June 22, 2023

Aston Bay Holdings Ltd. (TSXV:BAY) (OTCQB:ATBHF) ("Aston Bay" or the "Company") reports significant new drill results from the spring reverse circulation (RC) drilling program at the Storm Copper Project ("Storm" or the "Project") on Somerset Island, Nunavut, Canada. The program was conducted this April and May by American West Metals Limited ("American West"), who are the project operator since entering an option agreement with Aston Bay in March 2021.

- Additional thick and high-grade near-surface copper intervals intersected at the 4100N Zone with numerous intervals over 5% Cu and a peak value of 8% Cu

- Drill hole SR23-13 has intersected:

- 29m @ 1.2% Cu from 62.5m, including,

- 3m @ 5% Cu from 86.9m, including,

- 1.5m @ 8.2% Cu from 86.9m

- 3m @ 5% Cu from 86.9m, including,

- Drill hole SR23-14 has intersected:

- 25.9m @ 1.3% Cu from 61m, including,

- 9.1m @ 2.1% Cu from 76.2m, including,

- 3m @ 3.7% Cu from 82.3m

- 9.1m @ 2.1% Cu from 76.2m, including,

- Drill hole SR23-07 has intersected:

- 10.7m @ 1.3% Cu from 76.2m, including,

- 4.6m @ 2.9% Cu from 76.2m, including,

- 1.5m @ 6.5% Cu from 76.2m

- 4.6m @ 2.9% Cu from 76.2m, including,

- Drill hole SR23-09 has intersected:

- 10.6m @ 1% Cu from 67.1m, including,

- 4.6m @ 2% Cu from 71.6m

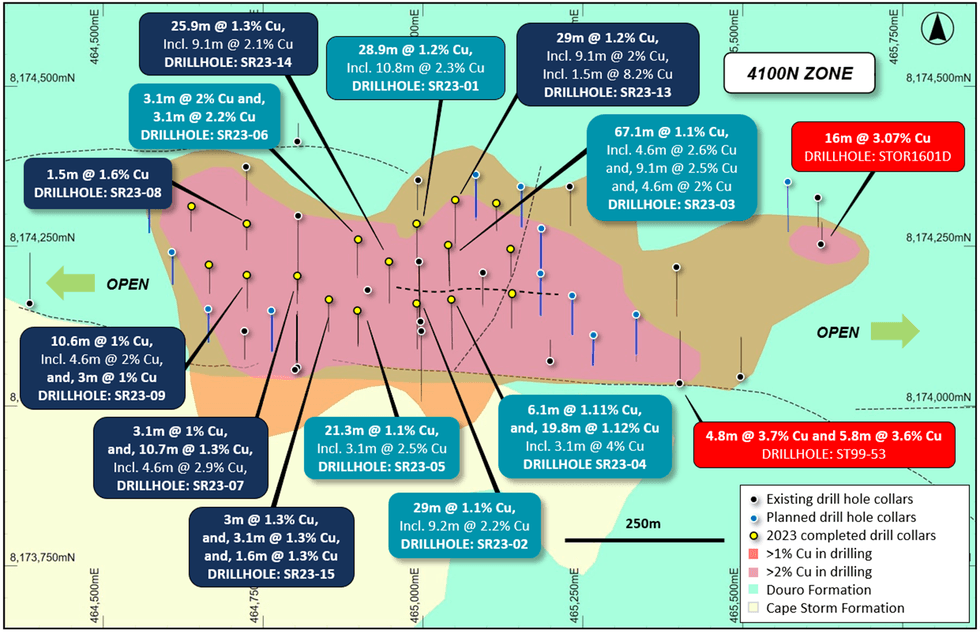

- Copper mineralization remains open laterally in all directions

- These results continue to expand the volume of the near-surface mineralization and provide further support for the exploration potential of the large gravity anomaly located below the 4100N Zone

"We continue to receive impressive results from the RC program conducted at Storm by our partners America West Metals," stated Thomas Ullrich, CEO of Aston Bay. "The high grades, up to 8% copper in these results and higher elsewhere at Storm, speaks to the quality of the mineralized system, while its apparent continuity and consistency demonstrates a significant increase in the known near-surface high-grade mineralization.

"The 4100N Zone sits directly above the largest of several geophysical targets recently delineated at Storm, adjacent to faults that may have served as conduits for the mineralizing fluids. Our exploration model suggests that the 4100N Zone may be the uppermost of a series of stacked mineralized zones. This would be a game-changing discovery, and we eagerly look forward to testing this hypothesis in the upcoming summer drill program."

Figure 1: Plan view of the 4100N Zone showing interpreted copper mineralization footprint (defined by historical drilling and EM), historical and recent drilling details, overlaying regional geology. Stated drill hole intersections are all core length, and true width is expected to be 60% to 95% of stated length.

HIGH GRADES AND THICK INTERVALS CONTINUE

Assay results have been received and interpretation has been completed on drill holes SR23-07, SR23-08, SR23-09, SR23-13, SR23-14, and SR23-15. The drill holes are located within the central part of the 4100N Zone and have been prioritized to allow resource modeling on drill sections with complete data sets.

The drilling results continue to demonstrate consistent copper grades and excellent lateral continuity of the known copper mineralization. The mineralization is open along most sections and is defined by broad intervals of vein and fracture-style chalcocite, bornite and lesser chalcopyrite hosted within a distinct, horizontally extensive dolomite.

