March 25, 2024

Many Peaks Minerals Limited (ASX:MPK) (Many Peaks or the Company) is pleased to announce entering a binding Share Sale Agreement (Agreement) with Turaco Gold Limited (Turaco) to acquire its 89% interest in CDI Holdings (Guernsey) Ltd (CDI Holdings). CDI Holdings is an 89% subsidiary of Turaco, held with Predictive Discovery Limited (Predictive), holding an 11% free carry ownership in a joint venture with Turaco. The Agreement will trigger Turaco’s drag-along right in its joint venture with Predictive, whereby Many Peaks will also acquire Predictive’s remaining 11% interest and consolidate 100% ownership of the joint venture entity CDI Holdings.

HIGHLIGHTS

- Agreement to acquire 100% interest in Turaco Gold Ltd and Predictive Discovery Ltd joint venture holding the right to acquire an 85% interest in four mineral permits in Cote d’Ivoire

- Permits cover expansive 1,275km2 land package including recent gold discoveries with over US$4m previous exploration expenditure

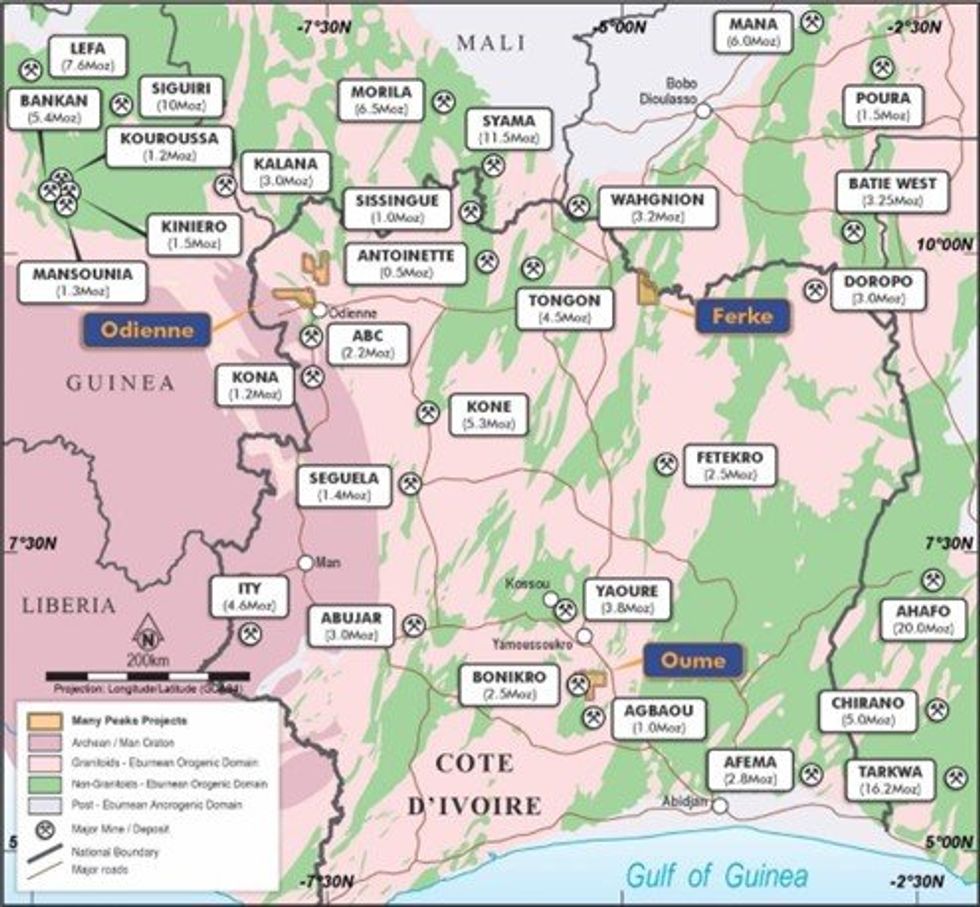

- Acquisition includes the Ferke Gold Project, hosting the recent Ouarigue South discovery with open mineralisation ready for follow-up, and the Odienne Project immediately along strike from new gold discoveries

- Drilling to commence as soon as practicable in the coming quarter

Ferke Gold Project, 300km2

- 16km mineralised trend in soils with limited exploration follow-up.

