October 20, 2024

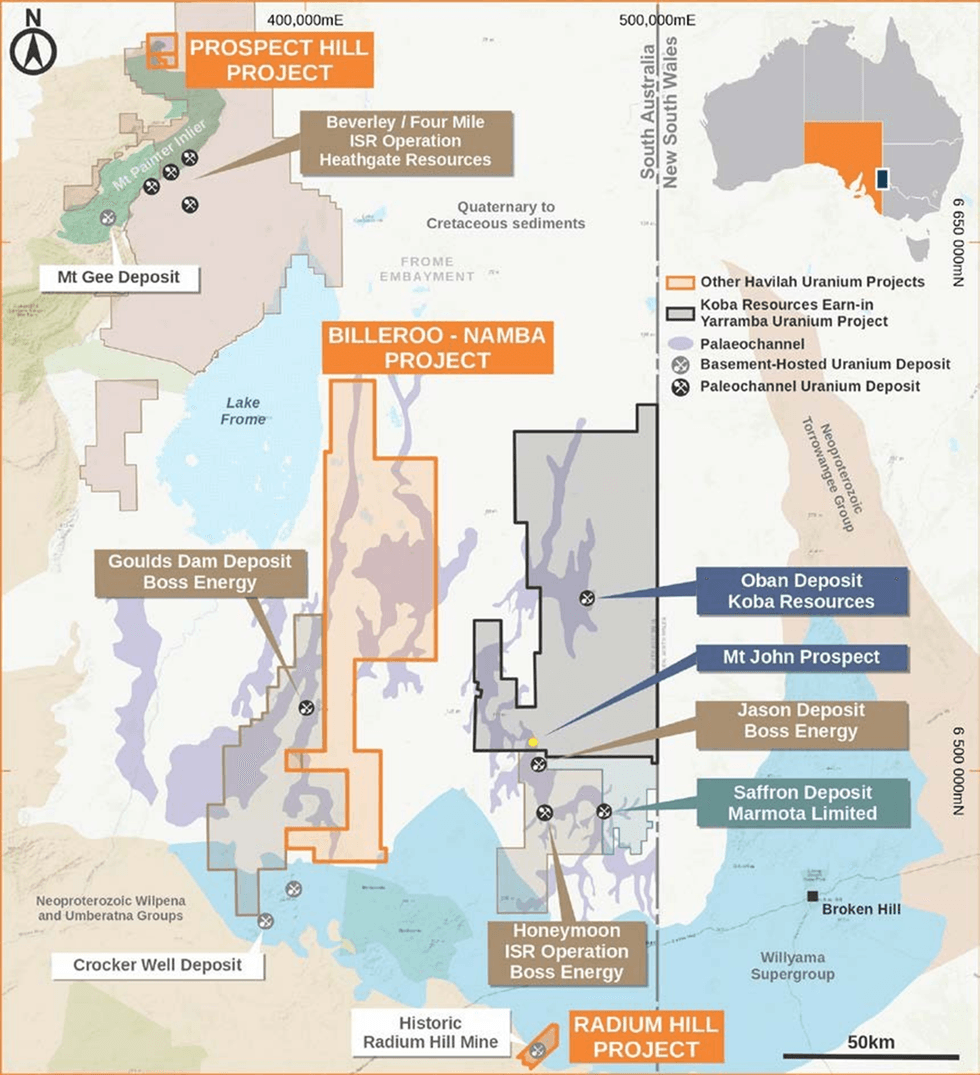

Havilah Resources Limited (Havilah or the Company) (ASX: HAV) is pleased to report that it has entered into binding agreements with Heavy Rare Earths Limited (ASX: HRE) relating to a portion of its extensive uranium exploration assets in the Curnamona Province of northeastern South Australia (Figure 1).

HIGHLIGHTS

- Binding agreements signed with Heavy Rare Earths Limited (HRE) conferring exploration and mining rights for various high calibre uranium assets on certain of Havilah’s exploration licences (Uranium).

- Effectively monetises a portion of Havilah’s remaining uranium assets, providing Havilah with potentially significant uranium market exposure and uranium project development upside.

The Uranium assets include:

1. The Radium Hill project – strike extensions of the historic Radium Hill uranium mine (but not including it)1 with significant discovery potential for uranium. HRE’s exploration and mining rights also extend to rare earth elements and scandium on the Radium Hill project.

2. An unexplored 15 km section of the Billeroo palaeochannel project immediately downstream from Boss Energy Ltd’s Goulds Dam deposit.

3. A lightly explored 35 km section of the Lake Namba palaeochannel project, with numerous wide- spaced historic uranium drill intersections.

4. Prospect Hill project area representing an untested possible geological analogue to the prolific Beverley-Four Mile uranium mining camp.

Key terms of the transaction involve:

1. Issue of 38 million fully paid ordinary shares in HRE to Havilah, half of which are subject to a 6 month voluntary escrow and the other half to a 12 month voluntary escrow (Consideration Shares).

2. Grant of 17.5 million unlisted options over HRE ordinary shares, each exercisable at 6 cents within a period of 3 years from the date of issue (Consideration Options).

3. An expenditure commitment of $3 million over 3 years, with a minimum commitment of $1 million within the first year.

4. Subject to the above, an ability for HRE to earn an 80% interest in the Uranium exploration and mining rights within certain Havilah exploration licences and an 80% joint venture interest in any discovery tenements that it applies for over a Uranium discovery.

5. HRE will free carry Havilah’s 20% joint venture interest in a Uranium discovery until completion of a bankable feasibility study, following which Havilah may elect to contribute or dilute to a 1.5% NSR (net smelter return) royalty on Uranium produced.

6. Completion of the transaction and consequent issue of the ordinary shares and grant of the options to Havilah and commencement of the joint venture earn-in is subject to the following conditions precedent:

A. HRE completing due diligence, to its sole satisfaction;

B. HRE obtaining shareholder approval for the issue of the Consideration Shares and Consideration Options; and

C. The parties obtaining all other shareholder, regulatory and third-party approvals, consents or waivers which are required to complete their respective obligations under the agreements (together the Conditions Precedent).

These terms have been effected by execution of a binding Term Sheet that sets out the commercial arrangements and a binding Tenement Access and Mineral Rights Agreement that governs the access rights of HRE to Havilah’s relevant exploration licences.

After this transaction with HRE and the earlier transaction with Koba Resources Limited (refer to ASX announcement 22 January 2024), Havilah still retains 100% ownership of several promising hard rock prospects including the Johnson Dam prospect (refer to ASX announcement 17 May 2023), the Homestead prospect (refer to ASX announcement 29 August 2023), the Birksgate prospect (refer to ASX announcement 15 January 2024) and the Coolibah palaeochannel.

Click here for the full ASX Release

This article includes content from Havilah Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

7h

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

15h

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00