(TheNewswire)

Toronto, Ontario TheNewswire - June 2 9 2021 - Noble Mineral Exploration Inc. ( "Noble" or the "Company" ) (TSXV:NOB ) ( FRANKFURT:NB7 ) ( OTC:NLPXF) is pleased to announce that it has acquired the Laverlochere property near Rouyn-Noranda, Quebec. The property consists of 12 claims (518 hectares). The property is road and power accessible, located about 100 kilometers south of Rouyn-Noranda.

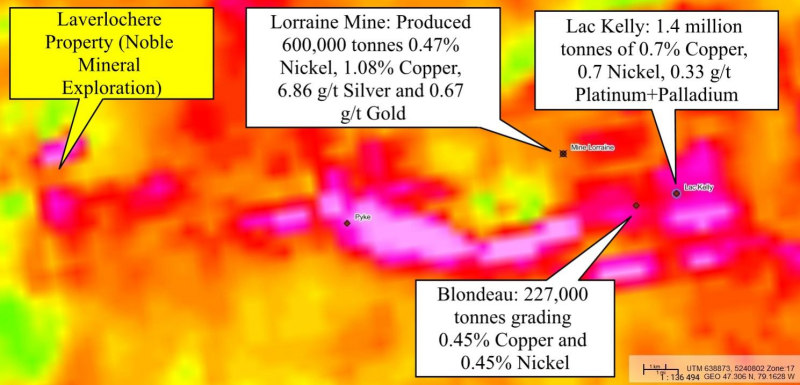

The Laverlochere property is located on the southern part, of the east-west trending Belleterre-Angliers greenstone belt that is made up of an assemblage of sedimentary and volcanic rocks of Archaen age (See Figure 1). Several Nickel-Copper-Platinum Group occurrences and showings have been discovered in the Belleterre-Angliers greenstone belt. Approximately 30 km east of the Laverlochere property, the Lac Kelly property reportedly contains of 1.4 million tonnes of 0.7% Copper, 0.7% Nickel, 0.33 g/t Platinum+Palladium with a potential for minor amounts of Cobalt and Rhenium. In the same general area, Blondeau Nickel has outlined 227,000 tonnes of mineralization grading 0.45% Copper and 0.45% Nickel. Historic exploration in the area has outlined four separate zones of Nickel-Copper-Platinum Group mineralization in gabbroic bodies interbedded in mafic to felsic volcanics (the above estimates are historic in nature not 43-101 compliant).

The Lorraine Mine, located about 24 km east of the Laverlochere property operated from 1964 to 1968 and reported to have produced 600,000 tonnes grading 0.47% Nickel, 1.08% Copper, 6.86 g/t Silver and 0.67 g/t Gold from basaltic and gabbroic rocks. (See Figure 1)

Figure 1: Regional setting of the Laverlochere Property on a magnetic background. Areas coloured pink are magnetic highs denoting mafic to ultramafic rocks. The noted reserves or resources are not 43-101 compliant and historic in nature.