Multiple very high-grade lenses are located within the broader zones of mineralization, and these targets and further expansion of the mineralized footprint will be a focus for follow-up drilling in this zone.

Hole ID | Prospect | Easting | Northing | Depth (m) | Azimuth | Inclination | Copper Mineralized Interval (m) |

SR23-01 | 4100N | 464991 | 8174285 | 137.2 | 180 | -65 | 28.9 |

SR23-02 | 4100N | 464990 | 8174157 | 140.2 | 180 | -59 | 21 |

SR23-03 | 4100N | 465041 | 8174251 | 151 | 178 | -65 | 52.5 |

SR23-04 | 4100N | 465045 | 8174166 | 152.4 | 179 | -69 | 25.9 |

SR23-05 | 4100N | 464899 | 8174146 | 131.1 | 180 | -66 | 21.3 |

SR23-06 | 4100N | 464899 | 8174261 | 166.1 | 180 | -69 | 13.7 |

SR23-07 | 4100N | 464805 | 8174203 | 137.2 | 180 | -71 | 7.7 |

SR23-08 | 4100N | 464726 | 8174286 | 118.9 | 180 | -69 | 6.1 |

SR23-09 | 4100N | 464726 | 8174206 | 164.6 | 180 | -69 | 13.8 |

SR23-10 | 4100N | 464638 | 8174315 | 125 | 180 | -70 | 10.6 |

SR23-11 | 4100N | 464667 | 8174223 | 140.2 | 180 | -70 | 25.9 |

SR23-12 | 4100N | 465115 | 8174317 | 149.4 | 179 | -73 | 12.2 |

SR23-13 | 4100N | 465051 | 8174321 | 175.3 | 180 | -65 | 29 |

SR23-14 | 4100N | 464948 | 8174227 | 160 | 180 | -65 | 25.9 |

SR23-15 | 4100N | 464853 | 8174167 | 121.9 | 180 | -65 | 10.7 |

SR23-16 | 4100N | 465138 | 8174247 | 132.6 | 180 | -70 | 7.62 |

SR23-17 | 4100N | 465139 | 8174173 | 129.5 | 180 | -66 | 19.8 |

Table 1: 2023 program drill hole details and copper mineralization summary. The "Copper Mineralized Interval" data is based on laboratory assays (in bold) and visual estimates.

Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Laboratory assays are required to determine the presence and grade of any contained mineralization within the reported visual intersections of copper sulfides. Portable XRF is used as an aid in the determination of mineral type and abundance during the geological logging process.

DRILL HOLE SR23-07 DETAILS

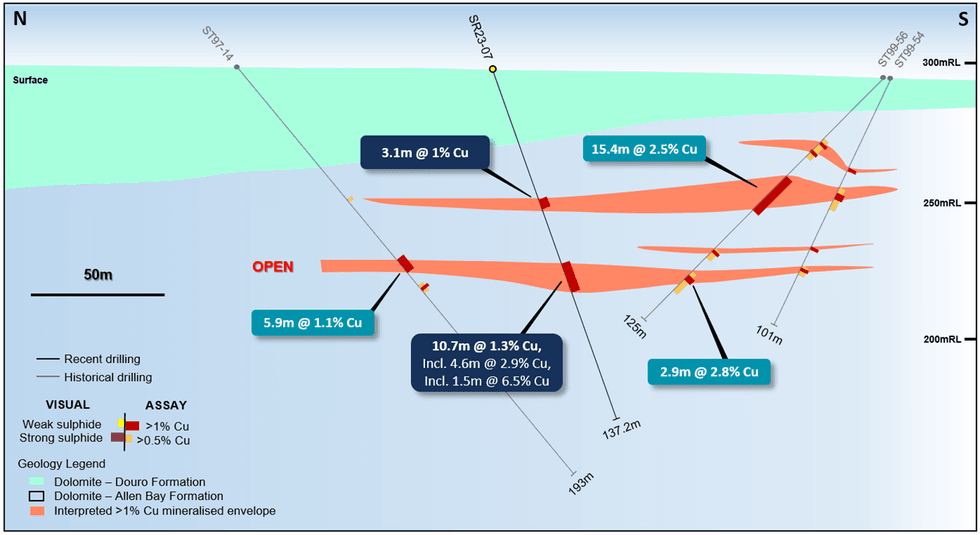

SR23-07 was drilled to a downhole depth of 137.2m and is located on drill section 464,800E (Figure 2), the same section as historical drill holes ST97-14, ST99-56, and ST99-54.

SR23-07 intersected two horizontal zones of strong vein and fracture-style copper sulfide mineralization hosted within fractured dolomite. The grade and mineralogy are identical to that of the historical drill holes and confirm the excellent lateral continuity of the mineralization along this section.

