October 21, 2024

Impact Minerals Limited (ASX:IPT) is pleased to announce that in collaboration with CPC Engineering and the Mineral Recovery Research Centre (MRRC) at Edith Cowan University, they have been awarded a grant of $2.87 million grant towards the commercialisation of the company’s innovative process to produce High Purity Alumina (HPA) from the Lake Hope deposit located 500 km east of Perth in Western Australia. HPA is on the list of critical minerals for Australia, Europe, and North America.

The grant is provided under the Federal Government’s Cooperative Research Centres Projects (CRC-P) program which fosters short-term, industry-led research collaborations. The grant is part of an estimated $6.4 million research and development project to be completed within three years and designed to provide Impact with the relevant information required to complete a Definitive Feasibility Study in that time frame. A key component of the grant funding will be to construct a pilot plant, which is a key goal for 2025, and this will provide consistent material for off-take and qualification trials.

Impact Minerals’ Managing Director Dr Mike Jones, said, “We are immensely proud to drive this transformative project, which aligns with and advances Australia’s strategic interests in critical minerals. We thank Minister Husic for his personal interest in the project as this federal funding not only underscores the national importance of our work but also enhances our capability to implement world- leading technologies that set new standards in sustainability and efficiency in the mineral sector. Being able to commence work on our pilot plant and the subsequent feasibility studies with the world-leading research of Edith Cowan University and the unique skills and experience of CPC Engineering will position Impact Minerals at the forefront of the global HPA market, ready to meet increasing demands with a sustainably produced, high-quality product. The project is scheduled to advance from initial trials to a definitive study phase swiftly, ensuring timely delivery of HPA and fertilizer samples to potential customers and partners. This grant and likely contributions from the R and D rebate will ensure our next stage of work after the PFS will be well funded.”

The research project brings together three groups with the unique assets and skills to bring the Lake Hope project to fruition.

Impact has developed innovative metallurgical processes to produce HPA and fertiliser by-products from the salts in the Lake Hope deposit, which will be mined and trucked to Kwinana for processing. The mining and processing will have a minimal environmental footprint, with no on-site beneficiation required at the mine, nominal long-term rehabilitation requirements and one of the lowest Scope 1 and Scope 2 CO2 emissions of any HPA production process globally (ASX Release June 19th 2024).

The Mineral Recovery Research Centre at ECU, led by Associate Professor Amir Razmjou, is a world leader in Membrane Selective Technology (MST) in which plastic or ceramic membranes are used to remove a wide variety of contaminants from reagents and water. The technology is well-established in water treatment, and the MRRC is adapting the technology to the mining industry.

Impact believes MST to be a further game changer for producing HPA, and in particular, for cost-effective reagent regeneration and removal of contaminants in waste water. This, in turn, will lead to lower energy costs, emissions and, in particular, operating costs for the project. It adds to the overall small environmental footprint of the Lake Hope project and the research aims to design a “zero-liquid discharge” project to minimise or even eliminate waste from the process.

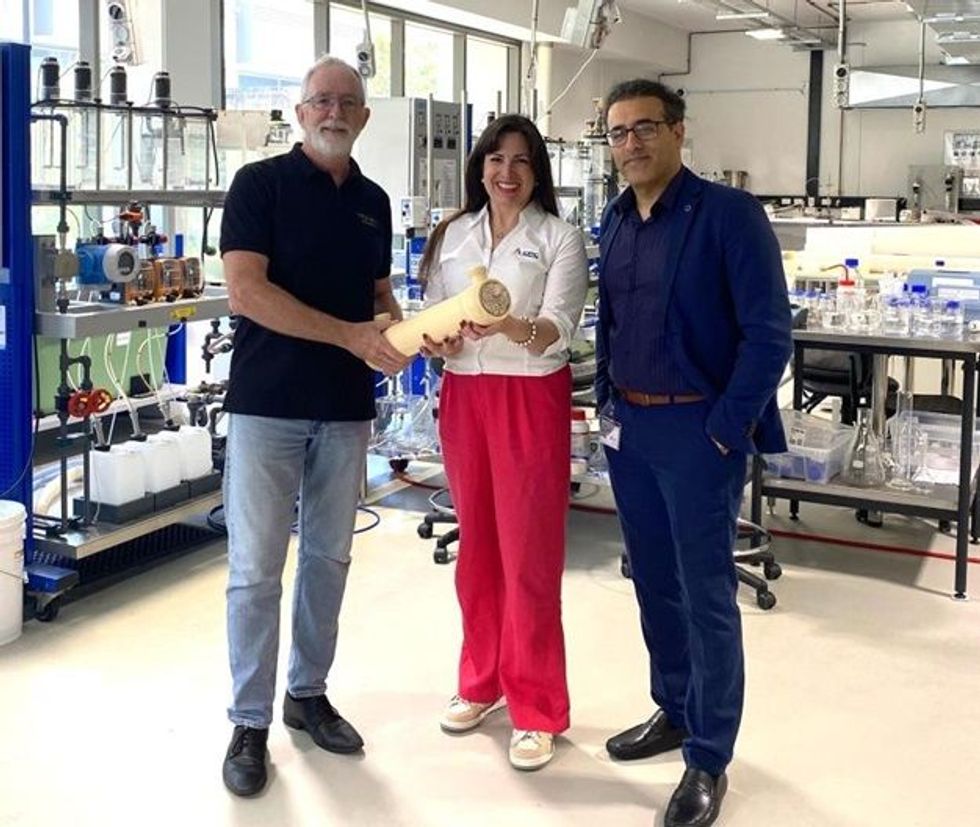

CPC Engineering is completing the engineering design studies and estimates of the operating and capital costs for the proposed 10,000 tonnes per annum HPA plant as part of Impact’s Pre-Feasibility Study on Lake Hope (ASX Release October 9th 2024). Eugenia Phegan of CPC, who has previous experience in building HPA pilot plants, recognised the potential of MST for Lake Hope and Impact thanks her for her insight and energy in helping design and complete the grant application as well as her on-going contribution to the Lake Hope journey.

CPC will design, build and manage the pilot plant under the research project. In addition, Impact will also work with ECU and CPC to generate new uses for HPA.

About the Grant and Future Directions

The CRC-P grant of $2.87 million aims to foster the development of competitive, sustainable, and productive Australian industries through strategic research collaborations. Impact Minerals, along with its partners, will fund the remainder of the $6.4 million project, being $3.53 million, with cash and in-kind contributions. Impacts contribution will be about $1.7 million, much of which will be potentially eligibility for the Research and Development rebate of 43%.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

7h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00