November 11, 2024

Many Peaks Minerals Limited (ASX:MPK) (Many Peaks or the Company) is pleased to announce that exploration activities have commenced at both the Ferké gold project and the Odienné gold project in Côte d’Ivoire, now the wet season is drawing to a close. The first month of this 2024/25 field season will see two concurrent drilling campaigns commence with auger drilling at Ferké, and air core drilling at Odienné.

HIGHLIGHTS

- Over 10,000m of drilling planned for December quarter to follow-up previous drilling successes at the Odienné and Ferké gold projects, Côte d’Ivoire

- Ferké project auger drilling has commenced, with a 5,000m campaign covering +9km segment of gold anomalism, targeting extensions to high-grade gold mineralisation confirmed in previous drilling

- Odienné project air core drilling planned to commence over coming weeks to assess priority targets generated in previous quarter’s auger results

- Both projects fully funded for follow-up diamond and RC drilling as part of staged exploration campaigns planned to continue through the 2024/25 field season

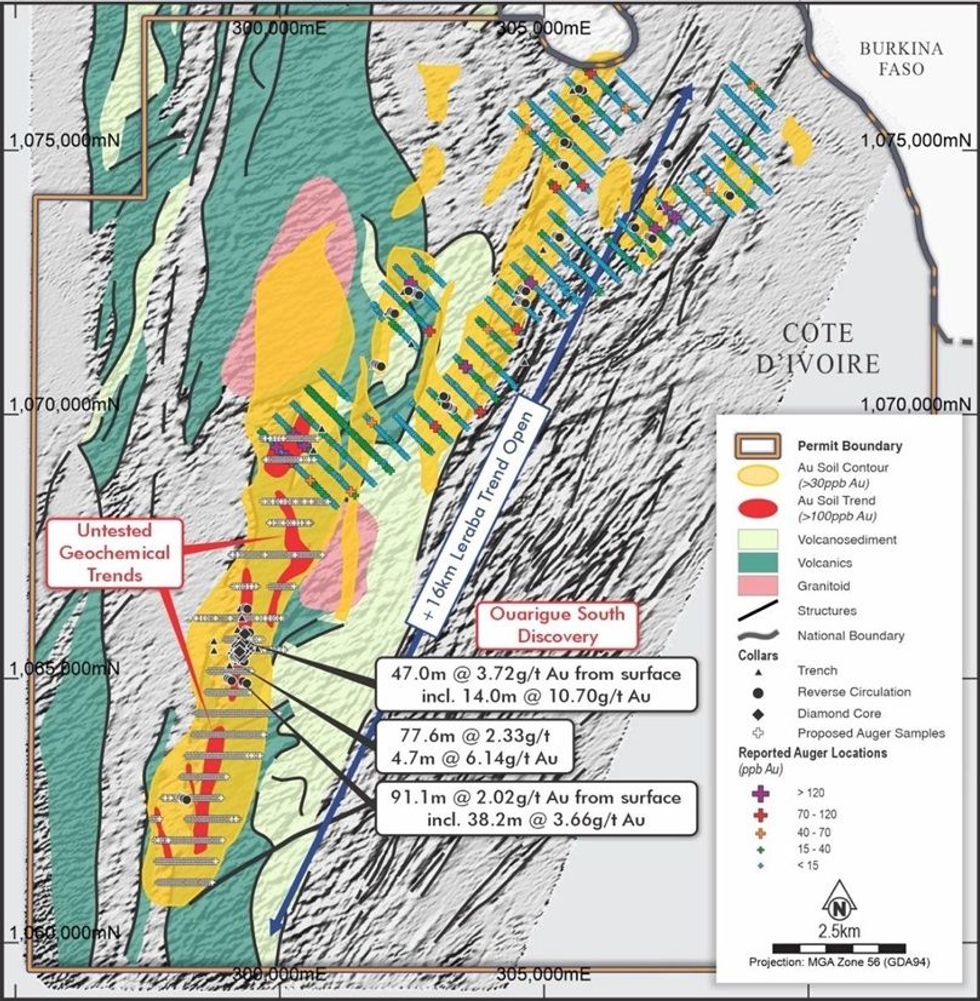

Auger drilling has already commenced at the Ferké gold project, with three drill rigs mobilised to cover 9km of reconnaissance drilling along the highly prospective structural corridor hosting the Ouarigue South prospect. This program is designed to delineate extensional targets to open gold mineralisation confirmed in previous drilling that returned:

