Battery Mineral Resources Corp. (TSXV: BMR) ("BMR" "Battery" or the "Company") is very pleased to provide a broad corporate update on its recent accomplishments in Chile as it moves its Punitaqui mine complex towards a production restart. The Punitaqui mine and mill have been on continuous care and maintenance since April 2020, when copper prices as low as $2.00 per pound forced the previous operators to cease operations.

Drilling and Updated 43-101 Resource Estimates

The Phase 1 drill program at the Punitaqui Mining complex was completed in May and all assays have now been received and reported. The final tally for the Phase 1 program totalled nearly 33,000 meters ("m") of diamond drilling focusing on three zones: San Andres, Dalmacia and Cinabrio Norte. The results of these drilling campaigns will be combined with historical drilling and resource estimates will be calculated and reported. In addition, the current remaining resources for the Cinabrio mine, which fed the Punitaqui copper processing plant for eight-plus years, will be included in the report.

The Company's management are very excited with the results of the Phase 1 program for several reasons, as follows:

Dalmacia

- A change in drilling azimuth and dip discovered several new areas of mineralization and was also able to connect several smaller zones into larger bodies which are more suitable for larger scale mining.

- The focus area for the upcoming resource statement covers approximately one-third of the known strike length and BMR is optimistic further infill drilling could lead to a significantly larger resource as the remaining two-thirds of the strike is explored.

Cinabrio Norte

- The drilling results reported from Cinabrio Norte were very encouraging as this area immediately north of the Cinabrio mine had very minor drilling prior to the recent Phase 1 surface drilling program.

- The Company now expects the Cinabrio Norte zone will be included in the upcoming resource estimate. This is particularly important since this zone is approximately 110m north of the 220m level in the Cinabrio mine and can therefore be accessed from Cinabrio with relatively little effort.

- The Cinabrio Norte zone is open at depth, which BMR plans to continue drilling from underground once access has been established.

San Andres

- Infill and step out drilling intersected broad areas of copper mineralization to the north and south.

- The main mineralized zone has now been traced for up to 450m in strike, up to 200m in width and up to 30m in thickness.

- The company expects that San Andres will be included in the upcoming resource estimate.

- The planning for a Phase 2 RC infill drill program at San Andres is well underway with the construction of all drill pads completed.

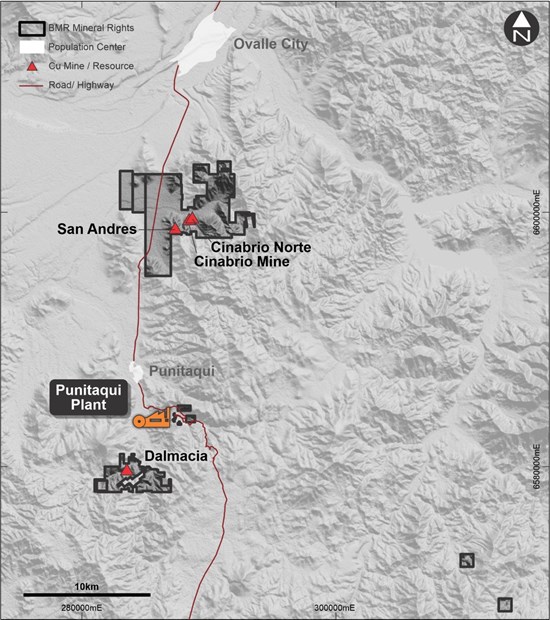

Figure 1: Punitaqui Project Tenement Holdings, Resource Targets & Plant Location Map

To view an enhanced version of Figure 1, please visit:

https://images.newsfilecorp.com/files/6076/130679_c021bacc14250aba_002full.jpg

JDS Energy and Mining, Inc. are working to complete the updated NI 43-101 resource estimate at the Punitaqui mining complex since receiving all final assays from the Phase 1 drill program. An NI 43-101 resource is to be received in the next three to four weeks.

Punitaqui Mill Maintenance Audit

The Punitaqui mill is a standard crush, grind and flotation mill rated for processing of up to 3,600 tonnes per day, which was improved upon and optimized by Glencore Plc during the approximately 8 years that they operated the mill. As part of the planned restart of production, the Company recently engaged a third-party firm to conduct a full maintenance audit of the Punitaqui mill to assess its readiness to recommence processing ore and producing copper concentrate. The audit scope included all mechanical, electrical and instrumentation items. This included inspection of all pumps, motors, conveyor belts, primary, secondary, and tertiary crushers, ball mills, liners, flotation cells, concentrate filters, tailings thickeners, cranes and hoists, electrical supply and water supply.

