September 25, 2024

EMU NL (“EMU” or “the Company”) is pleased to provide an update on recent exploration work at the Company’s newly named Yataga Copper Project1, located within the Yataga Igneous Complex near Georgetown in North Queensland.

- Recent surface Geochemical surveys have updated EMU’s Ecological modelling and identified multiple intra-pluton porphyry copper centres close to surface within the Yataga Copper Project at Georgetown in Far North Queensland.

- EMU’s consultants have advised that these porphyry centres are concentrated along a “structural belt” and modelled to be near surface and their advice is that the unusual character of these intra-pluton copper centres nay be analogous to the Highland Valley Copper Mine, where a series of porphyry copper deposits host Canada’s largest open pit copper nine which produced more than 130kt in 2021.

- Dr Gregg Morrison, Queensland-based Geological Consultant with 45 years’ experience, has accepted an invitation to be appointed Technical Advisor to the Project. His authority and significant knowledge of the metallogenic systems of northern Queensland adds substantial value to the developing discovery.

- EMU’s recent work has identified a combined area of 8km2 of copper-in-soil anomalism with significant potential for expansion.

- Additional work includes;

- a 220-line km airborne electromagnetics survey (results pending).

- A 20-line km ground-based Pole-Dipole Induced Polarisation (PDIP) and Magnetotelluric (MT) survey currently underway.

- These geochemistry and geophysics survey results will provide an optimized low risk drilling programs to be carried out in the near future.

EMU Non-Executive Chairman Peter Thomas commented:

“Whilst it is still early days, results from EMU’s field work continue to provide encouragement that this project has the potential to be a Global Tier 1 scale copper discovery.

EMU has undertaken a meticulous, methodical and measured exploration programme guided by the best available expertise. EMU has carried out important Geophysical and Geochemical survey work that is assisting Ecological assessment of what appears to be high grade surface mineralisation indicating the presence of multiple Cu-bearing intrusive centres close to surface. EMU is determined to do a professional job driven by fundamentals and first principles.

Accordingly, EMU remains focused on establishing sound compelling drill vectors that give the project its best chances of success

Prudent and diligent field and desktop work being pursued is a comparatively low-cost avenue to optimise drilling efforts.

We are absolutely delighted and honoured to have secured the services of Dr Gregg Morrison, an expert in the style of mineralisation we are encountering at the Yataga Copper Project. Dr Morrison has already added value with his input to recent exploration and modelling. His technical knowledge on ore controls and hydrothermal system Geometry will be invaluable in defining and building confidence in drill targets as we seek to unlock the potential large-scale economics of the project.

Our recent 27km2 Geochemistry field survey, has demonstrated vast copper-in-soil anomalism over an area of 8km2 in aggregate reflecting very large potential. Our exploration team believes that the abundant and pervasive surficial expression of copper cannot be explained other than that there simply MUST be a near surface local concentrated source. Our goal is to find that source.

The team is working with preliminary pXRF Geochemistry to delineate the likely mineralisation fluid- flow geometry leading to defining priority structural/geological drill targets. Meanwhile, we continue to take samples for Geochemical analysis and to gather Geophysical data directed at providing compelling vectors for drilling at Yataga and, additionally, to assess bonanza grade gold occurrences across the broader 850km2 project.

EMU will prepare an appropriate drilling program the project once its team is comfortable that a higher level of confidence in targets can be achieved.”

Exploration Activity

EMU’s discovery team has made significant progress with the latest Geochemistry field work. The termite mound sampling methodology has proven to be highly reliable and productive.

