August 26, 2024

Final assays include 7.54% Ag (75,439g/t), 5.35% Ag (53,506g/t) & 13.6% Cu

White Cliff Minerals Limited (“the Company”) is delighted to announce it has received the final batch of assay results from rock chip samples taken during the maiden field program at the Great Bear Project (“Great Bear” or “the Project”), Northern Canada. Results confirm extraordinary silver grades from epithermal structures and polymetallic results from skarn-style mineralisation.

- Truly outstanding silver results from Slider mark another high-grade discovery. Approximately 550m along strike to the NW from the two historical producing underground silver mines that produced 34,200,000oz of refined silver

- Slider, a significantly expanded silver region a newly defined area of interest of at least 1.5km x 1.5km:

- includes a newly identified westerly extension of the two historical silver mines which includes a zone of native silver bearing breccias

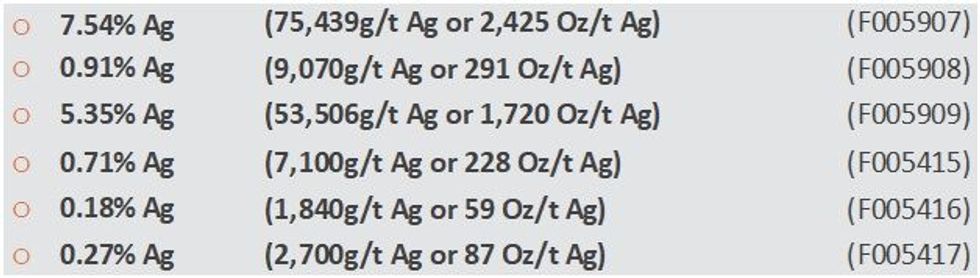

- Results from Slider include bonanza silver concentrations shown below as percentage of silver, grammes of silver and ounces of silver:

- Additional newly identified E-W structural trend within the Slider region identified over ±450m of strike length returned assays up to 904g/t Ag, 6.5% Cu and 8.1% Zn (F005606)

- a similar mineralised structure, sampled over 450 m N-S also returned 383g/t Ag and 13.6% Cu (F005649)

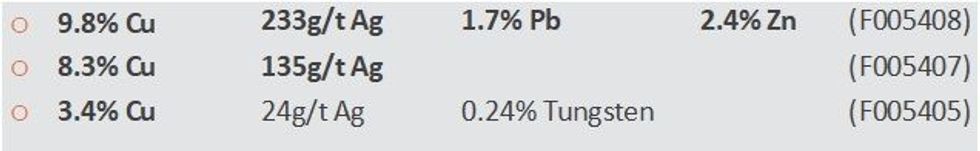

- Charlie, a skarn horizon covering a strike of approximately 900m, previously identified by state geologists has returned consistently high-grade polymetallic results adding further depth to the metal basket at Great Bear:

“Well, this not something you see every day, let alone to find on surface during a maiden field program - possibly the highest- grade silver results published in recent history. It’s remarkable that the team has now delineated a total of six high grade Copper, Gold and Silver mineralised districts at Great Bear. Results to date have included massive, mineralised contents of 42.6% Cu, 42.2% Cu, 39.5% Cu, 38.2g/t Au, 29.7g/t Au and 716g/t Ag and, now, those results have now potentially been outshone by this silver discovery. To reel off, with consistency these results in a maiden campaign from around 15-20% of the overall Great Bear Project Area is great. If we are able to marry these results and structures up with the recently completed geophysics and prove depth potential we will be well placed for significant discovery.

Coming into this campaign, there was a high expectation given what historically had been identified at Great Bear. Pleasingly, we have not only exceeded those historical high grade assay results, but we have also extended mineralisation in all directions and in some cases into the kilometres as districts are identified.

Amazingly, the 1.5 x 1.5 km Slider District remains underexplored. Given these results - there is a lot of upside for additional high grade silver structures to exist.”

Troy Whittaker - Managing Director

Click here for the full ASX Release

This article includes content from White Cliff Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00