August 18, 2024

Condor Energy Ltd (ASX: CND) (Condor or the Company) is pleased to advise that Quantitative Interpretation (QI) and AVO studies on the legacy 3,800km2 of 3D seismic data covering most of the Company’s Tumbes Technical Evaluation Agreement (TEA or Block) have potentially identified a highly porous sandstone fairway spanning the Raya Prospect, significantly enhancing the probability of success.

Highlights

- Leading Quantitative Interpretation (QI) company, e-Seis Inc, completes LithSeis and amplitude versus offset (AVO) volumes on legacy 3D seismic data covering the Company’s Peruvian Tumbes TEA.

- New seismic inversion and AVO studies have produced indications of high-quality reservoirs and hydrocarbon fill at the Raya Prospect, significantly upgrading its prospectivity.

- A robust fairway of highly porous sandstone has been delineated coincident with the location of the Raya Prospect.

- This is complemented by recently completed field work which mapped sediment input points leading into the Tumbes TEA during deposition of the Zorritos Formation.

- Reprocessing of the 3D seismic data is nearing completion. Once delivered, these data will be interpreted to allow for the estimation of resources in the Tumbes TEA.

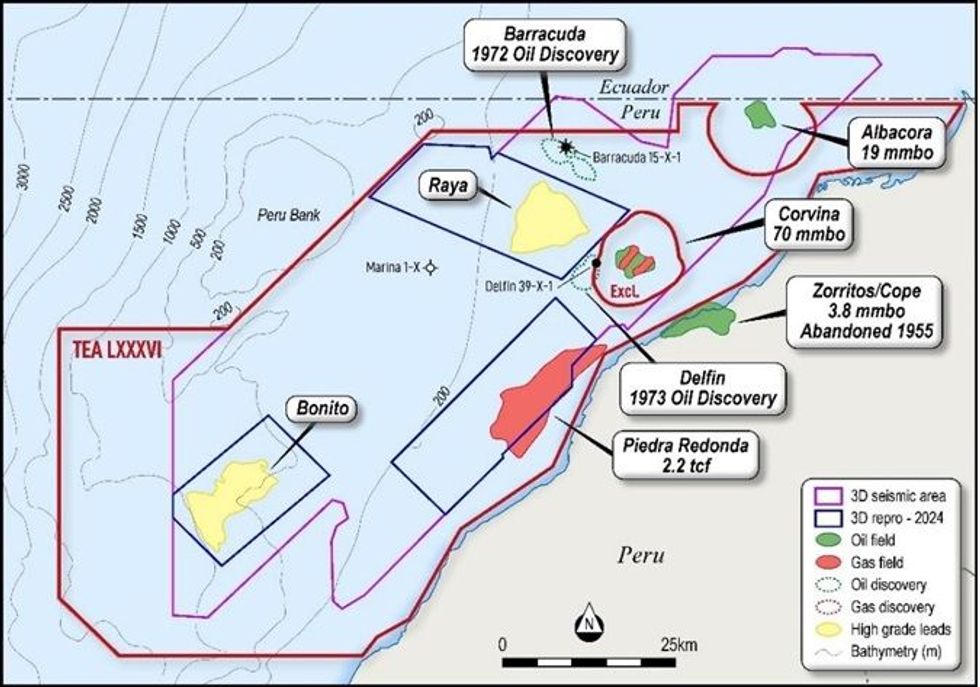

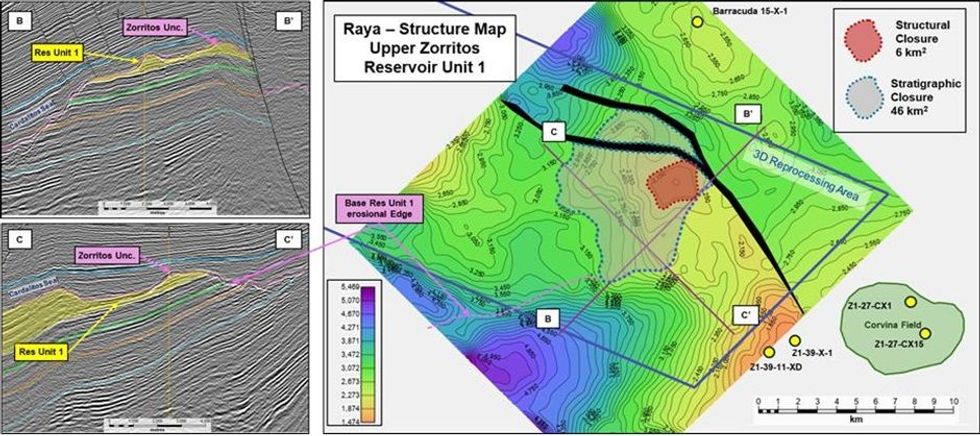

The Raya Prospect is defined as a structural high against an east-west fault within the Zorritos Formation, the primary reservoir in the basin, with a combined 46km2 structural and stratigraphic trap with shales overlying the Zorritos Unconformity providing a regional seal1 (Figure 2).

