November 27, 2023

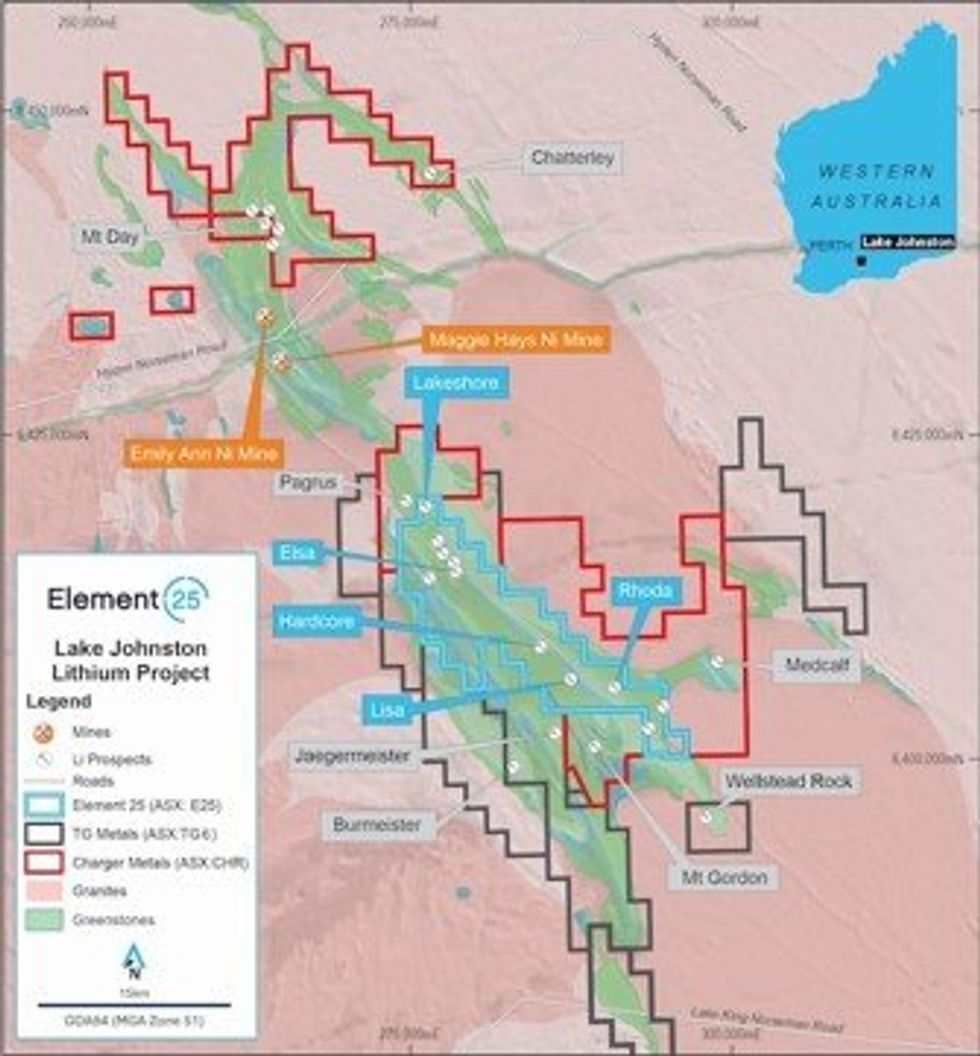

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is pleased to provide an update on exploration activities at its Lake Johnston Lithium Project in WA.

Lake Johnston is rapidly becoming an emerging province for hard rock pegmatite-hosted lithium mineralisation. The Company holds significant exploration tenure over the Lake Johnston Greenstone Belt, where recent exploration activities continue to enhance the belt’s potential for commercial lithium mineralisation. Despite the recent increase in global lithium exploration activity, the Lake Johnston greenstone belt remains relatively underexplored, with exploration previously focusing on gold and nickel. Recent results announced by explorers, including TG Metals Limited (ASX:TG6) and Charger Metals Limited (ASX:CHR), however, demonstrate there is significant potential for lithium mineralisation in the belt.

Accordingly, E25 has undertaken data compilation and target generation in the area to identify high-priority targets for follow- up testing. The activities to date have included the compilation of historical exploration results, re-processing and re- interpreting available geophysical datasets, and analysing satellite imagery and other remote sensing data sets to identify potential outcropping pegmatites or other geological or geochemical targets.

