September 20, 2023

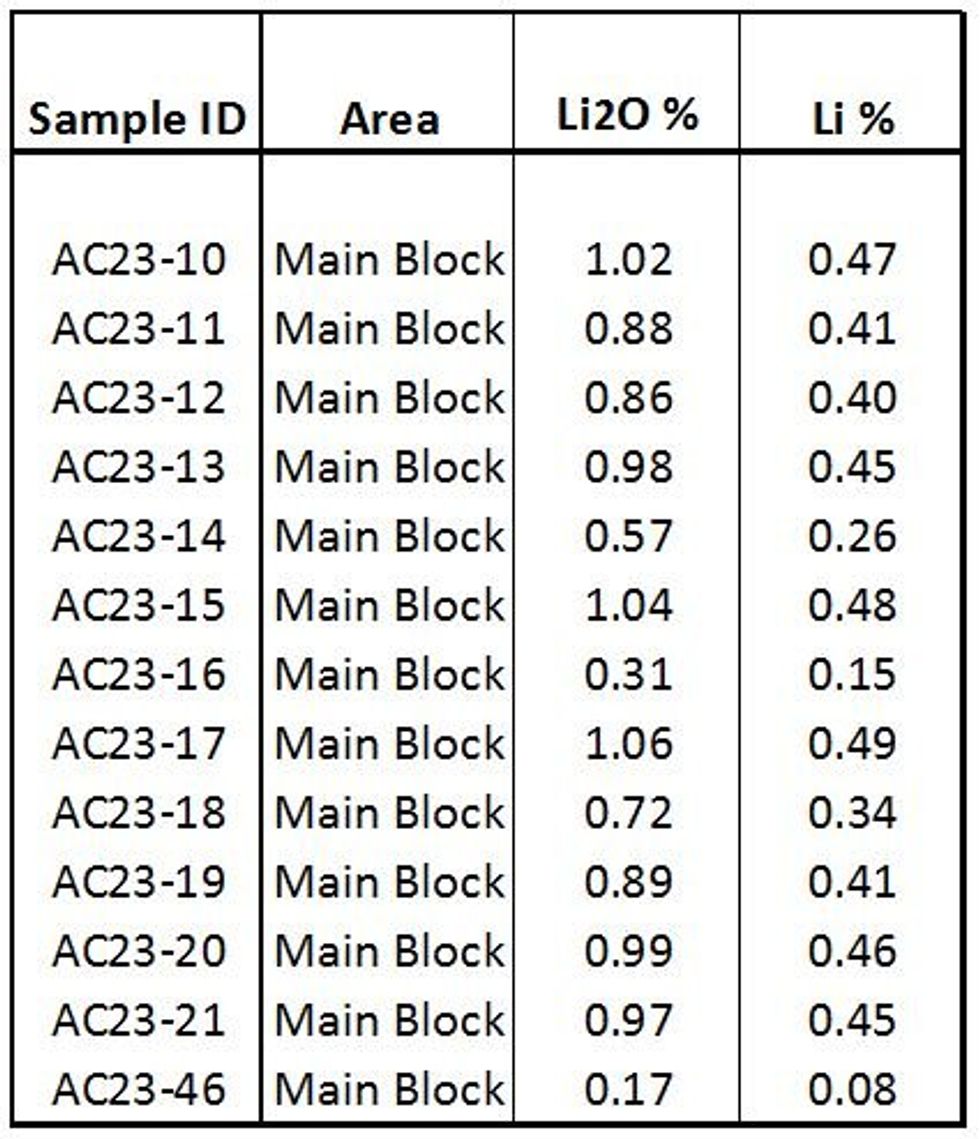

Caprock Mining Corp. (CSE: CAPR) ("Caprock" or the "Company") is pleased to announce high-grade lithium assay results from samples obtained during a recently concluded prospecting and sampling program on the eastern-most claim block (the "Main Claim Block") at its Ackley Lithium-Tin-Molybdenum-REEs property ("Ackley", or the "Property") located in south-eastern Newfoundland, for which the Company has an option to acquire a 100% interest. Assay highlights from the sampling program are provided in Figure 1 below.

