February 05, 2024

Lincoln Minerals (ASX: LML) is pleased to provide an update on the exploration and development of its Kookaburra Gully Graphite Project (KGGP) on South Australia’s Eyre Peninsula.

- 25 air-core holes completed on the northern section of Lincoln’s Eyre Peninsula Kookaburra Gully deposit

- Graphite intersections encountered in multiple of those holes, with final assays expected in April 2024

- Lincoln expects that the inclusion of these recent drill results will deliver on its aim to double the September 2023 graphite Resource at KGGP.

- LML to commence an update to the 2017 Feasibility Study with a Pre-Feasibility Study targeting 60-100ktpa of high-quality graphite concentrate

- LML’s remaining air-core program adjusted to incorporate Reverse Circulation and Diamond Drill holes required for the Pre-Feasibility Study.

Lincoln has completed drilling of the northern portion of Kookaburra Gully graphite deposit, with assays expected in early April and an updated Resource statement due shortly thereafter.

Lincoln Minerals CEO Jonathon Trewartha commented: “In the past three months, we have increased the resource at the Kookaburra Gully Graphite Project by 87%, and Lincoln is confident this additional drilling, combined with drilling completed in 2017 but previously not included in the Resource calculation, should deliver on the Company’s Resource growth objective which was to double the Resource from the September 2023 level. Pleasingly, this outcome looks set to be achieved in six months, far faster than originally planned, which is a testament to the quality of the KGGP mineralisation.

With this result achieved earlier than anticipated, Lincoln has now accelerated its plan to update the 35ktpa concentrate Feasibility Study, completed in 2017, with a planned Pre-Feasibility Study for a project producing 60 to 100ktpa of concentrate. This level of output is expected to be far more attractive to potential offtake partners as well as allowing submission of Lincoln’s final program for environment protection and rehabilitation, or PEPR, enabling finalisation of the approvals required for advancement of project development at the KGGP.”

Graphite mineralisation intersected in recent drilling

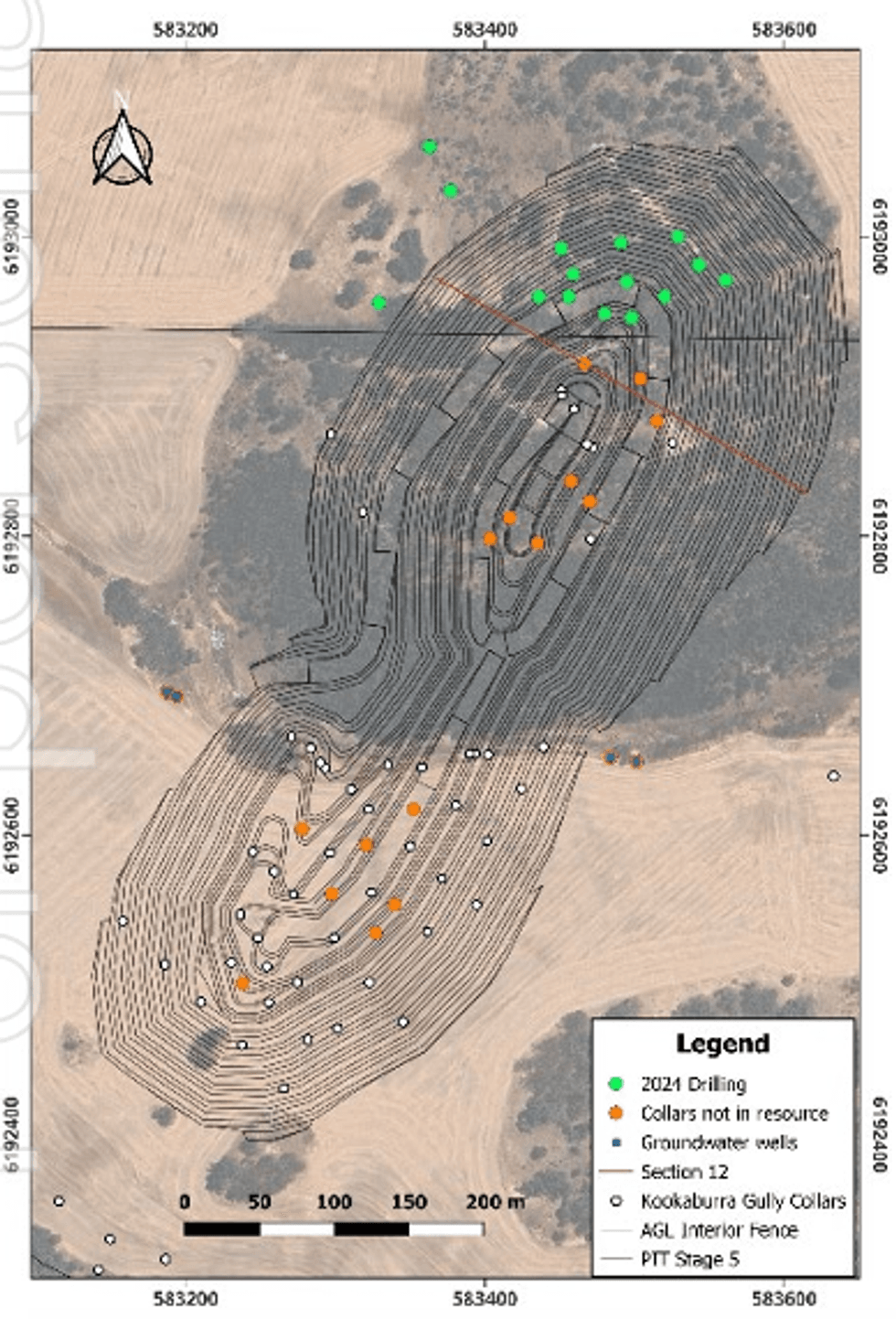

Recent holes completed in December 2023 and January 2024, shown in green in Figure 1, were drilled in the northern portion of the Kookaburra Gully (KG) deposit.

