December 18, 2023

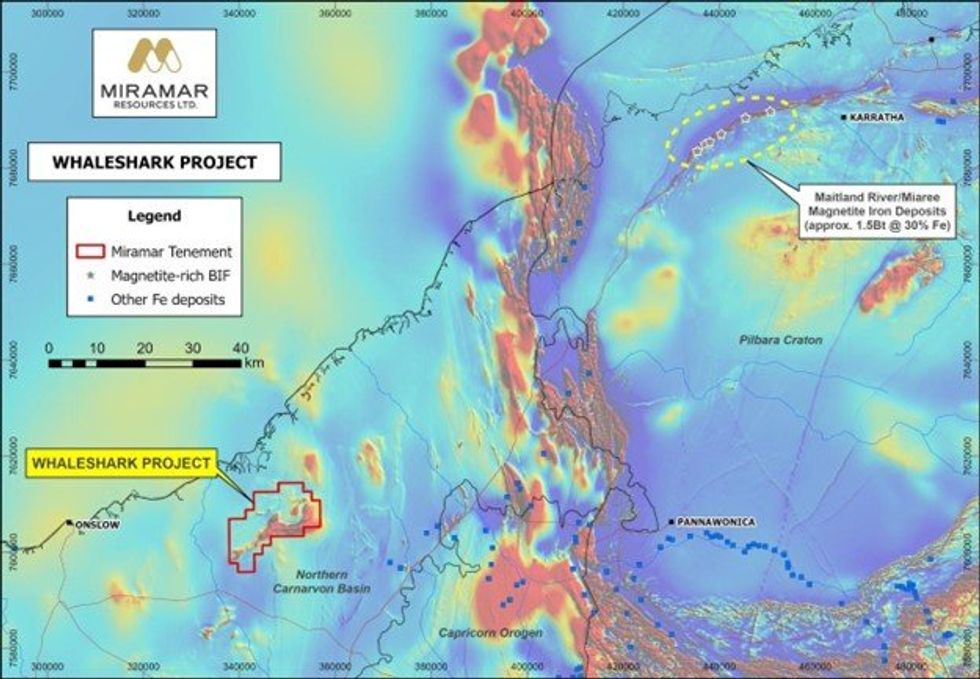

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) advises that a review of historical drilling data has revealed potentially very significant magnetite iron opportunities at the Company’s 100%- owned Whaleshark Project in the Ashburton Region of WA (Figure 1).

