- WORLD EDITIONAustraliaNorth AmericaWorld

May 25, 2022

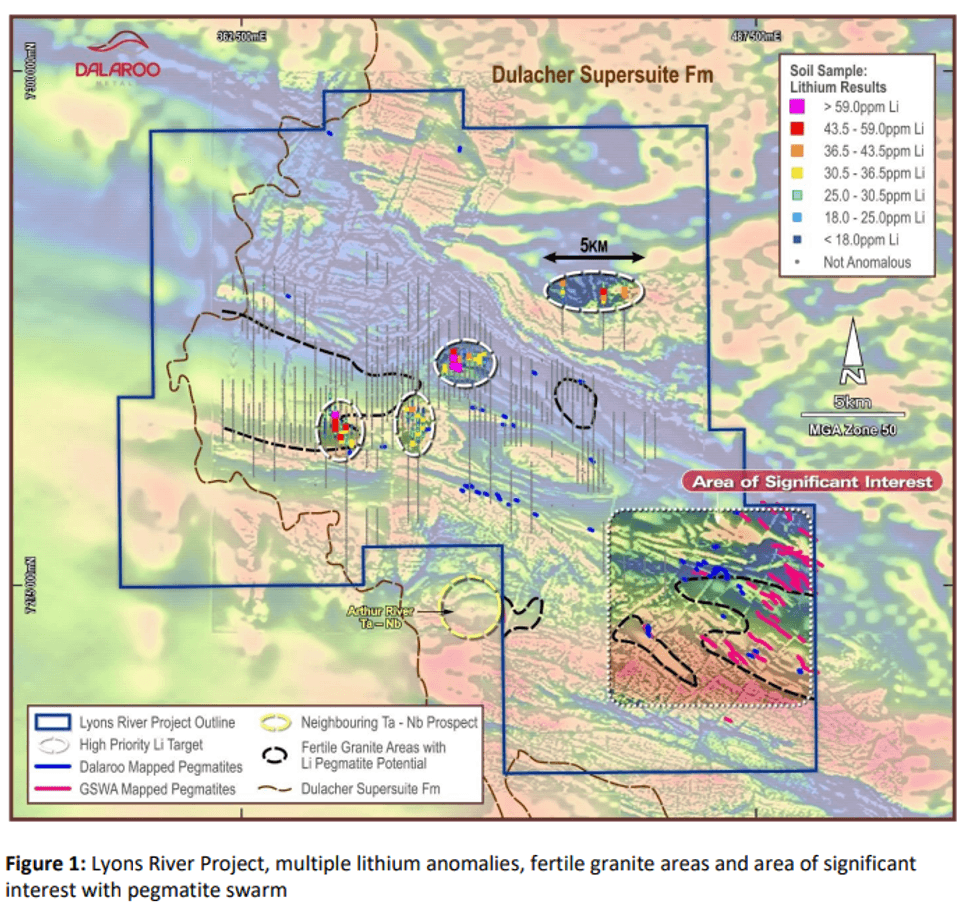

First mover, Dalaroo Metals Ltd (ASX: DAL, “Dalaroo” or “Company”) advises that analysis of historical multi-element geochemical data from its 100% owned 702 km2 Lyons River base metal project has identified multiple lithium anomalies where statistically elevated lithium concentrations have been observed. These lithium anomalies are supported by elevated levels of pathfinder and indicator elements including rubidium, beryllium, caesium, tantalum and tin in the underexplored Gascoyne Province of the Capricorn Orogen in Western Australia.

Highlights

- Multiple lithium anomalies outlined.

- High Priority lithium anomalies with values of up to 125ppm Li and strike lengths of up to 1.5km.

- Lithium anomalies are supported by elevated levels of pathfinder and indicator elements including rubidium, beryllium, caesium, tantalum and tin.

- Targeted 50m spaced airborne magnetic data has highlighted five granite fertile areas with potential to host lithium bearing pegmatites. Some of the granite fertile areas coincide with zones of anomalous lithium.

- Follow-up exploration to commence immediately in June.

Dalaroo’s lithium anomalies are located approximately 50 km west of the Malinda Lithium Project previously explored by Segue Resources Ltd (renamed Arrow Minerals Ltd) (ASX: AMD – See ASX announcement from 20 September 2017) with a significant drill intersection of 14m @ 1.25% Li2O.

A total of 3,700 soil geochemical samples have been collected on a 250 X 100 to 500 X 100m grid pattern over the period from 2017 to 2021 covering an area of 22km x 10 to 15km at the Lyons River Project. Soil samples have been collected over an exposed regolith domain with granite gneisses and psammites mapped by the Geological Survey of Western Australia (GSWA). A subset of 300 samples from initial areas of interest were re-assayed using a four acid digest for lithium and associated supporting elements. This data was then analysed by a specialist geochemist.

Lithium values of up to 125 ppm are seen in the four acid data showing enrichments compared to average background granites concentrations by up to six times and are supported by elevated levels of pathfinder and indicator elements including rubidium, beryllium, caesium, tantalum and tin.

The multi-element signatures of these soil anomalies are consistent with possible hard rock lithium mineralisation.

”Importantly, assessment of our 50m spaced airborne magnetic data has highlighted five granite fertile areas which have the potential to host lithium bearing pegmatites. Some of the granite fertile areas coincide with zones of anomalous lithium and this is really exciting to guide our future exploration focus,” said Dalaroo Managing Director, Harjinder Kehal.

With our focus to date being on base metals, the geochemical data over the Lyons River has not been specifically evaluated for lithium mineralisation. Geological mapping over the project has discovered numerous outcropping pegmatites in addition to those mapped by GSWA, particularly the eastern part of the Lyons River Project area.

Next Steps

“Further assessment of our lithium anomalies in conjunction with other data sets and in-field investigation by a lithium expert geologist commencing in June will determine their significance and the ability to host lithium rich pegmatites,” said Dalaroo Managing Director, Harjinder Kehal.

A program of field geological mapping and rock chip sampling of outcropping pegmatites on the high priority lithium targets generated by multi-element data review and geophysical targets.

Dalaroo will also undertake infill soil sampling programs at the various lithium targets.

Results from the field geological mapping coupled with rock chip sampling and subsequent infill soil geochemical sampling programs will guide the next phase of exploration including RC drill testing to determine the extent of Li rich pegmatites.

Click here for the full ASX Release

This article includes content from Dalaroo Metals Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

DAL:AU

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00