July 08, 2024

Moab Minerals Limited (ASX: MOM) (Moab or the Company) is pleased to announce that it has completed the acquisition of 81.85% of the shares in Australian proprietary company Linx Resources Pty Ltd (Linx), plus an additional 7.75% following the conversion of loans owing to Moab by Linx, bringing Moab’sownership of Linx to 89.6%. Linx is the 80% owner of certain Prospecting Licenses comprising the Manyoni Uranium Project and the Octavo Uranium Project, both located in Tanzania (refer ASX announcement dated 12 March 2024).

HIGHLIGHTS

- Moab has completed the acquisition of 81.85% of the shares of Linx Resources Pty Ltd, which boasts a diverse portfolio of advanced, large-scale uranium projects in Tanzania.

- Moab has converted its loan to Linx of $521,000 to equity in Linx, bringing Moab’s ownership of Linx to 89.6%.

- The Asset portfolio includes the Manyoni and Octavo Uranium Projects, covering a total of 216 km2.

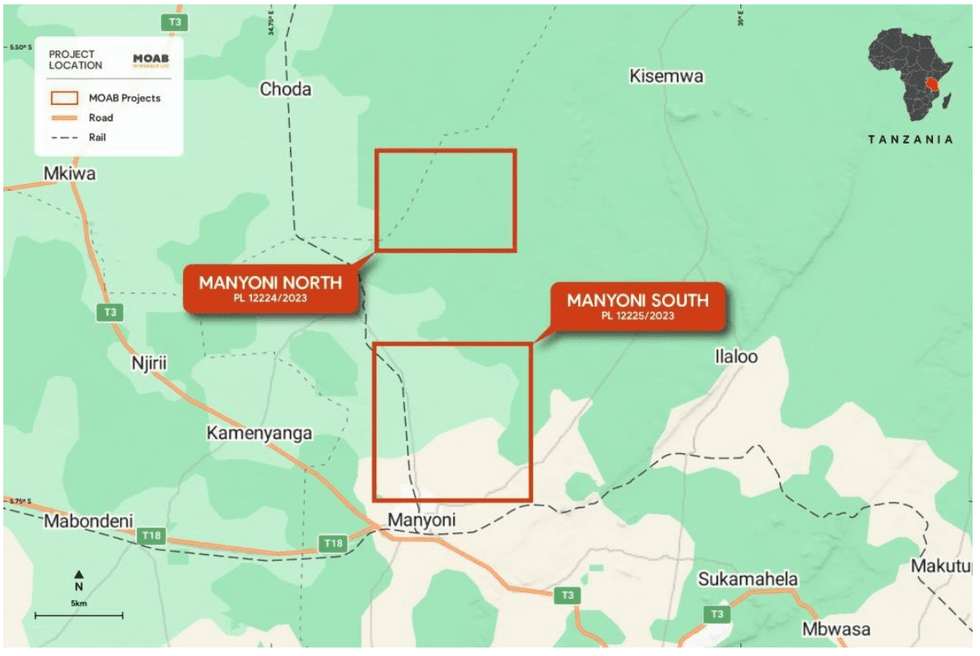

- Strategically located just 5km north of Manyoni town, the Manyoni Uranium Project enjoys convenient access to modern railway and sealed highway infrastructure as well as readily available power and water resources.

- The Manyoni Uranium Project was previously explored, and extensively drilled, by Uranex Ltd from the early 2000’s until 2013.

- Drilling to commence at the Manyoni project in August/September.

- With approximately $1.9 million in cash and equivalents, Moab is well equipped to fund exploration and development initiatives.

Moab Managing Director, Malcolm Day commented “The completion of the acquisition of such high potential uranium projects is transformational for the Company. The fact that Uranex Ltd previously explored, and extensively drilled, the Manyoni Uranium Project from the early 2000’s to 2013 assists the Company greatly. There is a large volume of historic exploration data, including drilling data, that the Company has access to that will effectively save the Company a lot of time and money. The Fukushima disaster in 2011 had a dramatic impact on the uranium price, and thus most pre-production uranium projects worldwide were shelved. Given the current uranium price of circa US$85/lb, Moab is in the right place at the right time to re-evaluate the Manyoni Uranium Project and to commence exploration on the Octavo Uranium Project”.

