July 10, 2023

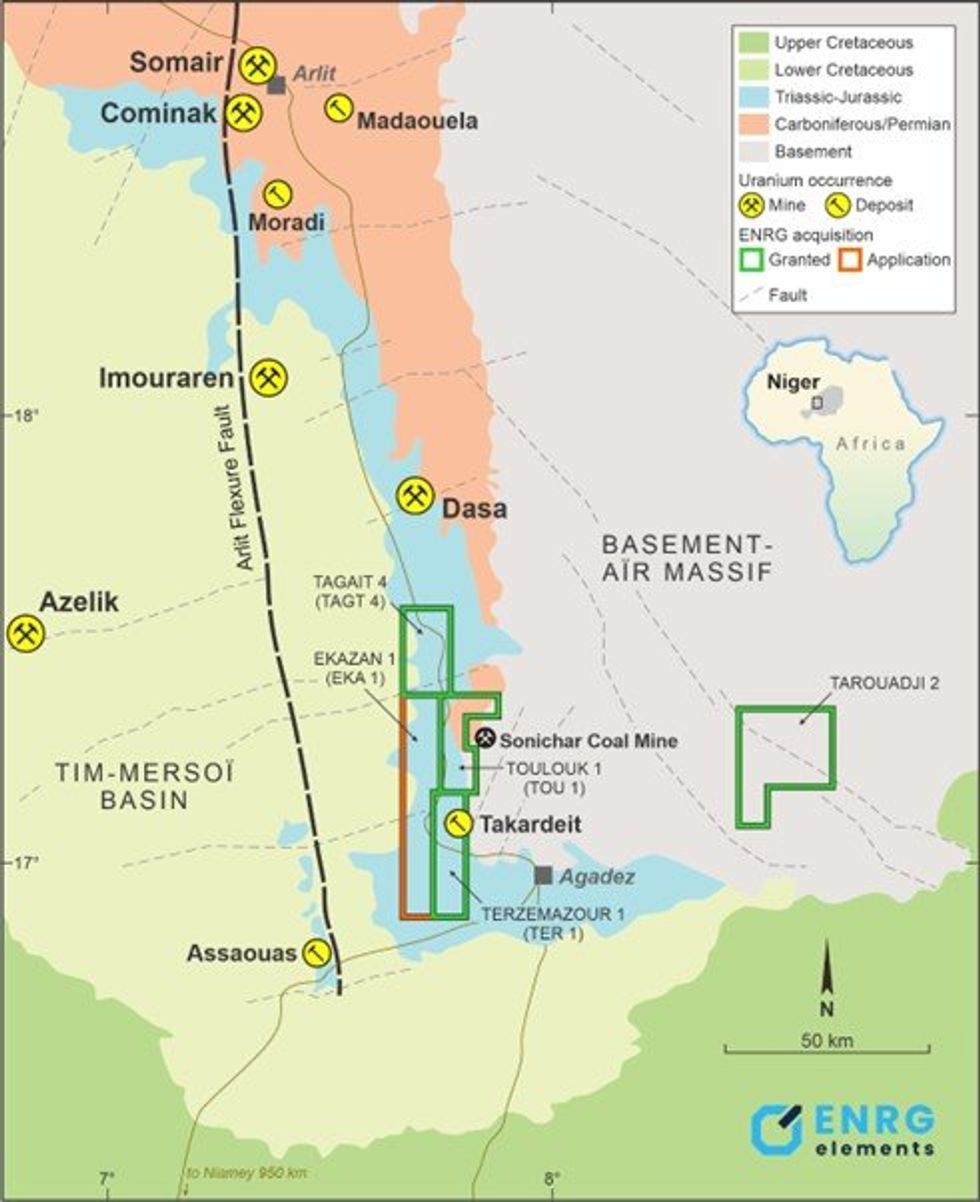

ENRG Elements Limited (ASX:EEL, OTC:EELFF) (“ENRG Elements” or the “Company”) is pleased to announce it has been granted the Tarouadji 2 exploration permit in the largely underexplored Tarouadji area, located in the Agadez region of Niger (“Tarouadji Project”). The Tarouadji Project is prospective for lithium and tin minerals, within a multiphase granitic setting in the Air Massif.

Highlights:

- Tarouadji Project granted, covering historic lithium and tin anomalies.

- Geological setting favorable to host lithium mineralisation.

- Project located 70km east of the Company’s existing Agadez Uranium Project.

- Initial exploration work to commence Q3 CY2023, in conjunction with the verification of historic data.

- Tarouadji Project complements existing uranium and copper asset portfolio.

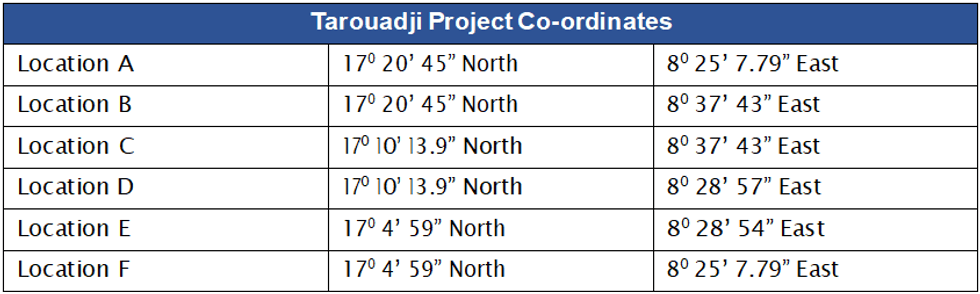

The Tarouadji Project represents a strategic increase in the Company’s land holding position in Niger, situated 70km east of the Company’s Agadez Uranium Project (“Agadez Project”) and covers an area of 499.7km2 (see Figure 1), with the coordinates listed in Table 1.

The Tarouadji Project was initially explored in early 1969 by N Mikhailoff1through surface sampling and geological mapping. The region contains the world’s largest ring dykes, with the tenement mostly covering the “Tarouadji-Type” ring structure and hosting identified pegmatitic intrusions2.

The Company is currently undertaking a verification of the historic sample results which identified lithium and tin anomalies and will report them in accordance with JORC Code 2012 in due course.

The Company aims to commence an exploration program at the Tarouadji Project using a staged approach, signifying its dedication to unlocking new resources and advancing its position as an explorer of uranium, lithium and copper for a carbon-neutral and electric future.

ENRG Managing Director, Caroline Keats, commented:

“The Tarouadji Project offers a unique opportunity for the Company to acquire an area that is host to historic exploration activity that identified a strong lithium anomaly extending for over 2km within granitic host rocks that is adjacent to historic alluvial tin mining1. As our main operation at the Agadez Uranium Project is only 70km to the west, we are well placed logistically to manage the exploration and development of any potential lithium discovery.”

Geological Setting

The tenement is located at the southern end of the “Air Massif”, which covers over 100,000km2 and includes three geological units:

- Precambrian basement;

- Circular Palaeozoic sub volcanic ring structures; and

- Cenozoic volcanism.

Click here for the full ASX Release

This article includes content from ENRG Elements Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00