October 03, 2024

Operating in Kazakhstan since 2008, Jupiter Energy (ASX:JPR) is an established oil exploration and production company producing approximately 600 to 700 barrels of oil per day. The company's operations are fully compliant, with its three commercial production licenses secured until 2045/46/49. Jupiter Energy’s reserve base has been independently confirmed by a Sproule International competent person’s report (CPR), effective 31 December 2023, detailing significant recoverable reserves.

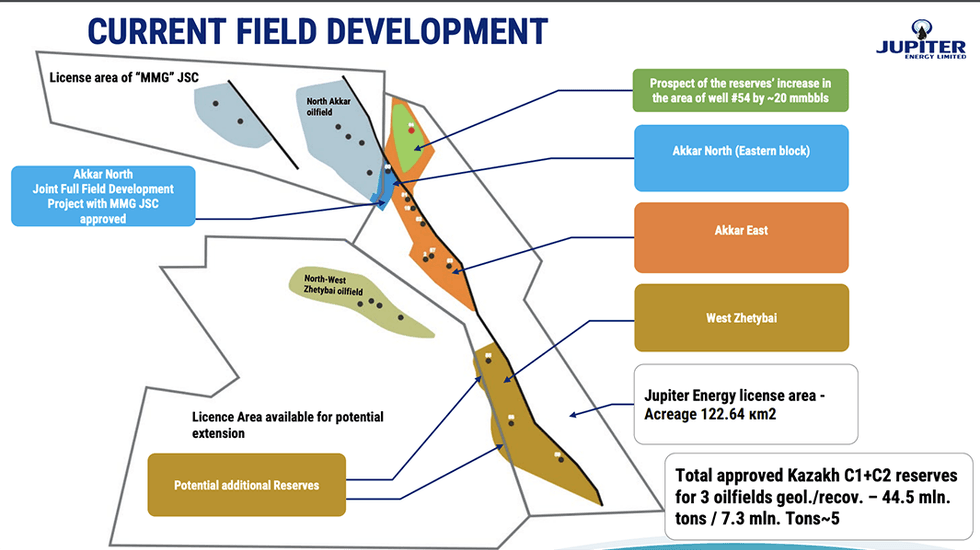

Jupiter has successfully transitioned its oilfields through the various regulatory phases required to reach full commercial production. Its three oilfields – Akkar East, Akkar North (East Block) and West Zhetybai – all operate under their respective 25-year full commercial licences. The company’s established compliance and operational framework underline its commitment to long-term sustainable production in Kazakhstan.

Block 31 is Jupiter Energy’s flagship project located in the Mangistau Basin of West Kazakhstan. Covering an area of approximately 123 sq km, it lies in a highly prospective region with proven oil reserves. The company acquired extensive 3D seismic data over the entire block and surrounding areas, totaling 235 sq km, which then enabled the identification of multiple drilling targets.

Company Highlights

- Operating in Kazakhstan since 2008, with three oilfields under licence.

- Holds commercial production licenses for all three oilfields, valid until 2045/2046/2049.

- Current production is approximately 640 barrels per day from four wells, with plans to increase to approximately 1,000 barrels per day by the end of 2024.

- After-tax NPS (20 percent discount) of US$180 million, with an EV of approximately AU$54 million (~US$36 million) – based on a share price of AU$0.025 per share.

- Operates in West Kazakhstan in the Mangistau region, a proven area for Kazakhstan’s oil reserves.

- The company is cash flow positive at the operational level.

- Key shareholders include Waterford (60.5 percent) and Blackbird Trust (21 percent), aligning interests and providing stability.

- Jupiter’s strategic investment in gas utilisation infrastructure, signifies its commitment to sustainable operations and its contribution to the welfare of the local community.

This Jupiter Energy profile is part of a paid investor education campaign.*

Click here to connect with Jupiter Energy (ASX:JPR) to receive an Investor Presentation

JPR:AU

The Conversation (0)

21 October 2025

Sep25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Sep25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

21 October 2025

Sep25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Sep25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Appendix 5B

Jupiter Energy (JPR:AU) has announced Jun25 Appendix 5BDownload the PDF here. Keep Reading...

13 July 2025

Jun25 Quarterly Activities Report

Jupiter Energy (JPR:AU) has announced Jun25 Quarterly Activities ReportDownload the PDF here. Keep Reading...

22 May 2025

Variation to Noteholder Agreements

Jupiter Energy (JPR:AU) has announced Variation to Noteholder AgreementsDownload the PDF here. Keep Reading...

5h

Beyond Oil, Middle East Crisis Ripples Across Global Commodities

The war raging in the Middle East is sending shock waves across global commodity markets, disrupting far more than just oil and gas.As the conflict enters its second week, the near shutdown of shipping through the Strait of Hormuz is beginning to affect a wide range of materials essential to... Keep Reading...

23h

Josef Schachter: Oil Prices Spike on Iran War, What Happens Next?

Josef Schachter, president and author at the Schachter Energy Report, shares his outlook for oil prices and stocks as the Iran war continues. "The key thing is how long does it last and what is the reason that they want the war," he said.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

11 March

IEA Considers Record Oil Reserve Release Following Hormuz Disruptions

Global energy officials are weighing the largest coordinated release of emergency oil reserves ever proposed as supply disruptions linked to the ongoing Middle East conflict continue to disrupt global markets, according to an exclusive report by the Wall Street Journal.Officials familiar with... Keep Reading...

11 March

Angkor Resources Reports Copper Mineralization Over 286 Metres At Thmei North Prospect, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 11, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") reports results from diamond drill hole AB25-009 completed at the Thmei North copper target on the Andong Bor mineral exploration license in Cambodia. The... Keep Reading...

10 March

QIMC Completes 711 Metre Discovery Hole DDH-26-01 at West-Advocate, Nova Scotia: Hydrogen System Confirmed at Depth

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") today announced the completion of Discovery Hole DDH-26-01 to a depth of 711 metres at its West-Advocate hydrogen project in Nova Scotia. Drilling intersected a persistent hydrogen-bearing system... Keep Reading...

09 March

Oil Tops US$100 as Iran Conflict Threatens Strait of Hormuz Supply Route

Global oil and gas prices rallied sharply over the weekend as escalating geopolitical tensions in the Middle East rattled energy markets and triggered fears of a major supply disruption. Benchmark crude prices surged to their highest levels in years, with traders pricing in the possibility of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00