- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

April 15, 2024

Sonic drilling program delivers significant increase in Resource confidence to support gold production at Mt Boppy

Manuka Resources Limited (ASX: MKR) (“Manuka” or the “Company”) is pleased to release an updated Mineral Resources Estimate for Mt Boppy. The Resource update supports Manuka’s strategy to install a purpose-built gold processing plant at Mt Boppy and recommence on-site gold production from Q4 2024.

Highlights:

- The results of a recently completed Sonic Drilling Program over the Main Waste Rock Dump and Dry Tailings have successfully delivered an updated Mineral Resource Estimate for Mt Boppy.

- The updated Resource comprises 4.28Mt at 1.19g/t Au for 163koz of contained gold. Importantly, the updated Resource has seen an 100% increase in the portion of contained gold ounces classified as Indicated.

- The Mt Boppy Measured and Indicated Resource categories now comprises 82% of total Resource Estimate.

- A high-grade component of the Resource comprising 1.8Mt at 1.74g/t containing 102koz Au has been identified as a basis for future mine planning.

- The results support Manuka’s strategy to install on-site processing plant at Mt Boppy and provides confidence in the development of a mine plan that will underpin the recommencement of gold doré production.

Dennis Karp, Manuka’s Executive Chairman, commented:

“The Sonic Drilling Program was critical precursor to the recommencement of the processing of rock dumps and dry tailings at Mt Boppy. The results of this program have been extremely positive allowing us to significantly improve the confidence of our Mt Boppy Resource.

Consequently, Manuka is confident in its strategy to progress the establishment a fit-for- purpose on-site gold processing plant at Mt Boppy in the coming months and in turn free up our Wonawinta process plant, most recently used to process Mt Boppy ore, for future silver production from the existing Wonawinta Silver mine.

The bullish gold and silver markets, combined with the fact that Manuka has two granted mining licenses - both fully permitted for on-site processing - and existing processing infrastructure, translate to a very exciting time for the Company.”

Mt Boppy Resource Statement Summary

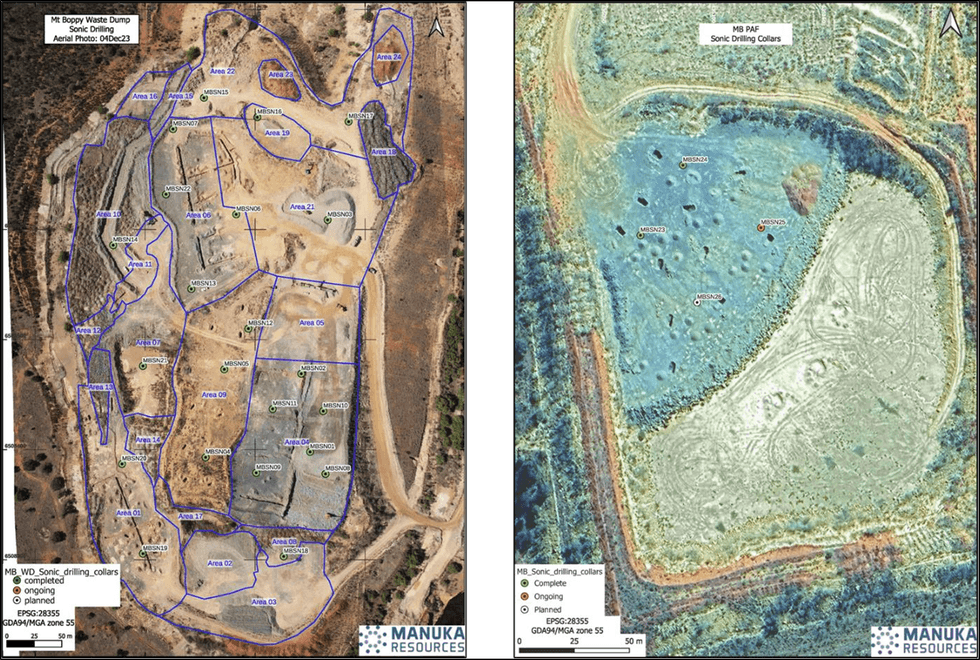

The Mineral Resource Estimate at Mt Boppy has been updated subsequent to the completion of a 26 borehole 506m sonic drilling evaluation programme over the Mt Boppy Rock Dumps and Dry Tailings completed in December 2023 (Figure 1).

The updated Resource comprises 4.28Mt at 1.19g/t Au for 163koz of contained gold of which 82% is contained in the Measured and Indicated categories (Table 1). Importantly, the Resource update sees the ounces classified as Indicated increase by 100% over the previous estimate.

The Resource for Mt Boppy comprises (Table 2):

Rock dumps and tailings depositories, with gold grades derived from recent Sonic drilling to bedrock, and fire assay head grades of +90, -90+20, +10-20, and -10mm size fractions, each weighed to ascertain mass % distribution. The rock dump and tailings Resources are reported at a cutoff of 0.25g/t Au total 3.9Mt tonnes at a grade of 0.89g/t Au for 110,628oz Au.

In-situ hard rock Resources including:

- a Mt Boppy open cut pit shell that reaches a depth of 215m below surface at the southern end of the Mt Boppy deposit. Material within the current pit design is reported at a 1.6g/t Au cut off and material below the pit design is reported to a 3.0g/t Au cut off

- the Boppy South mineral zone based on a grade shell modelled at a 1.6g/t cut off. This prospect still requires final drilling and evaluation before assessing the viability of establishing a small opencast mine.

The incremental change to the overall Mt Boppy Resource relates to updates to Rock dumps and Tailings depositories. The combined Mt Boppy Open Cut and Boppy South Resource of 282kt at a grade of 4.95 g/t Au for 44,820 ounces gold remain unchanged from that previously reported (ASX Release 25 August 2023) and all material assumptions continue to apply.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MKR:AU

The Conversation (0)

26 March 2025

Manuka Resources

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales Keep Reading...

05 August 2025

Results of Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced Results of Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

31 July 2025

June 2025 Quarter Activities and Cashflow Reports

Manuka Resources (MKR:AU) has announced June 2025 Quarter Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

29 July 2025

Maiden Mt Boppy Open Pit Ore Reserve

Manuka Resources (MKR:AU) has announced Maiden Mt Boppy Open Pit Ore ReserveDownload the PDF here. Keep Reading...

10 July 2025

Further Information to 26 June Announcement

Manuka Resources (MKR:AU) has announced Further Information to 26 June AnnouncementDownload the PDF here. Keep Reading...

08 July 2025

Reinstatement to Quotation

Manuka Resources (MKR:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

6h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

17h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00