- WORLD EDITIONAustraliaNorth AmericaWorld

Overview

Interra Copper (CSE:IMCX,OTCQB:IMIMF,FRA:3MX) is an exploration and development company with prolific assets in Canada and Chile, both tier-1 jurisdictions.

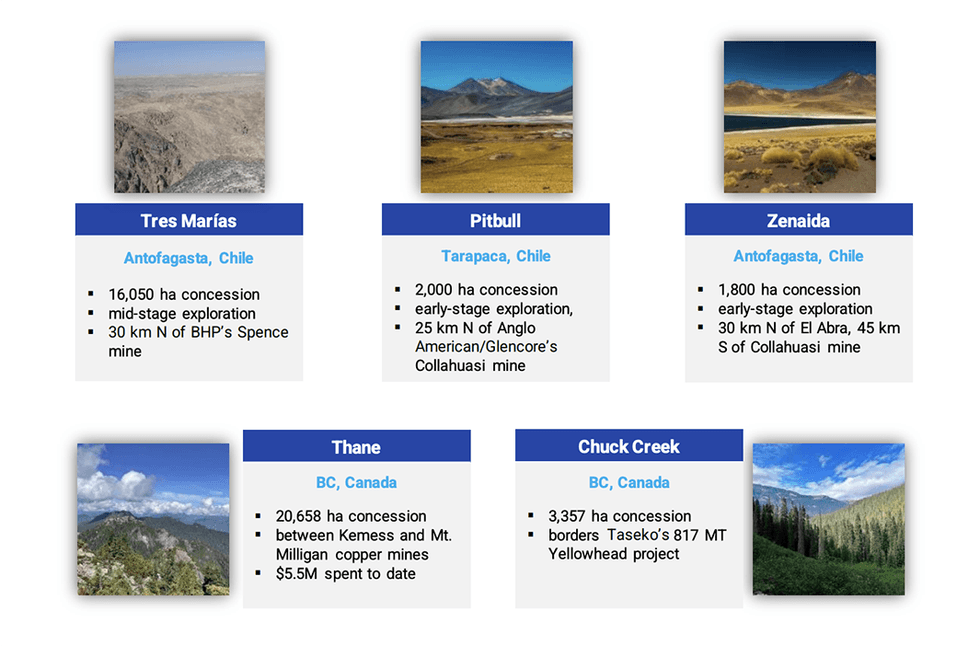

Interra’s two exploration properties in British Columbia, Canada - Thane and Chuck Creek - demonstrate significant potential to increase shareholder value as they are explored. The 20,658-hectare Thane project is located in the Quesnel Terrane of Northern BC and contains six high-priority target areas with significant copper and precious metal mineralization, including high-grade silver and gold. The approximately 3,356-hectare Chuck Creek asset also has historical silt sample concentrations up to a significant 58,600 parts per billion (ppb) gold.

In September 2023, Interra entered into a non-binding letter of intent for a potential 80-percent earn-in and joint venture agreement with ArcWest Exploration for its Rip Copper-Molybdenum Project in Central BC. The 2,309-hectare Rip project is located in Stikine Terrane in a prolific belt of Late Cretaceous (Bulkley Plutonic Suite) porphyry copper-molybdenum deposits, which includes Imperial Metals’ Huckleberry Mine, 33 kilometers to the southwest and presently on care and maintenance. The Bulkley porphyry belt also includes the Whiting Creek, Poplar, Seel and Ox Cu-Mo (gold-silver) deposits.

The company’s three copper assets in Chile are all within a prolific Chilean copper belt: Tres Marias and Zenaida in the Antofagasta Region, and Pitbull in Tarapaca Region. With a significant land package spanning 16,250 hectares, Interra’s Chilean projects are in the company of some of the world’s largest mines owned by global mining firms, including Glencore, Anglo American, Teck Resources and BHP. As the top global producer of copper responsible for 28 percent of the world’s supply, Chile’s mining-friendly policies and established infrastructure provide confidence in the potential development of Interra’s Chilean copper assets.

Interra Copper completed Phase 1 of the drilling program at Tres Marias, which began on May 24, 2023, with six RC holes totalling 1,896 meters drilled. Samples were sent to ALS Global in Santiago for analysis.

An expert leadership team leads Interra toward fully exploring its assets and increasing shareholder value.

The leadership team is backed by an advisory board of notable mining industry experts that include Mike Ciricillo who has served as president of Freeport McMoRan Africa and as head of worldwide copper assets for Glencore (LON:GLEN); Rich Leveille whose last corporate position was senior vice president of exploration for Freeport-McMoRan, Dave Garofalo who has led the biggest mining names Goldcorp, Hudbay Minerals, Agnico-Eagle Mines and Inmet Mining in different capacities; and Dr. Mark Cruise who founded and led Trevali Mining from an initial discovery phase into a top-ten global zinc producer. It is also important to note that director Rick Gittleman has held notable positions at Glencore SA and Freeport-McMoRan Africa.Company Highlights

- Interra Copper is an exploration and development company with prolific assets in Canada and Chile, both tier-1 jurisdictions with mining-friendly regulations, existing infrastructure and skilled local workforce.

- Two exploration properties in British Columbia, Canada - Thane and Chuck Creek - demonstrate significant potential to increase shareholder value as they are explored, and include six high-priority target areas with significant copper and precious metals mineralization.

- Interra is negotiating an 80-percent earn-in and joint venture agreement with ArcWest Exploration for its 2,309-hectare Rip Copper-Molybdenum Project in Central BC.

- Interra’s three copper assets in Chile are all within a prolific Chilean copper belt: Tres Marias and Zenaida in th Antofagasta Region, and Pitbull in Tarapaca Region

- An experienced management team backed by special expert advisors with the depth of expertise necessary to realize the full value of its asset portfolio.

Get access to more exclusive Copper Investing Stock profiles here