July 08, 2024

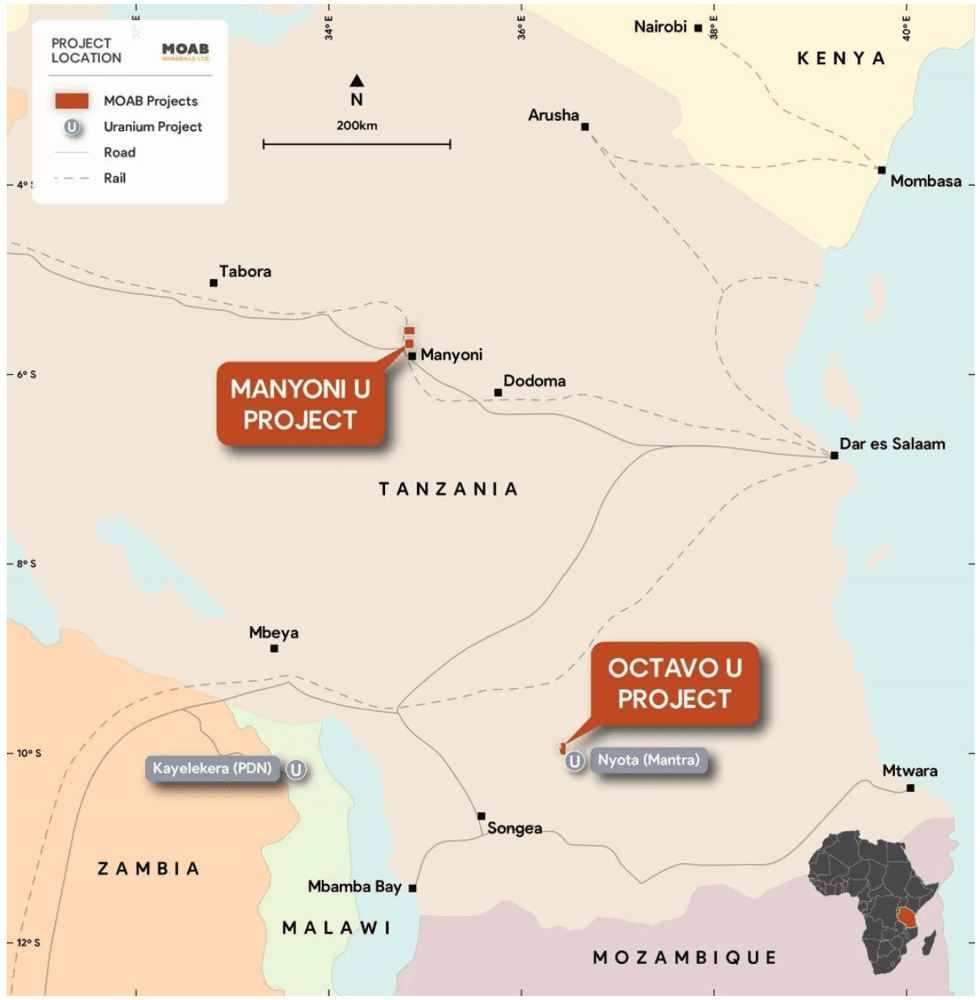

Moab Minerals Limited (ASX: MOM) (Moab or the Company) is pleased to announce that it has completed the acquisition of 81.85% of the shares in Australian proprietary company Linx Resources Pty Ltd (Linx), plus an additional 7.75% following the conversion of loans owing to Moab by Linx, bringing Moab’sownership of Linx to 89.6%. Linx is the 80% owner of certain Prospecting Licenses comprising the Manyoni Uranium Project and the Octavo Uranium Project, both located in Tanzania (refer ASX announcement dated 12 March 2024).

HIGHLIGHTS

- Moab has completed the acquisition of 81.85% of the shares of Linx Resources Pty Ltd, which boasts a diverse portfolio of advanced, large-scale uranium projects in Tanzania.

- Moab has converted its loan to Linx of $521,000 to equity in Linx, bringing Moab’s ownership of Linx to 89.6%.

