | 0.41 | 99 | 1.6 | 58 | 0.01 | 34 | 227 | ||

| 198.00 | 200.00 | 2.00 | 1.49 | 1.27 | 235 | 5.3 | 131 | 0.02 | 87 | 611 | ||

| 211.00 | 220.00 | 9.00 | 1.15 | 0.93 | 356 | 5.1 | 66 | 0.01 | 467 | 1384 | ||

| 218.10 | 220.00 | 1.90 | 3.61 | 2.96 | 1133 | 16.5 | 140 | 0.04 | 1687 | 4278 | ||

| 240.25 | 240.45 | 0.20 | 1.58 | 0.87 | 878 | 6.9 | 306 | 0.24 | 411 | 749 | ||

| LRD79 | 61.70 | 68.30 | 6.60 | 0.61 | 0.46 | 33 | 4.4 | 67 | 0.07 | 933 | 2195 | |

| 67.45 | 68.30 | 0.85 | 2.02 | 1.77 | 49 | 11.5 | 107 | 0.04 | 594 | 867 | ||

| 75.90 | 83.60 | 7.70 | 0.87 | 0.73 | 42 | 5.1 | 98 | 0.02 | 64 | 504 | ||

| 75.90 | 77.55 | 1.65 | 1.37 | 1.14 | 53 | 10.2 | 102 | 0.03 | 153 | 1232 | ||

| 82.40 | 83.60 | 1.20 | 3.21 | 2.80 | 81 | 14.8 | 315 | 0.04 | 92 | 745 | ||

| 115.00 | 115.45 | 0.45 | 3.83 | 3.34 | 99 | 17.6 | 274 | 0.11 | 357 | 341 | ||

| 129.10 | 131.35 | 2.25 | 1.78 | 1.57 | 43 | 5.6 | 177 | 0.04 | 39 | 175 | ||

| 159.25 | 166.60 | 7.35 | 0.85 | 0.71 | 57 | 3.5 | 106 | 0.03 | 151 | 768 | ||

| 161.70 | 163.50 | 1.80 | 1.19 | 0.99 | 59 | 4.6 | 146 | 0.05 | 107 | 463 | ||

| 165.85 | 166.60 | 0.75 | 3.55 | 3.14 | 107 | 14.2 | 261 | 0.08 | 502 | 3940 | ||

| LRD80 | 7.85 | 12.00 | 4.15 | 0.23 | ||||||||

| 113.00 | 146.00 | 33.00 | 0.50 | 0.28 | 524 | 1.3 | 79 | 0.01 | 45 | 145 | ||

| 120.00 | 144.60 | 24.60 | 0.57 | 0.31 | 660 | 1.4 | 86 | 0.01 | 30 | 136 | ||

| 141.00 | 144.60 | 3.60 | 1.00 | 0.47 | 1501 | 2.0 | 110 | 0.01 | 28 | 190 | ||

| LRD81 | 29.00 | 56.10 | 27.10 | 0.53 | 0.36 | 370 | 1.1 | 75 | 0.01 | 54 | 118 | |

| 36.00 | 49.00 | 13.00 | 0.71 | 0.46 | 645 | 1.2 | 86 | 0.01 | 32 | 92 | ||

| 39.70 | 44.00 | 4.30 | 1.20 | 0.99 | 420 | 2.5 | 85 | 0.01 | 73 | 110 | ||

| 54.30 | 56.10 | 1.80 | 1.79 | 1.59 | 162 | 6.0 | 109 | 0.03 | 59 | 222 | ||

| 54.30 | 54.80 | 0.50 | 5.47 | 4.90 | 439 | 18.8 | 256 | 0.08 | 177 | 645 | ||

| LRD85 | 28.00 | 37.00 | 9.00 | 0.70 | 0.61 | 26 | 3.1 | 55 | 0.01 | 62 | 156 | |

| 28.00 | 32.00 | 4.00 | 1.30 | 1.15 | 30 | 6.1 | 90 | 0.02 | 73 | 162 | ||

| 29.75 | 30.40 | 0.65 | 6.64 | 5.96 | 88 | 32.2 | 354 | 0.06 | 149 | 87 | ||

| 111.00 | 121.00 | 10.00 | 1.69 | 1.52 | 48 | 6.5 | 112 | 0.02 | 80 | 222 | ||

| 118.60 | 119.30 | 0.70 | 18.16 | 16.80 | 323 | 60.1 | 757 | 0.12 | 227 | 975 | ||