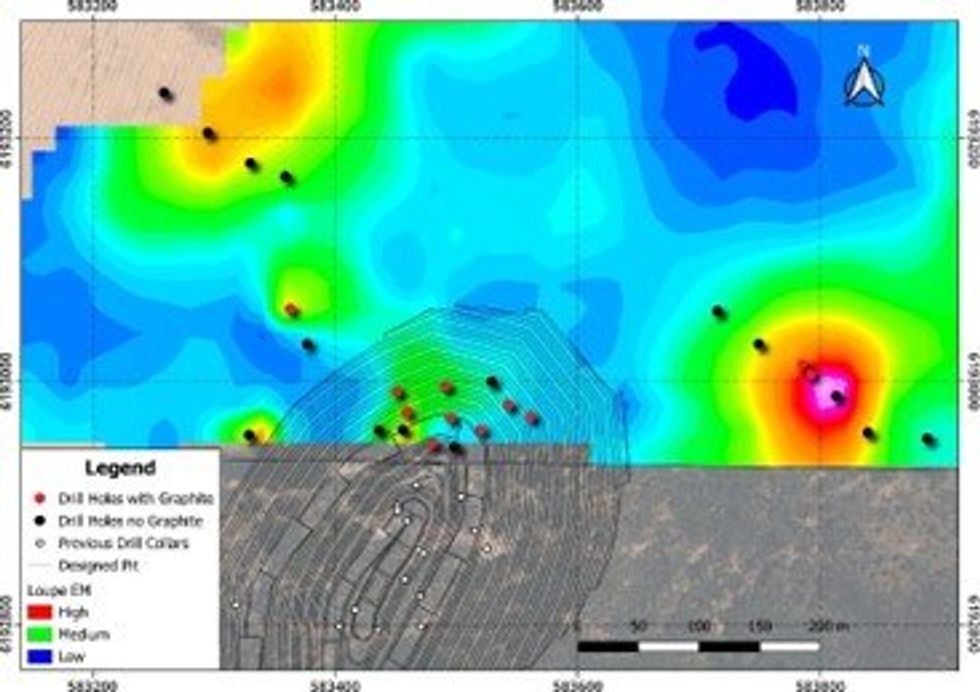

The recent drilling focussed on the previously undrilled northern portion of the Kookaburra Gully deposit and in January 2024 was successful in intersecting graphite mineralisation extending north from the current resource. Eleven (11) holes from 25 drilled intersected graphite shown here in red (Figure 2). Eight holes were north of the current resource, demonstrating strong continuity.

Drilling completed was part of a two-part exploration program, firstly to extend known KG Resource to the north, and secondly to test electromagnetic anomalies from a Loupe ground magnetic survey conducted in February 2023 to the north-west and north-east of the designed pit.

Results from latest drilling are expected in early April 2024.

Click here for the full ASX Release

This article includes content from Lincoln Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

18h

Iyan Deposit Delivers Further Significant Graphite Intercepts from Surface in the Final Release of Assays

Final Assay Batch Again Reinforces Bulk Blending Strategy, Resource Growth and Imminent JORC

Blencowe Resources Plc (LSE: BRES) is pleased to report the final set of assay results completed from the 87 shallow holes drilled at the Iyan deposit, part of the Company's Orom-Cross Graphite Project in Uganda. These results represent the third batch from the Stage 7 drilling programme, with... Keep Reading...

18 February

US Slaps Higher Tariffs on Chinese Graphite Imports After Final Commerce Determination

The US Department of Commerce has sharply increased trade penalties on Chinese graphite anode materials, concluding that producers in China engaged in unfair pricing and subsidy practices that harmed the US market.In a final determination issued February 11, 2026, Commerce raised countervailing... Keep Reading...

27 January

Top 5 Canadian Graphite Stocks (Updated January 2026)

Graphite stocks and prices have experienced volatility in recent years recently due to bottlenecks in demand for electric vehicles, as graphite is used to create lithium-ion battery anode materials. One major factor experts are watching is the trade war between China and the US.China introduced... Keep Reading...

09 December 2025

Greenland Government Grants Exploitation Licence for Amitsoq

GreenRoc Strategic Materials Plc (AIM: GROC), a company focused on the development of critical mineral projects in Greenland, is delighted to announce that the Government of Greenland has granted an Exploitation Licence for the Amitsoq Graphite Project to Greenland Graphite a/s ("Greenland... Keep Reading...

30 November 2025

Altech - Board Renewal and Strategic Focus

Altech Batteries (ATC:AU) has announced Altech - Board Renewal and Strategic FocusDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00