E25 Managing Director Justin Brown commented: “Whilst Element 25’s primary focus is and will remain the commercialisation of our innovative high purity manganese refining process, recent activities in the Lake Johnston Greenstone Belt provide a compelling case for the presence of potentially economic lithium mineralisation within Element 25’s ground-holding in the region. The Board therefore supports the allocation of resources to test this potential, without impacting on the progress at our Butcherbird Manganese Mine in WA or the HPMSM facility being developed in Louisiana, USA in partnership with General Motors and Stellantis to provide long-term, ethical manganese supply to the US electric vehicle industry.”

E25 has identified several high-priority targets from its activities, and follow-up work is planned to define the targets further and pave the way for drill-testing of the most compelling targets.

Hardcore Prospect

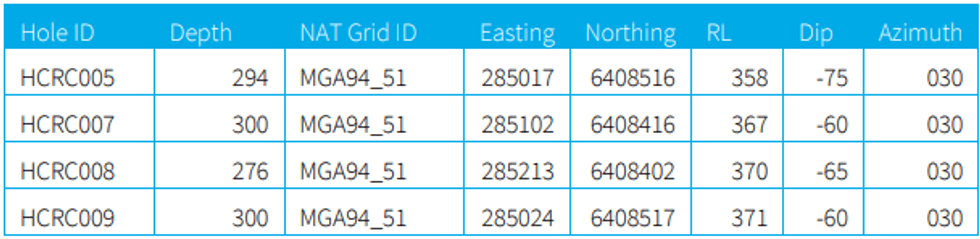

Historic drilling (refer Table 1) intersected broad zones of light- coloured igneous rocks logged as “pegmatites”. Previous attempts to resample the drill spoils were unsuccessful as the spoils washed away; however drill chips have been successfully recovered from the historic chip trays. These have been sampled as composites and submitted for assay, and while the results will not be quantitative, they will determine if there is anomalous lithium or lithium pathfinder elements in these intersections.

- HCRC005 234m-294m (60m)

- HCRC007 227m-293m (66m)

- HCRC008 228m-255m (27m)

- HCRC009 185m-290m (105m)

Lisa Prospect

Satellite image interpretation has identified a potential target at the Lisa Prospect at Lake Johnson. The satellite image clearly shows a light-coloured outcrop with a strike length of approximately 250m. The anomaly is interpreted as a potential pegmatite target, however it will require on-ground follow-up investigations to determine the geological nature of the anomaly.

Rhoda Prospect

The Rhoda Prospect was identified from the Geological Survey of Western Australia (GSWA) regional mapping data. Six pegmatite dykes are recorded over a strike length of approximately seven kilometers on the GSWA 1:100k map of the area with two areas identified in the ‘critical minerals database’ as mapped pegmatites.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25:AU

The Conversation (0)

14 August 2023

Element 25

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future Keep Reading...

21 April 2024

Goldfields Exploration Update

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on gold exploration activities within the Company’s strategic Eastern Goldfields project portfolio. RC drill hole completed under high-grade Blackfriars gold prospect (Gidji JV)New Exploration Licence... Keep Reading...

12 February

Top Australian Mining Stocks This Week: Great Dirt Leads with Rise of Over 155 Percent

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Australia’s mining industry is entering mid-February with electrification and clean energy initiatives continuing to reshape... Keep Reading...

23 January

Top 5 Canadian Mining Stocks This Week: Euro Manganese Gains 134 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.On Monday (January 19), Statistics Canada released the consumer price index (CPI) figures for... Keep Reading...

22 January

Manganese Market Forecast: Top Trends for Manganese in 2026

After taking a bearish turn in late 2024, manganese prices started 2025 on a flat note despite a robust demand outlook supported by growth in the electric vehicle (EV) battery segment. In the first half of 2025, the manganese market experienced mixed signals as supply dynamics shifted and demand... Keep Reading...

04 December 2025

Rubidium Could be Next Frontier for Critical Minerals Exploration, Investment

In the evolving landscape of critical minerals investing, the alkali metal rubidium is increasingly gaining attention as a potential growth opportunity. Historically under the radar compared to lithium, cobalt or rare earth elements, rubidium’s unique properties, constrained supply and emerging... Keep Reading...

12 November 2025

Spartan Metals Touts Eagle Project as Critical Minerals Supply Source to DoD

On the heels of the recent identification of a silver-rich deposit at its Eagle project in Nevada, Spartan Metals (TSXV:W) is ramping up exploration and drilling efforts toward a potential resource estimate.In a recent interview, Spartan President and CEO Brett Marsh highlighted the polymetallic... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00