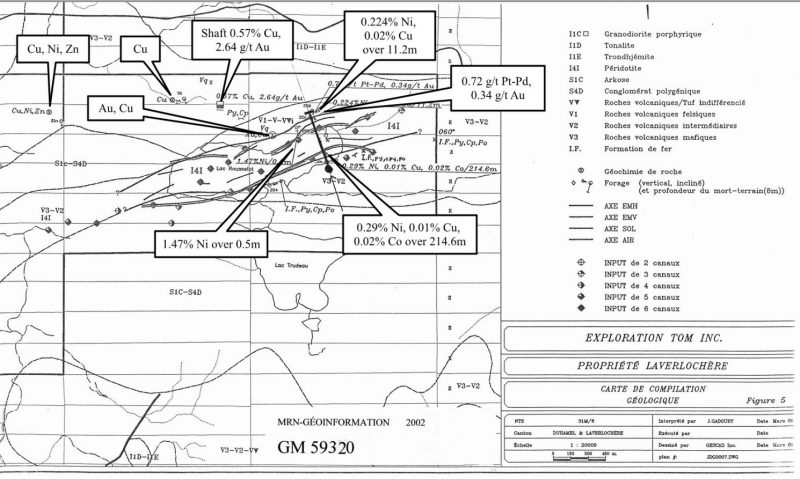

On the Laverlochere property, historic trenching and drilling on the north shore of Lac Rousselot led to the discovery of a band of iron formation, striking N60°E (See Figure 2). The iron formation is brecciated and contains pyrite-rich lenses and veinlets of quartz. A trench, approximately 1,080 m to the southeast of the iron formation, exposed a silica bearing that contains considerable veinlets or dike-like masses of quartz that are well mineralized with chalcopyrite and pyrite. A 1.8 by 3.0 m shaft was sunk on a 3 m long by 30 cm wide, mineralized quartz lens. The lens strikes northwest and cuts across N30°W striking sheared andesites. The mineralization is primarily chalcopyrite and a 30 cm sample across the quartz lens analyzed 0.57% copper and 2.6 g/t gold .

In 1969, Inco drilled three holes under Lac Rousselot (See Figure 2). Drill hole 32375 was drilled to a depth of 309 m and in the upper section (0 to 93.9 m) intersected mainly andesitic and gabbroic rocks that were locally, weakly mineralized in pyrite, pyrrhotite and chalcopyrite. The lower part of the hole (from 93.9 to 309 m) intersected serpentinized peridotite that was systematically analyzed for copper, nickel and cobalt. The analyses reportedly revealed a 214.7 meter mineralized interval grading 0.01% Copper, 0.29% Nickel and 0.02% Cobalt (Exact width not known at this time).

Drill hole 32376, intersected mainly intermediate volcanics, gabbroic, and dioritic rocks down to 97.6 m that were weakly mineralized with pyrite, chalcopyrite and pyrrhotite (See Figure 2). From 97.6 m to the bottom of the hole at 108.8 m peridotite was intersected. Eight samples of core from the gabbro, andesite and a chlorite bearing schist were analyzed for copper, nickel, zinc, platinum group and gold. Analyses from the peridotite graded 0.02% Copper and 0.224% Nickel over the 11.2 meter interval. In addition, combined Platinum-Palladium was 0.72 g/t and Gold 0.34 g/t (Exact width not known at this time). These analytical results are historic and have not been verified by Noble)

Figure 2: Compilation of significant mineralization on the Laverlochere Property.

Future work will include a complete compilation of past work, geophysical surveys and a drill program to verify past results.

The consideration for the acquisition are the costs of staking and reserving to the vendor a 2% NSR that will be subject to Noble's right to buyback 50% of the NSR for $1,000,000.

The Transactions are subject to approval of the Board of Directors of each party where applicable, as well as to TSX Venture Exchange approval and to compliance with securities and other laws and regulations.

Vance White, President and CEO of Noble, said "This additional acquisition continues to add to our broad portfolio of potential project generator opportunities with past documented exploration success over a number of years. We will continue to add to our base in this time of improved commodity prices and junior resource financial capital market interest."

Michael Newbury PEng (ON), a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Noble.

About Noble Mineral Exploration Inc.:

Noble Mineral Exploration Inc. is a Canadian-based junior exploration company which, in addition to its shareholdings in Canada Nickel Company Inc., Spruce Ridge Resources Ltd. and MacDonald Mines Exploration Ltd., and its interest in the Holdsworth gold exploration property in the Wawa, Ontario area, holds approximately 72,000 hectares of mineral rights in the Timmins-Cochrane areas of Northern Ontario known as Project 81. Project 81 hosts diversified drill-ready gold, nickel-cobalt and base metal exploration/VMS targets at various stages of exploration. Additional projects are being acquired. More detailed information is available on the website at www.noblemineralexploration.com .

Noble's common shares trade on the TSX Venture Exchange under the symbol "NOB".

Cautionary Statement:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

The foregoing information may contain forward-looking statements relating to the future performance of Noble Mineral Exploration Inc. Forward-looking statements, specifically those concerning future performance, are subject to certain risks and uncertainties, and actual results may differ materially from the Company's plans and expectations. These plans, expectations, risks and uncertainties are detailed herein and from time to time in the filings made by the Company with the TSX Venture Exchange and securities regulators. Noble Mineral Exploration Inc. does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts:

H. Vance White, President

Phone: 416-214-2250

Fax: 416-367-1954

Email: info@noblemineralexploration.com

Investor Relations

Email: ir@noblemineralexploration.com

Copyright (c) 2021 TheNewswire - All rights reserved.