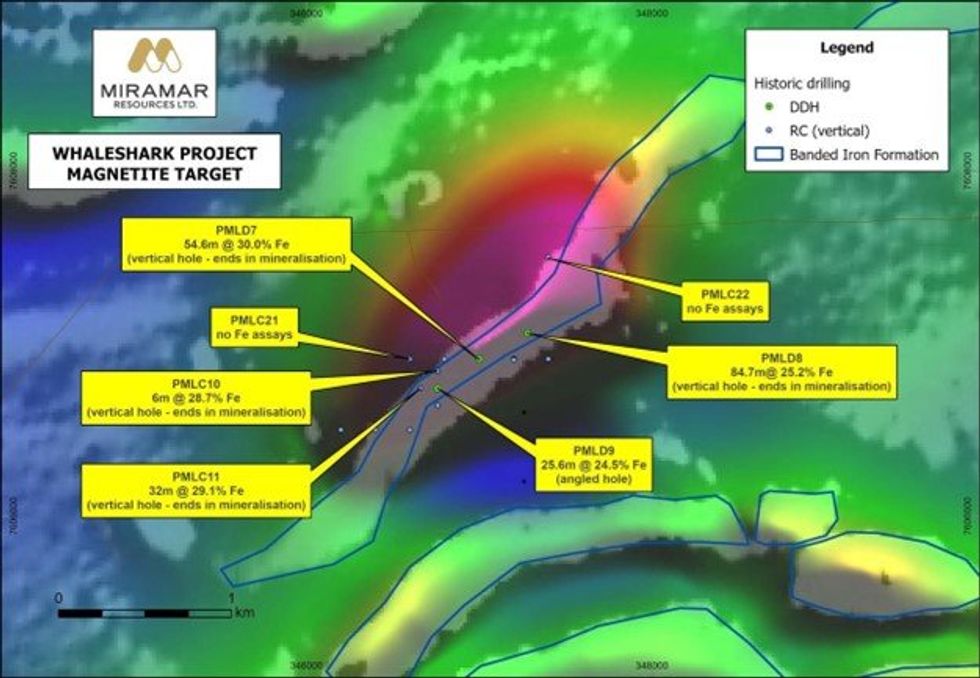

- Thick magnetite iron intersections >25% Fe identified in historic drill holes

- Similar scale opportunity to the Maitland River/Miaree magnetite iron deposits

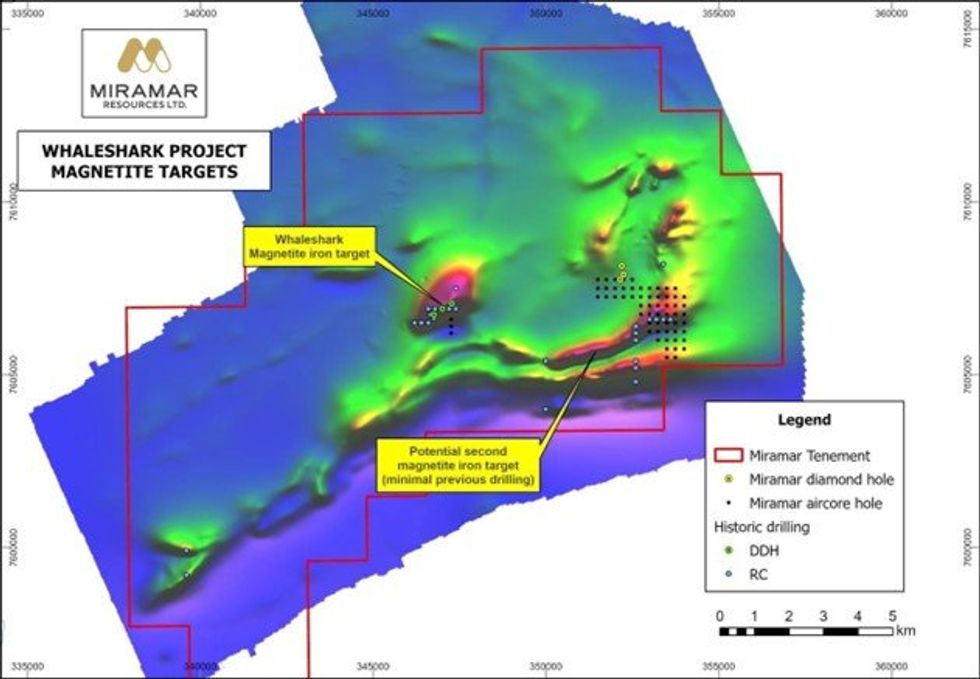

Drilling conducted at Whaleshark by Western Mining Corporation (WMC) in the 1990’s, whilst exploring for iron oxide copper-gold, intersected significant widths of magnetite-rich banded iron formation averaging >25% Fe beneath younger sediments, with several holes ending in mineralisation (Figures 2 and 3). Miramar recently re-examined those holes, following completion of its own diamond drilling campaign.

Miramar’s Executive Chairman, Mr Allan Kelly, said the magnetic anomalies seen at Whaleshark are similar in scale to the 1.5 billion tonne Maitland River and Miaree magnetite iron deposits1.

“The recognition of two potentially very large magnetite iron deposits is very significant for Miramar, especially given the location of the Whaleshark Project with respect to existing infrastructure,” he added.

A larger and virtually untested magnetite target is observed on the southern side of the granodiorite pluton.

Drill testing of the second magnetic anomaly is limited, with only a handful of historic RC holes that were not assayed for iron, and recent aircore holes completed by Miramar in 2022 that ended in 18-32% Fe.

In general, the basement is significantly shallower within this target, with average cover thickness in the order of 25-30m.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksnickel-stocksasx-stocksgold-explorationgold-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

4h

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

6h

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to make gains, driven by supply and demand fundamentals and further boosted by tariff fears.The price reached a record high on January 29, and while it has since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them has... Keep Reading...

24 February

Faraday Copper Signs LOI to Acquire BHP’s San Manuel Property in Arizona

Faraday Copper (TSX:FDY,OTCQX:CPPKF) has signed a letter of intent (LOI) to acquire BHP's (ASX:BHP,NYSE:BHP,LSE:BHP) San Manuel property, which sits next to its Copper Creek project in Arizona. The company says the move will combine the two adjacent assets into a single US-focused copper... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00