Figure 1: Assay Highlights from Samples at Ackley

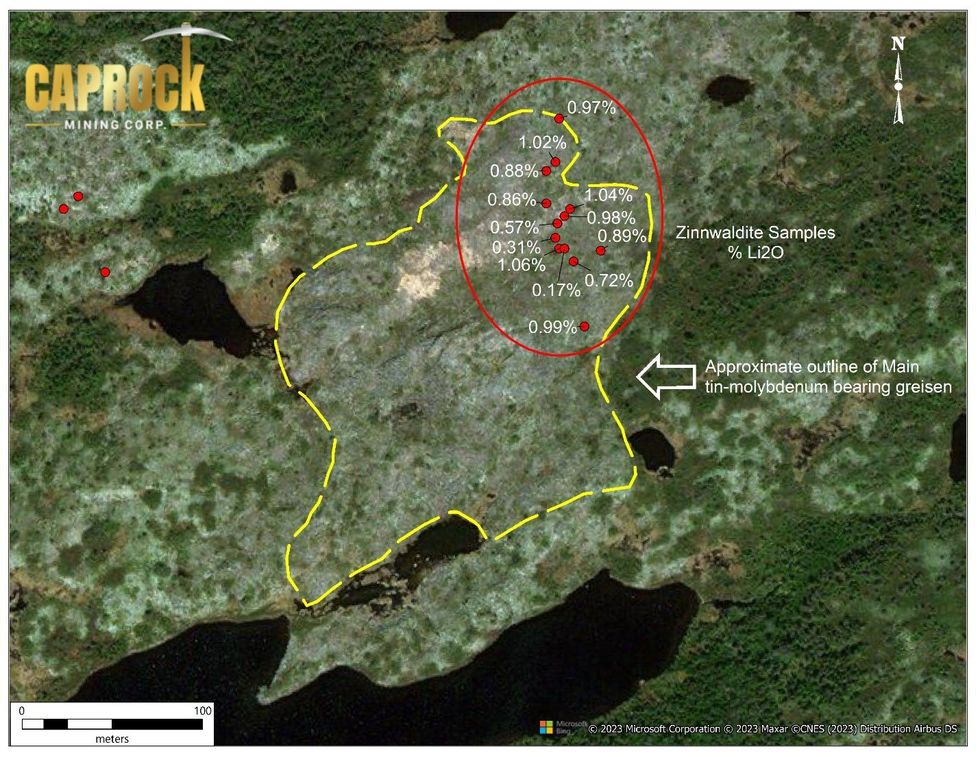

Caprock's CEO Mr. Vishal Gupta states: "Today's assay results confirm our assessment that Ackley has the potential to host significant lithium mineralization. While these samples were obtained from in-situ zinnwaldite boulders and sub-crop during a first-pass prospecting program in a very small portion of the Main Block called the 'Deer Pond' area, we are already starting to see the delineation of a mineralized trend within the greisened rock at Deer Pond. On the basis of these high-grade assays, Caprock's technical team plans to continue its aggressive exploration of the Main Block in the coming weeks."

Field observations indicate that the sampled zinnwaldite boulders and sub-crop occur in close proximity to the large greisen zone at Deer Pond, however the mineralization appears to be more spatially related to the fine-grained Devonian-aged Ackley granite. This provides Caprock's technical team a prospective area spanning several square kilometres within the Main Block where additional lithium-bearing mineralization could be uncovered. The Company awaits additional confirmation of the zinnwaldite mineralization through detailed petrographic analysis of field samples. Highlighted sample locations are illustrated in Figure 2 below.

Figure 2: Location of Highlighted Samples and Outline of Greisen Zone in the Deer Pond area

Procedures Utilized for Assay Analysis

The samples were submitted to the AGAT Laboratories Ltd. (AGAT) laboratory in St John's, Newfoundland and internally couriered to the AGAT Mining Geochemistry Laboratory in Mississauga, Ontario for sample preparation and assay testing using Sodium Peroxide Fusion (lithium) with inductively coupled plasma - optical emission spectrometry (ICP-OES) and inductively coupled plasma - mass spectrometry (ICP-MS) finish for multi-element analysis. AGAT is independent of Caprock and is accredited to ISO/IEC 17025:2017 standards.

