June 08, 2022

Charger Metals NL (ASX: CHR, “Charger” or the “Company”) is pleased to provide an update for its Lake Johnston Lithium Project, which includes proposed drilling at the Medcalf Prospect. This program will follow the completion of drilling campaigns at the Company’s Coates and Bynoe Projects where drilling approvals are expected in the near term. The Lake Johnston Lithium Project’s ownership is predominately 70% Charger and 30% Lithium Australia NL (ASX: LIT) (see Schedule 1).

- Project-wide soil geochemistry programs complete at Lake Johnston Lithium Project

- Three lithium-caesium-tantalum (LCT) pegmatite target zones along a 50km long corridor

- The most advanced, the Medcalf Spodumene Prospect, is being prepared for drilling in the March quarter of 2023.

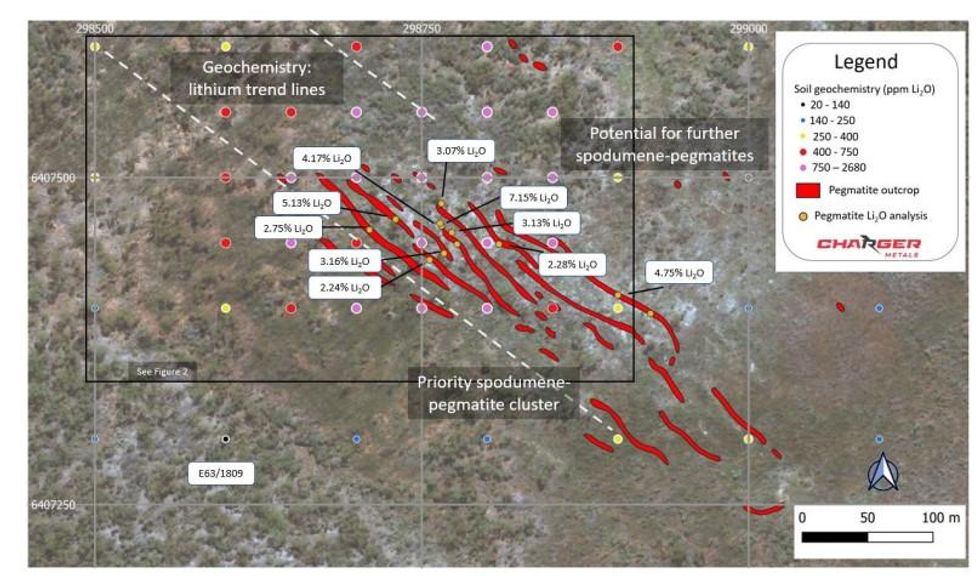

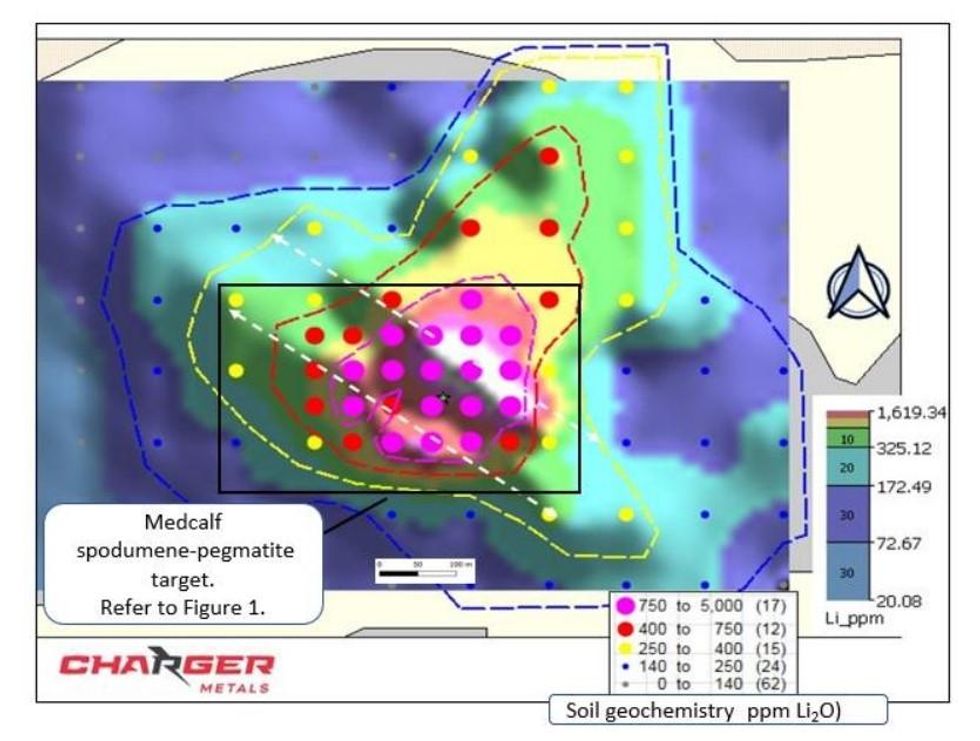

- Spodumene pegmatite cluster at least 500m long within a 300m-wide corridor

- Rock-chip assays from Medcalf pegmatites range between 1.51% and 5.13% Li2O

- Final soil analyses awaited however field work to resume at Mt Day and Pagrus Prospects

Charger’s Managing Director, David Crook commented:

“Charger has commenced the statutory approvals process required before the commencement of drilling of the spodumene-pegmatite target at the Medcalf Spodumene Prospect, which has mineralised outcrops extending over at least 500m of strike and where rock chip samples returned between 1.51% and 5.13% Li2O.

