Libra Energy Materials Inc. (CSE: LIBR) (FSE: W0R0) ("Libra" or the "Company") is pleased to announce the acquisition of a 100% undivided interest in the Stimson project, located within the Case Lake lithium-cesium district in Ontario ("Stimson" or the "Project"), pursuant to an asset purchase agreement dated August 21, 2025 (the "Agreement").

"With a low acquisition cost, we are executing our strategy of consolidating the lithium space through bottom-market M&A. The drill-ready Stimson project is strategically located along the same geological subprovince boundary that hosts Power Metals' nearby Case Lake lithium-cesium project - one of the largest cesium resources globally. Historical drilling at Stimson noted at least three intervals of possible spodumene, the largest of which was ~40m of logged 'granitic complex'. In addition to its prospectivity, the Project benefits from excellent infrastructure access, with existing roads and proximity to rail," said Koby Kushner, CEO of Libra. "With lithium prices starting to break-out, we are consolidating the lithium space at an opportune time, and we are eager to announce further accretive acquisitions."

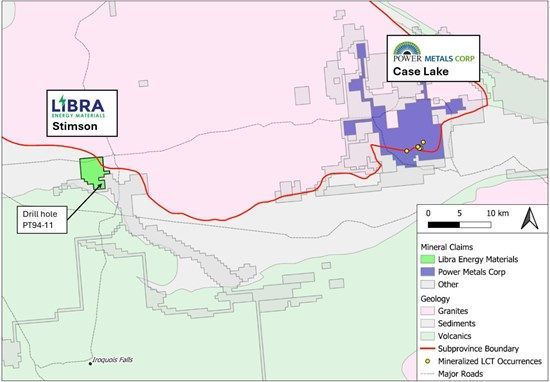

Figure 1: Regional map, showing geology, nearby claims, and infrastructure.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9331/263708_1b507b5db438a8db_001full.jpg

Geology Overview

The Stimpson project is strategically located along strike of Power Metals' Case Lake Li-Cs-Ta (LCT) deposit, straddling the same boundary between the Quetico and Abitibi subprovinces. Importantly, a historical drill log at Stimpson noted three intervals, the largest being 39.8m (60.0 - 99.8m) logged as a 'granitic complex', an unknown portion of which was pegmatite containing possible spodumene in DDH PT94-11 (OGS Assessment Record 42H02SE0010). This historical result provides evidence of a potential Li-bearing pegmatite system on the Stimpson project that Libra plans to test through future drilling. Although Libra is primarily targeting spodumene, the key lithium-bearing mineral found in LCT pegmatites, the Company will also evaluate the potential for pollucite, which is the main cesium-bearing mineral in LCT pegmatites. The Company notes that while mineralization on nearby or adjacent projects is not necessarily indicative of mineralization at Stimson, the Quetico-Abitibi subprovince boundary is proven to be fertile for hosting both pollucite and spodumene.

Terms of the Agreement

Under the terms of the Agreement, Libra will acquire a 100% undivided interest in the Project from Last Resort Resources Ltd. and Bounty Gold Corp. (collectively, the "Vendors") for a total purchase price of CAD$50,000, payable through the issuance of Libra common shares (the "Shares") based on the 5-day volume-weighted average price prior to issuance. The Vendors have the option to defer receipt of the payment of the Shares for up to one-year from the date of the Agreement. Additional consideration to the Vendors include:

- Bonus Shares: Libra will issue additional Shares to the Sellers based on drilling results within three years from the commencement of initial drilling, as follows:

- CAD$100,000 payable in Shares if drill results yield at least 20 meters grading greater than one percent (1%) Li₂O.

- CAD$250,000 payable in Shares if drill results yield at least 5 meters grading greater than three percent (3%) Cs₂O.

- Net Smelter Return ("NSR") Royalty: Upon commencement of commercial production, Libra will pay a two percent (2%) NSR royalty to the Vendors, with an option to repurchase half of the royalty (for CAD$250,000.

The entering into of the Agreement by Libra represents an arm's length transaction and there were no finder's fees payable.

Qualified Person and Third-Party Data

The scientific and technical information in this news release has been reviewed and approved by Benjamin Kuzmich, P.Geo., VP Exploration of Libra. Ben Kuzmich is a "qualified person" as defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Libra Energy Materials Inc.

Libra (CSE: LIBR) (FSE: W0R0) is a Canadian mineral exploration company focused on the discovery and development of the critical minerals necessary for the green energy transition. Libra's Flanders North, Flanders South, and SBC projects in Ontario are being explored under a CAD$33M earn-in deal with KoBold Metals Company. In addition, Libra has 100% ownership over its Toivo and Stimson projects in Ontario, and its Nemiscau and Wegucci projects in Quebec, Canada. The Libra team comprises a mix of seasoned executives, engineers, and geoscientists, with extensive experience in mining and mineral exploration, capital markets, asset management, energy, and First Nations engagement.

For more information, please contact the Company at:

Koby Kushner, P.Eng., CFA

Chief Executive Officer, Libra Energy Materials Inc.

e: kkushner@libraenergymaterials.com

t: 416-846-6164

Forward-Looking Information

This news release contains forward‐looking statements and forward‐looking information within the meaning of applicable securities laws. These statements relate to future events or future performance. All statements other than statements of historical fact may be forward‐looking statements or information. The forward‐looking statements and information are based on certain key expectations and assumptions made by management of the Company. Although management of the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward‐looking statements and information since no assurance can be given that they will prove to be correct.

Forward-looking statements and information are provided for the purpose of providing information about the current expectations and plans of management of the Company relating to the future. Readers are cautioned that reliance on such statements and information may not be appropriate for other purposes, such as making investment decisions. Since forward‐looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Accordingly, readers should not place undue reliance on the forward‐looking statements and information contained in this news release. Readers are cautioned that the foregoing general disclosure is not exhaustive nor should it be construed as such. The forward‐looking statements and information contained in this news release are made as of the date hereof and no undertaking is given to update publicly or revise any forward‐looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws. The forward-looking statements or information contained in this news release are expressly qualified by this cautionary statement.

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange ) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/263708