May 18, 2023

Balkan Mining and Minerals Ltd (ASX: BMM; “Balkan Mining” or “the Company”) advises that the Company has begun an extensive soil sampling program at the Gorge Project in Ontario, Canada.

HIGHLIGHTS

- Soil sampling underway at the Gorge Lithium Project, Ontario.

- Focused on the identified Koshman and Nelson pegmatite occurrences following on from the successful 2022 channel sampling program, which included 1.8m @ 3.75% Li20, confirming significant project potential.1

- Appointment of Valerie Pascale as the Company’s head of ESG and permitting.

Balkan Mining and Minerals, Managing Director, Ross Cotton, commented:

“We have continued to diligently complete our work programs as we embark upon our 2023 field season. We are on track to do justice to our multiple projects in Ontario and Quebec, aligning ourselves with the rapidly growing Canadian lithium market.”

Gorge Sampling Program

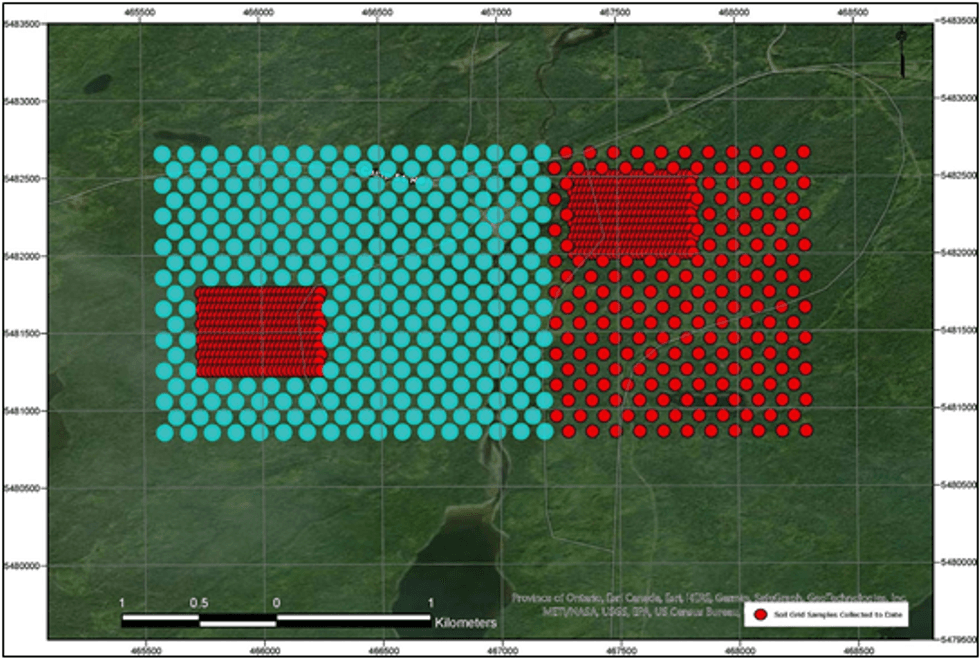

With the onset of Spring and improved access, the Company has begun an extensive soil sampling program at the Koshman and Nelson occurrence in 20m grids, then stepping out to a wider area at a 100m grid pattern, covering an area of approximately 5km2.

Historical and recent sampling and channeling completed in 2022 returned very positive results with high lithium grades (refer to announcements dated 4 July, 28 September and 16 December 2022). The results of the sampling program will assist in the delineation of targets for follow up drilling.

The field teams’ immediate focus can be seen in Figure 1.

This program will also serve to benefit the Company’s endeavours to systematically explore the larger Gorge Project area, including the additional 5 claims secured in November 2022.

Corporate

The Company is pleased to have appointed Valerie Pascale, formerly of Modern Core, has as the Company’s in-country head of ESG and permitting in Canada.

Ms Pascale has worked Corporate Social Responsibility (CSR) capacity in the mining industry for 13 years. Until recently, she was the Manager of CSR at Newmont (formerly Goldcorp) for almost 11 years. Ms Pascale worked with NGOs, Aboriginal organizations, community groups, and governments on a variety of development projects and pro before moving to the private sector.

Ms Pascale is a graduate of International Development Studies from Guelph University in Canada. While at Newmont, she was responsible for the development of the first CSR and Human Rights corporate policies. Ms Pascale worked closely with the VP of CSR to develop the first corporate CSR Framework/Strategy for Goldcorp. She was responsible for the ongoing development of corporate CSR strategies, policies, and guidelines. She supported global CSR/community relations teams, exploration teams, development projects and operations. She also focused on building strategic partnerships with various stakeholder groups to maximize the local benefits of mining and to achieve effective and sustainable community development.

Authorised for release by the Managing Director of Balkan Mining and Minerals Limited

Click here for the full ASX Release

This article includes content from Balkan Mining and Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BMM:AU

The Conversation (0)

05 September 2021

Bayan Mining and Minerals

Mining Critical Minerals from the Balkan Region

Mining Critical Minerals from the Balkan Region Keep Reading...

19 January 2025

Further Exploration Targets Identified at Bayan Springs

Bayan Mining and Minerals (BMM:AU) has announced Further Exploration Targets Identified at Bayan SpringsDownload the PDF here. Keep Reading...

31 October 2024

Quarterly Activities/Appendix 5B Cash Flow Report

Balkan Mining and Minerals (BMM:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00