November 14, 2023

Jindalee Resources Limited (to be renamed “Jindalee Lithium Limited”) (Jindalee, the Company) announced initial head assay results for metallurgical samples from the Company’s 100% owned McDermitt Lithium Project located in Oregon, USA and noted that beneficiation was underway, ahead of acid leach testwork2. The testwork is being undertaken at consultant metallurgists Hazen (Colorado, USA) and being managed by leading global engineering, procurement, construction and maintenance company Fluor Corporation.

- Exceptional results from beneficiating McDermitt ore using simple screening

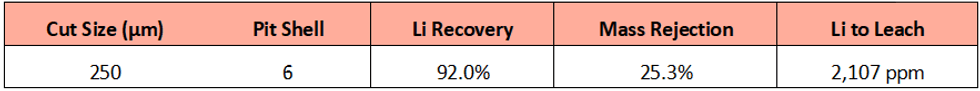

- Attrition scrubbing at a coarse cut size of 250 microns returns 92.0% Li recovery with 25.3% mass rejection

- Lithium grade to leach increases to 2,107 ppm Li, 57% higher than the average Mineral Resource grade (1,340 ppm Li)1

- Potential for further improvements by optimising cut size for specific mineralised units

- Leach testwork on beneficiated samples currently underway with results to feed into PFS

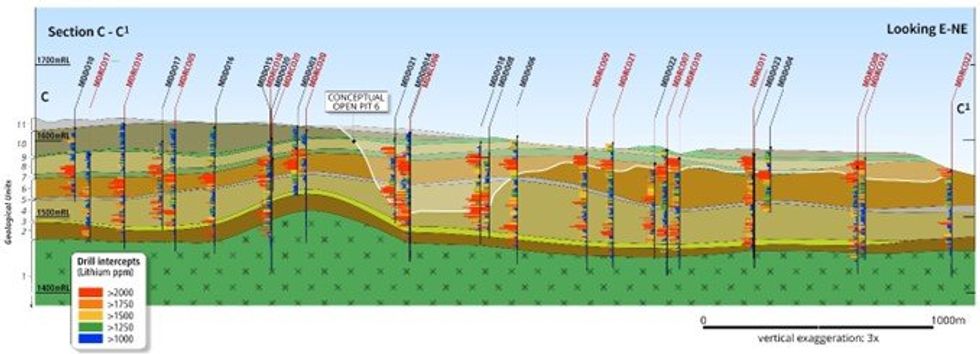

Jindalee is pleased to advise that beneficiation of these samples via attrition scrubbing has been completed, returning excellent results. Pit shell composites consisting of Units 4, 6, 8 and 10 from conceptual Pit Shell 6 (nominal 43 years) (Figures 2 and 3), recovered 92.0% of the lithium to leach feed and rejected 25.3% of the mass at a cut size of 250 microns (Table 1). The average grade to leach was 2,107 ppm Li, 18% higher than the average head grade of the metallurgical samples (1,790 ppm Li)2 and 57% higher than the average Mineral Resource grade (1,340 ppm Li; refer Table 2).

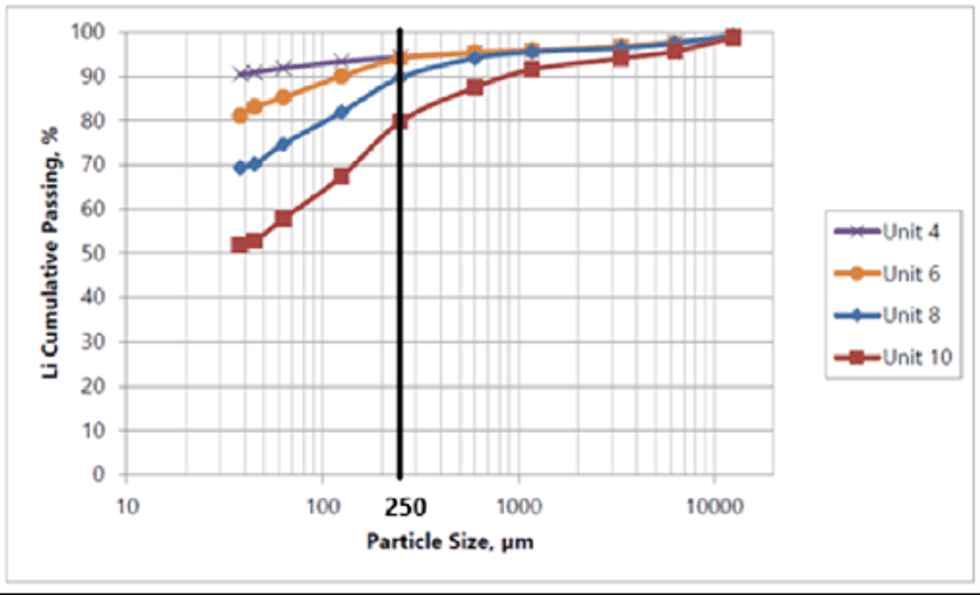

Beneficiation testwork on individual units has confirmed higher lithium concentrations in the finer fractions of Units 4 and 6, where the minus 38-micron fraction contains 90.5% and 81.1% of the contained lithium respectively (Figure 1). This has positive implications for processing of these deeper units with the potential to optimise lithium recoveries by adopting a finer cut size as development progresses.

The 250-micron cut size will be adopted for initial acid leaching testwork for the McDermitt Pre-feasibility Study (PFS), with variable attrition times and cut sizes, and scrubbing of coarse material (to increase recovery of lithium to fines), to be further investigated. Initial results are expected early December 2023.

Discussion

In March 2023 Jindalee announced that previous metallurgical testwork undertaken at McDermitt had been reviewed and that acid leaching with ore beneficiation (to upgrade the leach head grade) had been determined to deliver the best financial outcome among the alternatives considered3. It was also noted that the very large Mineral Resource Estimate (MRE) at McDermitt (21.5 Mt LCE, Table 2)1 allowed flexibility in development, providing the opportunity to optimise mining and feed higher grade ore early in the mine life. Subsequently, a comprehensive metallurgical testwork program has commenced to provide testwork data upon which the preferred flowsheet for the processing of McDermitt ore can be designed.

Recent relogging of McDermitt drilling has recognised up to 12 distinctive stratigraphic units which can be tracked across the Project (Figure 2). Four of these units (Units 4, 6, 8 and 10) carry elevated lithium grades and selective mining of these units has the potential to deliver significantly higher grade material (when compared to the MRE average grade) for processing2.

In June 2023 leading mine engineering group Cube Consulting generated conceptual pit shells using the McDermitt MRE geological model (Figures 2 and 3) to assist with selection of samples for the metallurgical testwork program. Samples from Units 4, 6, 8 and 10 within the Indicated portion of Pit Shell 6 (nominal 43 years) were selected and approximately 700kg of drill core was despatched to Hazen for testing. Initial head assays for these samples were announced on 23 October 20232 with results from beneficiation of these samples now being reported.

Click here for the full ASX Release

This article includes content from Jindalee Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

JRL:AU

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00