October 30, 2023

Jindalee Resources Limited (Jindalee, the Company) is pleased to provide its Quarterly Activities Report for the period ending 30 September 2023.

- Excellent head assays from McDermitt metallurgical testwork

- McDermitt Pre-Feasibility Study (PFS) progressing well (on time and on budget)

- Priority Offer to Jindalee shareholders closed 27 October 2023, raising $0.6M (before costs)

- The Company to be renamed Jindalee Lithium Ltd, subject to shareholder approval at the forthcoming AGM

US LITHIUM

McDermitt Lithium Project (Jindalee 100%)

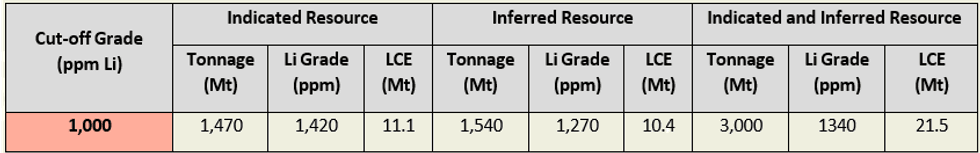

In February 2023, Jindalee Resources Limited (Jindalee or the Company) announced an updated Mineral Resource Estimate (MRE) at Jindalee’s 100% owned McDermitt Lithium Project (US) following drilling completed in October 2022 (Figure 1)1.

The 2023 MRE for McDermitt contains a combined Indicated and Inferred Mineral Resource Inventory of 3.0 Billion tonnes at 1,340ppm Li for a total of 21.5 Million tonnes LCE at 1,000 ppm cut-off grade. At 21.5 Mt LCE, McDermitt is the largest lithium deposit in the US by contained lithium in Mineral Resource, and a globally significant resource (Table 1), with the deposit remaining open to the west and south (Figure 1).

Metallurgical Testwork

In March 2023 Jindalee announced that global engineering, procurement, construction and maintenance (EPCM) company Fluor Corporation (NYSE: FLR) (Fluor) had reviewed metallurgical testwork undertaken at McDermitt and had determined that acid leaching with ore beneficiation (to upgrade the leach head grade) delivered the lowest operating costs and best financial outcome among the alternatives considered2.

Click here for the full ASX Release

This article includes content from Jindalee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JRL:AU

The Conversation (0)

11h

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00