Conquest Resources Limited (TSXV: CQR) ("Conquest" or the "Company") has completed 17 holes into 32 geophysical targets on its Belfast-TeckMag Project located approximately 50km east of Sudbury, Ontario. Bore Hole EM surveys are currently underway on the company's VMS targets and should be completed this week. The company intends to follow up on the results from the surveys with additional drilling following the drilling of the balance of the remaining untested targets.

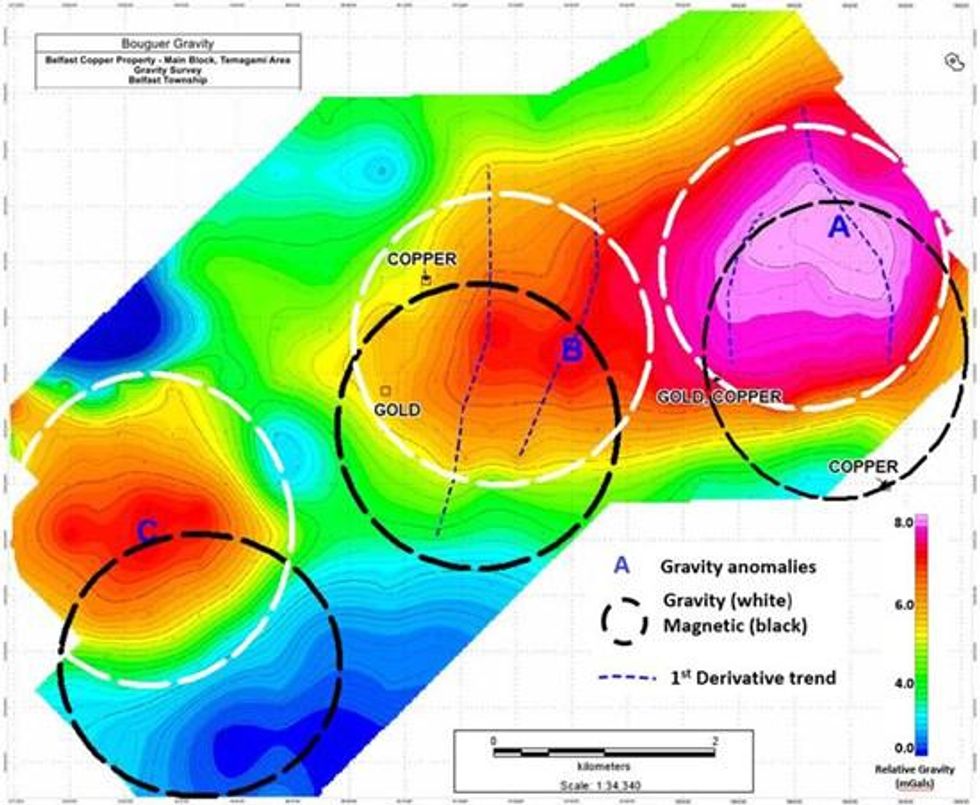

After a scheduled break by the drill contractor, Conquest will commence drilling on the IOCG targets in mid-October. The targets have a similar gravity and magnetic signatures to the Olympic Dam deposit in Australia which produces copper, uranium, silver and gold (Figure 1). The area hosting Conquest's geophysical anomalies are geochemically anomalous with minor elements associated with IOCG deposits.

Figure 1 - IOCG Target Anomalies, Belfast-TeckMag Project

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/7183/97995_c96aeddb74f4fb3c_002full.jpg

