Vanstar Mining Resources Inc. (TSXV: VSR) (OTCQX: VMNGF) (FSE: 1V8) ("Vanstar", or the "Company") is pleased to announce initial assay results from IAMGOLD's 2021 exploration diamond drilling program at its Nelligan joint venture project (IAMGOLD: 75%, Vanstar: 25%), located 60 kilometres southwest of Chibougamau, Quebec, Canada and 15 kilometres from the Monster Lake Project, 100% owned by IAMGOLD. The Nelligan Gold project (on a 100% basis) hosts Inferred Mineral Resources containing 3.2 million ounces of gold grading 1.02 gt Au (refer to news releases dated October 22, 2019 and February 17, 2021).

Highlights include:

Renard Zone - Infill

- 86.7 meters ("m") at 1.34 grams per tonne gold ("g/t Au") in drill hole NE-21-170 from 126.0 m including

- 12.0 m at 2.65 g/t Au from 148.5 m;

Followed by a separate interval of:

- 45.0 m at 2.13 g/t Au from 222.0 m including

- 12.0 m at 6.27 g/t Au from 234.0 m;

- 111.0 m at 1.11 g/t Au in drill hole NE-21-173 from 175.5 m; followed by a separate interval of:

- 16.5 m at 2.05 g/t Au from 327.0 m;

- 46.5 m at 1.26 g/t Au in drill hole NE-21-172 from 183.0 m including

- 12.7 m at 3.05 g/t Au from 200.4 m;

Followed be a separate interval of:

- 28.7 m at 1.70 g/t Au from 238.3 m including

- 0.9 m at 27.0 g/t Au from 239.1 m;

Followed by a separate interval of:

- 42.0 m at 1.06 g/t Au from 301.5 m;

- 34.5 m at 1.26 g/t Au in drill hole NE-21-174 from 199.5 m; followed by a separate interval of:

- 19.5 m at 3.80 g/t Au from 283.5 m including

- 1.5 m at 24.6 g/t Au from 283.5 m;

Followed by a separate interval of:

- 7.6 m at 5.69 g/t Au from 343.5 m including

- 1.5 m at 21.0 g/t Au from 348.0 m;

Renard Zone - West Extension

- 40.5 m at 1.28 g/t Au in drill hole NE-21-178 from 51.0 m;

- 15.0 m at 7.81 g/t Au in drill hole NE-21-180 from 36.0 m including

- 1.3 m at 70.1 g/t Au from 45.0 m.

JC. St Amour, President and CEO of Vanstar Mining commented, "I am very encouraged by today's results which clearly demonstrate the resource is open and is expanding to the west, while the infill drill program is confirming and improving the existing resource. It is important to note that the Western Extension drill results reported today are near surface and are showing similar grade and widths as the results reported from the infill program. We are keen to see the impact of the winter drill program as IAMGOLD further tests the western extension of the Nelligan gold deposit."

In a separate IAMGOLD's press release issued today, Craig MacDougall, Executive Vice President, Growth for IAMGOLD, stated: "The results of the 2021 Nelligan drill program continue to confirm the continuity of mineralization in the resource area at similar observed grades and widths as we work to improve resource classification. Importantly, our drill program continues to confirm the extension of mineralization along strike to the west - well beyond the area of the currently defined mineral resources. This provides a significant opportunity to further increase the mineralized envelope of Nelligan, which remains a prime objective of our exploration program. We look forward to initiating our 2022 winter exploration program which will step out to test the west extensions and providing an updated Nelligan resource towards the end of 2022."