The Manyoni and Octavo Uranium Projects

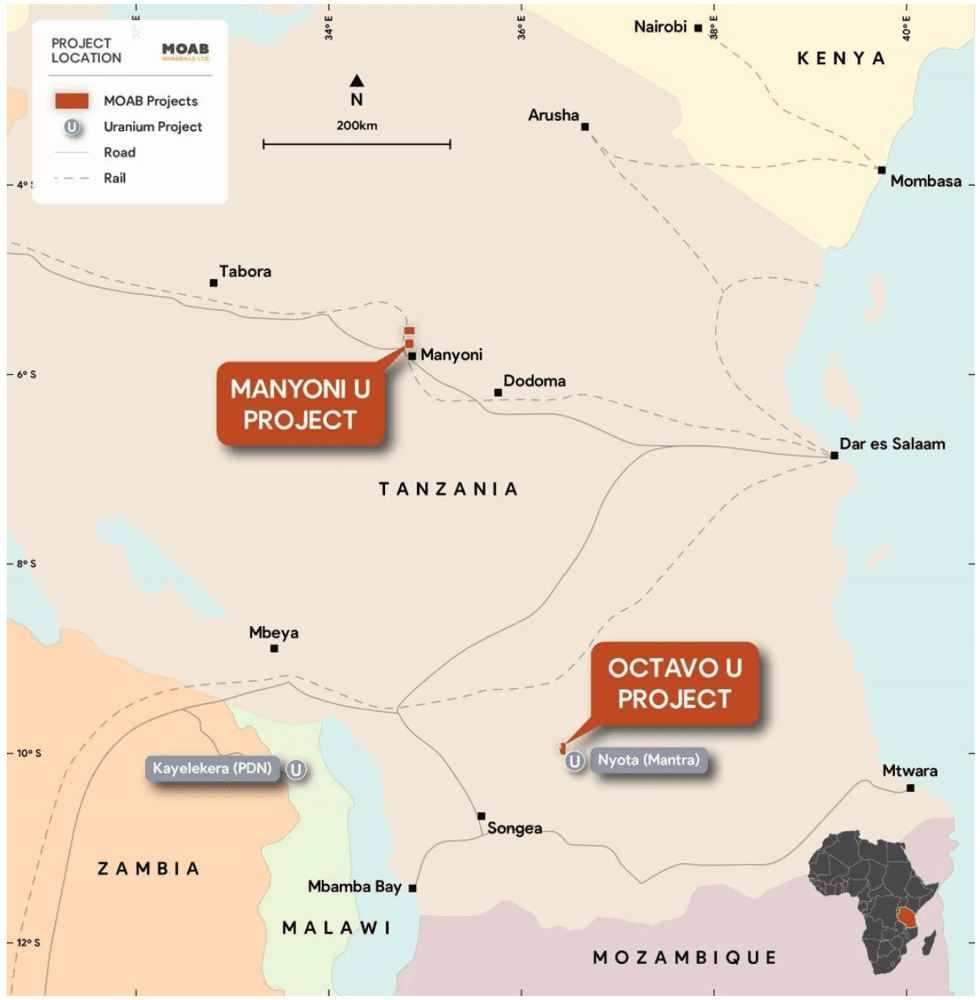

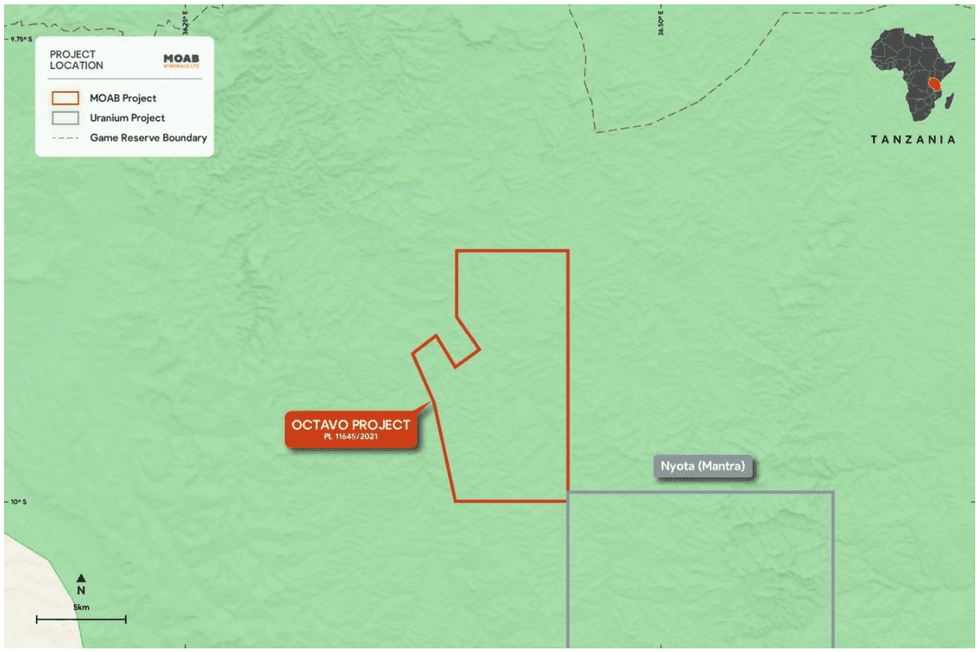

The Manyoni Uranium Project tenements are located in the Republic of Tanzania (pop. 65 million), approximately 100km northwest of the capital city of Dodoma (pop. 765,000). The location of the uranium project at Manyoni is shown in Figure 1 and Figure 2 and the location of the Octavo uranium project is shown in Figure 1 and Figure 3.

Tenement Information

The Manyoni and Octavo tenements are Prospecting Licences that are granted for an initial period of 4 years, renewable for further periods of 3 years and then 2 years.

Click here for the full ASX Release

This article includes content from MOAB Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00