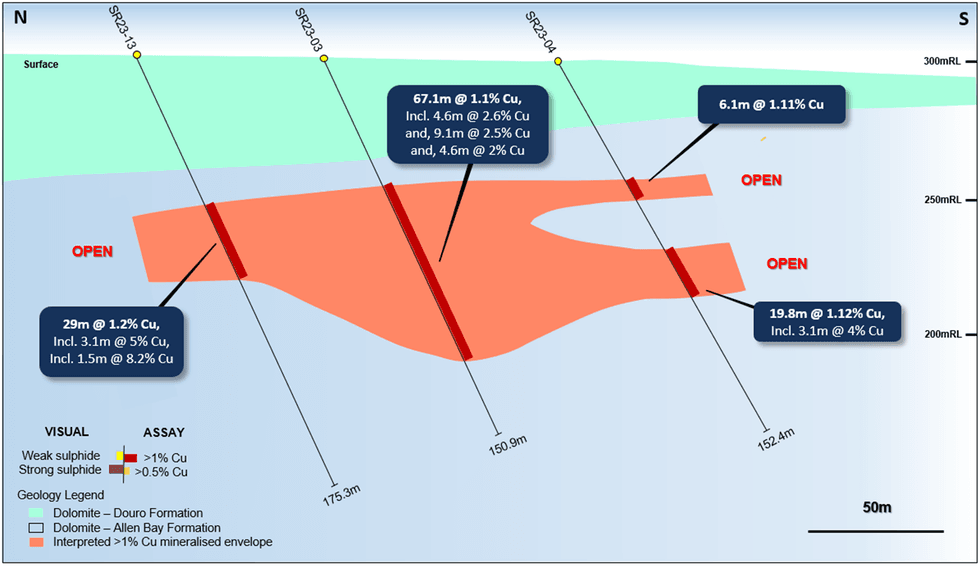

Figure 2: Geological section view at 464,800E showing the interpreted mineralization envelope (>>1% Cu) and recent drill hole assays and visual observations. Stated drill hole intersections are all core length, and true width is expected to be 60% to 95% of stated length.

Tables 2 - 7 below summarise the significant intersections in drilling. Intersections are expressed as downhole widths and are interpreted to be approximately 90-100% of true width. A cut-off grade of 0.5% copper is used to define a significant intersection and is based on mineralogy, mineralization habit and expected beneficiation performance.

Hole ID | From (m) | To (m) | Width | Cu % | Zn % | Ag g/t |

SR23-07 | 50.3 | 54.9 | 4.6 | 0.9 | - | 2 |

Including | 51.8 | 54.9 | 3.1 | 1 | - | 2.5 |

And | 76.2 | 86.9 | 10.7 | 1.3 | - | 2.9 |

Including | 76.2 | 80.8 | 4.6 | 2.9 | - | 5.7 |

Including | 76.2 | 77.7 | 1.5 | 6.5 | - | 13 |

Table 2: Summary of significant drilling intersections for drill hole SR23-07 (>0.5% Cu)

