October 03, 2024

Operating in Kazakhstan since 2008, Jupiter Energy (ASX:JPR) is an established oil exploration and production company producing approximately 600 to 700 barrels of oil per day. The company's operations are fully compliant, with its three commercial production licenses secured until 2045/46/49. Jupiter Energy’s reserve base has been independently confirmed by a Sproule International competent person’s report (CPR), effective 31 December 2023, detailing significant recoverable reserves.

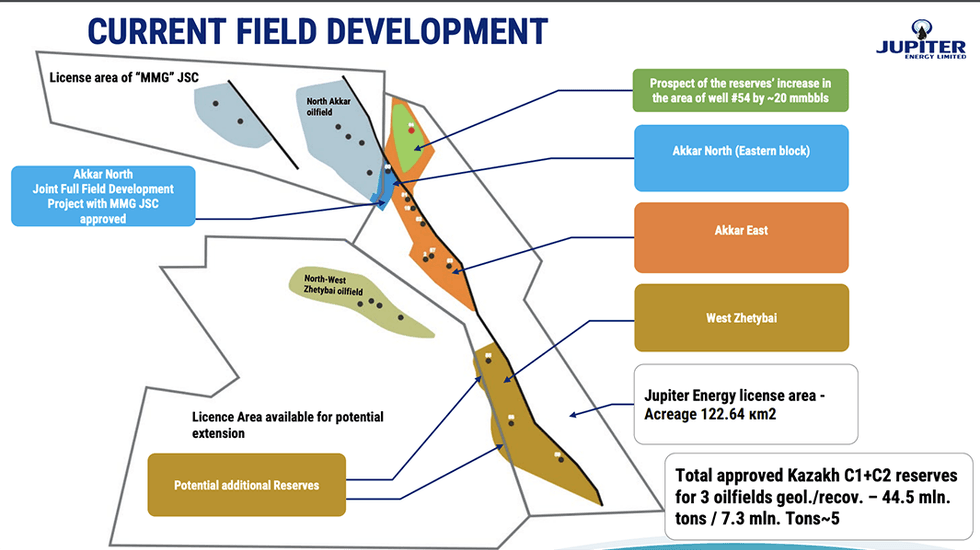

Jupiter has successfully transitioned its oilfields through the various regulatory phases required to reach full commercial production. Its three oilfields – Akkar East, Akkar North (East Block) and West Zhetybai – all operate under their respective 25-year full commercial licences. The company’s established compliance and operational framework underline its commitment to long-term sustainable production in Kazakhstan.

Block 31 is Jupiter Energy’s flagship project located in the Mangistau Basin of West Kazakhstan. Covering an area of approximately 123 sq km, it lies in a highly prospective region with proven oil reserves. The company acquired extensive 3D seismic data over the entire block and surrounding areas, totaling 235 sq km, which then enabled the identification of multiple drilling targets.

Company Highlights

- Operating in Kazakhstan since 2008, with three oilfields under licence.

- Holds commercial production licenses for all three oilfields, valid until 2045/2046/2049.

- Current production is approximately 640 barrels per day from four wells, with plans to increase to approximately 1,000 barrels per day by the end of 2024.

- After-tax NPS (20 percent discount) of US$180 million, with an EV of approximately AU$54 million (~US$36 million) – based on a share price of AU$0.025 per share.

- Operates in West Kazakhstan in the Mangistau region, a proven area for Kazakhstan’s oil reserves.

- The company is cash flow positive at the operational level.

- Key shareholders include Waterford (60.5 percent) and Blackbird Trust (21 percent), aligning interests and providing stability.

- Jupiter’s strategic investment in gas utilisation infrastructure, signifies its commitment to sustainable operations and its contribution to the welfare of the local community.

This Jupiter Energy profile is part of a paid investor education campaign.*

Click here to connect with Jupiter Energy (ASX:JPR) to receive an Investor Presentation

JPR:AU

The Conversation (0)

21 October 2025

Sep25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Sep25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

21 October 2025

Sep25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Sep25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Jun25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Jun25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

22 May 2025

Variation to Noteholder Agreements

Jupiter Energy (JPR:AU) has announced Variation to Noteholder AgreementsDownload the PDF here. Keep Reading...

03 March

Syntholene Energy Corp. Closes Oversubscribed $3.75 Million Non-Brokered Private Placement

Proceeds to be used to Accelerate Procurement and Component Assembly for Demonstration Facility Deployment in IcelandSyntholene Energy CORP. (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) (the "Company" or "Syntholene") is pleased to announce that it has closed its previously announced... Keep Reading...

02 March

Oil, LNG Prices Climb on Fears of Prolonged Hormuz Shutdown

Oil and gas prices surged Monday (March 2) after fresh military strikes between the US, Israel, and Iran rattled energy markets and brought shipping through the Strait of Hormuz close to a halt, raising fears of a wider supply shock.Brent crude, the global oil benchmark, jumped as much as 10... Keep Reading...

02 March

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00