August 18, 2024

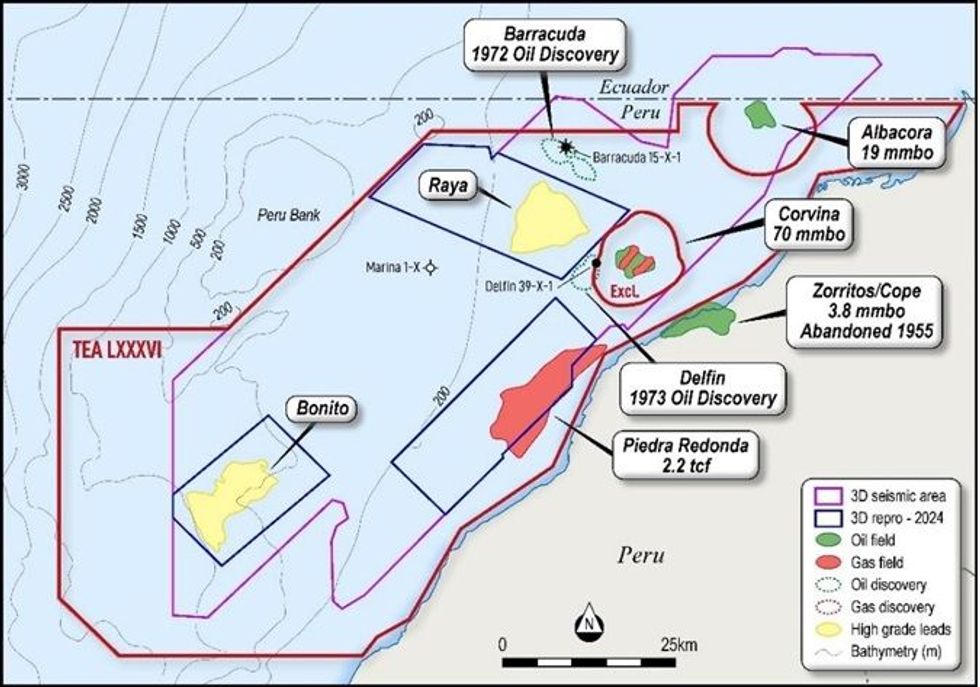

Condor Energy Ltd (ASX: CND) (Condor or the Company) is pleased to advise that Quantitative Interpretation (QI) and AVO studies on the legacy 3,800km2 of 3D seismic data covering most of the Company’s Tumbes Technical Evaluation Agreement (TEA or Block) have potentially identified a highly porous sandstone fairway spanning the Raya Prospect, significantly enhancing the probability of success.

Highlights

- Leading Quantitative Interpretation (QI) company, e-Seis Inc, completes LithSeis and amplitude versus offset (AVO) volumes on legacy 3D seismic data covering the Company’s Peruvian Tumbes TEA.

- New seismic inversion and AVO studies have produced indications of high-quality reservoirs and hydrocarbon fill at the Raya Prospect, significantly upgrading its prospectivity.

- A robust fairway of highly porous sandstone has been delineated coincident with the location of the Raya Prospect.

- This is complemented by recently completed field work which mapped sediment input points leading into the Tumbes TEA during deposition of the Zorritos Formation.

- Reprocessing of the 3D seismic data is nearing completion. Once delivered, these data will be interpreted to allow for the estimation of resources in the Tumbes TEA.

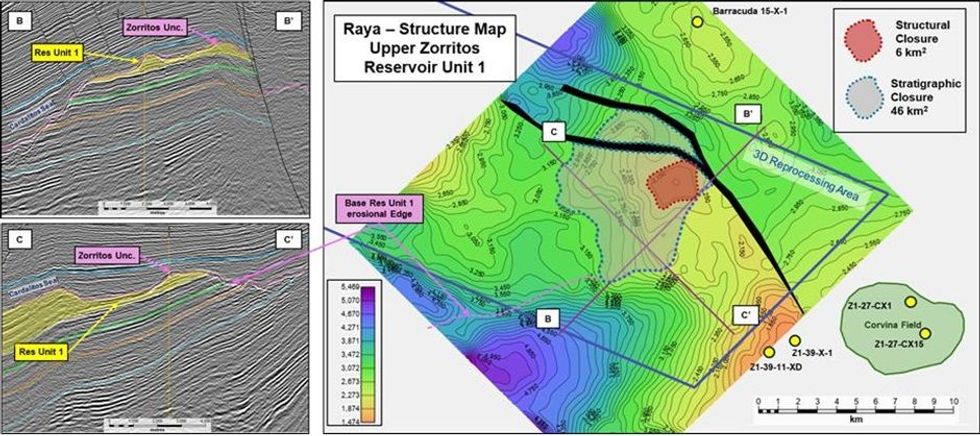

The Raya Prospect is defined as a structural high against an east-west fault within the Zorritos Formation, the primary reservoir in the basin, with a combined 46km2 structural and stratigraphic trap with shales overlying the Zorritos Unconformity providing a regional seal1 (Figure 2).

The Company notes that results from the adjacent Delphin and Barracuda wells confirm the presence of oil charge in the area and, in order to determine resevoir quality, has conducted Quantitative Interpretation (QI) studies of the seismic data covering the Raya prospect.

eSeis Inc., a leading Houston-based QI company, has provided LithSeis and Amplitude Versus Offset (AVO) volumes over the entire 3D data set.

The LithSeis cube, although uncalibrated by well data, is a pre-stack seismic-based petrophysical analysis that yields lithology, porosity, and possible hydrocarbon fill. In the LithSeis section (Figure 3b), yellow colours are interpreted to represent porous sandstones, with red reflectors interpreted to represent very high porosity and/or where hydrocarbons are present. In this case, several layers of high porosity at the top of potential reservoir zones (such as layer SC 1) are evident.

The AVO sections illustrate the responses of seismic reflections to increasing angles of offset and uses a colour bar to differentiate between the five commonly recognised classes of AVO responses; in this area, Class 2 or Class 3 responses are of particular interest as they may be indicative of a hydrocarbon- filled reservoir (either gas or oil).

The highly encouraging culmination of these analyses are the mapped responses of LithSeis and AVO across the SC 1 layer (Figure 4). The strong and consistent LithSeis response suggests the presence of a highly porous sandstone fairway running NE-SW across the Raya prospect, potentially derived from one of the feeder systems identified during field mapping.

Click here for the full ASX Release

This article includes content from Condor Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CND:AU

The Conversation (0)

26 September 2024

Condor Energy

Rare world-class hydrocarbon exploration opportunity

Rare world-class hydrocarbon exploration opportunity Keep Reading...

29 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Condor Energy (CND:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

22 January 2025

A$3M Placement to Advance High-Impact Workplan for Peru

Condor Energy (CND:AU) has announced A$3M Placement to Advance High-Impact Workplan for PeruDownload the PDF here. Keep Reading...

20 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

15 January 2025

Piedra Redonda Gas Field Best Estimate Resource of 1 Tcf

Condor Energy (CND:AU) has announced Piedra Redonda Gas Field Best Estimate Resource of 1 TcfDownload the PDF here. Keep Reading...

13 January 2025

Trading Halt

Condor Energy (CND:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00