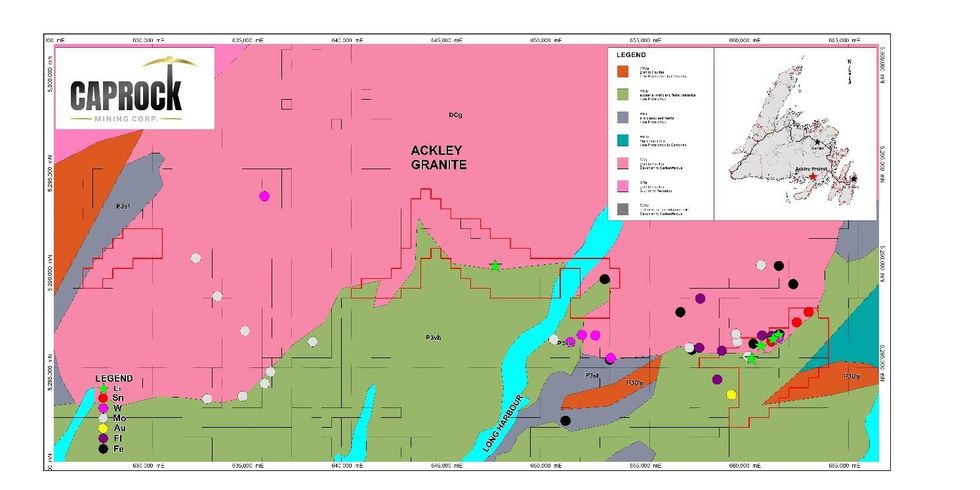

About the Ackley Property

Ackley comprises three claim blocks that collectively span an area of 4,550 hectares located less than two hours' drive from St. John's. The claim blocks overlie portions of the contact zone of a large Devonian-aged granite complex with Proterozoic metasediments and volcanics, parts of which are "greisened", or hydrothermally altered, that is similar in age and lithology to the Mount Pleasant deposit in New Brunswick and the East Kemptville deposit in Nova Scotia. Limited historical exploration work across the Main Claim Block by companies including Esso Minerals, American Zinc, Inco and others, discovered occurrences and anomalies of lithium, tin, molybdenum, tungsten and REEs.

Recent magnetometer survey work over part of the Main Claim Block indicates that the altered contact zone may be extensive, covering several square kilometres. Recent limited prospect sampling and historical Esso trenches across the Main claim block returned assays of up to 0.91% lithium oxide, 5.0% molybdenum, 0.67% tin and 1-5% fluorine on surface. Newfoundland government survey maps of this region report some of the highest lake sediment values for REEs on the entire island.

Figure 3: Location of the Three Ackley Claim Blocks Outlined in Red

About Caprock Mining Corp.

Caprock Mining Corp. is a Canadian mineral exploration company focused on exploring battery metals in Newfoundland and precious metals in Ontario.

The Company has an option to earn a 100% interest in the Ackley Lithium-Tin-Molybdenum-REEs property located on the Burin Peninsula in south-eastern Newfoundland. Additionally, the Company's 100% interest in several gold exploration properties gives it a substantial landholding in the historical Beardmore-Geraldton Gold Belt ("BGB") of Ontario - a belt that has produced over four million ounces of gold historically, and contains the world-class Greenstone gold project (formerly known as the Hardrock gold project) which is being brought to production by a joint venture partnership between Equinox Gold (TSX: EQX) and Orion Mine Finance.

With an experienced management team that has a strong exploration pedigree, Caprock is poised to generate incremental shareholder value by advancing its portfolio of highly prospective exploration projects.

The scientific and technical information disclosed in this release has been reviewed and approved by Mr. Vishal Gupta, the Company's President & CEO. Mr. Gupta is a P.Geo. registered with the Professional Geoscientists of Ontario (PGO), and a. "qualified person" as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects.

For More Information

Please contact:

Vishal Gupta

President & CEO

Tel.: (647) 466-0506

E-Mail: vgupta@caprockmining.com

Cautionary Statement Regarding Forward-Looking Statements

All statements in this press release about anticipated future events or results constitute forward-looking statements including, but not limited to, statements with respect to: the Company's exploration plans and the timing thereof, the possibility of additional lithium-bearing mineralization being uncovered, the ability to obtain additional confirmation of zinnwaldite mineralization, and the ability to generate incremental shareholder value by advancing the Company's portfolio of projects. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "believe", "plan", "estimate", "expect" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions. All statements, other than statements of historical fact, included herein, are forward-looking statements. Although Caprock believes that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed on forward-looking statements since Caprock can give no assurance that such expectations will prove to be correct. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements, including the risks, uncertainties and other factors identified in Caprock's periodic filings with Canadian securities regulators. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Important factors that could cause actual results to differ materially from Caprock's expectations include risks associated with the business of Caprock; risks related to reliance on technical information provided by Caprock; risks related to exploration and potential development of the Company's mineral properties; business and economic conditions in the mining industry generally; fluctuations in commodity prices and currency exchange rates; uncertainties relating to interpretation of exploration results and the geology, continuity and grade of mineral deposits; the need for cooperation of government agencies and First Nation groups in the exploration and development of properties and the issuance of required permits; the need to obtain additional financing to develop properties and uncertainty as to the availability and terms of future financing; the possibility of delay in exploration or development programs and uncertainty of meeting anticipated program milestones; uncertainty as to timely availability of permits and other governmental approvals; and other risk factors as detailed from time to time and additional risks identified in Caprock's filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.ca). Forward-looking statements are based on estimates and opinions of management at the date the statements are made. Caprock does not undertake any obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

CAPR:CC

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00