Guide to Uranium Mining in Canada

Overview

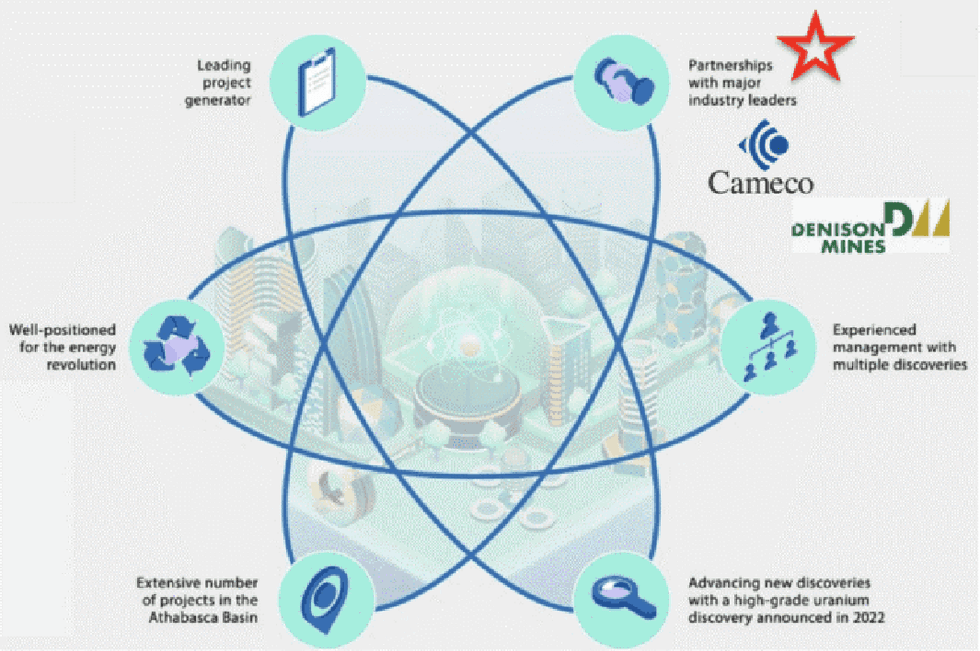

CanAlaska Uranium (TSXV:CVV, OTCQX:CVVUF, FWB:DH7N) is a Canadian exploration company developing a portfolio of high-grade uranium and nickel projects located in Saskatchewan and Manitoba. The company follows a hybrid project generator and explorer model, with properties in both the Athabasca Basin and the Thompson Nickel Belt regions.

CanAlaska collectively holds one of the largest land positions in the Athabasca Basin with more than 311,000 hectares in land claims. The company’s strategic investments have attracted the interest of major mining companies, including Cameco (TSX:CCO,NYSE:CCJ) and Denison (TSX:DML,NYSE:DNN). Prior partnerships have been with KORES, KEPCO, Mitsubishi and De Beers.

CanAlaska’s flagship West McArthur project is a joint venture with Cameco, with CanAlaska serving as operator and majority owner at 80 percent. Results from the 2022 drill program at West McArthur returned multiple high-grade uranium intersections with the first drill hole returning 9 meters at 2.4 percent U3O8 with follow-up holes returning grades as high as 25.4 percent U3O8. The Pike Zone discovery is located in a new area of the project that had not previously been drill-tested. The 2022 results are similar in character to the nearby high-grade Fox Lake and McArthur River uranium deposits, among others.

The company commenced its $10 million 2023 drilling program aimed to advance the new high-grade Pike Zone uranium discovery The drill program was completed in May 2023 with reports of uranium mineralization intersected in six of the nine drill holes completed with step-out drill fences 100 and 160 meters northeast of the original basement-hosted discovery and includes the first-ever intersection of unconformity-associated uranium mineralization at Pike Zone. The mineralization drilled to date at Pike Zone remains open in all directions.Company Highlights

- An extensive portfolio of uranium and nickel projects in Canada, including projects located in the Athabasca Basin and Thompson Nickel Belt, has attracted the attention of Cameco and Denison. Recent acquisitions include:

- CanAlaska acquired the Frontier project, totalling 15,929 hectares, in the northeastern Athabasca Basin, located approximately 30 kilometers northeast of the McClean Lake mill complex and Roughrider uranium deposit, and 35 kilometers north of Cameco's Eagle Point uranium mine.

- The company acquired the Enterprise project, totalling 14,344 hectares, in the southeastern Athabasca Basin, 20 kilometers south of the Key Lake Mine and Mill complex

- CanAlaska acquired the Mel nickel deposit and 10 mineral claims covering a total of 2,613 hectares in the Thompson Nickel Belt in Manitoba.

- CanAlaska acquired the Voyager project, totalling 5,634 hectares in the southeastern Athabasca Basin, 30 kilometers south of the Key Lake Mine and Mill complex

- West McArthur uranium project is under a joint venture with Cameco, with multiple high-grade uranium discoveries on the property, including the recently announced Pike Zone discovery where a new, high-grade uranium intersection returned 9 meters at 2.4 U3O8 with other intersections grading up to 25.4 percent U3O8

- CanAlaska announced a new discovery on its Moon Lake South Joint Venture project with Denison Mines in April where drillhole MS-23-10A intersected 8.7 meters at 1.37 percent eU3O8.

- CanAlaska commenced first exploration programs on its Marshall, North Millennium and Geikie projects under a new AU$15 million option agreement with Basin Energy

- CanAlaska completed its first drilling program on its Key Extension project, located 10 kilometers southwest of the Key Lake Mine and Mill complex, where it intersected elevated radioactivity along hydrothermally altered graphitic fault structures.

- CanAlaska's newly acquired Constellation Project spans 11,143 hectares in the southeastern Athabasca Basin. This latest acquisition is part of the company's strategy to strengthen and focus its landholding in that region.

Get access to more exclusive Uranium Investing Stock profiles here