October 06, 2024

Lightning Minerals (L1M or the Company) is pleased to announce the start of a targeted infill soil sampling program at its Dundas lithium project in Western Australia. The program is designed to infill the existing geochemistry program which was completed on a grid spacing of 400m x 400m and will consist of approximately 500 samples.

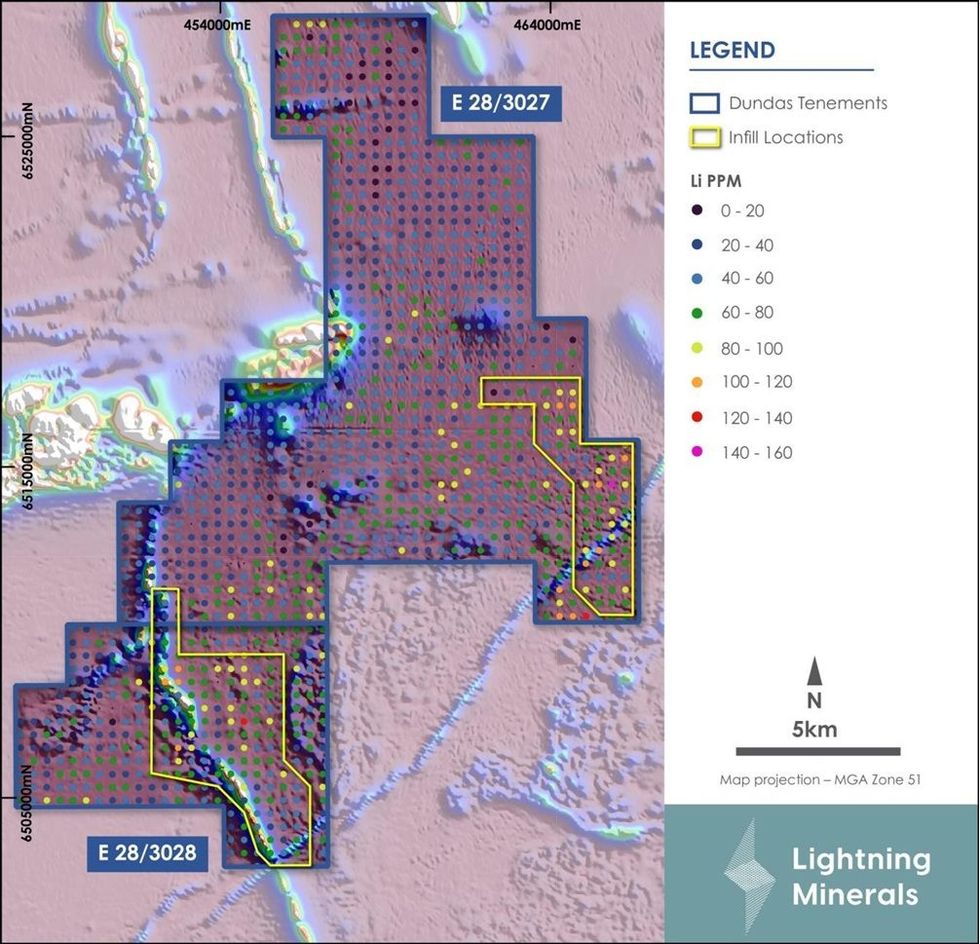

A number of areas of interest were identified in the previously completed regional soil sampling program, particularly on Dundas North tenements E28/3027 and E28/3028 where broad lithium in soil anomalism was identified across an area of 35km2 and up to 147ppm Li1.

HIGHLIGHTS

- Infill soil sampling program of ~500 samples to further test previously identified lithium in soil anomalism of up to 147ppm Li1

- Dundas North tenements to be tested across three large lithium targets up to 35km2, as identified in March 2023. Sampling to be completed down to granularity of 200m x 100m in some areas

- On-ground works at the Company’s Brazil lithium projects in Lithium Valley is in progress with results expected imminently

Lightning Minerals Managing Director Alex Biggs said, “It’s good to be getting back to our works at Dundas following a period of review. We are focusing on areas of interest that have been previously identified as containing lithium in soil anomalism. Our work program is focused and targeted and will allow us to identify appropriate drill targets for a future exploration program. The infill soil sampling on our Dundas North tenements is of particular interest as it allows for us to develop higher confidence drill targets across the project areas. As much as our focus is on Brazil and our accelerated exploration on those projects it is important that we further our efforts at Dundas also particularly as we have gained significant knowledge of the region since our works began there in 2022. The Company now possesses lithium exploration potential in three of the strongest jurisdictions globally for the commodity which sets us up well for success as we move forwards.”

Dundas North Infill Soil Sampling

Phase 1 soil sampling was completed during Q1 and Q2 of CY2023 with samples collected on a nominal 400m x 400m grid across the tenements, with analysis completed by LabWest Minerals Analysis (LabWest). Analysis utilised the Ultrafine + (UFF+) method with chemical analysis for a suite of 62 elements including lithium and associated pathfinders typically used for identification of lithium-caesium-tantalum (LCT) mineralisation.

The tenor of background lithium level within the project area and the Mt Belches lithological unit appears to be approximately 40-60ppm lithium. The elevated zones returning multiple samples with values above 80ppm lithium and up to a peak result of 147ppm lithium. Results are thought to provide sound vectors toward potential mineralisation as the elevations are clustered and are proximal to suitable granitic protoliths within the ‘goldilocks zone’ for LCT pegmatite mineralisation. The ‘goldilocks zone’ is typically estimated to be between 2km and 10km from the source granitic body.

This geological setting therefore requires follow up exploration works to ascertain the source of the anomalies and forms the basis of the infill soil sampling program as shown in Figure 1. Infill sampling will be completed down to a granularity of 200m x 100m.

Dundas South Infill Soil Sampling

Soil sampling will also be undertaken at the Dundas South project area following up zones of interest identified by the regional soil program. Grids of differing resolutions will be completed across tenements E63/2028, E63,1932, E15/1748 and E63/1993 down to a minimum of 200m x 200m. Targeting criteria in these areas focus mainly on existing results for lithium and its pathfinder elements identified during the reginal program (as reported in ASX Announcement 23 March 2023), but also aim to assess gold/nickel potential as the genetic models can share attributes regarding lithologies, geochemistry and rheology. The planned sites are shown on Figure 2 below, modifications may be undertaken in the field as guided by the supervising geologist.

Click here for the full ASX Release

This article includes content from Lightning Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

L1M:AU

The Conversation (0)

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00