January 15, 2025

Gold Mountain Limited (ASX: GMN) (“Gold Mountain” or “the Company” or “GMN”) is excited to announce it has received 38 stream sediment samples from the Salinas South Project in the Lithium Valley and has defined anomalies over 5 km along regional structural strike direction.

Highlights

Work Undertaken

- Encouraging assays were received from 38 stream sediment samples.

- Lithium anomalies were identified over a 5.8 km distance, which includes high order anomalies over an artisanal working.

- Anomalies interpreted to lie over a major concealed granite body at depth.

Future Workplan

- Carry out soil sampling over the strongest lithium anomalies with coincident pathfinder element anomalies and the known artisanal working.

- Continue on ground mapping to search for pegmatite outcrops.

- Define drill targets and get environmental permits for drilling.

Managing Director David Evans commented

“Over the past few years, Gold Mountain has built up an impressive ground position in Brazil’s Lithium Valley, an emerging lithium hotspot, home to two producing mines and Latin Resources’ Colina deposit. The new results from Salinas South complement the recent announcement of 10 drill targets from our Salinas II Project and give the company a strong pipeline of targets for us to test right across this highly prospective region.”

Details

Strongly anomalous stream sediment sample results were received on the Salinas South 830.557/2023 tenement with strongly correlated beryllium (Be), rubidium (Rb), niobium (Nb) and potassium (K).

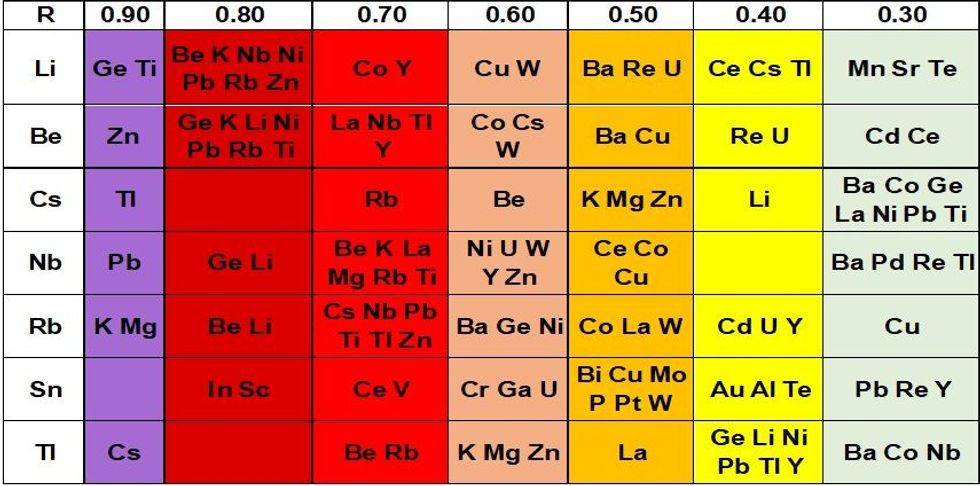

Table 1 shows the correlation chart for the anomalous lithium samples in tenement 830.557/2023

Note that correlations show spatial associations that include lithium pegmatites and may include other rock types. The presence of chrysoberyl in the area suggests that pegmatites have intruded mafic to ultramafic rocks to pick up the chromium necessary to form chrysoberyl rather than beryl. This gives additional criteria to search for lithium pegmatites and explains part of the unusual associated elements in the correlation chart such as Ni, Mg and Zn.

The Salinas South project consists of 26 tenements with a total area of 50,911 hectares in the Lithium Valley. Post tectonic granites surround the tenements which contain favourable weak, schistose host rocks.

The Salinas South Project area is thought to lie on the margins of a major granite at depth, with the margins also passing through the area of the Sigma Resources and CBL lithium mines. A strong NE trending structural direction is also present at the Salinas South Project, similar in direction to those identified at Sigma Lithium and in the vicinity of the Colina deposit held by Latin Resources. The structural directions are also visible on the radiometric and magnetic images of the Salinas South Project.

Structurally controlled occurrences of pegmatites including one known to contain lithium are located just to the northwest of the Salinas South Project area on prominent NE trending structures. Similar orientation structures are seen in the topography in the Salinas South 830.557/2023 tenement.

Mapping in 830.557/2023 during sampling identified an occurrence of pegmatite as well as late tectonic granites. Mapping elsewhere in the Salinas South tenements has also shown that there are significant scale pegmatites present. An artisanal working was identified. It lies within or adjacent to a high order lithium anomaly and is the highest priority target area in this tenement at present.

It was also evident that remnants of an old surface were present on many of the ridges, indicating that subdued anomalies could be anticipated from sources on the hills. Presence of an old lateritised surface indicates where lithium pegmatites may be concealed by leaching of lithium.

Click here for the full ASX Release

This article includes content from Gold Mountain, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00