April 04, 2023

MAX RESOURCE CORP. (TSXV: MAX) (OTC Pink: MXROF) (FSE: M1D2) ("Max" or the "Company") is pleased to provide the following exploration update on its 100% owned CESAR Copper-Silver Project located in Northeast Colombia.

Highlights

- Max Resource has commenced the 2023 exploration season with over $15 million in the treasury.

- In the last two-years, Max has collected 6,500 surface rock samples over the 90-km-long CESAR belt: 1,125 samples have returned values greater than 1.0% copper with average grades of 3.5% copper and 36 g/t silver.

- Max's geological crew has now started to revisit the clusters of the outcrops with grades >1.0% copper and performing detailed mapping with the objective of delineating feeders; this has led to the discovery of 2 new priority targets ("Sierra" at AM and "Potrero Grande" at URU).

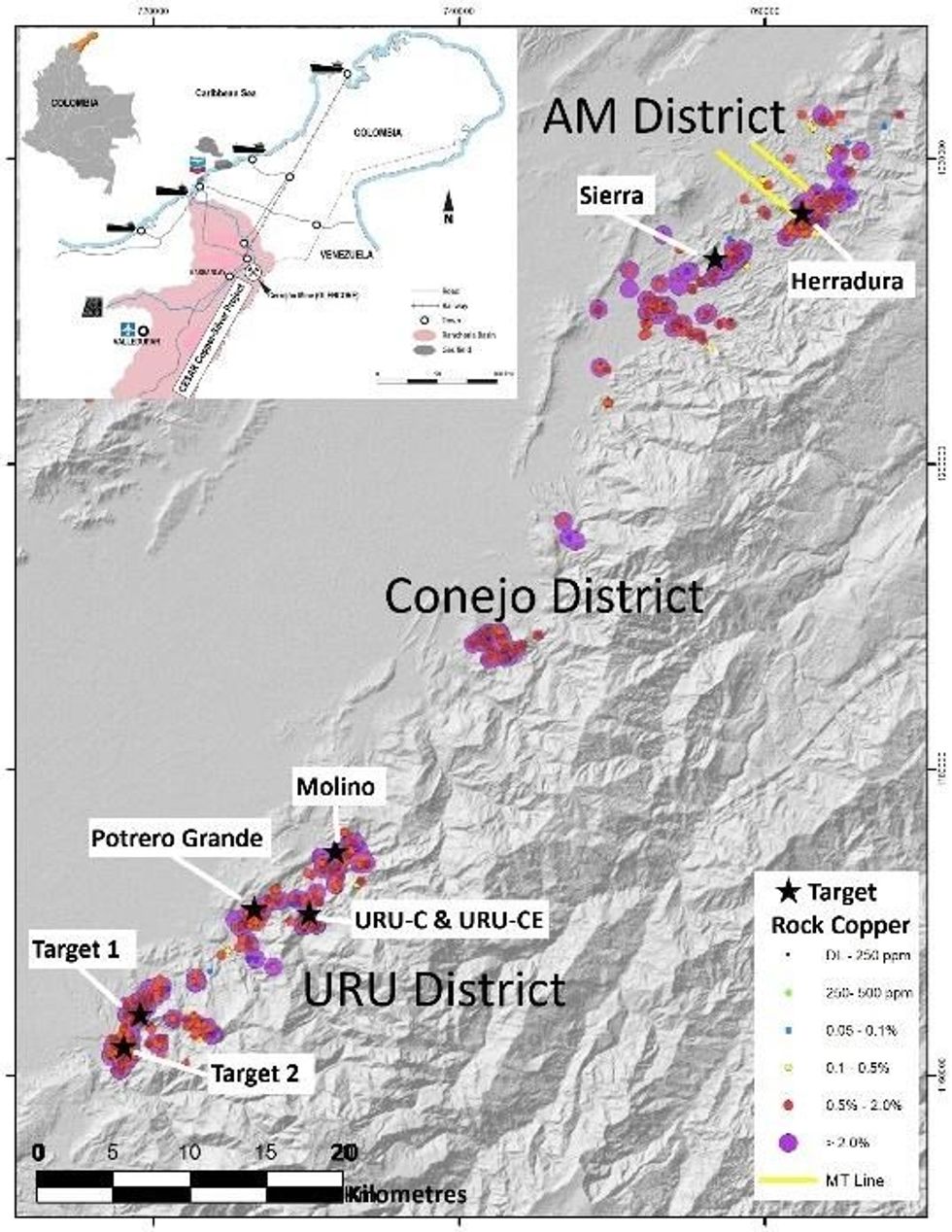

- Presently, 6 priority targets are being evaluated (Herradura, Sierra, Molino, Potrero Grande, URU South Target 1 and Target 2). At the same time, the regional program continues with the objective to identify additional targets (refer to Figure 1).

- Recent drilling at the AM District has confirmed Kupfershiefer style stratiform mineralization is present.

- Metallurgical testing of URU-C and URU-CE drill samples is underway.

Max is taking a two-pronged approach to on-going exploration on its CESAR project: 1) evaluate and prioritize existing targets within the 187-km² of mining concessions for drill testing; and 2) continue the regional sampling and prospecting program to identify additional copper-silver targets along the 90-km long CESAR belt.