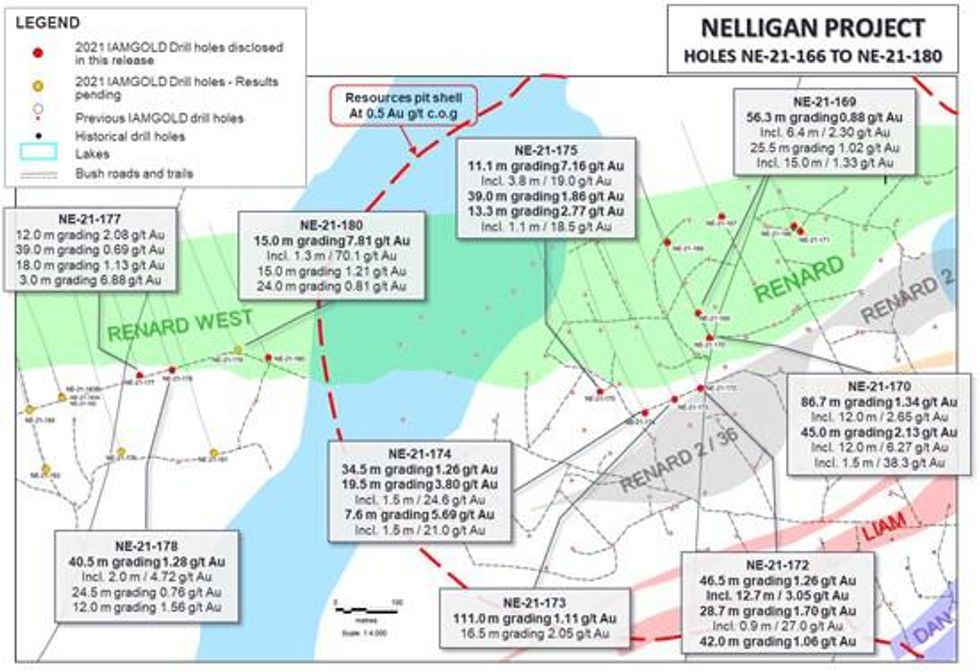

The Company is reporting assay results from thirteen (13) diamond drill holes totaling 4,260 metres as part of the completed 2021 drilling program totaling 9,534 metres. One hole was re-drilled to validate the results from a previous hole for which core recovery was considered very poor and not representative. The assay results reported herein are provided in Table 1 below (see plan map attached to this news release for drill hole locations - Figure 1).

The 2021 diamond drilling program was designed to in-fill and delineate selected areas of the deposit to improve resource classification, as well as continue step-out drilling to evaluate and confirm the extension of mineralization to the west along strike which was sparsely tested in previous drilling programs. Mineralization is now observed over a strike length of at least 1,500 metres, over widths varying from 100 to 300 metres and to depths ranging from 200 to 350 metres. The mineralized system of Renard remains open along strike and at depth.

Next Steps

The results of the 2021 exploration drilling program will be used to update the deposit model to help guide future drilling programs. Planning is well advanced for the 2022 winter exploration program which will test further the west extensions and expand the known resources in specific areas. An updated resource estimate is anticipated for the end of 2022.

Regional exploration activities and future exploration programs continue to be guided by the ongoing incorporation and compilation of exploration data to refine geological, geochemical and structural models to help identify and prioritize additional targets for evaluation on the large project land package.

Figure 1 - Nelligan - Drill hole plan map and highlighted 2021 assay results.

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/8185/107819_9b98cbe574072863_002full.jpg

About the Nelligan Project

The Nelligan project is underlain by a portion of the Caopatina segment of the North Volcanic Zone of the Abitibi Belt of the Superior Province. The property is centered on the E-W Druillette syncline with sediments of the Caopatina Formation bounded to the north and to the south by volcanic rocks of the Obatogamau Formation. The North and South portions of the property are occupied by granodioritic to tonalitic intrusions. The project is transected by numerous regional and local structures and deformation zones which can be important in the localization of gold mineralization.

Gold showings of the area are observed broadly as two styles of mineralization: 1) Quartz-sulphide vein type, and 2) disseminated sulphide (pyrite) mineralization in hydrothermally altered units. Mineralization observed on the Nelligan project is dominated by the latter and is characterized by hydrothermal alteration of the host meta-sedimentary units displaying variable carbonatization, sericite, phlogopite and pervasive silicification; and associated with widespread disseminated pyrite, varying from 1% to locally 15%, trace molybdenite and occasionally fine grains of visible gold. Mineralization associated with the estimated mineral resources has been intersected in drilling over a strike length of more than 1.5 kilometres, and to a depth of 200 to over 350 vertical metres.

As at December 31, 2020, IAMGOLD reported (on a 100% basis) inferred mineral resources of 97.0 million tonnes grading 1.02 g/t Au for 3.2 million contained ounces (see news releases dated October 22, 2019 and February 17, 2021). In 2019 the Nelligan Gold Project was awarded the Discovery of the Year by the Association de l'Exploration Minière du Québec ("AEMQ").