| 139.00 | 153.00 | 14.00 | 0.43 | 0.33 | 91 | 1.5 | 78 | 0.01 | 39 | 498 | ||

| LRD86 | 112.20 | 112.90 | 0.70 | 1.76 | 1.52 | 321 | 7.3 | 90 | 0.01 | 86 | 982 | |

| 115.00 | 135.00 | 20.00 | 0.70 | 0.51 | 392 | 2.9 | 72 | 0.01 | 43 | 345 | ||

| 122.00 | 131.80 | 9.80 | 1.12 | 0.89 | 414 | 4.6 | 86 | 0.01 | 41 | 406 | ||

| 122.00 | 126.00 | 4.00 | 1.82 | 1.52 | 521 | 7.4 | 99 | 0.01 | 47 | 566 | ||

| 130.50 | 131.80 | 1.30 | 1.62 | 1.19 | 927 | 6.9 | 112 | 0.01 | 75 | 478 |

1Metal prices used: Copper US$6,200 per tonne, Silver USD22.50 per ounce, Gold US$1,500 per ounce, Cobalt US$32,800 per tonne and Tin US$18,000 per tonne. The copper equivalent (CuEq ) values are for exploration purposes only and include no assumptions for metal recovery.

The results add near-surface copper and tin mineralization in the west and show the mineralization extends over approx. 1.1km strike. The latest drill results continue to show that the mineralization remains open in several directions.

The primary mineralization includes mainly stockwork, semi-massive sulphides and bands of massive sulphide, with chalcopyrite as the primary copper mineral and cassiterite as the only observed tin mineral. The copper mineralization is also associated with elevated levels of silver, cobalt and gold. A metal zonation is also apparent, progressing from copper and tin in the west to copper and then zinc in the east.

Drill hole LRD76 extends the copper mineralization approx. 50m to the west where it remains wide open, with approx. 30m grading 0.5% Cu, including a 7m near surface oxide/leached copper zone immediately followed by a 20m interval of mostly supergene chalcocite with traces of native copper and elevated tin. Results include:

- 7.4m at 0.3% Cu (oxides) from 13m downhole, immediately followed by

- 20.6m at 0.9% CuEq (chalcocite; 0.5% Cu, 0.10% Sn, 1.3g/t Ag) from 20.4m, including;

- 8.5m at 1.3% CuEq (0.7% Cu, 0.20% Sn, 1.6g/t Ag, 102ppm Co)

Drill hole LRD77 (together with LRD79) tested a 120m gap in the drilling between holes LRD51 and LRD14, and confirmed down-dip continuation of the copper zone. Notable results include:

- 2.7m at 1.1% CuEq (0.95% Cu, 5.9g/t Ag, 117ppm Co) from 61.3m;

- 0.7m at 3.1% CuEq (2.8% Cu, 13.1g/t Ag, 145ppm Co) from 73.9m

- 7.7m at 1.1% CuEq (1.0% Cu, 3.5g/t Ag, 110ppm Co) from 98.5m, including;

- 3.65m at 1.8% CuEq (1.6% Cu, 5.7g/t Ag, 160ppm Co)

Drill hole LRD78 tested approximately 50m downdip from hole LRD09. The hole confirms the main copper zone continues to the north and remains open down-dip. The hole also intersected a shallow zone of oxide copper mineralization. Results include:

- 11m at 0.2% Cu (oxide) from 23m

- 6.7m at 0.8% CuEq (0.7% Cu, 2.7g/t Ag) from 156.6m, including

- 3.7m at 1.1% CuEq (1.0% Cu, 3.6g/t Ag)

- 16m at 0.5% CuEq (0.4% Cu, 0.01% Sn, 1.6g/t Ag) from 184m, including

- 2m at 1.5% CuEq (1.3% Cu, 0.02% Sn, 5.3g/t Ag, 131ppm Co)

