February 26, 2024

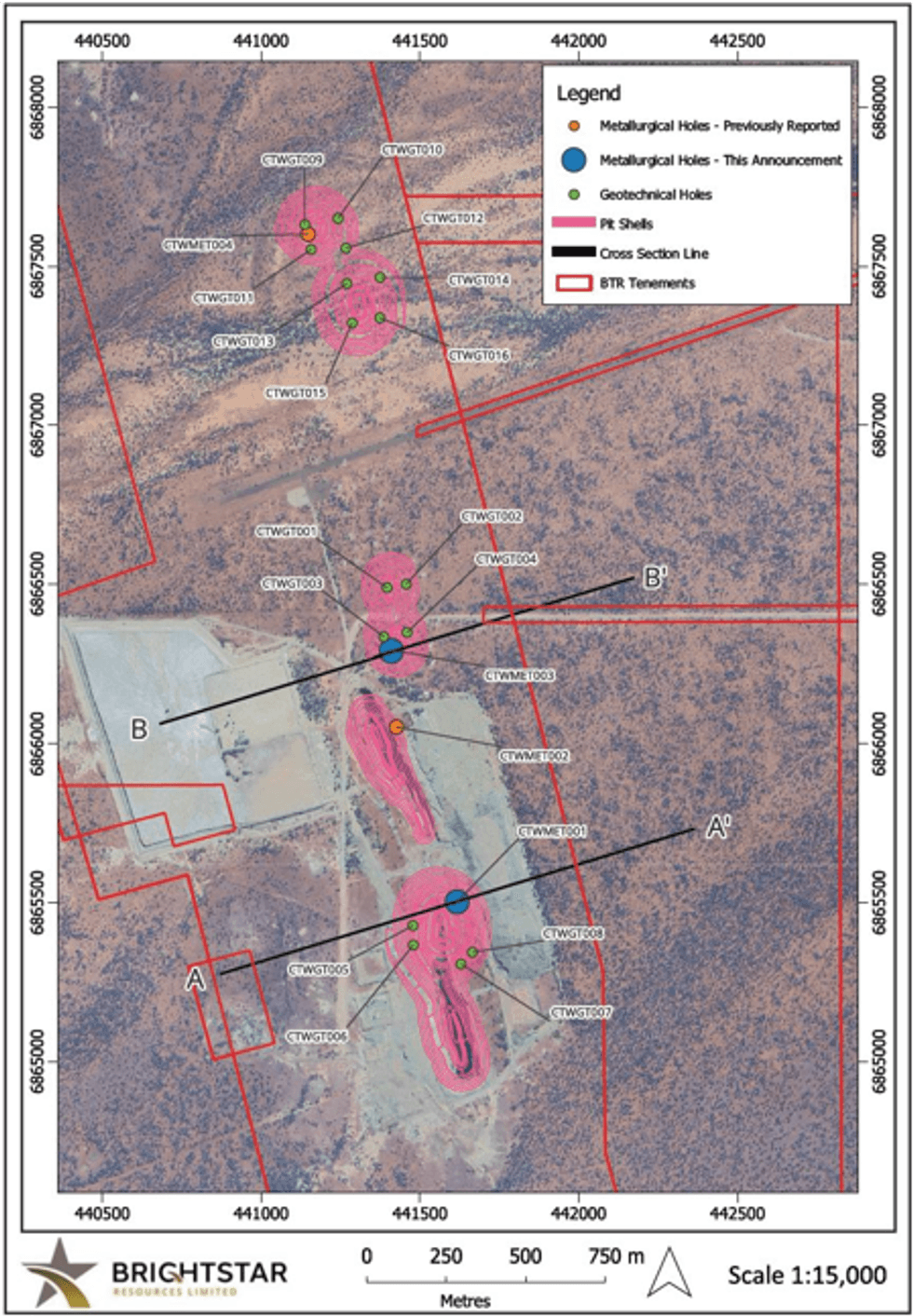

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce the second round of priority assay results from the remaining two metallurgical diamond drillholes at Cork Tree Well (CTW) within the Laverton Gold Project (LGP). These two holes were part of a broader 20 hole diamond drilling program1 which has now been successfully completed.

