September 22, 2023

Ocumetics Technology Corp. (TSXV:OTC, OTCQB:OTCFF, FRA:2QBO) focuses on a groundbreaking vision enhancement product - the Ocumetics Accommodating Lens. Leading the forefront of research and product development, Ocumetic's intraocular lens (IOL) is engineered to seamlessly shift the eye's focus from close to far distances without any noticeable lag. This process is called accommodation.

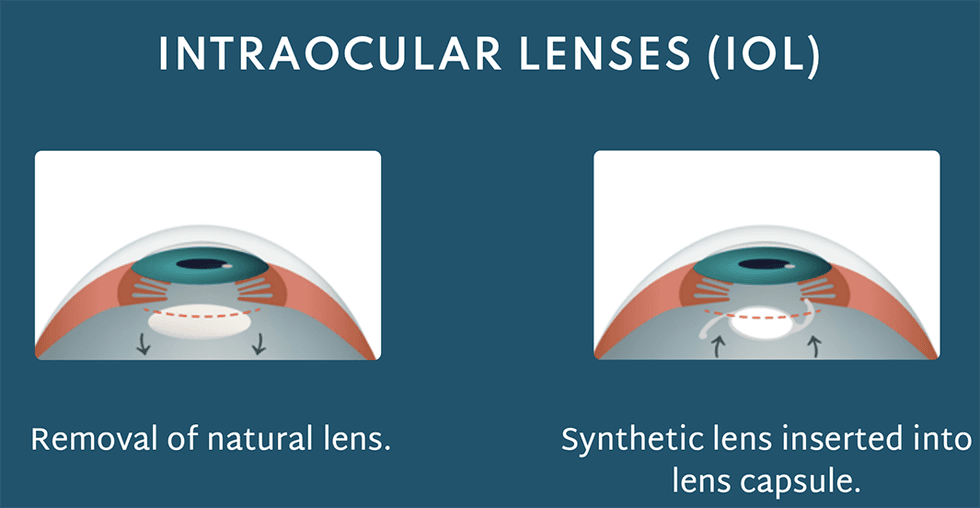

The eye's natural lens loses its flexibility to bend light rays accurately due to aging and injuries. This leads to the deterioration of eyesight and potential conditions like cataracts with or without astigmatism. Ocumetics has designed a very unique IOL that is surgically implanted to restore a patient’s vision. This lens is designed to harmoniously align with the eye's natural mechanisms, enhancing vision by appropriately bending light rays. Notably, it's designed to last a lifetime, presenting a significant potential advancement over other cataract technologies.

Ocumetics aims to solve the problem of eyesight degradation. The proposed solution is a surgically implanted lens that takes over the function of properly bending rays of light by working with the eye’s natural mechanisms, resulting in enhanced vision. Following a series of product enhancements, development of surgical procedure protocols, and animal testing for biocompatibility, the Ocumetics Accommodating Lens will soon begin human trials as the company works toward bringing the product to market.

Company Highlights

- Ocumetics Technology Corp. is an R&D company developing a vision enhancement product with the potential to disrupt the vision correction industry.

- The Ocumetics Accommodating Lens is an intraocular lens designed to allow the human eye to shift between close and long-distance images without perceptible adjustment lag.

- Ocumetics’ product is surgically implanted and is designed to enhance the natural processes, allowing the patient’s eyes to bend light properly for better vision.

- The Ocumetics Accommodating Lens has substantially completed a series of design improvements, animal studies, surgical procedure development and biocompatibility studies and will soon move toward human clinical trials, slated to begin in Q1 2024.

- The company aims to receive full US FDA approval within three-and-a-half years and bring its product to a projected intraocular lens market segment of US$6.4 billion by 2030 (Delveinsight 2022).

- An expert team with experience in clinical eye care, R&D and corporate development is leading the company toward bringing its transformative product to market.

This Ocumetics Technology profile is part of a paid investor education campaign.*

OTC:CA

The Conversation (0)

21 September 2023

Ocumetics Technology

Pioneering Vision Enhancement with the Ocumetics Accommodating Lens

Pioneering Vision Enhancement with the Ocumetics Accommodating Lens Keep Reading...

28 January

Seegnal Presents Real-World Evidence on Reducing Fall Risk in Geriatric Patients at Caltcm Summit

Seegnal Inc. (TSXV: SEGN) ("Seegnal" or the "Corporation"), a global leader in AI-enhanced prescription intelligence, today announced real-world clinical results demonstrating how medication governance may reduce fall-risk drivers in older adults -- a significant clinical and financial challenge... Keep Reading...

05 January

Pathways to Commercialising Biotech Innovations

In the medical technology industry, innovation is only the first step. While key to long-term success, innovation is only as good as a company’s commercialisation strategy. Once a technology has been developed and proven, the organisation must then embark on a process to commercialise it for... Keep Reading...

25 February 2025

HeraMED Signs Strategic Collaboration Agreement with Garmin Health

HeraMED Limited (ASX: HMD), a medical data and technology company leading the digital transformation of maternity care, is delighted to announce it has entered into a collaboration agreement with Garmin (NYSE: GRMN), a leading global provider of smartwatches and GPS-enabled products, aimed at... Keep Reading...

23 January 2025

Cyclopharm Signs US Agreement with HCA Healthcare for Technegas®

Cyclopharm Limited (ASX: CYC) is pleased to announce the signing of a major contract with Hospital Corporation of America Healthcare (HCA), one of the largest single healthcare providers in the United States. This agreement marks a significant milestone for the company which will allow the... Keep Reading...

23 January 2025

CONNEQT App Launches in USA as Pulse Deliveries Commence

Cardiex Limited (CDX:AU) has announced CONNEQT App Launches in USA as Pulse Deliveries CommenceDownload the PDF here. Keep Reading...

16 January 2025

Revolutionizing Women's Health: Antifungal Innovation Brings New Investment Opportunities

The intersection of women's health and antifungal innovation represents a pivotal moment in healthcare, offering both transformative medical advancements and compelling investment opportunities. The groundbreaking developments in antifungal treatments specifically targeting women's health issues... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00