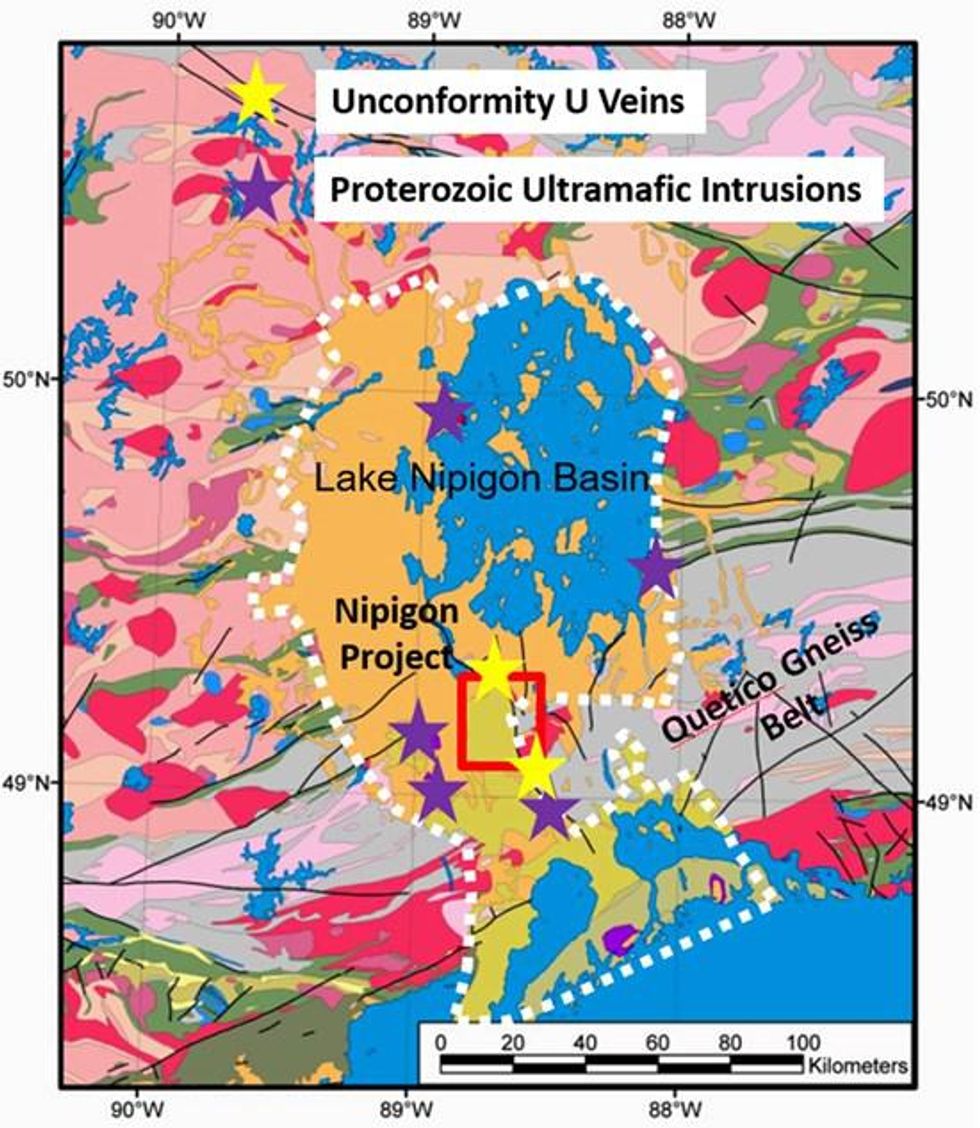

Uranium and Ni-Cu-PGE Property Acquisition

Conquest Resources is targeting high-grade Uranium deposits associated with veins and faults at or near the Archean-Proterozoic unconformity, and Proterozoic rift mafic intrusive Ni-Cu-Pge deposits near the unconformity south of Black Sturgeon Lake, in the Lake Nipigon Basin (LNB). In the LNB the most probable source area for uranium deposits associated with veins and faults that are proximal to the Proterozoic/Archean unconformity, is the granitoid and associated meta-sedimentary rocks of the Quetico Gneiss Belt (Figure 2). The Quetico Gneiss Belt's signature is one of anomalously high uranium background levels, as identified from Ontario Geological Survey (Scott,1987) highlighting the similarities of the Athabasca basin and the Sibley Basin geological and structural histories. Building on the Athabasca Uranium exploration and Proterozoic rift related Pge-Ni-Cu deposits exploration models, Conquest is exploring the SW Lake Nipigon region in search for economic minerals deposits and employing extensive use of modern deep searching geophysical tools. Conquest will initiate exploration with a proof-of-concept drill program to discover this part of the Nipigon Rift system.

Conquest's CEO Tom Obradovich commented, "It is our belief that exploration for larger more valuable mineral deposits or mineral camps in Canada requires expertise in looking at depth. I believe we have assembled a team of geophysical consultants and geologists that have already demonstrated proof of concept at our Belfast-TeckMag Project that can successfully apply their skills to the LNB."

Conquest can earn 100% interest in the LNB project by issuing 200,000 shares per year over 4 years and spending $400,000 on exploration. The property is subject to a 2% NSR with a buy back of 1% at any time for $1,000,000.

References:

Scott, J.F. 1987: Uranium Occurrences of the Thunder Bay-Nipigon-Marathon Area; Ontario Geological Survey, Open File Report 5634, 158p.

Figure 2 - Uranium Veins of the Quetico Gneiss Belt

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/7183/97995_c96aeddb74f4fb3c_003full.jpg

Qualified Person

The technical content of this News Release has been reviewed and approved by Joerg Kleinboeck, P.Geo., a qualified person as defined in NI 43-10.

ABOUT CONQUEST

Conquest Resources Limited, incorporated in 1945, is a mineral exploration company that is exploring for base metals and gold on mineral properties in Ontario.

Conquest holds a 100% interest in the Belfast - Teck Mag Project, located in the Temagami Mining Camp at Emerald Lake, approximately 65 kilometers northeast of Sudbury, Ontario, which hosts the former Golden Rose Gold Mine and is underlain by highly prospective Abitibi greenstone geology along a strike length of seventeen (17) kilometers.

In October 2020, Conquest completed the acquisition of Canadian Continental Exploration Corp. which holds an extensive package of mining claims which surround Conquest's Golden Rose Mine, and subsequently doubled its land holdings in the Temagami Mining Camp through the staking of 588 mining cells, encompassing approximately 93 sq km., centered on Belfast Township, on the edge of the Temagami Magnetic Anomaly.

Conquest now controls over 350 sq km of underexplored territory, including the past producing Golden Rose Mine at Emerald Lake, in the Temagami Mining Camp.

Conquest also holds a 100% interest in the Alexander Gold Property located immediately east of the Red Lake and Campbell mines in the heart of the Red Lake Gold Camp on the important "Mine Trend" regional structure. Conquest's property is almost entirely surrounded by Evolution Mining land holdings.

In addition, Conquest owns a 100% interest in the Smith Lake Gold Property of six patented claims and 181 staked mining claims to the north, west and south of the former Renabie Gold Mine in Rennie Township in northern Ontario, operated by Corona and Barrick that had reported gold production of over 1,000,000 ounces between 1947 and 1991 (Northern Miner March 4, 1991).

FOR FURTHER INFORMATION CONTACT:

general@conquestresources.com

www.conquestresources.com

Tom Obradovich

President & Chief Executive

416-985-7140

Forward-looking statements. This news release may include certain "forward-looking statements". All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding the completion of the Acquisition and the Consolidation, the release of escrowed funds, future cash on hand, potential mineralization, resources and reserves, exploration results, and future plans and objectives of Conquest, are forward-looking statements that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Conquest's expectations are exploration risks detailed herein and from time to time in the filings made by Conquest with securities regulators. Neither the TSXV nor its Regulation Services Provider (as defined in the policies of TSXV) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/97995