DRILL HOLE SR23-08 and SR23-09 DETAILS

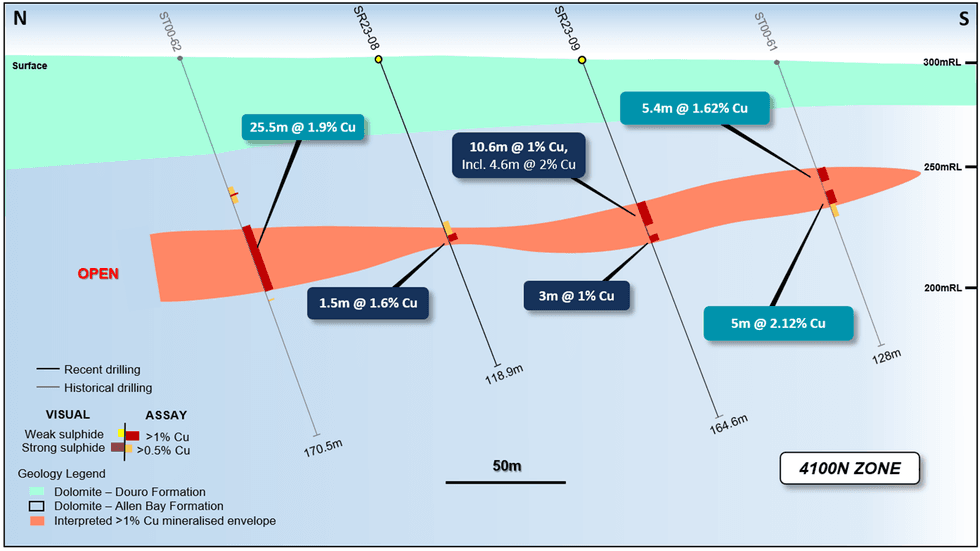

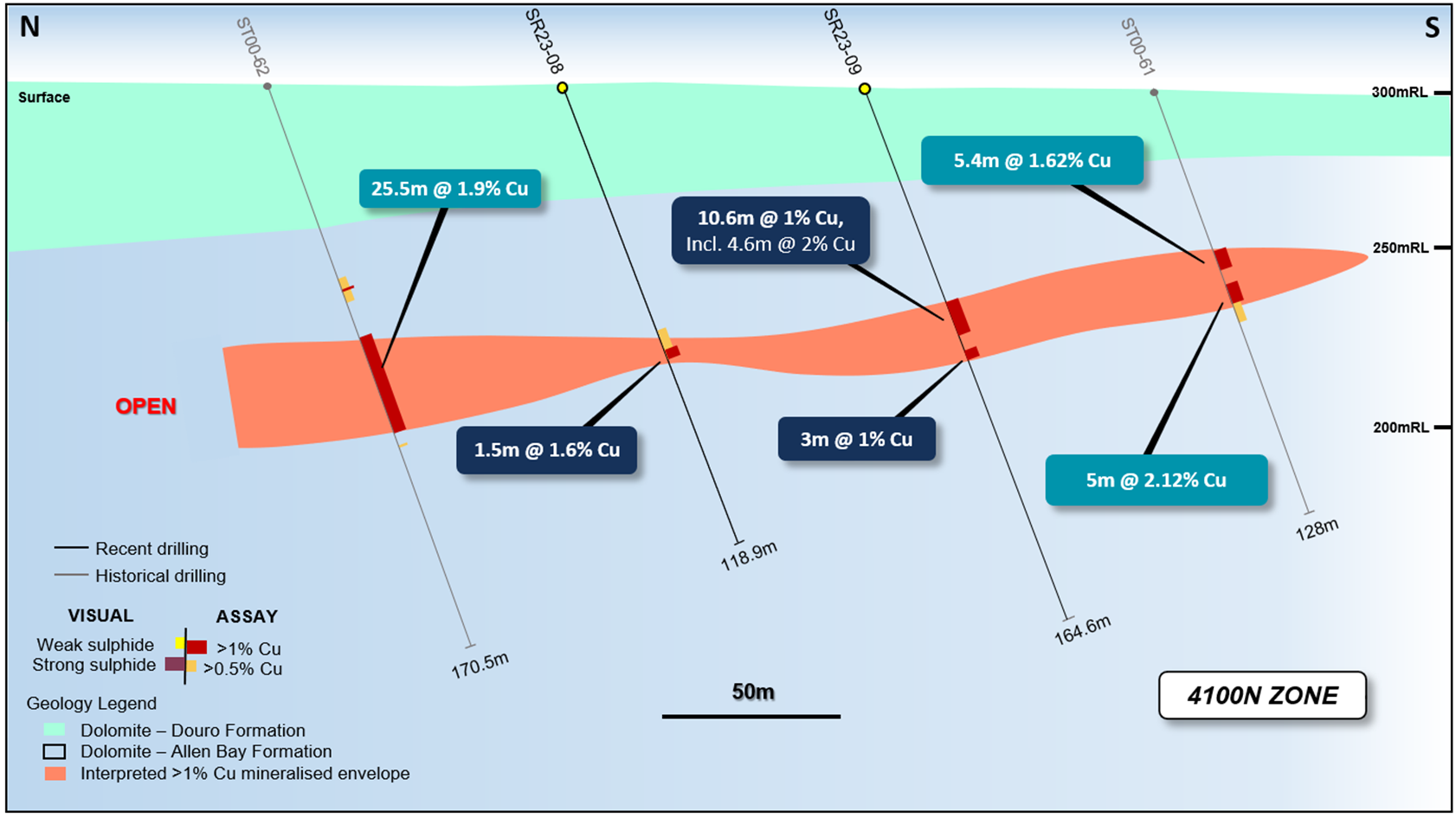

SR23-08 and SR23-09 were drilled along section 464,725E (Figure 3). The drill holes were completed to a downhole depth of 118.9m and 164.6m respectively and were designed to test the continuity of the mineralization between the thick intervals of copper encountered within historical drill holes ST00-61 and ST00-62.

Both drill holes intersected wide zones of vein and fracture-style copper sulfide mineralization hosted within fractured dolomite. Higher-grade zones of mineralization (>2% Cu) are contained within the broader intervals of >1% copper sulfide mineralization.

The mineralization on drill section 464,725E remains open to the north.

Figure 3: Geological section view at 464,725E showing the interpreted mineralization envelope (>1% Cu) and recent drill hole assays and visual observations. Stated drill hole intersections are all core length, and true width is expected to be 60% to 95% of stated length.

Figure 3: Geological section view at 464,725E showing the interpreted mineralization envelope (>1% Cu) and recent drill hole assays and visual observations. Stated drill hole intersections are all core length, and true width is expected to be 60% to 95% of stated length.

Hole ID | From (m) | To (m) | Width | Cu % | Zn % | Ag g/t |

SR23-08 | 71.6 | 82.3 | 10.7 | 0.6 | - | 3.2 |

Including | 80.8 | 82.3 | 1.5 | 1.6 | - | 2 |

Table 3: Summary of significant drilling intersections for drill hole SR23-08 (>0.5% Cu)

Hole ID | From (m) | To (m) | Width | Cu % | Zn % | Ag g/t |

SR23-09 | 67.1 | 77.7 | 10.6 | 1 | - | 5.3 |

Including | 71.6 | 76.2 | 4.6 | 2 | - | 10.3 |

And | 82.3 | 85.3 | 3 | 1 | 6 |

Table 4: Summary of significant drilling intersections for drill hole SR23-09 (>0.5% Cu)

DRILL HOLE SR23-13 DETAILS

Drill hole SR23-13 was completed on the same section (465,050E) as drill holes SR23-03 and SR23-04 (Figure 4). The drill hole is located to the north of SR23-03 (67m (core length) @ 1.1% Cu) and was drilled to a downhole depth of 175.3m.

The drill hole confirmed the extension of the thick mineralization to the north and intersected a broad interval of strong copper sulfide mineralization with three higher-grade bands. The lower 1.5m thick band consists of very dense chalcocite veining and averages 8.2% Cu.

Importantly, SR23-13 remains open to the north in an area with significant EM anomalism.

Figure 4: Geological section view at 465,050E showing the interpreted mineralization envelope (>1% Cu) and recent drill hole assays and visual observations. Stated drill hole intersections are all core length, and true width is expected to be 60% to 95% of stated length.