“Charger has successfully delivered new, priority drill targets at each of the Company’s three projects, and despite delays out of our control, we continue to work proactively with Western Australian and Northern Territory regulatory bodies and other stakeholders to commence drilling on each project as soon as permitting is finalised.”

The region hosting the Lake Johnston Project has attracted considerable interest in LCT pegmatite mineralisation due to its proximity to the large Mount Holland Lithium Project under development by Covalent Lithium Pty Ltd (a joint venture between subsidiaries of Sociedad Química y Minera de Chile S.A. and Wesfarmers Limited) located approximately 70km west of the Lake Johnston Project. Mt Holland is understood to be one of the largest undeveloped hard-rock lithium projects in Australia with Ore Reserves for the Earl Grey Deposit estimated at 94.2 Mt at 1.5% Li2O1.

Drilling schedule

The DMIRS2 has flagged delays processing “Program of Work” approvals for ground disturbing activities in Western Australia, which has impacted the start date for drilling at the Company’s Coates Ni Cu Co PGE Project. Similarly, the Company is working through the Northern Territory “Mine Management Plan” process prior to drilling commencing at its Bynoe Lithium Project. The Company is prepared for an immediate start at either of these projects on receipt of the respective statutory approvals.

Drilling planned for the Medcalf Spodumene Prospect

A program of approximately 40 RC holes is proposed to test the Medcalf Spodumene Prospect pegmatites.

The Medcalf Spodumene Prospect was discovered by reconnaissance fieldwork in 2018 and 20193, which included soil geochemistry, mapping and rock chip analysis centred on an area northeast of Lake Medcalf4, WA. Previously, the GSWA5 1:250,000 Lake Johnston map indicated a pegmatite outcrop at this location.

The fieldwork identified a spodumene-pegmatite swarm, comprising about 20 anastomosing pegmatite dykes that outcrop in an area between 500m and 800m long within a corridor 300m wide. The strike direction of the pegmatite dykes is approximately northwest and dip is to the southwest.

Charger’s 2022 soil geochemistry program extended the halo of the lithium-in-soil geochemical anomaly at Medcalf further north into an area where pegmatite-derived sands and minor outcrops suggest a possibly sub-parallel zone just northeast of the main Medcalf pegmatite swarm.

Click here for the full ASX Release

This article includes content from Lithium Australia NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LIT

The Conversation (0)

05 December 2025

Livium Receives A$663k in RsD Tax Incentive Rebates for VSPC

Livium Ltd (ASX: LIT) (“Livium” or the “Company”) advises that it has received A$663,000 in research and development ("R&D") tax incentive rebates from the Australian Tax Office for the 2025 financial year ("FY25"), relating to its wholly owned subsidiary VSPC Pty Limited ("VSPC"). The rebate... Keep Reading...

22 October 2025

Argentina Lithium & Energy Corp. Announces Initial Mineral Resource Estimate at the Rincon West Lithium Project

TSX Venture Exchange (TSX-V): LITFrankfurt Stock Exchange (FSE): OAY3OTCQX Venture Market: LILIF Argentina Lithium & Energy Corp. (TSX-V: LIT, FSE: OAY3, OTCQX: LILIF), ("Argentina Lithium" or the "Company") is pleased to announce the results of the first Mineral Resource estimate ("MRE") for... Keep Reading...

17 October 2025

Successful A$4.5M Placement to Accelerate Battery, REE and Solar Panel Recycling Growth

Livium Ltd (ASX: LIT) (“Livium” or the “Company”) is pleased to announce it has received firm commitments from new and existing, institutional and sophisticated investors to raise $4.5m (“Placement”) before costs. HighlightsFirm commitments of A$4.5m received from institutional and sophisticated... Keep Reading...

15 October 2025

Livium Ltd (ASX: LIT) – Trading Halt

Trading in the securities of Livium Ltd (‘LIT’) will be halted at the request of LIT, pending the release of an announcement by LIT. Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of: the commencement of normal trading on Friday, 17 October 2025; orthe... Keep Reading...

09 October 2025

Locksley Resources Limited 400% Increase in Antimony Target Strike Length

Perth, Australia (ABN Newswire) - Locksley Resources Ltd (ASX:LKY,OTC:LKYRF) (FRA:X5L) (OTCMKTS:LKYRF) announces a major advancement at its Mojave Project in California. Recent structural mapping has dramatically expanded the target mineralised corridor at the Desert Antimony Mine (DAM) Prospect... Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00