(TheNewswire)

Highlights

-

Jervois Global Limited ("Jervois") completes Bankable Feasibility Study ("BFS") for Stage 1 of São Miguel Paulista Nickel and Cobalt refinery ("SMP") restart to process mixed nickel hydroxide ("MHP") and cobalt hydroxide through to metal.

-

Initial Stage 1 forecast production of 10,000mtpa 1 and 2,000mtpa of refined nickel and cobalt metal cathode respectively. Stage 2 BFS regarding a return to full 25,000mtpa refined nickel production capacity expected to be finalized in 2H 2022.

-

Net Present Value ("NPV") for Stage 1 restart of US$228 million and US$141 million at an 8% (real) discount rate on a pre-tax and post-tax basis respectively; nominal Internal Rate of Return ("IRR") of 47% (pre tax) and 35% (post tax).

-

At US$8.00/lb nickel and US$25.00/lb cobalt, post ramp up of Stage 1 to BFS production rates, average annual EBITDA in real terms projected to be over US$30 million. Refinery economics resilient to a range of market scenarios, including current spot market conditions for refined and intermediate products.

-

Total project capital cost of US$55 million, representing a competitive refurbishment of an existing brownfield nickel and cobalt refinery. SMP has a long operating history, most recently placed into care and maintenance managed by current owner Companhia Brasil de Alumino ("CBA").

-

Restarting the only electrolytic nickel-cobalt refinery in South and Latin America will deliver significant local and regional economic and social benefits to the São Miguel Paulista area of São Paulo city, Brazil.

-

SMP benefits from competitive low carbon energy (predominantly hydropower), skilled workforce, existing infrastructure including main arterial roads and ~120km from Brazil's largest container port at Santos.

-

Jervois is advancing discussions on commercial supply contracts of MHP and cobalt hydroxide to underpin SMP restart. Work continues on design of an autoclave to process cobalt concentrates from Jervois's 100%-owned Idaho Cobalt Operations ("ICO"); once available, this will be incorporated into the Stage 1 BFS.

-

Execution planning has commenced and a final investment decision for Stage 1 is anticipated to occur in parallel to closing of the SMP acquisition. Jervois continues to advance operating permit renewal process with the São Paulo City Hall, a condition precedent to closing, before 31 August 2022.

-

First commercial production from SMP's Stage 1 restart is expected during 2023.

Australia - April 28, 2022 – TheNewswire - Jervois Global Limited (the "Company" or "Jervois") (ASX:JRV) (TSXV:JRV) (OTC:JRVMF) is pleased to announce successful completion of the BFS for an initial Stage 1 partial restart of the SMP refinery.

SMP, located in São Paulo, Brazil, previously operated for more than 30 years, producing high quality nickel and cobalt electrolytic cathode. Refined products from SMP are registered and marketed as the brand Tocantins, which Jervois plans to continue after restarting the facility. SMP was placed on care and maintenance in 2016 upon the closure of the majority of nickel feed supply at the time, the Niquelandia mine in the Brazilian State of Goias, also owned by CBA.

Jervois engaged Ausenco Pty Ltd (" Ausenco ") to lead the BFS engineering and Metso Outotec to complete testwork, using third-party supplier samples of mixed nickel-cobalt hydroxide (" MHP ") and cobalt hydroxide. Testwork was carried out in Pori, Finland, at Metso Outotec's laboratory. Brazilian permitting is being handled by Environmental Resource Management (" ERM "), Jervois' environmental and licensing adviser during its SMP due diligence.

SMP's location in São Paulo is exceptional, providing good access to highways and nearby port facilities, access to competitive energy and skilled labour, and due to its nature as an existing refinery, can be refurbished for a fraction of what a similar greenfield would cost to construct.

Key technical and economic outputs from the BFS are summarised in Table 1 below.