The results of the audit confirmed that the budgeted cost estimate, which was based on operating and maintenance records, was accurate and no new major repairs or replacements are required. Finally, the audit confirmed that the Punitaqui mill is in good working condition to restart production after the planned maintenance program concludes, which is expected later this year.

Metallurgical Study on Processing of Punitaqui Ores

Although the Punitaqui copper processing plant successfully operated for nearly a decade, the company elected to undertake a comprehensive metallurgical test program on each potential different ore types from the Punitaqui mining complex including material from two zones at the Cinabrio mine (M1 & M2), the Cinabrio Norte, San Andres, and Dalmacia zones. The samples were shipped to the SGS Laboratory in Lakefield, Ontario, where a full flotation program was conducted. SGS Lakefield is a recognized global leader in mineral processing and recovery and their work was overseen by BMR metallurgical consultant Dr. Joseph Ferron. The goal of this study was to minimize any potential start-up risk and maximize metal recoveries and copper concentrate quality.

As previously announced in our June 9th press release, metallurgical studies confirmed that the combined copper concentrate to be produced from the four main deposits (Cinabrio, Cinabrio Norte, Dalmacia and San Andres) is commercially marketable and the company has received strong interest from several concentrate off-takers. Moreover, the testing demonstrated the combined future sources of ore to the Punitaqui mill demonstrate an average of overall 84% copper recovery - a 5% higher recovery than historically realised at Punitaqui by prior operators. Additionally, we are working to refine and improve upon these initial very positive results.

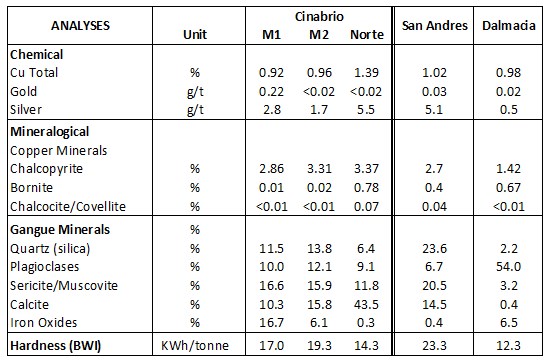

The Punitaqui samples were prepared and submitted for complete chemical and mineralogical analyses. In addition, the sample hardness was measured using the Bond work index procedure (BWI). Most relevant results are presented in the following Table #1.

Table #1 - Chemical & Mineralogical Results of Punitaqui Feed Material

To view an enhanced version of Table #1, please visit:

https://images.newsfilecorp.com/files/6076/130679_c021bacc14250aba_003full.jpg

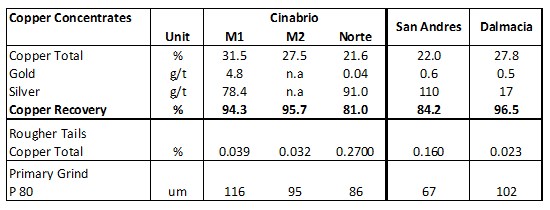

The flotation program included: rougher kinetics tests, open circuit cleaner tests and locked cycle tests. The main parameters examined were copper and precious metals recovery, fineness of primary grind, use of regrind and circuit configuration. The results of the locked cycle tests are presented in the following Table #2.

Table #2 - Concentrate Recoveries & Grades by Zone

To view an enhanced version of Table #2, please visit:

https://images.newsfilecorp.com/files/6076/130679_c021bacc14250aba_004full.jpg

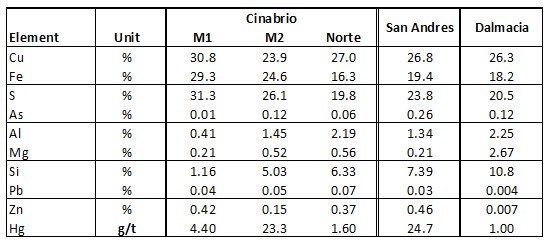

The flotation circuit used during these locked cycle tests incorporated a regrind of the entire rougher concentrate, and an open circuit first cleaner stage. Results clearly indicated that the copper recovery was directly related to the percent liberation of the copper sulphides. Copper concentrate grades for all five ore types were squarely in ranges which are marketable (ranging from 21.6% up to 31.5%). Representative copper concentrates produced from each ore sample were submitted to standard smelter analysis. Significant results are presented in Table 3.