"The ultimate goal of our detailed mapping and geophysical surveys is to delineate multiple drill-ready targets along this massive copper system within Max's wholly-owned CESAR Project," commented Max CEO, Brett Matich.

Drill Target Evaluation & Prioritization

The sampling, along with geological mapping, has already identified 6 priority prospects and has helped to define two primary deposit models: a red-bed/Kupfershiefer style stratiform copper mineralization at AM and Central African Copper Belt style, as well as structurally controlled mineralization, at URU and Conejo.

In parallel, orientation geophysical surveys have commenced over targets where copper mineralization is outcropping at surface and there is evidence of historical artisanal mining.

The goal of the orientation surveys is to identify which geophysical techniques best identify the copper mineralization based on the two depositional models. Ground geophysical methods including Magneto Telluric ("MT"), Magnetic, Gravity, Induced Polarization ("IP") and Electromagnetic ("EM") are being tested. In addition, historical seismic data collected over the prospects are being re-processed and interpreted.

Proof of Concept at AM Mining Concessions (112 km²)

Max initiated the 2023 exploration season on the AM mining concessions in the northern portion of the CESAR Project. The Company's hypothesis in this area of the project is that mineralization is sediment-hosted and stratiform, which is similar in style to the Kupfershiefer deposits located in central Europe.