Table 1: Key SMP BFS Parameters

| Parameter | Input | Parameter | Result | |

| Assumed operating life | 20 years | NPV (@ 8% real post-tax) | US$141 million | |

| Capital cost | US$54.8 million | IRR (nominal post-tax) | 35% | |

| Nickel price 1 Cobalt price 2 | US$8.00/lb US$25.00/lb | EBITDA 3, 4 Payback (post-tax) | US$33 million per annum 3.3 years | |

| MHP payability Cobalt hydroxide payability Brazilian real: US dollar | 75% CIF Santos 75% CIF Santos 5.30 | Production rate | 10,000 mtpa Nickel metal 2,000 mtpa Cobalt metal 10,740 mtpa Ammonium Sulphate | |

-

LME Cash in real 2022 dollars.

-

Fastmarkets Metal Bulletin ( MB ") Standard Grade (" SG ") in real 2022 dollars.

-

Average life of operations, in real 2022 dollars.

-

EBITDA is a non-IRFS measure but is commonly used in evaluating financial performance. While the common definition of EBITDA is "Earnings Before Interest Expense, Taxes, Depreciation and Amortization", EBITDA used in this news release may not be comparable to EBITDA presented by other companies.

Background

The Votorantim Group, a Brazilian diversified family conglomerate, constructed the refinery in 1981. Originally designed by Outotec (now Metso Outotec), the refinery underwent several stages of debottlenecking and expansion up to its nameplate of 25,000mtpa nickel and 2,000mtpa cobalt, in refined metallic form.

Due to a change in proportion of nickel feed, from nickel carbonate to MHP, a decision was made to conservatively cap nickel throughput at 10,000mtpa refined nickel. Cobalt third-party feed remains unchanged (cobalt hydroxide), and Jervois notes that approximately 10-20 percent of refinery nickel feed in the years prior its being placed on care and maintenance, was also MHP.

Figure 1: SMP Site Overview

Figure 2: SMP Location

SMP is located in the city of São Paulo, the most populous city in Brazil and the Americas. SMP is 14km by road southeast from the main Brazilian international airport of São Paulo Guarulhos, and 120km by road northwest from the Port of Santos, Brazil's largest commercial port. Access from the Port of Santos is 100km north along BR-050 Highway and 20km east along Ayrton Senna Highway (SP-070 Highway).

The State of São Paulo is the industrial and manufacturing heartland of Latin America, with a population of greater than 45 million people. The State accounts for approximately one third of total Brazilian GDP, with its economy in the region second only to Mexico. The State of São Paulo's GDP exceeds that of other advancing national economies such as Chile, South Africa or Singapore. It is the manufacturing and export hub of South America, and an extremely competitive and attractive investment destination.

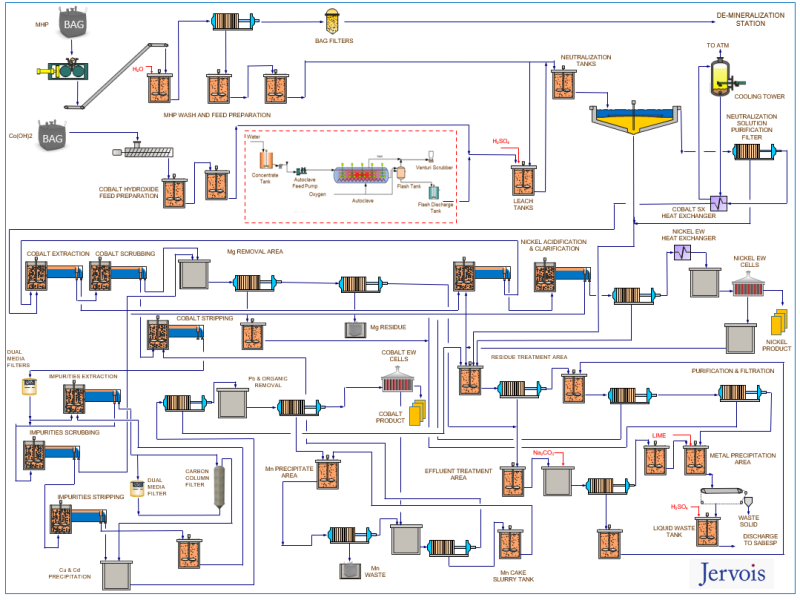

Flowsheet Overview

The SMP flow sheet includes a feed preparation circuit, atmospheric leaching and neutralization circuits, impurity removal and filtration, cobalt solvent extraction (" SX "), nickel and cobalt electrowinning, product packaging, and associated infrastructure.

