January 21, 2024

Toro Energy Limited (Toro or the Company) is pleased to announce that it has secured firm commitments for a A$12.3 million placement (before costs) comprising the issue of approximately 23 million new fully-paid ordinary shares in the capital of the Company (Placement). The Placement was well supported by new and existing institutional, sophisticated and professional investors.

- Toro has received firm commitments to raise A$12.3 million at $0.52 per share

- Strong support from offshore and domestic institutional investors

- Use of funds include pilot plant development and associated works and drilling at the Company’s Wiluna Uranium Project

- In addition to the Placement, the Company announces that it will offer eligible shareholders the opportunity to apply for new Toro shares under a Share Purchase Plan to raise up to at least A$2 million at the same price as the Placement

The Placement funds will primarily support further development of the Wiluna Uranium Project and provide working capital for the Company. Specifically, proceeds will be used to fund the following:

- Pilot plant program as part of the Lake Maitland pre-feasibility study and to test samples across the Company’s entire Wiluna Uranium Project;

- Drilling for additional samples at Lake Maitland, Lake Way and Centipede-Millipede for further metallurgical test work to inform an improved processing flowsheet;

- Additional exploration and evaluation activities to maintain tenements in good standing; and

- General working capital and costs of the Placement.

Commenting on the capital raise, Executive Chairman, Richard Homsany said:

“Toro is extremely pleased with the outcome of this capital raising and is delighted to welcome new highly reputable investors to its register together with the increased investment from existing shareholders. On behalf of the Board, we would like to thank the joint lead managers and all investors who supported the transaction which further strengthens Toro’s register. The Board is grateful for the continued support of our existing shareholders and will offer eligible shareholders the opportunity to apply for new Toro shares under a Share Purchase Plan.

As global uranium markets continue to strengthen and public sentiment and government support align, Toro remains committed to developing the Wiluna Uranium Project to maximise its value. With further work, Toro is confident its assets will emerge as attractive stand-alone mining projects and we very much look forward to the year ahead.”

Canaccord Genuity (Australia) Limited and Euroz Hartleys Limited acted as Joint Lead Managers and Bookrunners to the Placement.

Placement

Toro received strong support from a number of high-quality institutional investors both domestically and internationally for the Placement.

Under the Placement, the Company will issue new fully-paid ordinary shares (Placement Shares) at $0.52 per Placement Share. The Placement offer price represents a 13.3% discount to the last-close on 17 January 2024 ($0.60 per share) and a 13.2% discount to the 5-day VWAP ($0.599 per share).

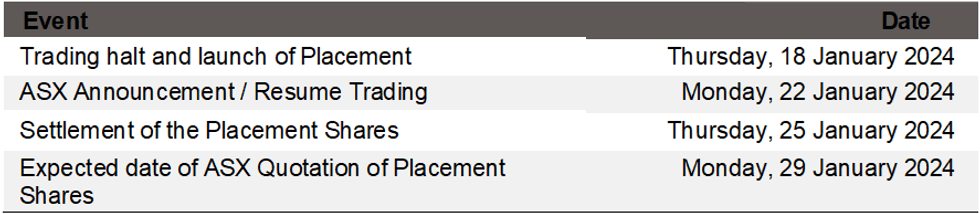

The Placement Shares will be issued within the Company’s existing placement capacity under ASX Listing Rules 7.1 and 7.1A. Settlement of the Placement Shares is expected to occur on Thursday, 25 January 2024. All Placement Shares will rank equally with the Company’s existing shares on issue.

Key Dates

Uranium Market Update

Global uranium markets continue to strengthen and fundamentals remain strong. There has been significant sector momentum with spot uranium prices recently breaking through US$100/lb, the second highest level in history as price action continues to reconcile with supply tightness as evidenced by unfilled RFPs over recent months. Contracting volumes are at decade long highs with UxC estimating that utilities have contracted more than 160Mlb in 2023, compared to a total of 125Mlbs in 2022. Nuclear power sentiment is improving and gathering momentum, with the US and 20 other countries announcing that their nuclear power will be tripled by 2050. Security of supply remains critical, with the potential US ban on Russian LEU imports, which the Senate is expected to vote in favour of in the coming weeks.

Click here for the full ASX Release

This article includes content from Toro Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TOE:AU

The Conversation (0)

12 October 2025

IsoEnergy to Acquire Toro Energy

Toro Energy (TOE:AU) has announced IsoEnergy to Acquire Toro EnergyDownload the PDF here. Keep Reading...

12 October 2025

Joint Investor Presentation

Toro Energy (TOE:AU) has announced Joint Investor PresentationDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities and Cashflow Report June 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report June 2025Download the PDF here. Keep Reading...

27 May 2025

Updated Scoping Study Results Lake Maitland Uranium Project

Toro Energy (TOE:AU) has announced Updated Scoping Study Results Lake Maitland Uranium ProjectDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities and Cashflow Report March 2025

Toro Energy (TOE:AU) has announced Quarterly Activities and Cashflow Report March 2025Download the PDF here. Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00