Hole ID | From (m) | To (m) | Width | Cu % | Zn % | Ag g/t |

SR23-13 | 62.5 | 91.5 | 29 | 1.2 | - | 3.7 |

Including | 62.5 | 64 | 1.5 | 2.9 | - | 8 |

And | 67.1 | 68.6 | 1.5 | 2.4 | - | 20 |

And | 80.8 | 82.3 | 1.5 | 2.1 | - | 5 |

And | 86.7 | 91.4 | 4.7 | 3.5 | - | 4.7 |

Including | 86.9 | 89.9 | 3 | 5 | - | 6 |

Including | 86.9 | 88.4 | 1.5 | 8.2 | - | 9 |

Table 5: Summary of significant drilling intersections for drill hole SR23-13 (>0.5% Cu)

DRILL HOLE SR23-14 and SR23-15 DETAILS

SR23-14 and SR23-15 were drilled to test continuity along the East-West main strike of the mineralization. The holes were drilled to a downhole depth of 160m and 166.1m respectively.

The drill holes have successfully confirmed the consistency of the copper mineralization between the historical sections and increased the resource confidence in the central part of the 4100N Zone.

Drill hole SR23-14 has intersected a single, very wide interval of vein and fracture-style copper sulfide mineralization with individual assays up to 4.9% Cu.

Drill hole SR23-15 also intersected a wide zone (30m) of >0.5% Cu mineralization with higher-grade bands of >1% Cu mineralization toward the base of the interval.

Hole ID | From (m) | To (m) | Width | Cu % | Zn % | Ag g/t |

SR23-14 | 61 | 86.9 | 25.9 | 1.3 | - | 2.4 |

Including | 76.2 | 85.3 | 9.1 | 2.1 | - | 3.8 |

Including | 82.3 | 85.3 | 3 | 3.7 | - | 5.5 |

Table 6: Summary of significant drilling intersections for drill hole SR23-14 (>0.5% Cu)

Hole ID | From (m) | To (m) | Width | Cu % | Zn % | Ag g/t |

SR23-15 | 44.2 | 74.7 | 30.5 | 0.5 | - | 1.3 |

Including | 44.2 | 47.2 | 3 | 1.3 | - | 2 |

And | 65.5 | 68.6 | 3.1 | 1.3 | - | 2.5 |

And | 71.6 | 73.2 | 1.6 | 1.3 | - | 3 |

Table 7: Summary of significant drilling intersections for drill hole SR23-15 (>0.5% Cu)

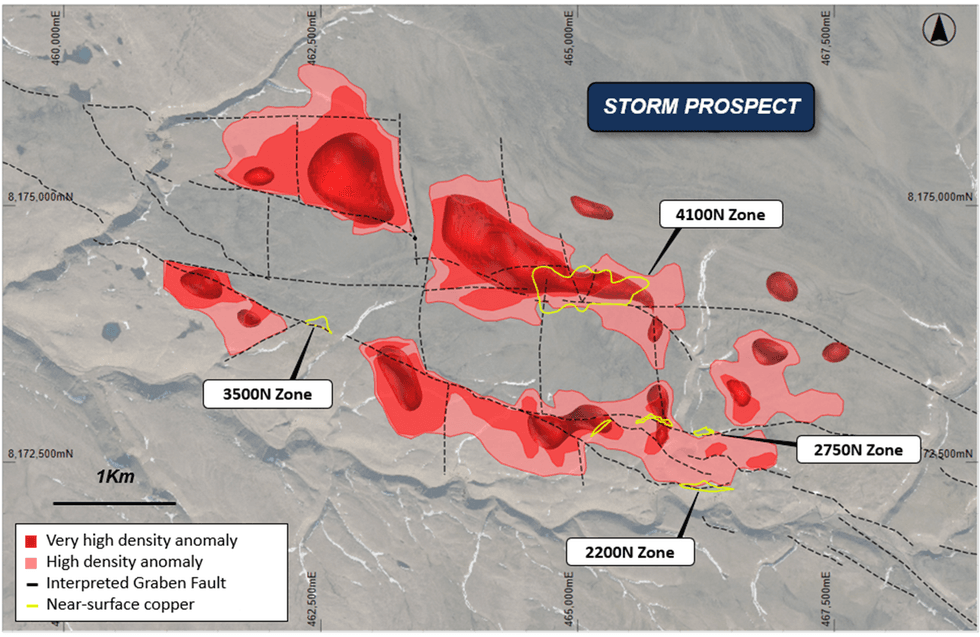

4100N ZONE - TIP OF THE ICEBERG?

