June 28, 2023

GMV Minerals (TSXV:GMV, OTCQB:GMVMF) is a well-established junior gold development company that shifted its focus knowing that current lithium production simply cannot keep up with soaring demand, unless there is an exponential increase in available supply.

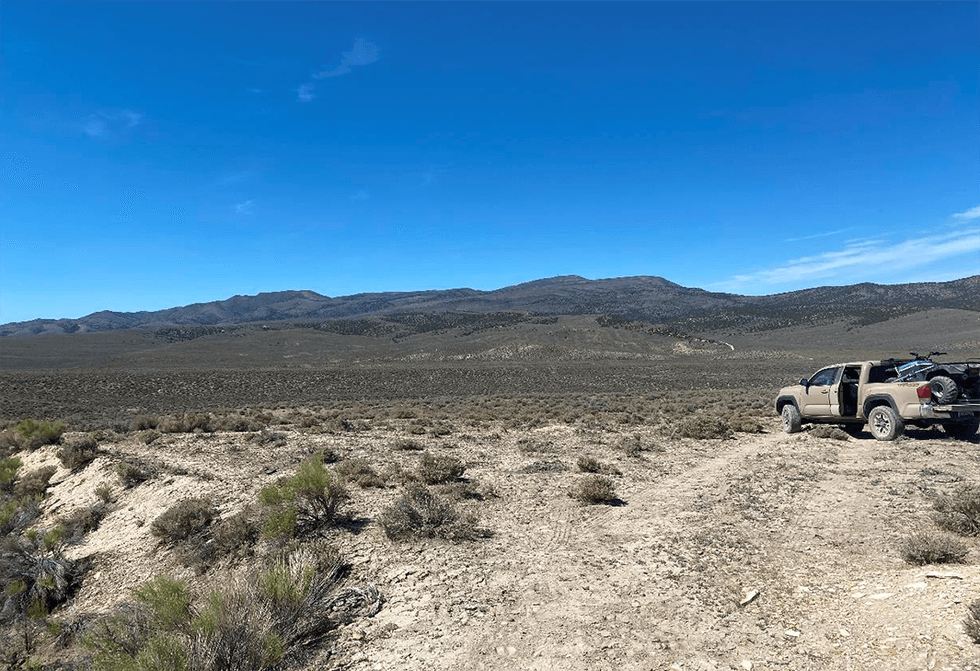

GMV intends to explore the Daisy Creek lithium project, located in Lander County, Nevada, to assess its potential for expansion prior to development. Daisy Creek was first identified as a rich potential source of lithium in the 1980s after high-grade lithium was noted to have been likely contained in lithium-bearing clay found in altered volcanic tuffs. Geologists staked claims in the area after seeing similarities between the geology of Daisy Creek and Lithium America’s significant Thacker Pass discovery.

The Daisy Creek Lithium project was initially targeted for uranium by multiple oil and mining companies in the late 1970s and early 1980s, the project instead proved rich in lithium, displaying values of up to 2 percent in clay-altered volcanic tuffs, which geologists noted was likely hectorite-based.

Company Highlights

- GMV Minerals is a junior gold development company with a recently added claim block focusing on lithium.

- Driven by investor interest and market conditions, the company entered into an agreement to obtain 100-percent ownership of the highly prospective Daisy Creek lithium project.

- GMV also maintains 100-percent ownership of the Mexican Hat gold project, notable for its estimated 10-year mine life, low capex and a pre-tax $153-million NPV using a US$1,600 per oz base case.

- Mexican Hat hosts an inferred 688,000 ounces of gold, excellent metallurgical results and a low strip ratio.

- Both Daisy Creek and Mexican Hat are situated in safe, mining-friendly jurisdictions with readily available and experienced service providers. Each asset is also situated in close proximity to existing infrastructure, further reducing initial capex.

- GMV is also noteworthy for its tightly-held share structure, with 24 percent of shares held by management and advisors.

This GMV Minerals profile is part of a paid investor education campaign.*

Click here to connect with GMV Minerals (TSXV:GMV, OTCQB:GMVMF) to receive an Investor Presentation

GMC:CC

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00