Engineering and testwork are progressing for the future integration of the pressure oxidizing (" POX ") leach circuit to process cobalt concentrate from Jervois' Idaho Cobalt Operations (" ICO ") in the USA at the existing refinery.

Metallurgy

Metal hydroxides are leached at nominal temperatures of +90 0 C at a pH of

Upon recommissioning the refinery on nickel and cobalt hydroxides, the copper content is low and most of the copper is therefore co-precipitated as a residue with iron and aluminium.

Copper can be recovered separately via a selective precipitation circuit using sodium hydrosulphide (" NaHS "), however the initial restart will not recover the small amount of copper in the hydroxide feed.

Testwork to support the initial restart of the refinery was completed by the Metso Outotec Research Center in Pori, Finland under supervision of the Jervois team. The testwork program was progressed to understand the kinetics and extent of extraction for nickel and cobalt hydroxides. Results were favorable and typically consistent with the plants historical performance when it commercially processed the same feed materials as envisaged in this BFS.

Magnesium and manganese are deleterious elements contained in MHP and cobalt hydroxide feedstock. To manage manganese, an existing fit for purpose SX circuit will be recommissioned in the cobalt electrowinning (" EW ") circuit as part of the refinery restart using D2EPHA extractant to remove manganese calcium and zinc. This will be stripped and precipitated in a wastewater stream using lime and soda ash. Similarly, magnesium is also removed from the wastewater stream using lime prior to discharging the clarified liquor to the SABESP (São Paulo State water and sewerage company) treatment facility, located close to the refinery.

A separate cobalt SX circuit extracts cobalt from the "clean" SX feed. The cobalt catholyte is recycled as the cobalt strip solution to strip the cobalt from the Cyanex 272. The cobalt SX raffinate nickel sulphate is discharged to the nickel EW circuit for harvesting. Nickel electrolyte is recycled back to the leach circuit utilising the acid generated at the cathode to re-leach nickel and cobalt hydroxides.

Nickel harvesting is completed in stages, with two days required to prepare the starter sheets and six days required to achieve the optimum nickel cathode product quality with typical dimensions of 1m by 1m by 15mm full plate cathode. Cobalt is harvested after two days; no starter sheets are required as the cathode produced is in broken form, suitable for subsequent dissolution by customers.

Overall nickel and cobalt recovery from blended MHP and cobalt feed is forecast at 99% nickel and 97% cobalt respectively.

Figure 3: SMP Process Flowsheet

Engineering

Ausenco was the lead engineer for the BFS. Ausenco was supported by Metso Outotec and Elemental Engineering (" Elemental ") to progress testwork and sysCAD modelling. Mass and energy balances, steam and water balances were prepared by Elemental under the direction of Ausenco. The process design criteria (" PDC ") were prepared by Ausenco for the BFS. Marked up PDFs were used to markup key control loops. Equipment lists including motor and power loads were prepared by Ausenco.

Promon Engenharia Ltda. (" Promon ") initially completed an independent refinery refurbishment capital estimate and preliminary schedule. Promon is an experienced local engineering contractor that has completed major projects in Brazil. Ausenco utilized the initial Promon refinery refurbishment cost as a platform for the BFS. In addition to that, several site visits were scheduled to:

-

assess the condition of all processing equipment, building and infrastructure;

-

validate the existing process flow diagrams;

-

review procedures, reports, manuals, and other documents;

-

identify plant bottlenecks;

-

carry out on-site interviews with former process, mechanical, electrical staff;

-

discuss contractors' estimation strategy to ensure proper scope of work was captured; and

-

identify key equipment that represent a sample of the overall plant (i.e., pumps, agitators, etc.).

Ausenco used a combination of factored costs and budget estimates to define the capital refurbishment cost including new plant and equipment to a AACE Class 3 +/-15% level of estimate.

As the refinery is a brownfield restart, most of the refurbishment activities fall within a number of clustered critical activities such as initial geotechnical investigation, 3D plant laser scanning, and updating engineering drawings and preparation of vendor packages.