The Nelligan Gold Project is held under an earn-in option to joint venture agreement with Vanstar (IAMGOLD: 75%; Vanstar: 25%) where IAMGOLD has a further option to acquire an additional interest of 5%, to hold an 80% interest in the Nelligan project by completing and delivering a Feasibility Study. Vanstar would then retain a 20% undivided non-contributory carried interest until the commencement of commercial production, after which: (1) the 20% undivided interest becomes participating; and (2) Vanstar will pay its attributable portion of the total development and construction costs to the commencement of commercial production from 80% of its share of any ongoing distributions from the Joint Venture. Vanstar will also retain a 1% NSR royalty on selected claims of the project.

| Table 1 Nelligan Project Drilling Results - 2021 Drilling program | |||||||||||||

| Hole No. | UTM NAD83 Zone18 | AZ | DIP | EOH | from | To | Interval | True Width (1) | Au (2) (3) | NOTE | |||

| Easting | Northing | Elevation | (°) | (°) | (m) | (m) | (m) | (m) | (m) | (g/t) | |||

| NE-21-166 | 522996.24 | 5474057.94 | 381.76 | 330 | -50 | 276.00 | 127.75 | 144.00 | 16.25 | 10.45 | 0.51 | RENARD FOOTWALL ZONE | |

| NE-21-167 | 522878.86 | 5474071.60 | 381.05 | 330 | -45 | 222.00 | 60.00 | 64.50 | 4.50 | 3.90 | 0.97 | RENARD ZONE | |

| 120.00 | 126.00 | 6.00 | 4.24 | 0.78 | RENARD FOOTWALL ZONE | ||||||||

| NE-21-168 | 522790.80 | 5474032.70 | 375.74 | 330 | -50 | 243.00 | 54.00 | 69.90 | 15.90 | 11.24 | 1.03 | RENARD ZONE | |

| 79.50 | 85.50 | 6.00 | 4.60 | 0.89 | |||||||||

| NE-21-169 | 522841.38 | 5473925.46 | 379.44 | 330 | -49 | 330.00 | 62.20 | 118.50 | 56.30 | 43.13 | 0.88 | RENARD ZONE | |

| Including (3) | 100.50 | 106.90 | 6.40 | 4.53 | 2.30 | ||||||||

| 135.00 | 144.00 | 9.00 | 6.36 | 0.96 | |||||||||

| 160.50 | 186.00 | 25.50 | 19.53 | 1.02 | |||||||||

| Including (3) | 160.50 | 175.50 | 15.00 | 11.49 | 1.33 | ||||||||

| 204.00 | 220.50 | 16.50 | 12.64 | 0.78 | |||||||||

| 240.00 | 253.50 | 13.50 | 10.34 | 0.68 | RENARD FOOTWALL ZONE | ||||||||

| NE-21-170 | 522859.83 | 5473888.25 | 380.74 | 330 | -50 | 402.00 | 47.02 | 62.08 | 15.06 | 11.54 | 1.93 | ||

| Including (3) | 51.00 | 52.50 | 1.50 | 1.15 | 10.20 | ||||||||

| 126.00 | 212.65 | 86.65 | 66.38 | 1.34 | RENARD ZONE | ||||||||

| Including (3) | 148.50 | 160.50 | 12.00 | 9.19 | 2.65 | ||||||||

| Including (3) | 204.00 | 206.30 | 2.30 | 1.76 | 6.22 | ||||||||

| 222.00 | 267.00 | 45.00 | 31.82 | 2.13 (1.85 capped at 30g/t) | |||||||||

| Including (3) | 234.00 | 246.00 | 12.00 | 8.49 | 6.27 (5.23 capped at 30g/t) | ||||||||

| Including (3) | 238.50 | 240.00 | 1.50 | 1.06 | 38.30 | ||||||||

| NE-21-171* | 523007.00 | 5474050.26 | 381.45 | 330 | -51 | 141.00 | No significant results | ||||||