Table #3 - Punitaqui Copper Concentrate Chemical Analysis

To view an enhanced version of Table #3, please visit:

https://images.newsfilecorp.com/files/6076/130679_c021bacc14250aba_005full.jpg

Final Punitaqui Permitting

The permitting process which is a combination of modifying and combining existing environmental and operating permits is progressing in lockstep with the goal restarting the Punitaqui copper mine complex. Permits for operation of the Punitaqui mill, tailings deposition and re-starting underground mine development have already been approved by the regulators.

After resources are updated, mine designs are modified and the remainder of the capital required for recommencing operations is secured, Cinabrio will be the first area to be mined, to be followed soon after by a sequence that brings in mining at San Andres, Cinabrio Norte and Dalmacia.

To recommence underground mining of ore at Cinabrio and San Andres, BMR submitted a simplified environmental impact study (DIA) for the Cinabrio mine and San Andres zone in December 2021 as requested by the authorities. After reviewing the DIA study, regulators are afforded two rounds of comments/questions for clarification. BMR is in the process of preparing the answers to the second and final round of comments sent by the regulatory authorities. These will be filed on July 15th, with final approval expected within 60 days.

Local Community Engagement

Battery Mineral Resources is committed to a strong focus of continuous improvement on community relations by proactively engaging with our local communities and especially with the residents of the town of Punitaqui. Earlier this year, BMR engaged the services of consulting firm Integratio Mediação Social e Sustentabilidade ("Integratio"). Integratio is a socio-environmental management, strategic relationship, and stakeholder engagement consultant group operating for over 17 years and based in Belo Horizonte, Brazil. Integratio has recently delivered a report to BMR with community assessment and stakeholder mapping that also highlights the main issues to be focused on in our community relations and social license program and provides the framework for a wholistic and proactive approach to social engagement. As a next step to the responses received in the report, BMR plans to initiate a social management and engagement plan that considers the entire relationship and communication of the company within the area, including the establishment of a social investment program, which will allow direct communication with the entities and population in the area of influence of our Punitaqui mine complex. This program is now being prepared, reviewed and should be implemented by the end of the month. We look forward to continuing to engage in a proactive and positive manner with all our stakeholders and local communities.

About Battery Mineral Resources Corp.

Battery Mineral Resources ("BMR") is a battery mineral company focused on growth through cash-flow, exploration, and acquisitions in favourable mining jurisdictions. BMR is currently developing the Punitaqui Mining Complex, a past copper-gold producer, in the Coquimbo region of Chile and pursuing a potential near-term resumption of operations in late 2022. Battery Mineral's mission is the discovery, acquisition, and development of battery metals (namely cobalt, lithium, graphite, nickel, and copper), in North America, South America and South Korea, to become a premier and responsible supplier of battery minerals to the electrification marketplace. BMR is the largest mineral claim holder in the historic Gowganda Cobalt- Silver Camp in Ontario, Canada, and continues to pursue a focused program to build on the recently announced, +1-million-pound high-grade cobalt resource at McAra. In addition, Battery Mineral owns 100% of ESI Energy Services, Inc. a profitable pipeline equipment rental and sales company with operations in Alberta, Canada and Arizona, USA. Battery Minerals Resources is based in Canada and its shares are listed on the Toronto Venture Exchange under the symbol "BMR" and on the OTCQB under the symbol "BTRMF". Further information about BMR and its projects can be found on www.bmrcorp.com

For more information, please contact:

Martin Kostuik, CEO

Phone: +1 (604) 229 3830

info@bmrcorp.com

Mars Investor Relations

+1 (604) 335-1976

bmr@marsinvestorrelations.com

Harbor Access Corp.

475-477-9402

jody.kane@harbor-access.com

Twitter: @BMRcorp_

www.bmrcorp.com

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

Forward-Looking Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections of the Company on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain sufficient financing to complete exploration and development activities, the ability of the Company to complete the Debenture offering, risks related to share price and market conditions, the inherent risks involved in the mining, exploration and development of mineral properties, the ability of the Company to meet its anticipated development schedule, government regulation and fluctuating metal prices. Accordingly, readers should not place undue reliance on forward-looking statements. Battery undertakes no obligation to update publicly or otherwise revise any forward-looking statements contained herein, whether because of new information or future events or otherwise, except as may be required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/130679