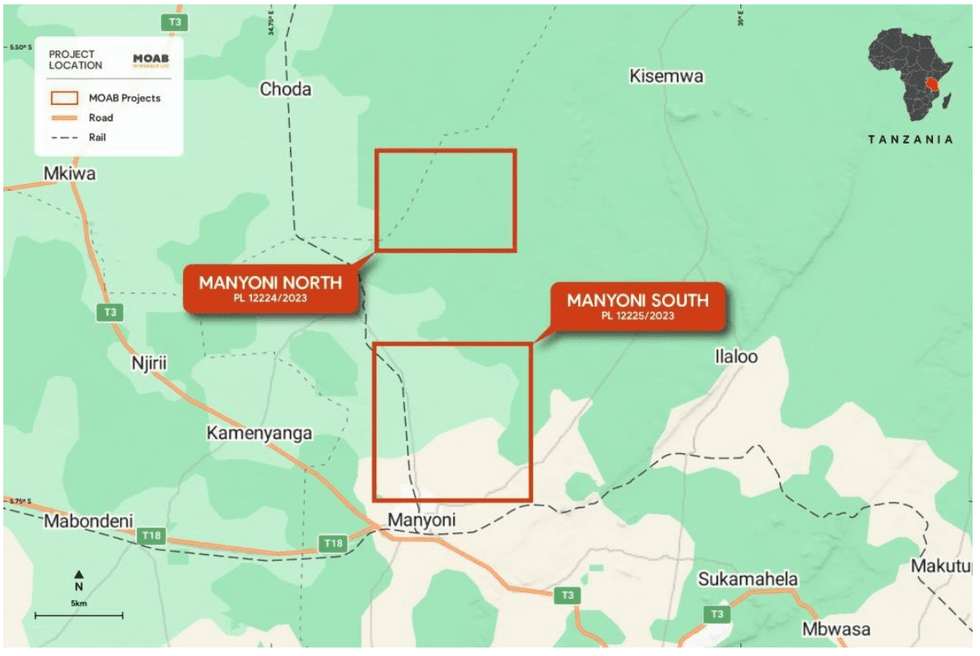

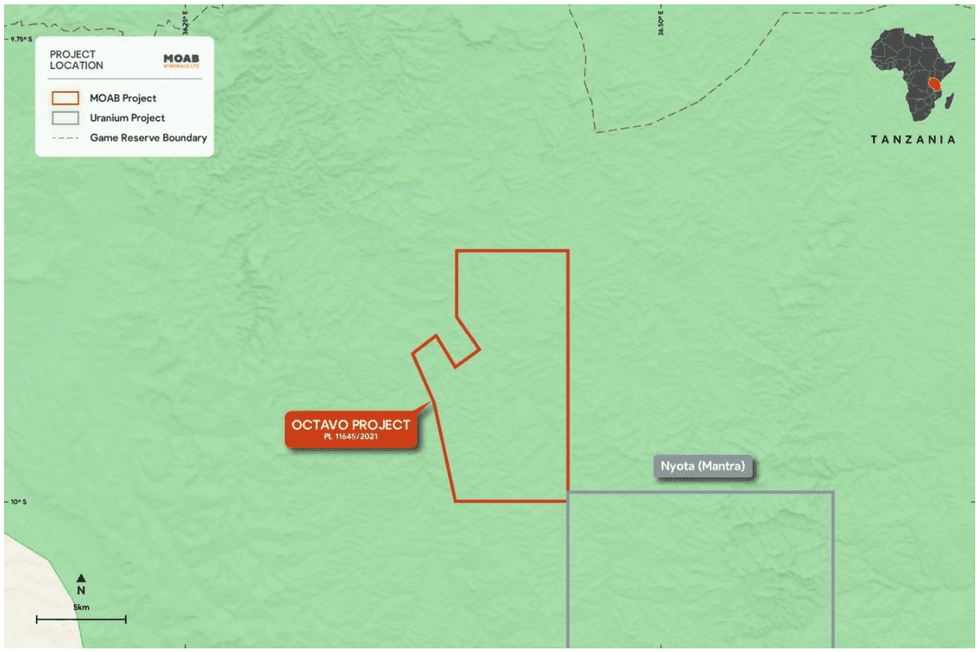

- The Asset portfolio includes the Manyoni and Octavo Uranium Projects, covering a total of 216 km2.

- Strategically located just 5km north of Manyoni town, the Manyoni Uranium Project enjoys convenient access to modern railway and sealed highway infrastructure as well as readily available power and water resources.

- The Manyoni Uranium Project was previously explored, and extensively drilled, by Uranex Ltd from the early 2000’s until 2013.

- Drilling to commence at the Manyoni project in August/September.

- With approximately $1.9 million in cash and equivalents, Moab is well equipped to fund exploration and development initiatives.

Moab Managing Director, Malcolm Day commented “The completion of the acquisition of such high potential uranium projects is transformational for the Company. The fact that Uranex Ltd previously explored, and extensively drilled, the Manyoni Uranium Project from the early 2000’s to 2013 assists the Company greatly. There is a large volume of historic exploration data, including drilling data, that the Company has access to that will effectively save the Company a lot of time and money. The Fukushima disaster in 2011 had a dramatic impact on the uranium price, and thus most pre-production uranium projects worldwide were shelved. Given the current uranium price of circa US$85/lb, Moab is in the right place at the right time to re-evaluate the Manyoni Uranium Project and to commence exploration on the Octavo Uranium Project”.

The Manyoni and Octavo Uranium Projects

The Manyoni Uranium Project tenements are located in the Republic of Tanzania (pop. 65 million), approximately 100km northwest of the capital city of Dodoma (pop. 765,000). The location of the uranium project at Manyoni is shown in Figure 1 and Figure 2 and the location of the Octavo uranium project is shown in Figure 1 and Figure 3.

Tenement Information

The Manyoni and Octavo tenements are Prospecting Licences that are granted for an initial period of 4 years, renewable for further periods of 3 years and then 2 years.

Click here for the full ASX Release

This article includes content from MOAB Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21h

Uranium Market Facing Supply Crunch as Nuclear Fleet Grows

The global uranium market is entering what industry leaders describe as a pivotal phase, with strengthening nuclear demand colliding with tightening supply and rising geopolitical competition for fuel.At the Prospectors & Developers Association of Canada (PDAC) convention in Toronto, an... Keep Reading...

21h

Uranium Supply Behind, Demand Evolving — What's Next? Denison Mines' David Cates

David Cates, president and CEO of Denison Mines (TSX:DML,NYSEAMERICAN:DNN), discusses uranium market dynamics, as well as the company's path forward after its recent final investment decision for the Phoenix ISR uranium project in Saskatchewan's Athabasca Basin. Construction at the asset has... Keep Reading...

22h

Generation Uranium CEO: Underexplored Thelon Basin Offers Major Discovery Upside

Generation Uranium (TSXV:GEN,OTCQB:GENRF,FWB:W85) CEO and Director Michael Collins highlighted the potential of the underexplored Thelon Basin in Nunavut, Canada, where the company’s 100 percent owned Yath project is located. The Thelon Basin is an unconformity basin recognized as similar to the... Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00