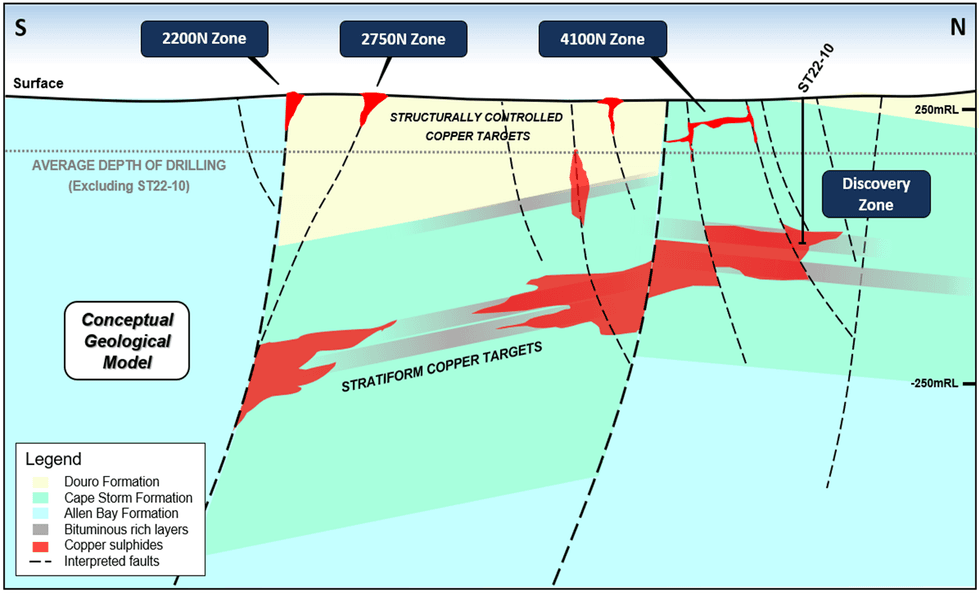

The new drill hole data at the 4100N Zone is helping to further the understanding of the geological setting and mineralization processes of the Storm copper system. The drilling is revealing a laterally extensive zone of mineralization that displays many of the features of a typical sediment hosted copper deposit, including multiple stacked copper horizons. The recent gravity survey data has highlighted a large and dense body underneath the 4100N Zone (see June 9, 2023 news release) which is interpreted to potentially represent a larger accumulation of copper sulfides (Figure 5).

Importantly, the geology of the 4100N displays marked similarities to that observed in drilling that has tested deeper parts of the system. Drill hole ST22-10, drilled to the west and below the stratigraphic level of the 4100N Zone, targeted a large EM anomaly and intersected 68 m of a typical sediment hosted mineral assemblage including chalcopyrite, pyrite, sphalerite, and galena. At the 4100N Zone and elsewhere at Storm, this mineral assemblage is located peripheral to a larger and higher-grade core dominated by chalcocite, bornite and covellite.

The geological similarities and spatial association between the 4100N Zone and ST22-10 suggest that the two types of mineralization may be related and form part of a large, stacked copper system hosted in several prospective stratigraphic horizons (Figure 6).

Figure 5: Gravity data interpretation map showing the 3D gravity targets, zones of known near-surface copper sulfide mineralization and major faults (overlaying topography).

Figure 6: Conceptual geological and exploration targeting model for the Storm Project, showing depth of current drilling and conceptual location of discovery drill hole ST22-10.

EVIDENCE OF A MAJOR COPPER SYSTEM

The drilling and geophysical evidence strongly support the potential for a large-scale copper system within the Storm Project area.

The geology of the area displays all the elements required in the sediment-hosted mineralizing process: permeable carbonate rocks to act as a fluid conduit and host mineralization, hydrocarbons to reduce metal-bearing fluids and force metal precipitation, sulfur source from bitumen and sour gas, proximity to faults known to be an effective source for plumbing, all within a favourable structural setting.

A distinct zonation of metal and mineralogy is also observed at Storm. The zonation appears as a large copper-rich core (chalcocite, bornite and covellite) that gives way laterally and vertically to thinner peripheral zones of copper-iron (chalcopyrite), iron (pyrite), zinc (sphalerite) and minor lead (galena). This zonation provides a powerful vector for exploration.

These key features are similar to many of the world's major sediment-hosted copper systems, including the deposits of the Kalahari Copper Belt (Botswana) and Central African Copper Belt (DRC, Zambia).

PLANNED PROGRAM

- The drilling at the 4100N Zone will be followed by resource definition drilling at the 2200N and 2750N Zone, where drilling during 2022 intersected high-grade copper sulfides close to surface including 41m (core length) @ 4.18% Cu from 38m (ST22-05) downhole.

- Processing and interpretation of the MLEM data is almost complete. Drilling is being planned to follow-up any new MLEM anomalies.

- Diamond drilling has been scheduled to test the large geophysical copper targets below the near-surface mineralization defined in recent EM and gravity surveys.

- Sorting, beneficiation and process optimisation continues on a range of mineralization styles.

- An environmental baseline survey will begin in the Storm area during Q3 2023.