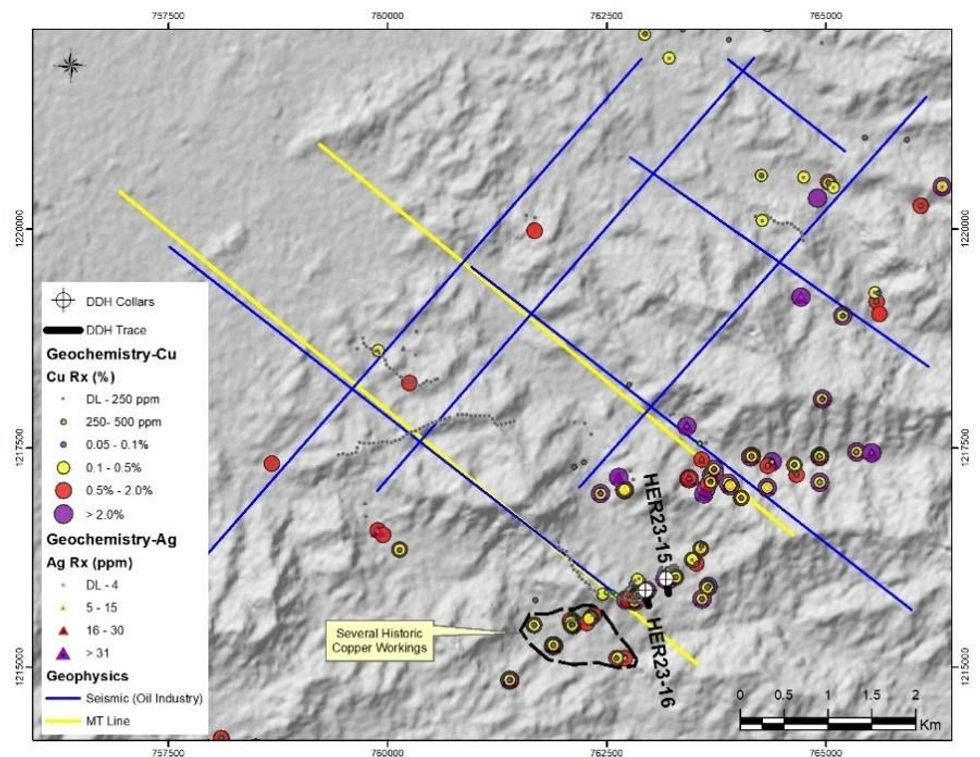

Geological mapping and historical artisanal mining at the "Herradura" and "Sierra" targets, located within the AM mining concessions, indicates that mineralization occurs in at least four horizons in the stratigraphic sequence. To confirm the continuity of mineralization and its hypothesis, Max drilled two scout holes (refer to Table 1 and Figure 2) down dip from surface exposures at "Herradura" in January 2023. The holes were spaced 250m apart and drilled to a depth of approximately 350m. Both intersected multiple copper-replacement beds containing malachite and chalcocite with copper values ranging from 0.04% to 0.96%.

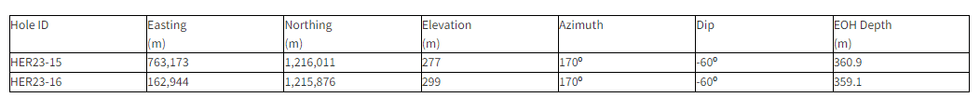

Table 1: Herradura Prospect - 2023 Drill Hole Collars

Metallurgical Studies and drill targets at URU Mining Concessions (74 km²)

In late 2022, Max commenced its inaugural drilling program at the URU District, in the southern portion of the CESAR Project. The objective was to test the continuity of the structurally controlled copper silver mineralization within the volcanic host rocks in the sub-basinal environment of the CESAR sedimentary basin.

Drilling consisted of 12 holes at the URU-C target and 2 holes at the URU-CE target, located 750m apart for a total of 2,244m. 12 holes intersected mineralized zones, with 6 intersecting significant copper silver mineralization, including 10.6m at 3.4% copper and 48 g/t silver.

ALS Metallurgy ("ALS") are conducting metal recovery analysis of the high-grade URU-C mineralization where chip channel sampling returned 7.0% copper and 115 g/t silver over 9.0m.

In addition, ALS are conducting leach recovery testing of samples from URU-CE drill hole URU-9, which intersected broad copper mineralization with associated alteration zone implying potential for a bulk tonnage system, returning 33.0m of 0.3% copper, including 16.5m of 0.5% copper.

Commencement of Geophysical Orientation Surveys

In February 2023, Max engaged Southern Rock Geophysics to commence an MT orientation survey on two 8-km lines within the AM mining concessions. The lines cover where drilling, mapping, geochemical sampling and artisanal mining have defined compelling copper-silver targets. MT is useful in mapping the major lithological units as well identifying potential deep-seated, mineralizing structures (refer to Figure 2).

Regional Exploration and Target Development

Max is conducting on-going regional exploration, which has already identified two new copper-silver prospects in 2023. Work is being conducted over the entire length of the CESAR project and is aimed at detecting target areas that can be further refined. The program includes on-going prospecting and regional stream sediment sampling programs. Max is also planning property scale magnetic - radiometric and LiDAR surveys to assist with geological and structural mapping.