Long lead items required for the refinery restart are clustered around several packages including early environmental remediation works, new feed preparation circuit and D2EPHA solvent extraction plant (including media filters and carbon column to remove impurities such as manganese and zinc) and equipment (certain new agitators and pumps, media filters), rectifier refurbishment, warehousing and the waste water treatment plant upgrade.

The restart schedule is estimated at 12 months. Early works execution will occur at the refinery encompassing completion of the environmental remediation, geotechnical investigations, 3D laser scanning and modelling the existing refinery, preparation and updating plant engineering drawings, vendor packages preparation and new civils works. Full refinery refurbishment and construction is anticipated to restart once the anticipated closure of the SMP acquistion has occured with first commercial production forecast for 2023.

Next steps for Jervois, in addition to procurement packages, are to develop refurbishment package contracts, covering concrete and building repairs, refurbishment of inter alia rectifiers, automation, rotating equipment including pumps and agitators, static equipment, lifting equipment (overhead cranes, monorails, hoists) and filter presses.

Infrastructure

All infrastructure required for the restart of the refinery was assessed by Ausenco and is included in the capital cost estimate. This includes electrical distribution, motor control centers, rectifiers, mechanical and electrical workshops, warehouses and reagent storage. Wastewater treatment, raw water and demineralized water requirements were defined by the mass balance developed for the BFS, and have been incorporated into restart and operating forecasts.

Logistics

Feed materials will arrive containerized in 1.5-tonne bags into Santos port, and will be trucked to SMP. Due to the facilities location within an industrial hub of São Paulo, maintenance materials and other reagents, such as flocculant, extractants, and diluents, can be ordered on an as-needed basis. Waste solids from process residue will also be transported in 1.5-tonne bags by truck, as occurred historically.

Environment and Permitting

ERM's office in São Paulo coordinated the BFS environmental work stream, supported by Jervois's and CBA's local team in Brazil. Permitting and regulatory compliance were reviewed in preparation for the restart. In conjunction with finalization of the outstanding São Paulo City Hall permit by CBA, which remains a condition precedent to acquisition closing by Jervois, the modifications associated with the restart for the existing BFS scope will require approval by CETESB (the São Paulo Environmental Agency). Agreed timelines with the regulator have been captured in the 12-month restart timeline.

Capital Cost

The capital cost estimate was prepared in accordance with an Advancement of Cost Engineering (AACE) International Class 3 feasibility study estimate and Ausenco's capital cost estimating guidelines, with an accuracy of ± 15%. The capital cost estimate was developed from first principles and is based on engineering deliverables, equipment pricing, and contractor rates obtained during the BFS, and is summarised in Table 2.

Prior to developing the capital cost estimate for the expansion, the site field inspection program was completed at the refinery to assess the condition of existing equipment and determine which equipment can be refurbished, reused, or repurposed. The field inspection program also quantified the refurbishment scope, which is major part of or the capital cost estimate.

Table 2: Capital Cost Estimate

| R$ millions | US$ millions | |

| Process Plant | 149.0 | 28.1 |

| On-site Infrastructure | 23.7 | 4.5 |

| Total Directs | 172.7 | 32.6 |

| Project Indirect | 43.8 | 8.3 |

| Owner's Costs | 44.1 | 8.3 |

| Contingency | 30.1 | 5.7 |

| Total Indirects | 118.0 | 22.3 |

| Total Restart Capex | 290.6 | 54.8 |

-

Note that numbers on table may not sum due to decimal place rounding.

Operating Cost

The operating cost estimate includes on-site costs from the receipt of cobalt hydroxide and MHP feed material and consumables through to product packaging and effluent discharge including processing, general and administration (G&A), and effluent disposal costs. The operating cost estimate for an average operating year is provided in Table 3. The average annual operating cost based on selected input cost assumptions for reagents, consumables, energy and labour, together with a currency of 5.3 reals to the US$, is US$36.5 million.