| NE-21-172 | 522845.36 | 5473812.82 | 379.84 | 330 | -48 | 426.00 | 63.00 | 72.00 | 9.00 | 6.89 | 0.58 | ZONE 36 | |

| 183.00 | 229.50 | 46.50 | 40.27 | 1.26 | RENARD ZONE | ||||||||

| Including (3) | 200.35 | 213.00 | 12.65 | 11.46 | 3.05 | ||||||||

| Including (3) | 211.25 | 212.38 | 1.13 | 1.02 | 13.25 | ||||||||

| 238.30 | 267.00 | 28.70 | 24.85 | 1.70 | |||||||||

| Including (3) | 239.10 | 240.00 | 0.90 | 0.78 | 27.00 | ||||||||

| 301.50 | 343.50 | 42.00 | 36.37 | 1.06 | RENARD FOOTWALL ZONE | ||||||||

| Including (3) | 316.50 | 318.00 | 1.50 | 1.30 | 7.09 | ||||||||

| NE-21-173 | 522803.50 | 5473795.67 | 380.27 | 330 | -48 | 456.00 | 46.18 | 52.50 | 6.32 | 4.84 | 1.91 | ZONE 36 | |

| Including (3) | 47.52 | 49.54 | 2.02 | 1.55 | 4.20 | ||||||||

| 102.50 | 112.50 | 10.00 | 6.43 | 1.49 | |||||||||

| 118.50 | 126.00 | 7.50 | 4.82 | 1.27 | |||||||||

| 175.50 | 286.50 | 111.00 | 90.93 | 1.11 | RENARD ZONE | ||||||||

| 327.00 | 343.50 | 16.50 | 12.64 | 2.05 | RENARD FOOTWALL ZONE | ||||||||

| Including (3) | 330.00 | 333.00 | 3.00 | 2.30 | 5.41 | ||||||||

| NE-21-174 | 522755.39 | 5473775.04 | 383.16 | 330 | -45 | 471.00 | 75.00 | 97.50 | 22.50 | 18.43 | 0.59 | ZONE 36 | |

| 157.50 | 166.50 | 9.00 | 6.36 | 0.66 | |||||||||

| 199.50 | 234.00 | 34.50 | 24.40 | 1.26 | RENARD ZONE | ||||||||

| 244.50 | 253.74 | 9.24 | 7.08 | 0.84 | |||||||||

| 264.00 | 274.50 | 10.50 | 8.04 | 1.41 | |||||||||

| 283.50 | 303.00 | 19.50 | 14.94 | 3.80 | |||||||||

| Including (3) | 283.50 | 285.00 | 1.50 | 1.15 | 24.60 | RENARD FOOTWALL ZONE | |||||||

| 343.45 | 351.00 | 7.55 | 5.34 | 5.69 | |||||||||

| Including (3) | 348.00 | 349.50 | 1.50 | 1.06 | 21.00 | ||||||||

| NE-21-175 | 522682.04 | 5473806.27 | 381.33 | 330 | -48 | 441.00 | 45.00 | 58.50 | 13.50 | 10.34 | 0.80 | RENARD ZONE | |

| 94.65 | 106.50 | 11.85 | 9.08 | 0.64 | |||||||||

| 150.00 | 161.10 | 11.10 | 8.50 | 7.16 | |||||||||

| Including (3) | 153.15 | 156.98 | 3.83 | 2.93 | 18.99 | ||||||||

| 178.00 | 196.50 | 18.50 | 14.17 | 0.60 | |||||||||

| 211.50 | 250.50 | 39.00 | 29.88 | 1.86 | |||||||||

| Including (3) | 248.00 | 249.00 | 1.00 | 0.77 | 25.10 | ||||||||

| 259.50 | 273.00 | 13.50 | 11.06 | 0.65 | RENARD FOOTWALL ZONE | ||||||||

| 279.00 | 292.25 | 13.25 | 10.15 | 2.77 | |||||||||

| Including (3) | 288.00 | 289.50 | 1.50 | 1.06 | 18.45 | ||||||||

| 360.00 | 369.00 | 9.00 | 7.79 | 1.02 | |||||||||

| NE-21-177 | 521932.88 | 5473827.80 | 375.17 | 340 | -45 | 276.00 | 48.00 | 60.00 | 12.00 | 11.82 | 2.08 | RENARD WEST ZONE | |