Quality Assurance

Max adheres to a strict QA/QC program for core handling, sampling, sample transportation and analyses. Drill core samples were securely transported to the Company's core facility in Valledupar, Colombia. Samples were sawn in half, labelled, placed in sealed, securitized bags and shipped directly for sample preparation at ALS Colombia LTDA in Medellin and analysis was completed at ALS laboratory in Lima, Peru. Check assays were done at Actlabs in Medellin, Colombia.

The ALS Medellin analytical technique was ME-ICP 61, a four-acid digestion of a 0.25g sample analyzed on an Inductively Coupled Plasma (ICP) with upper limits of 100 ppm for silver and 10,000 ppm for copper. Over limits for copper or silver were analyzed with the OG62 technique, a four-acid digestion of a 0.4g sample.

The Actlabs Medellin analytical technique was TD-AA, a 4-acid digestion of a 0.25g sampled for copper and silver analyzed on an Atomic Absorption (AA) unit, both with upper limits of 100 ppm for silver and 10,000 ppm for copper. Over limits for copper or silver were analyzed with the 8 4 Acid ICP technique, a four-acid digestion of a 0.4g sample.

QA/QC control procedures include the systematic insertion of duplicate, blank and certified reference materials (CRM), at regular intervals into the sampling stream.

Background

Max's CESAR Project lies along the copper silver rich CESAR basin in NE Colombia. This region provides access to major infrastructure resulting from oil & gas and mining operations, including Cerrejón, the largest coal mine in South America, held by global miner Glencore. Max's twenty mining concessions collectively span over 188-km² (refer to Figure 1).

In 2022, Max executed a 2-year co-operation agreement with Endeavour Silver Corp., which assists Max to significantly expand its 100% owned landholdings at CESAR, Endeavour will hold an underlying 0.5% NSR.

Starting in the far north of the Jurassic basin, classic stacked red bed outcrops with extensive lateral continuity have been rock sampled over many kilometres within the AM District. Highlight values of 34.4% copper and 305 g/t silver have been documented in the sedimentary red bed sequences.

The Conejo District, midway south, demonstrates mineralization at the contact of intermediate and felsic volcanics which outcrops over 3.7-km. The average of surface samples over a 2.0% cut-off come in at 4.9% copper.

To the far south, the 2022 inaugural drilling was initiated at two mineralized surface exposures, each located 0.75-km apart and lie within the URU District's 20-km-long, 2-km wide mineralized target area. The drill program at URU-C and URU-CE was the first opportunity to test continuity of the structurally controlled copper silver mineralization within the volcanic host rocks in the sub-basinal environment of the CESAR sedimentary basin.

Qualified Person

The Company's disclosure of a technical or scientific nature in this news release was reviewed and approved by Tim Henneberry, PGeo (British Columbia), a member of the Max Resource advisory board, who serves as a qualified person under the definition of National Instrument 43-101.

About Max Resource Corp.

Max Resource Corp. (TSXV: MAX) is a mineral exploration company advancing the newly discovered district-scale CESAR copper-silver project. The wholly owned CESAR project sits along the Colombian portion of the world's largest producing copper belt (Andean belt), with world class infrastructure and the presence of global majors (Glencore and Chevron).

In addition, Max controls the RT Gold project (100% earn-in) in Peru, encompassing a bulk tonnage primary gold porphyry zone, and 3-km to the NW, a gold bearing massive sulphide zone. Historic drilling in 2001, returned values ranging 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.0-metres.

Max is proactive, with the corporate goal of transitioning the CESAR basin towards the mining of copper, the key metal for Colombia's transition to clean energy. The safety of our people and the communities where we operate is most important. We conduct exploration in a manner which supports protection of ecosystems through responsible environmental stewardship.

Source: NI 43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, Oct.3, 2011

For more information visit: https://www.maxresource.com/

For additional information contact:

Tim McNulty E: info@maxresource.com T: (604) 290-8100

Rahim Lakha E. rahim@bluesailcapital.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com.

MAX:CC

The Conversation (0)

11h

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00