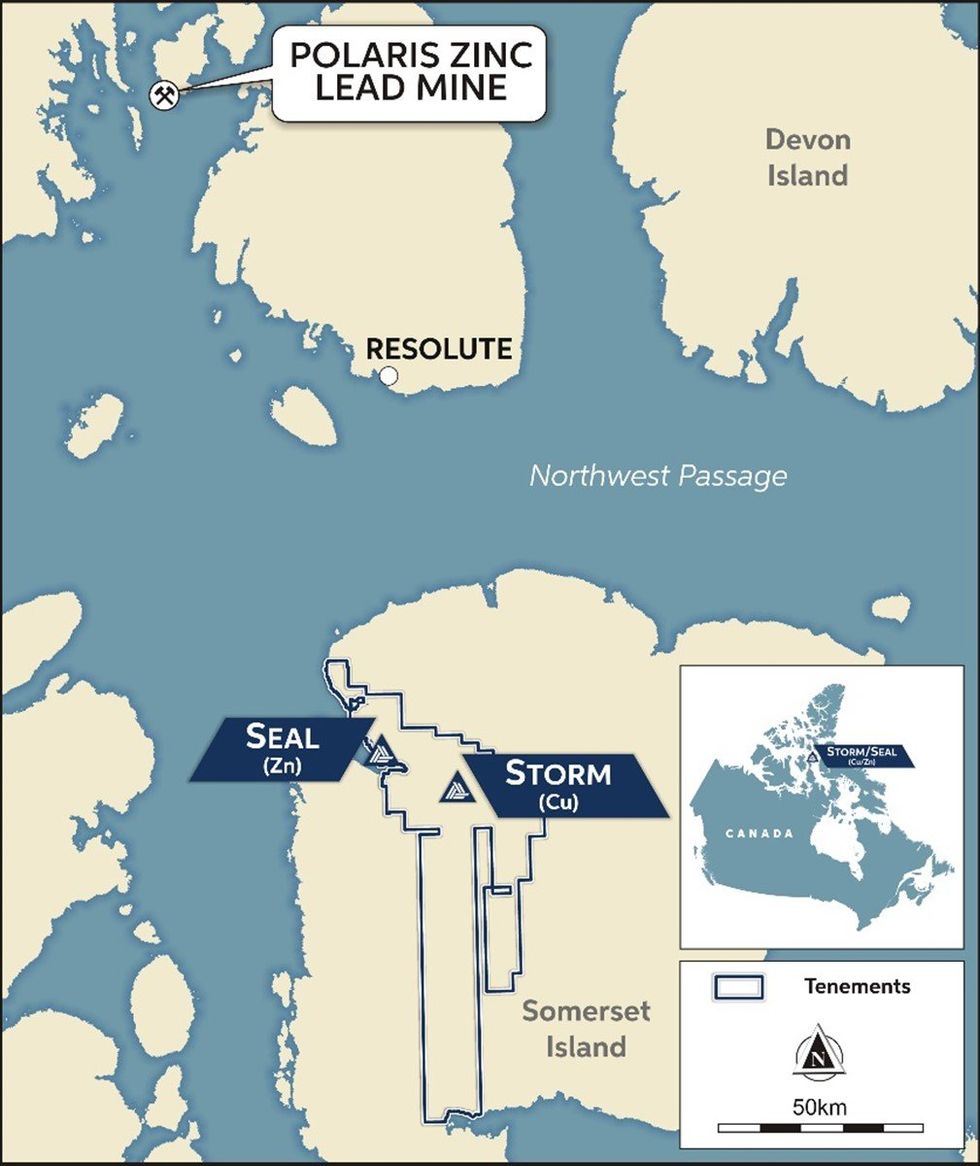

About the Storm Copper and Seal Zinc-Silver Projects, Nunavut

The Nunavut property consists of 173 contiguous mining claims covering an area of approximately 219,257 hectares on Somerset Island, Nunavut, Canada. The Storm Project comprises both the Storm Copper Project, a high-grade sediment-hosted copper discovery (intersections including 110m* @ 2.45% Cu from surface and 56.3m* @ 3.07% Cu from 12.2m) as well as the Seal Zinc Deposit (intersections including 14.4m* @ 10.58% Zn, 28.7g/t Ag from 51.8m and 22.3m* @ 23% Zn, 5.1g/t Ag from 101.5m). Additionally, there are numerous underexplored and undrilled targets within the 120-kilometre strike length of the mineralized trend, including the Tornado copper prospect where 10 grab samples yielded >1% Cu up to 32% Cu in gossans.

Storm Discovery and Historical Work

High-grade copper mineralization was discovered at Storm in the mid-1990s by Cominco geologists conducting regional zinc exploration around their then-producing Polaris lead-zinc mine. A massive chalcocite boulder found in a tributary of the Aston River in 1996 was traced to impressive surface exposures of broken chalcocite mineralization at the surface for hundreds of metres strike length at what became named the 2750N, 2200N, and 3500N Zones. Subsequent seasons of prospecting, geophysics and over 9,000 m of drilling into the early 2000s confirmed a significant amount of copper mineralization below the surface exposures as well as making the blind discovery of the 4100N Zone, a large area of copper mineralization with no surface exposure.

Following the merger of Cominco with Teck in 2001 and the closure of the Polaris Mine, the Storm claims were allowed to lapse in 2007. Commander Resources re-staked the property in 2008 and flew a helicopter-borne VTEM survey in 2011 but conducted no additional drilling. Aston Bay subsequently entered into an earn-in agreement with Commander and consolidated 100% ownership in 2015. Commander retains a 0.875% Gross Overriding Royalty in the area of the original Storm claims.

In 2016 Aston Bay entered into an earn-in agreement with BHP, who conducted a 2,000-station soil sampling program and drilled 1,951m of core in 12 diamond drill holes, yielding up to 16m* @ 3.1% Cu. BHP exited the agreement in 2017. Aston Bay conducted a property-wide airborne gravity gradiometry survey in 2017 and drilled 2,913m in nine core holes in the Storm area in 2018 yielding a best intercept of 1.5m* @ 4.39% Cu and 20.5m* @ 0.56% Cu.

Agreement with American West Metals

An earn-in agreement for the Storm and Seal properties was signed with American West Metals in March 2021. Under the terms of the agreement, an expenditure of C$10m will earn 80% ownership of the property for American West. Aston Bay is carried for all expenditures to the completion of a feasibility study and production decision. If Aston Bay chooses not to participate and is diluted below 10% ownership, the ownership converts to a 2% Net Smelter Royalty, half of which is purchasable by American West for C$5m at first production. Aston Bay received a cash payment of C$500,000 on signing.

Recent Work

American West completed a fixed loop electromagnetic (FLEM) ground geophysical survey in 2021 that yielded several new subsurface conductive anomalies. A total of 1,534m were drilled in 10 diamond drill holes in the 2022 season, yielding several impressive near-surface intercepts including 41m* @ 4.1% Cu as well as 68m of sulfide mineralization associated with a deeper conductive anomaly.