- 9m at 1.2% CuEq (0.9% Cu, 0.04% Sn, 5.1g/t Ag)

- 1.9m at 3.6% CuEq (3.0% Cu, 0.11% Sn, 16.5g/t Ag, 140ppm Co)

Drill hole LRD79 confirmed the mineralization continues down-dip from hole LRD77, including several narrow close-spaced high-grade intercepts. Results include:

- 6.6m at 0.6% CuEq (0.5% Cu, 4.4g/t Ag, 0.07g/t Au) from 61.7m, including

- 0.85m at 2.0% CuEq (1.8% Cu, 11.5g/t Ag, 107ppm Co)

- 7.7m at 0.9% CuEq (0.7% Cu, 5.1g/t Ag) from 75.9m, including

- 1.65m at 1.4% CuEq (1.1% Cu, 10.2g/t Ag, 102ppm Co)

- 1.2m at 3.2% CuEq (2.8% Cu, 14.8g/t Ag, 315ppm Co)

- 0.45m at 3.8% CuEq (3.3% Cu, 17.6g/t Ag, 274ppm Co, 0.11g/t Au) from 115m

- 2.25m at 1.8% CuEq (1.6% Cu, 5.6g/t Ag, 177ppm Co) from 129m

- 7.35m at 0.9% CuEq (0.7% Cu, 3.5g/t Ag, 106ppm Co) from 159.25m, including

- 1.8m at 1.2% CuEq (1.0% Cu, 4.6g/t Ag, 146ppm Co)

- 0.75m at 3.6% CuEq (3.1% Cu, 14.2g/t Ag, 261ppm Co)

Drill hole LRD80 confirms a more than 30m wide zone of copper and tin mineralization extending north of hole LRD46, and remains open downdip. The hole also intersected a narrow zone of near surface oxide copper mineralization. Results include:

- 4.15m at 0.23% Cu (oxide) from 7.85m

- 33m at 0.5% CuEq (0.3% Cu, 0.05% Sn, 1.3g/t Ag) from 113m, including

- 24.6m at 0.6% CuEq (0.3% Cu, 0.07% Sn, 1.4g/t Ag)

- 3.6m at 1.0% CuEq (0.5% Cu, 0.15% Sn, 2g/t Ag, 110ppm Co) from 141m

Drill hole LRD81 extends the near-surface copper mineralization west of hole LRD76 in the far west of the project area, including supergene chalcocite and chalcopyrite. Together with hole LRD48, the results show grade increasing downdip. Results include:

- 27.1m at 0.5% CuEq (0.4% Cu, 0.04% Sn, 1.1g/t Ag) from 29m, including

- 13m at 0.7% CuEq (0.5% Cu, 0.06% Sn, 1.2g/t Ag), including

- 4.3m at 1.2% CuEq (1.0% Cu, 0.04% Sn, 2.5g/t Ag)

- 1.8m at 1.8% CuEq (1.6% Cu, 0.02% Sn, 6g/t Ag, 109ppm Co), includes

- 0.5m at 5.5% CuEq (4.9% Cu, 0.04% Sn, 18.8g/t Ag, 256ppm Co)

- 13m at 0.7% CuEq (0.5% Cu, 0.06% Sn, 1.2g/t Ag), including

Drill hole LRD85 tested approximately 50m up-dip from hole LRD74 which intersected 6.5m at 2.5% CuEq. Together with holes LRD23 and LRD74, the results for LRD85 confirm a continuous zone of high-grade mineralization with grade increasing downdip and include a 0.7m thick ultra-high grade massive chalcopyrite intercept with 16.8% Cu (18.2% CuEq), which is the highest copper assay reported to-date at La Romana. The high-grade zone is open down-dip and an untested gap of approximately 150m exists along strike to the next hole to the east of LRD85. The hole also intersected a 9-meter thick near surface interval with supergene chalcocite. Results include:

- 9m at 0.7% CuEq (0.6% Cu, 3.1g/t Ag; chalcocite) from 28m, including

- 4m at 1.3% CuEq (1.15% Cu, 6.1g/t Ag), includes

- 0.65m at 6.6% CuEq (6.0% Cu, 32.2g/t Ag, 354ppm Co)

