November 17, 2024

Lightning Minerals (L1M or the Company) is delighted to announce the discovery of spodumene within a lithium bearing pegmatite at the Company’s recently acquired Esperança project. The discovery supports the Company’s approach to exploration in the district and its positive assessment of the prospectivity within the Lithium Valley region Minas Gerais, Brazil.

The discovery has been made during early-stage exploration programs which include project scale geological mapping, ground reconnaissance, and soil sampling. These early-stage programs remain ongoing with further results to come over the coming weeks. The discovery supports the Company’s exploration thesis and uplifts the remaining prospectivity across all three project areas: Canabrava, Caraíbas and Esperança projects.

HIGHLIGHTS

- Artisanal excavations reveal a lithium bearing pegmatite with elongate crystalline spodumene crystals up to 50cm in length

- LIBS (Laser Induced Breakdown Spectroscopy) results of spodumene crystals return up to 18,800 ppm Lithium, or 4.04% Li2O

- Discovery provides walk up drill target for fully funded drilling campaign to begin Q1 2025

- Soil sampling and geological mapping continues across the Esperança, Canabrava and Caraíbas projects with further results due over the coming weeks

Lightning Minerals Managing Director Alex Biggs said, “I am highly encouraged by these results from Brazil. As I have spoken about, as a team we are committed to discovery and completing our works in a diligent and structured manner, the proof of which is in these results. The Company is progressing its projects in Brazil quickly and cost effectively and generating significant results for the business which we feel will be transformational. I am proud of and congratulate our geology teams both in Australia and Brazil who have conducted themselves in a professional and astute manner which has been crucial in making a discovery such as this. This is a great first step for us in Brazil and is testament to the prospectivity of the region as I have discussed previously. We look forward to drilling in Q1 2025 and further results to come imminently from all three project areas in Brazil. I would also like to thank our shareholders who have supported our vision and exploration strategy. As a Company we are firmly committed to the lithium thematic and firmly committed to Brazil where we see significant potential moving forwards”.

Lithium Discovery at Esperança Project

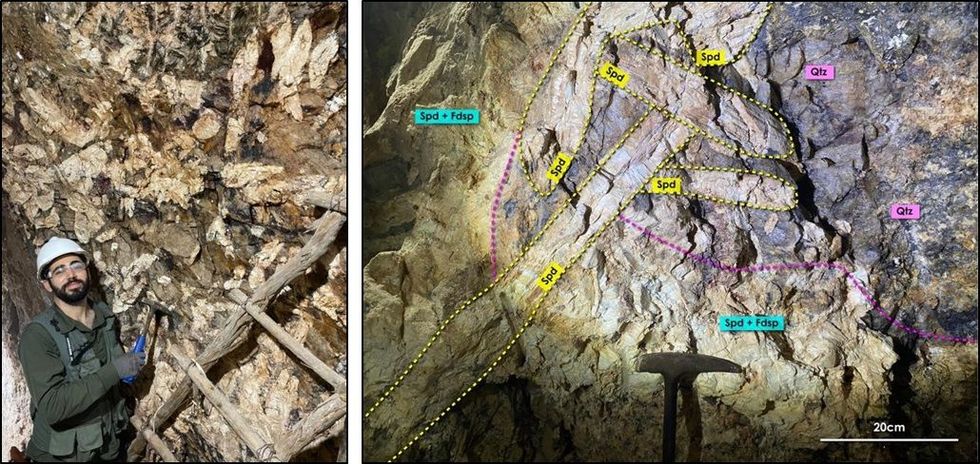

During geological mapping fieldwork conducted in mid-November 2024 field geologists encountered a previously unknown historical artisanal mine within the Esperança project area. The site presented with a small access which opened into a set of sub vertical shafts sunk several meters into schists of the Salinas formation. Upon investigation the geology team has discovered pegmatitic lithologies in the walls of the excavations, of which the suite of minerals indicates inclusion of macro crystalline (up to 50cm) elongate crystals of spodumene as shown in Figure 1(a) and Figure 1(b).

The Company’s geologists have collected selective mineral specimen grab samples in sample VLM207 (Figure 2). Six separate minerals have been analysed via a SciAps Z-903 hand-held LIBS (Laser-Induced Breakdown Spectroscopy) device which has returned lithium endowment of up to 18,800 ppm lithium, which equates to a lithium oxide percentage of 4.04% Li2O.

The SciAps Z-903 handheld LIBS device is considered a qualitative analysis technique only and is used as an in-field preliminary check to establish if a mineral is lithium-bearing. Certified laboratory assays are required to provide accurate, quantitative analysis. A table of the six SciAps Z-903 handheld LIBS results testing the spodumene crystals is shown in Table 1. A full table of results are presented in Appendix 2, Table 2.

While the current field observations indicate that the mineral identified is a lithium-bearing mineral, the percentage of lithium produced from the LIBS analyser does not correlate to an accurate quantitative measurement of the lithium concentration of the mineral itself, or to the overall grade of the pegmatite.

Click here for the full ASX Release

This article includes content from Lightning Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

L1M:AU

The Conversation (0)

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00