October 08, 2023

Impact Minerals Limited (ASX:IPT) is pleased to announce that the Company has adopted an Environmental, Social, and Governance (ESG) framework with 21 core metrics and disclosures created by the World Economic Forum (WEF).

Highlights

- Impact Minerals Limited has commenced disclosing Environmental, Social, and Governance (ESG) metrics

- Disclosures are made using the World Economic Forum Stakeholder Capitalism ESG framework

- Engagement of Socialsuite technology platform ESG Go for disclosing and monitoring progress

- Impact Minerals has set quarterly ESG actions and to release baseline ESG disclosure report

Managing Director, Dr Mike Jones said:

Impact Minerals is committed to building legitimate Environmental, Social, and Governance (ESG) credentials and we are now commencing ESG reporting as a tangible first step on our ESG journey. This is of increasing importance to us and to all of our stakeholders as we move along the path towards production from our Lake Hope High Purity alumina project here in Western Australia over the next few years.

We believe the Lake Hope project is already demonstrating strong ESG credentials, given the material is free- digging, and can be trucked off-site for processing at an established industrial site, leaving a very small environmental footprint compared to conventional mining. In addition, we have already received heritage clearance for the area to be mined from the Ngadju Peoples with whom we have an excellent relationship.

The ESG framework we have adopted, which will be applied throughout our entire project portfolio, will enable us to better identify material risks going forward, leading to better-informed decisions and business outcomes. Our commitment to ESG will also create a consistent and measurable approach that helps us contribute to the betterment of our communities both locally and globally.

We have adopted Socialsuite’s “ESG Go” as a best-in-class solution to start ESG reporting within a structured, standardised, and globally recognised solution that makes WEF framework accessible and operational. We look forward to sharing our ESG journey and reporting on our progress against the WEF framework.

ABOUT ESG REPORTING

The context in which the Company operates has been transformed by climate impact, nature loss, and social unrest around inclusion and working conditions. This new global environment is challenging the traditional expectations of corporations and redirecting investment capital. Global sustainable investment now tops $30 trillion, up 68% since 2014 and tenfold since 2004.

Impact Minerals Limited is charting a course to build resilience and enhance our social licence through a greater commitment to long-term, sustainable value creation that embraces the wider demands of people, planet and shared prosperity.

UNIVERSAL ESG METRICS

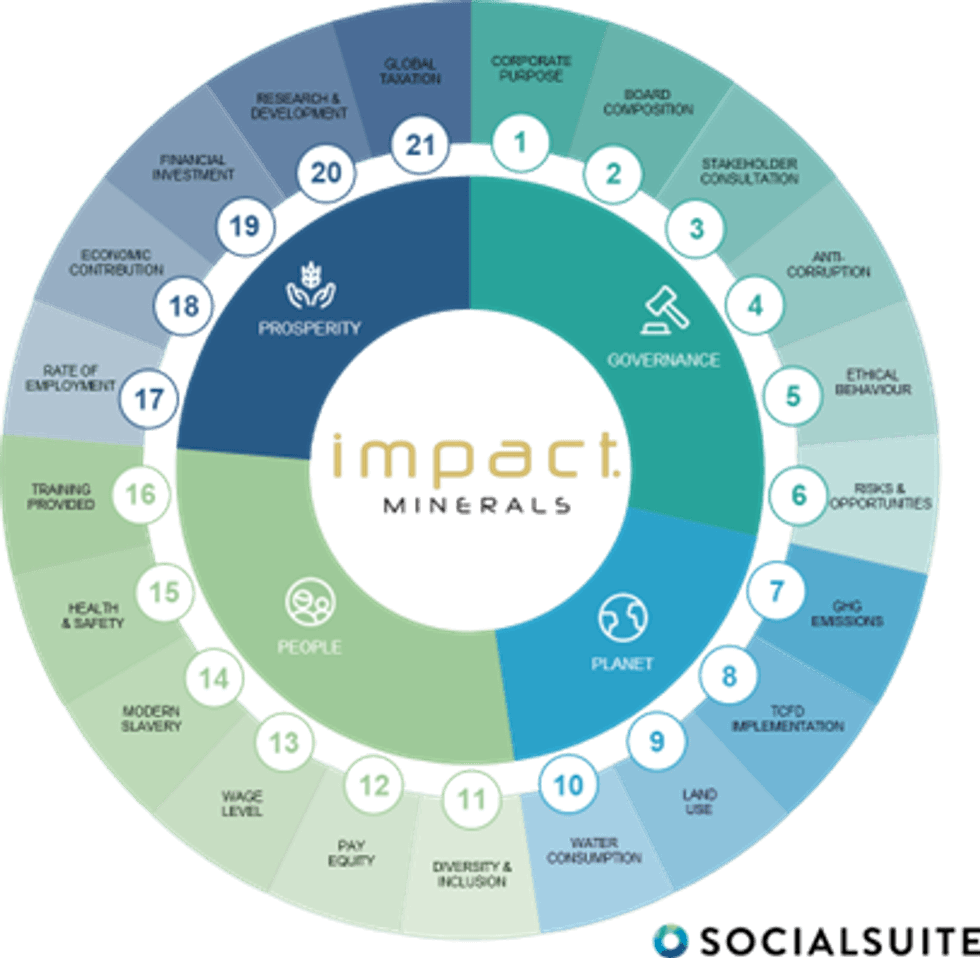

Impact Minerals Limited has commenced ESG reporting by making disclosures against the World Economic Forum Stakeholder Capitalism framework. The WEF framework is a set of common metrics for sustainable value creation captured in 21 core ESG disclosures (Figure 1). The Board of Impact Minerals Limited has resolved to use this universal ESG framework to align mainstream reporting on performance against ESG indicators.

Impact Minerals Limited sees the WEF Stakeholder Capitalism Metrics as the most appropriate ESG disclosure framework to start its ESG journey. The Stakeholder Capitalism framework leverages a variety of existing frameworks and is intentionally built to be a stepping stone to begin building capacity and capability in ESG reporting. It enables Impact Minerals Limited to report on core ESG matters of governance, anti-corruption practices, ethical behaviour, human rights, carbon emissions, land use, ecological sensitivity, water consumption, diversity and inclusion, pay equality and tax payments.

By including ESG metrics in mainstream reporting and integrating them into governance, business strategy, and performance management processes, Impact Minerals Limited sets out to demonstrate that it diligently considers all pertinent risks and opportunities in running its business. Impact Minerals Limited will demonstrate an ongoing commitment to ESG by sharing its progress toward ESG disclosures in regular updates.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

20h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

20h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

21h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

21h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00