| Including (3) | 49.50 | 51.00 | 1.50 | 1.48 | 6.67 | ||||||||

| 72.00 | 78.00 | 6.00 | 4.60 | 0.76 | |||||||||

| 103.50 | 142.50 | 39.00 | 29.88 | 0.69 | RENARD WEST FW ZONE | ||||||||

| 153.00 | 171.00 | 18.00 | 13.79 | 1.13 | |||||||||

| Including (3) | 162.00 | 163.50 | 1.50 | 1.15 | 5.37 | ||||||||

| 243.00 | 246.00 | 3.00 | 2.30 | 6.88 | |||||||||

| Including (3) | 243.00 | 244.50 | 1.50 | 1.15 | 12.65 | ||||||||

| NE-21-178 | 521985.60 | 5473836.37 | 375.42 | 340 | -45 | 261.00 | 51.00 | 91.50 | 40.50 | 35.07 | 1.28 | RENARD WEST ZONE | |

| Including (3) | 78.80 | 81.00 | 2.20 | 1.91 | 4.72 | ||||||||

| 103.00 | 127.50 | 24.50 | 18.77 | 0.76 | |||||||||

| Including (3) | 103.00 | 111.00 | 8.00 | 6.13 | 1.27 | ||||||||

| 141.00 | 153.00 | 12.00 | 9.19 | 1.56 | RENARD WEST FW ZONE | ||||||||

| 195.00 | 202.50 | 7.50 | 5.75 | 0.53 | |||||||||

| 229.50 | 240.00 | 10.50 | 8.60 | 0.58 | |||||||||

| NE-21-180 | 522142.43 | 5473855.84 | 372.42 | 330 | -50 | 315.00 | 36.00 | 51.00 | 15.00 | 10.61 | 7.81 (4.26 capped at 30g/t) | RENARD WEST ZONE | |

| Including (3) | 45.00 | 46.33 | 1.33 | 0.94 | 70.10 | ||||||||

| 94.50 | 102.00 | 7.50 | 5.30 | 1.17 | |||||||||

| 117.00 | 120.00 | 3.00 | 2.12 | 3.28 | RENARD WEST FW ZONE | ||||||||

| 132.00 | 147.00 | 15.00 | 10.61 | 1.21 | |||||||||

| 157.50 | 181.50 | 24.00 | 18.39 | 0.81 | |||||||||

| Including (3) | 157.50 | 162.00 | 4.50 | 3.45 | 1.79 | ||||||||

| Including (3) | 175.50 | 181.50 | 6.00 | 4.60 | 1.03 | ||||||||

Notes:

- True widths are estimated at 65 to 95% of the core interval.

- Drill hole intercepts are calculated with a lower cut-off 0.50 g/t Au and may contain lower grade interval of up to 5 metres in length. They are generally reported with a minimum g*m (or Metal factor) of 5.

- Assays intervals are reported uncapped and capped at 30 g/t Au and high grade sub-intervals are highlighted.

* Hole NE-21-171 is a re-drilled section with excessive bad core recovery in the original hole NE-21-166

This press release was read and approved by Mr. Gilles Laverdière, consulting geologist and qualified person under the NI 43-101 Canadian standard.

About Vanstar

Vanstar Mining Resources Inc. is a gold exploration company with properties located in Northern Québec at different stages of development. The Company owns a 25% interest in the Nelligan project (3.2 million inferred ounces Au, NI 43-101 October 2019) and 1% NSR. The Nelligan Project won the "Discovery of the Year" award at the 2019 Quebec Mineral Exploration Association Xplor Gala. Vanstar also owns 100% of the Felix property under development in the Chicobi Group (Abitibi mining camp, 65km East of Amex Perron property) and 100% of Amanda, a 7,306 ha property located on the Auclair formation with historic gold showings up to 12.1 g/t Au over 3 meters.

The TSX Venture Exchange and its Regulation Services Provider (as that term is defined in the TSX Venture Exchange Policies) do not accept any responsibility for the truth or accuracy of its content.

SOURCE :

JC St-Amour.

President and CEO

+1 (647) 296-9871

jc@vanstarmining.com

www.vanstarmining.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/107819