- 47m @ 3.72g/t gold from surface

- 77.6m @ 2.33 g/t gold from 45.9m

- 91.1m @ 2.02 g/t gold from surface

- 45.3m @ 3.16g/t gold from 45.9m

Concurrently, field work has commenced at the Odienné project, ahead of a planned 5,000m air core campaign that will assess priority targets delineated from the previous quarter’s auger drill results (refer to ASX release dated 20 August 2024). The drilling will be focussed on target delineation within more than 16km of anomalous gold trends located in the same high-strain corridor that hosts Predictive Discovery’s 5.4Moz Au Bankan deposit, as well as the recent discovery by Awalé Resources/Newmont joint venture, which is located on a contiguous land holding.

Many Peaks’ Executive Chairman, Travis Schwertfeger commented:

“Following the end of the West African wet season, we are pleased to have commenced Many Peaks’ 2024/2025 exploration program at our high-grade Cote d’Ivoire projects. Plans for the coming months include our maiden drilling at Ferké, where three auger rigs will drill 5,000m to identify extensional targets of historic holes that include 45.3m @ 3.16g/t and 39.7m @ 3.54g/t gold. We will also drill 5,000m of air core holes at Odienné, following up on extensive gold anomalism identified from drilling we conducted here in the previous season. We look forward to updating investors on our findings as we systematically assess the potential of these highly prospective projects.”

Ferké Gold Project

The Ferké Gold Project (Ferké) comprises 300km2 in a single granted exploration permit in northern Côte d’Ivoire currently undergoing a renewal process and remaining permitted for exploration activity. Ferké is situated on the eastern margin of the Daloa greenstone belt at the intersection of major regional scale shear zones (Figures 1 & 3). The project area has seen substantial previous exploration activity confirming gold mineralisation but with limited follow-up work. Previous work includes high resolution geophysics, soil sampling, trenching, and RC and Diamond drilling (refer to ASX release dated 26 March 2024).

Planned Work

Many Peaks’ initial field programme at Ferké is a 5,000m auger drilling campaign focused on extending the auger coverage at Ferké along an additional 9km of strike extent in the >16km long corridor of soil anomalism referred to as the Leraba trend. The auger campaign is estimated to be completed in 3 to 4 weeks’ time with 400m to 600m spaced lines of sampling and planned 25m spacing between samples. Results are anticipated to refine targeting for follow-up drilling within the extensive gold anomalism which measures over 2km in width in most places (Figure 1).

The planned auger drilling at Ferké is focused on expanding the footprint of gold mineralisation confirmed in previous drilling success. An initial 18 diamond holes drilled into a limited segment of the extensive gold corridor confirmed gold mineralisation at Ferké that remains open in all directions. Results from previous drilling include 45.3m @ 3.16g/t gold from 45.9m drill depth in hole FNDC001 and 39.7m @ 3.54g/t gold from 51.4m in drill hole FNCD008 (refer to ASX announcement dated 26 March 2024).

The current programme is designed to define extensional targets within in the predominantly undrilled north-south trending segment of gold in soil anomalism of the Leraba trend. This may justify expansion of planned follow-up RC and diamond drilling work over the coming field season, and complement drill ready targets already defined on open mineralisation at the Ouarigue South prospect.

Click here for the full ASX Release

This article includes content from Many Peaks Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

21m

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

3h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

20h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

23 February

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00