The Company notes that results from the adjacent Delphin and Barracuda wells confirm the presence of oil charge in the area and, in order to determine resevoir quality, has conducted Quantitative Interpretation (QI) studies of the seismic data covering the Raya prospect.

eSeis Inc., a leading Houston-based QI company, has provided LithSeis and Amplitude Versus Offset (AVO) volumes over the entire 3D data set.

The LithSeis cube, although uncalibrated by well data, is a pre-stack seismic-based petrophysical analysis that yields lithology, porosity, and possible hydrocarbon fill. In the LithSeis section (Figure 3b), yellow colours are interpreted to represent porous sandstones, with red reflectors interpreted to represent very high porosity and/or where hydrocarbons are present. In this case, several layers of high porosity at the top of potential reservoir zones (such as layer SC 1) are evident.

The AVO sections illustrate the responses of seismic reflections to increasing angles of offset and uses a colour bar to differentiate between the five commonly recognised classes of AVO responses; in this area, Class 2 or Class 3 responses are of particular interest as they may be indicative of a hydrocarbon- filled reservoir (either gas or oil).

The highly encouraging culmination of these analyses are the mapped responses of LithSeis and AVO across the SC 1 layer (Figure 4). The strong and consistent LithSeis response suggests the presence of a highly porous sandstone fairway running NE-SW across the Raya prospect, potentially derived from one of the feeder systems identified during field mapping.

Click here for the full ASX Release

This article includes content from Condor Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CND:AU

The Conversation (0)

26 September 2024

Condor Energy

Rare world-class hydrocarbon exploration opportunity

Rare world-class hydrocarbon exploration opportunity Keep Reading...

29 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Condor Energy (CND:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

22 January 2025

A$3M Placement to Advance High-Impact Workplan for Peru

Condor Energy (CND:AU) has announced A$3M Placement to Advance High-Impact Workplan for PeruDownload the PDF here. Keep Reading...

20 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

15 January 2025

Piedra Redonda Gas Field Best Estimate Resource of 1 Tcf

Condor Energy (CND:AU) has announced Piedra Redonda Gas Field Best Estimate Resource of 1 TcfDownload the PDF here. Keep Reading...

13 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

6h

Beyond Oil, Middle East Crisis Ripples Across Global Commodities

The war raging in the Middle East is sending shock waves across global commodity markets, disrupting far more than just oil and gas.As the conflict enters its second week, the near shutdown of shipping through the Strait of Hormuz is beginning to affect a wide range of materials essential to... Keep Reading...

11 March

Josef Schachter: Oil Prices Spike on Iran War, What Happens Next?

Josef Schachter, president and author at the Schachter Energy Report, shares his outlook for oil prices and stocks as the Iran war continues. "The key thing is how long does it last and what is the reason that they want the war," he said.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

11 March

IEA Considers Record Oil Reserve Release Following Hormuz Disruptions

Global energy officials are weighing the largest coordinated release of emergency oil reserves ever proposed as supply disruptions linked to the ongoing Middle East conflict continue to disrupt global markets, according to an exclusive report by the Wall Street Journal.Officials familiar with... Keep Reading...

11 March

Angkor Resources Reports Copper Mineralization Over 286 Metres At Thmei North Prospect, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 11, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") reports results from diamond drill hole AB25-009 completed at the Thmei North copper target on the Andong Bor mineral exploration license in Cambodia. The... Keep Reading...

10 March

QIMC Completes 711 Metre Discovery Hole DDH-26-01 at West-Advocate, Nova Scotia: Hydrogen System Confirmed at Depth

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") today announced the completion of Discovery Hole DDH-26-01 to a depth of 711 metres at its West-Advocate hydrogen project in Nova Scotia. Drilling intersected a persistent hydrogen-bearing system... Keep Reading...

09 March

Oil Tops US$100 as Iran Conflict Threatens Strait of Hormuz Supply Route

Global oil and gas prices rallied sharply over the weekend as escalating geopolitical tensions in the Middle East rattled energy markets and triggered fears of a major supply disruption. Benchmark crude prices surged to their highest levels in years, with traders pricing in the possibility of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00