Table 3: Annual Operating Cost Estimate

| R$ millions | US$ millions | % Total Opex | |

| Fixed Costs | |||

| Labour | 53.8 | 10.2 | 27.8% |

| G&A | 11.7 | 2.2 | 6.1% |

| Maintenance | 20.3 | 3.8 | 10.5% |

| Transportation from Port to the Plant | 4.1 | 0.8 | 2.1% |

| Subtotal (Fixed Costs) | 89.9 | 17.0 | 46.5% |

| Variable Costs | |||

| Reagents and Operating Consumables | 78.6 | 14.8 | 40.6% |

| Electrical | 17.9 | 3.4 | 9.2% |

| Effluent and Tailings Treatment Station | 7.2 | 1.4 | 3.7% |

| Subtotal (Variable Costs) | 103.6 | 19.6 | 53.5% |

| Total Opex | 193.6 | 36.5 | 100.0% |

-

Note that numbers on table may not sum due to decimal place rounding.

Marketing Summary

Nickel and cobalt prices used for the BFS were US$8.00/lb and US$25.00/lb respectively, lower than or consistent with analyst long term forecasts. Whilst current prices are higher for both commodities, the benefits of elevated near term pricing was not factored into the forecasts.

Intermediate Markets

Nickel and Cobalt Hydroxides or Mixed Hydroxides (" MHP ")

MHP is a growing intermediate form of nickel, with existing producers being the Ravensthorpe Nickel Operations in Australia, Goro in New Caledonia, Ramu in Papua New Guinea, and Gordes in Turkey. Historically SMP processed material from Ravensthorpe and Goro. MHP supply is expected to expand rapidly in the next decade with many large new HPAL operations planned, already commissioning or under construction to produce MHP in Indonesia. MHP is sold on the open market to refiners for further processing to final products.

Market terms and pricing for MHP are not publicly disclosed, but trade at a discount to metal prices depending on underlying demand and supply, and the prevailing metal prices. Whilst MHP payabilities today are approximately 90 percent, an MHP payable of 75 percent for nickel and cobalt was selected for the BFS, consistent with lower commodity prices than prevail today.

Cobalt Hydroxide

Cobalt hydroxide is the predominant intermediate product available to cobalt refiners, with the majority of this material coming from the Democratic Republic of Congo (" DRC ") as a by-product of copper production. Major producers in the DRC are Glencore, China Molybdenum, and ERG. Cobalt hydroxide is sold on the open market to refiners for further processing to final products. Whilst specific contracts between suppliers and refiners are not disclosed, Fastmarkets Metal Bulletin publishes a reference price which has largely become the industry benchmark for spot business. This index has varied from payables in the low 60 percents in 2019 to as high as the low 90 percent payables more recently on the back of supply shortages and strong demand. A cobalt hydroxide payable of 75 percent was selected for the BFS.

SMP has extensive historical experience at successfully refining cobalt hydroxide from tier 1 suppliers with the requisite, strong ESG credentials.

Due to elevated pricing and the absence of acquistion closing, Jervois has chosen to not yet enter formal supply contracts for either MHP or cobalt hydroxide to support the SMP restart. Discussions with supply partners to advance the restart are now accelerating in lieu of anticipated acquisition closing.

POX Circuit for Sulphide Concentrates

Work continues on design of an autoclave to process both cobalt concentrates from ICO and a limited volume of third party nickel concentrate. Once available, this will be incorporated into the Stage 1 BFS and is expected to fall within the existing refinery restart schedule. The POX circuit has long lead items and early works packages that will be progressed in parallel to the refinery restart. Appropriate engineering tie-ins will be required to support the installation of the POX circuit. Stage 2 BFS to expand nickel production back to the nameplate 25,000mtpa via a larger autoclave continues in parallel and is anticipated to be completed in the second half of 2022.

Economic Evaluation

As previously noted, the BFS has a pre-tax NPV of US$228 million at a discount rate of 8.0% (real); post-tax NPV is US$141 million on the same basis. The pre-tax and post-tax nominal IRR's are 47% and 35% respectively. Post-tax payback of all capital is forecast at 3.3 years from technical completion after commissioning (‘simple payback').

Table 4 summarises the key economic assumptions and BFS outcomes.