- Previous diamond drilling confirms new discovery at the Ouarigue South prospect; results include:

- 35.95m @ 3.88 g/t gold within 77.6m @ 2.33 g/t gold from 45.9m and; 4.7m @ 6.14 g/t gold from 134m – FNDC001

- 91.1m @ 2.02 g/t gold from surface – FNDC008

- 47m @ 3.72 g/t gold from surface – FNDC012

- 15m @ 2.06 g/t gold from surface and 116.5m @ 0.98 g/t gold from 34.5m, including 30.09m @ 1.86 g/t gold – FNDC005

- 18m @ 3.38 g/t gold from 107m and; 13.65m @ 2.13 g/t gold from 194m – FNDC018

- 9.75m @ 7.46 g/t gold within 54.17m @ 1.88 g/t gold from 59.58m – FNDC019

Odienne Project, 758km2

- Project covers significant extent of high-strain corridor associated with the Archean domain

- margin and is comparable in stratigraphy to Guinea’s Siguiri basin

- On trend with Predictive’s 5.4Moz Au Bankan Project and Centamin’s 2.16Moz ABC project and contiguous to a new discovery by Awalé Resources/Newmont joint venture

- Recent first pass, wide-spaced air core drilling highlights a continuous zone of mineralisation returning >1g/t gold over 1,200m strike extent, with results including:

- 12m @ 1.18g/t gold from 4m

- 12m @ 1.06g/t gold from 16m

- 8m @ 1.30g/t gold from 28m

CDI Holdings is the holding company for two wholly-owned Ivorian entities, including the Ivorian subsidiary party to a joint venture with Gold Ivoire Minerals SARL (GIV Joint Venture) in Cote d’Ivoire in which it has earned a 65% interest and retains an exclusive right to earn-in to an 85% interest by sole funding any project within four mineral licences in Cote d’Ivoire to feasibility study.

The consideration for the purchase of 100% of CDI Holdings will be an aggregate 5,617,978 fully paid ordinary shares in Many Peaks subject to a 12 month escrow, to be issued under the Company’s capacity under ASX listing rule 7.1. Upon completion, Many Peaks will also assume a royalty deed for a 1% net smelter return royalty payable to Resolute (Treasury) Pty Ltd (Resolute)—further information on terms and conditions precedent outlined below.

Many Peaks’ Executive Chairman, Travis Schwertfeger, commented: “The Ferke and Odienne Projects in Cote d’Ivoire deliver Many Peaks a strong foundation of exploration success in Cote d’Ivoire with the potential to build significant high- grade ounces in the near term. Both projects are already covered with systematic geochemical coverage and high-resolution geophysics, which have led to demonstrated gold mineralisation confirmed in drilling. Leveraging over US$4m of previous expenditure in recent years has generated multiple targets ready for follow-up, including extension targets, providing Many Peaks with a transformational acquisition with near-term resource potential viable.

Our team has a depth of West African operating experience tied to multiple discovery and development projects over the past 15 years, and our technical team looks forward to operating in Cote d'Ivoire again. Over recent years, it has emerged as a premier jurisdiction within West Africa to operate in, with several recent exploration and development successes.

Ferke Gold Project

The Ferké Gold Project (Ferke) is located in northern Cote d’Ivoire, covering 300km2 in a granted exploration permit licence. Ferke is situated on the eastern margin of the Daloa greenstone belt at the intersection of major regional scale shear zones (refer to Figure 1). Initial exploration undertaken at the Ferke Gold Project by Predictive Discovery Ltd in 2016 and 2017 (previously referred to as Ferkessedougou North) comprised several phases of geochemical stream and soil sampling across the permit area, which has defined a more than 16km long gold-in-soils anomaly on the ‘Leraba Gold Trend’ (refer to Figure 2 and Predictive’s ASX announcement dated 2 February 2017).

Click here for the full ASX Release

This article includes content from Many Peaks Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00