- 4m at 1.3% CuEq (1.15% Cu, 6.1g/t Ag), includes

- 10m at 1.7% CuEq (1.5% Cu, 6.5g/t Ag, 112ppm Co) from 111m, including

- 3m at 4.9% CuEq (4.5% Cu, 17.3g/t Ag, 250ppm Co), includes

- 0.7m at 18.2% CuEq (16.8% Cu, 0.03% Sn, 60.1g/t Ag, 0.08% Co, 0.12g/t Au)

- 3m at 4.9% CuEq (4.5% Cu, 17.3g/t Ag, 250ppm Co), includes

- 14m at 0.4% CuEq (0.3% Cu, 1.5g/t Ag) from 139m

Drill hole LRD86 was drilled approx. 50m north of hole LRD8 and confirmed that mineralization remains open down-dip on this section. Results include:

- 0.7m at 1.8% CuEq (1.5% Cu, 0.03% Sn, 7.3g/t Ag from 112.9m

- 20m at 0.7% CuEq (0.5% Cu, 0.04% Sn, 2.9g/t Ag) from 115m, including

- 9.8m at 1.1% CuEq (0.9% Cu, 0.04% Sn, 4.6g/t Ag), incudes

- 4m at 1.8% CuEq (1.5% Cu, 0.05% Sn, 7.4g/t Ag) and

- 1.3m at 1.6% CuEq (1.2% Cu, 0.09% Sn, 6.9g/t Au, 112ppm Co)

- 9.8m at 1.1% CuEq (0.9% Cu, 0.04% Sn, 4.6g/t Ag), incudes

Assay results are pending for an additional 21 completed drill holes including several new drill holes in the western limits of the project area with strong copper mineralization evident in drill core. Drilling is ongoing with two drill rigs.

QA/QC

Core size was HQ (63mm) and all samples were ½ core. Nominal sample size was 1m core length and ranged from 0.4 to 2m. Sample intervals were defined using geological contacts with the start and end of each sample physically marked on the core. Diamond blade core cutting and sampling was supervised at all times by Company staff. Duplicate samples of ¼ core were taken approximately every 30 samples and Certified Reference materials inserted every 25 samples in each batch.

Samples were delivered to ALS laboratory in Seville, Spain and assayed at the ALS laboratory in Ireland. All samples were crushed and split (method CRU-31, SPL22Y), and pulverized using (method PUL-31). Gold analysis was by 50gm Fire assay with ICP finish (method Au-ICP22) and multi element analysis was undertaken using a 4-acid digest with ICP AES finish (method ME-ICP61). Tin was analysed in selected intervals using Lithium borate fusion and ICP MS finish (method ME-MS81). Over grade base metal results were assayed using a 4-acid digest ICP AES (method OG-62). Over grade tin was determined using peroxide fusion with ICP finish (method Sn-ICP81x).

Qualified Person

Patrick Downey, a Director of Pan Global Resources and a qualified person as defined by National Instrument 43-101, has reviewed the scientific and technical information that forms the basis for this news release. Mr. Downey is not independent of the Company.

About Pan Global Resources

Pan Global Resources Inc. is actively engaged in base and precious metal exploration in southern Spain and is pursuing opportunities from exploration through to mine development. The Company is committed to operating safely and with respect to the communities and environment where we operate.

On behalf of the Board of Directors

www.panglobalresources.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

info@panglobalresources.com

Statements which are not purely historical are forward-looking statements, including any statements regarding beliefs, plans, expectations or intentions regarding the future. It is important to note that actual outcomes and the Company's actual results could differ materially from those in such forward-looking statements. The Company believes that the expectations reflected in the forward-looking information included in this news release are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Risks and uncertainties include, but are not limited to, economic, competitive, governmental, environmental and technological factors that may affect the Company's operations, markets, products and prices. Readers should refer to the risk disclosures outlined in the Company's Management Discussion and Analysis of its audited financial statements filed with the British Columbia Securities Commission.

The forward-looking information contained in this news release is based on information available to the Company as of the date of this news release. Except as required under applicable securities legislation, the Company does not intend, and does not assume any obligation, to update this forward-looking information.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105819