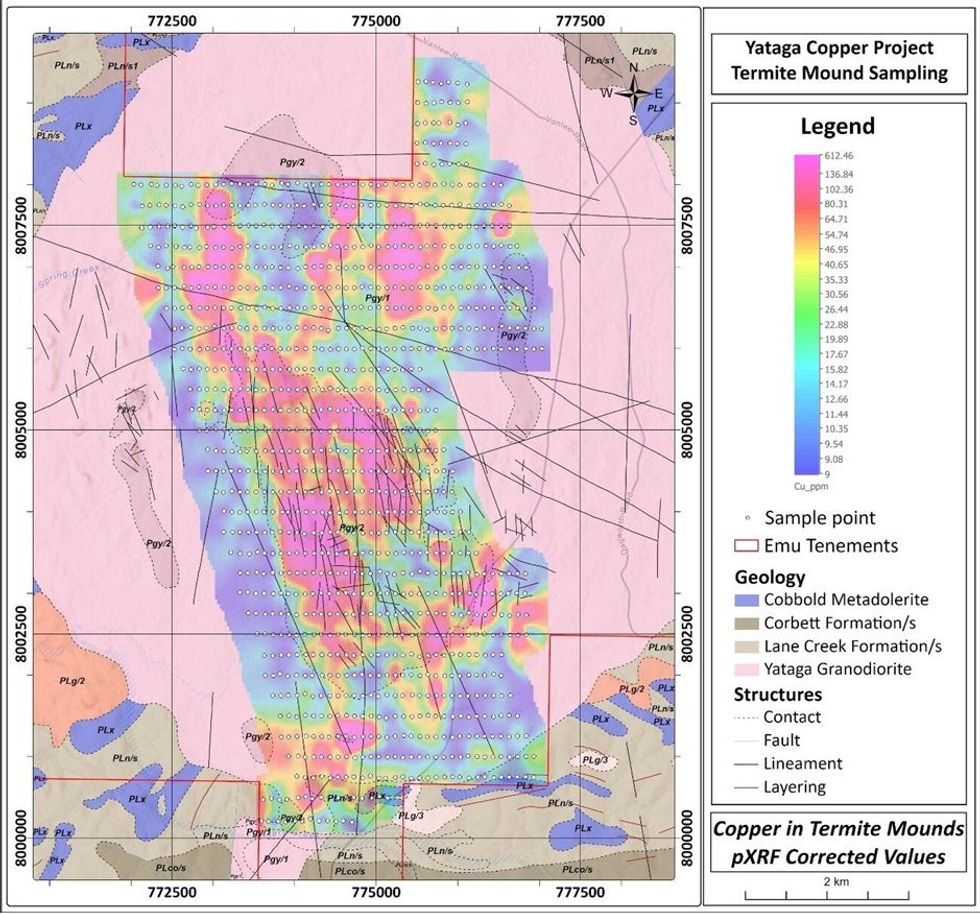

The 27km2, grid controlled pXRF (Portable X-Ray Fluorescence analyser) programme sampled 1152 termite mounds. The combined area of highly anomalous copper has been substantially extended with copper mineralisation surface expression now covering a vast area – approximately 8km2 including the original discovery prospect – Fiery Creek. (See Figure 1). The potential to extend the area of copper mineralisation even further is possible and will follow from in field geochemistry and geophysics surveys currently in progress.

The areas of copper-in-soil anomalies delineated in this first-pass programme are defined as pXRF values ranging between 150 – 76͘ ppm Cu, equivalent to 5 – 25 times the average crustal abundance (or background values) for copper in Granodiorites.

Modelling of the surface mineralisation indicates the presence of multiple Cu-bearing intrusive centres close to surface. Planned geophysical surveys to be conducted during September and October are targeted to “nap” the 3-dinensional aspects of the mineralised pluton and provide information on mineral pathways and mineralisation signatures. The surveys will provide a depth component to the surface field data collected to date, enhancing the definition of the erosional level of the mineralised system and the depth extent of the pluton roof and the location of the stocks and dykes that are the source of mineralisation.

Click here for the full ASX Release

This article includes content from EMU NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EMU:AU

The Conversation (0)

19 January 2025

EMU NL

Potential for large-scale copper porphyry discovery in Queensland, Australia

Potential for large-scale copper porphyry discovery in Queensland, Australia Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

EMU NL (EMU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

19 May 2025

EGM Voting Results

EMU NL (EMU:AU) has announced EGM Voting ResultsDownload the PDF here. Keep Reading...

15 May 2025

Trading Halt

EMU NL (EMU:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Amended Quarterly Activities Report/Appendix 5B

EMU NL (EMU:AU) has announced Amended Quarterly Activities Report/Appendix 5BDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

EMU NL (EMU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

2h

Editor's Picks: Is Gold and Silver's Price Correction Over?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

13h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00