In April 2022 results of beneficiation studies demonstrated that a mineralized intercept grading 4% Cu from the 4100N area could be upgraded to a 54% Cu direct ship product using standard sorting technology. Further beneficiation studies are ongoing.

In April 2023 American West embarked on a spring delineation drilling program using a helicopter-portable reverse circulation (RC) drill rig as well as gravity and moving loop electromagnetic (MLEM) ground geophysical programs. Results from the programs are in process and are released as they come available.

A summer 2023 program plans further delineation drilling of the near-surface high-grade copper zones to advance them toward maiden resource reports by late 2023. Diamond drilling is planned to test new high-priority gravity targets and environmental baseline studies will be initiated.

*Stated drill hole intersections are all core length, and true width is expected to be 60% to 95% of core length.

Figure 7: Storm Copper Project, Location Map.

QA/QC Protocols

The analytical work reported herein was performed by ALS Global ("ALS"), Vancouver Canada. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geoanalytical laboratory and is independent of Aston Bay Holdings Ltd., American West Metals Limited, and the QP. Reverse Circulation drilling was completed by Northspan Explorations Ltd using a Hornet helicopter-portable drilling rig. The sampling interval for reverse circulation drilling is five feet, with sampling and geological intervals determined visually by geologists with relevant experience. Samples were subject to crushing at a minimum of 70% passing 2 mm, followed by pulverizing of a 250-gram split to 85% passing 75 microns. Samples were subject to 33 element geochemistry by four-acid digestion and inductively coupled plasma atomic emission spectroscopy (ICP-AES) to determine concentrations of copper, silver, lead, zinc, and other elements (ALS Method ME-ICP61a). Overlimit values for copper (>10%) and were analyzed via four-acid digestion and ICP-AES (ALS Method Cu-OG62).

Aston Bay Holdings Ltd. and American West Metals Limited followed industry standard procedures for the work carried out on the Storm Project, incorporating a quality assurance/quality control (QA/QC) program. Blank, duplicate, and standard samples were inserted into the sample sequence and sent to the laboratory for analysis. No significant QA/QC issues were detected during review of the data. Aston Bay Holdings Ltd. and American West Metals Limited are not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

Qualified Person

Michael Dufresne, M.Sc., P.Geol., P.Geo., is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical information in this press release.

About Aston Bay Holdings

Aston Bay is a publicly traded mineral exploration company exploring for high-grade copper and gold deposits in Virginia, USA, and Nunavut, Canada. The Company is led by CEO Thomas Ullrich with exploration in Virginia directed by the Company's advisor, Don Taylor, the 2018 Thayer Lindsley Award winner for his discovery of the Taylor Pb-Zn-Ag Deposit in Arizona. The Company is currently exploring the high-grade Buckingham Gold Vein in central Virginia and is in advanced stages of negotiation on other lands with high-grade copper potential in the area.

The Company is 100% owner of the Storm Project property, which hosts the Storm Copper Project and the Seal Zinc Deposit and has been optioned to American West Metals Limited.

About American West Metals Limited

AMERICAN WEST METALS LIMITED (ASX: AW1) is an Australian clean energy mining company focused on growth through the discovery and development of major base metal mineral deposits in Tier 1 jurisdictions of North America. Our strategy is focused on developing mines that have a low-footprint and support the global energy transformation. Our portfolio of copper and zinc projects in Utah and Canada include significant existing resource inventories and high-grade mineralization that can generate robust mining proposals. Core to our approach is our commitment to the ethical extraction and processing of minerals and making a meaningful contribution to the communities where our projects are located.

Led by a highly experienced leadership team, our strategic initiatives lay the foundation for a sustainable business which aims to deliver high-multiplier returns on shareholder investment and economic benefits to all stakeholders.

For further information on American West, visit: www.americanwestmetals.com.

FORWARD-LOOKING STATEMENTS

Statements made in this news release, including those regarding the Option Agreement, grant of the Option and the expected closing date, American West's interest in the Storm Project and its other acquisitions and plans, plans for the upcoming field season, management objectives, forecasts, estimates, expectations, or predictions of the future may constitute "forward-looking statement", which can be identified by the use of conditional or future tenses or by the use of such verbs as "believe", "expect", "may", "will", "should", "estimate", "anticipate", "project", "plan", and words of similar import, including variations thereof and negative forms. This press release contains forward-looking statements that reflect, as of the date of this press release, Aston Bay's expectations, estimates and projections about its operations, the mining industry and the economic environment in which it operates. Statements in this press release that are not supported by historical fact are forward-looking statements, meaning they involve risk, uncertainty and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Although Aston Bay believes that the assumptions inherent in the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which apply only at the time of writing of this press release. Aston Bay disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by securities legislation.

For more information contact:

Thomas Ullrich, Chief Executive Officer

thomas.ullrich@astonbayholdings.com

(416) 456-3516

Sofia Harquail, IR and Corporate Development

sofia.harquail@astonbayholdings.com

(647) 821-1337

BAY:CA

Sign up to get your FREE

Aston Bay Holdings Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 June 2022

Aston Bay Holdings

Aston Bay Holdings Ltd is an exploration-stage company. It is engaged in the exploration and development of gold and base metal deposits in Virginia, USA and Nunavut, Canada.

Aston Bay Holdings Ltd is an exploration-stage company. It is engaged in the exploration and development of gold and base metal deposits in Virginia, USA and Nunavut, Canada. Keep Reading...

10h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Sign up to get your FREE

Aston Bay Holdings Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00