HIGHLIGHTS

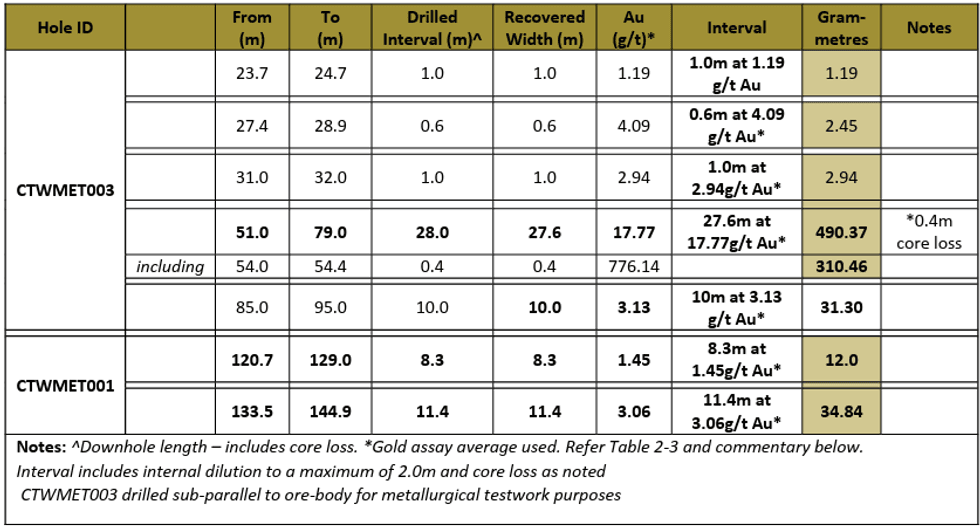

- Assays received from the final two metallurgical diamond holes completed at Cork Tree Well with bonanza-grade gold assays up to 1028.37g/t Au

- High-grade results substantiated by numerous observations of visible gold in both drill holes

- Intercepts returned include 27.6m @ 17.77g/t Au from 51m (CTWMET003)

- CTWMET003 was drilled into the unmined central deposit at Cork Tree Well, with the gold mineralisation entirely contained within a dolerite - quartz breccia unit

- Intercepts returned below the historical shallow open pit within CTWMET001 include:

- 11.4m @ 3.1g/t Au from 133.5m (estimated true width), and

- 8.3m at 1.45g/t Au from 120.7m (estimated true width)

- Twenty-hole diamond drilling program successfully concluded with metallurgical and geotechnical testwork underway to feed into PFS workstreams

Brightstar’s Managing Director, Alex Rovira, commented “It is great to see further high-grades assays continuing and visible gold being observed from the diamond drilling program that has recently been completed at Cork Tree Well. CTWMET003 returned an excellent high-grade, shallow intersection of 27.6m @ 17.77g/t Au from 51m, which complements the previously announced2 intersections which included a strong result of 34.4m @ 7.94g/t Au (CTWMET004) drilled 1km to the north.

The drilling campaign represented the first diamond holes drilled at Cork Tree Well by Brightstar, with our understanding of the geology and mineralisation styles being strengthened by the knowledge being gained from this recently completed program.

Today’s results continue to reinforce our view that the gold mineralisation at Cork Tree Well is structurally hosted, with a mafic metadolerite host rock observed in CTWMET003 whilst gold mineralisation returned in CTWMET001 is positioned within the sedimentary package underneath the historically mined shallow open pit.

The four metallurgical drillholes (CTWMET001 – 004) were drilled into the known orebody locations that fall within the optimised $2,750/oz pit shells generated in the 2023 Scoping Study3, with CTWMET003 and CTWMET004 drilled down plunge to the orebody to deliver maximum rock mass for metallurgical testwork and CTWMET001 and CTWMET002 drilled perpendicular to the orebody and represent estimated true width.

Given the calibre of the assays received from the drilling to date, Brightstar continues to see strong potential to build on the existing 303koz @ 1.4g/t Au Mineral Resource4 both at depth with high-grade plunging shoots and strike extensions targeting the structurally-controlled mineralised trends. The high-grade results returned to date are significantly higher than the current 1.4g/t Au head grade of the Mineral Resource and 1.85g/t mine grade from the 2023 Scoping Study, representing significant upside.

We look forward to updating shareholders with more information on the diamond program, which forms the basis for metallurgical and geotechnical testwork workstreams within our ongoing Pre-Feasibility Study5.

Due to the nuggety and high-grade nature of the gold mineralisation observed in CTWMET001 and CTWMET003, multiple samples had repeat assays completed following from best QA/QC laboratory practice. The repeat fire-assays provided additional analytical insight into the nuggety nature of mineralisation in addition to the visible gold observed. Where multiple repeat assay runs occurred, an average of the results has been used in the reporting in Table 1 above and within this announcement. The full breakdown of the re-assayed samples are outlined below in Table 2-3.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00