Table 4: Key Macro Economic Assumptions and BFS Outcomes

| Unit | Value | |

| Brazilian real | BRL : USD | 5.3 : 1.0 |

| Nickel (LME) (real) | USD/pound | 8.00 |

| Cobalt (Metal Bulletin Standard Alloy Grade) (real) | USD/pound | 25.00 |

| MHP Payability | % CIF Santos | 75.0 |

| Cobalt Hydroxide Payability | % CIF Santos | 75.0 |

| Discount rate (real) | % | 8.0 |

| Operating life | Years | 20 |

| NPV (pre tax) | USD millions | 228 |

| NPV (post tax) | USD millions | 141 |

| Nominal IRR (pre tax) | % | 47% |

| Nominal IRR (post tax) | % | 35% |

| Payback (pre tax) | Years | 2.5 |

| Payback (post tax) | Years | 3.3 |

Commodity prices and exchange rates are consistent with investment banking forecasts, despite current volatility in both markets. Sensitivity to commodity prices, the Brazilian real together with capital and operating cost variances are outlined below.

Table 5: Sensitivity analysis

| Sensitivities | -20% | -15% | -10% | -5% | 5% | 10% | 15% | 20% | |

| USD/BRL | 4.2 | 4.5 | 4.8 | 5.0 | 5.3 | 5.6 | 5.8 | 6.1 | 6.4 |

| IRR (Post Tax, Nominal) | 21% | 25% | 28% | 31% | 35% | 38% | 41% | 44% | 47% |

| NPV (Post Tax) | 69 | 90 | 109 | 126 | 141 | 154 | 167 | 178 | 189 |

| Nickel US$/Lb | 6.4 | 6.8 | 7.2 | 7.6 | 8.0 | 8.4 | 8.8 | 9.2 | 9.6 |

| IRR (Post Tax, Nominal) | 24% | 27% | 30% | 32% | 35% | 37% | 39% | 42% | 44% |

| NPV (Post Tax) | 74 | 91 | 108 | 124 | 141 | 157 | 174 | 191 | 207 |

| Cobalt US$/Lb | 20 | 21 | 23 | 24 | 25 | 26 | 28 | 29 | 30 |

| IRR (Post Tax, Nominal) | 32% | 33% | 33% | 34% | 35% | 35% | 36% | 36% | 37% |

| NPV (Post Tax) | 123 | 127 | 132 | 136 | 141 | 145 | 150 | 154 | 159 |

| Opex US$M pa | 29.2 | 31.0 | 32.9 | 34.7 | 36.5 | 38.3 | 40.2 | 42.0 | 43.8 |

| IRR (Post Tax, Nominal) | 42% | 40% | 38% | 36% | 35% | 33% | 31% | 29% | 27% |

| NPV (Post Tax) | 187 | 175 | 164 | 152 | 141 | 129 | 118 | 106 | 95 |

| Capex US$M | 43.9 | 46.6 | 49.4 | 52.1 | 54.8 | 57.6 | 60.3 | 63.1 | 65.8 |

| IRR (Post Tax, Nominal) | 40% | 39% | 37% | 36% | 35% | 33% | 32% | 31% | 30% |

| NPV (Post Tax) | 149 | 147 | 145 | 143 | 141 | 139 | 137 | 135 | 133 |

Planned closure of SMP acquisition

Jervois intends to close the acquisition of SMP once the the outstanding São Paulo City Hall permit has been finalized by CBA. This remains a condition precedent to acquisition closing by Jervois. The outside date for closing the acquistion is 31 August 2022. Closing the acquistion will trigger a payment of R$47.5 million (US$9.6 million) 2 in accordance with the terms of the acquistion announced on 29 September 2020.

On behalf of Jervois Global Limited,

Bryce Crocker, Chief Executive Officer

For further information, please contact:

| Investors and analysts: James May Chief Financial Officer Jervois Global | Media: Nathan Ryan NWR Communications nathan.ryan@nwrcommunications.com.au Mob: +61 420 582 887 |

Forward-Looking Statements

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan", "forecast", "may", "schedule", "expected" and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to the proposed operations at SMP refinery, including the proposed flowsheet, anticipated capital costs, anticipated operating costs, permitting, timing of construction and operations, markets and marketing products and certain other factors or information. Such statements represent Jervois' current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by Jervois, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. Jervois does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Metric tonnes per annum.

2 At current USD/BRL exchange rate of 4.95.

Copyright (c) 2022 TheNewswire - All rights reserved.