June 18, 2024

ASX-listed emerging mid-tier gold mining company Horizon Minerals (ASX:HRZ) focuses on a portfolio of highly promising gold projects in the world-class Western Australian goldfields. The company's near-term cash-flow potential and significant land package in the prolific Western Australian Goldfields position the company to positively leverage the current bull gold market opportunity.

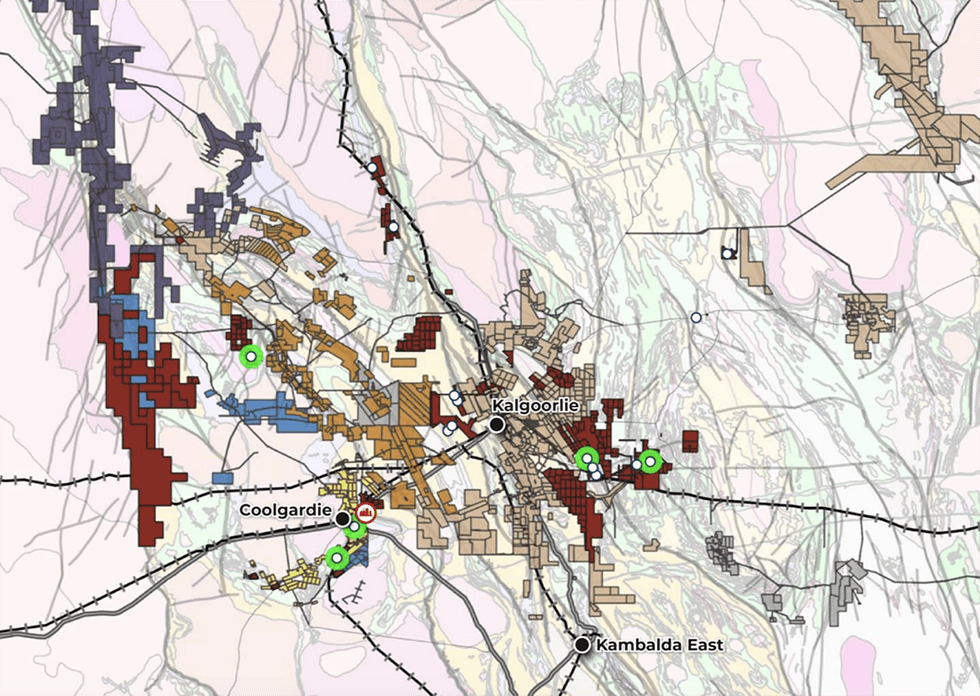

Horizon Minerals' recent merger with Greenstone has added nearly 0.5 million ounces (Moz) of high-grade resource to Horizon, taking its total tally to 1.8 Moz, and will result in Horizon Minerals holding a land package of 939 sq km in the Kalgoorlie-Coolgardie district.

The merger brings near-term cash-generating opportunities and adds greater scale to its baseload assets (Boorara) with the high-grade Burbanks deposit. Horizon’s dual-track strategy involves generating immediate cash flows by leveraging a pipeline of development-ready production assets and concurrently advancing the cornerstone assets, Boorara and Burbanks, which have a combined resource inventory of 914 koz at 1.7 grams per ton (g/t) gold with potential to support a profitable, long-life operation.

Company Highlights

- Horizon Minerals is an emerging mid-tier gold producer with an extensive portfolio of highly promising gold projects located in the world-class Western Australian goldfields.

- The recently announced merger with Greenstone Resources will establish Horizon as a mid-tier gold producer in the Western Australian Goldfields. The combined entity will boast a resource base of 1.8 Moz and enhance Horizon’s portfolio by combining two complementary cornerstone gold assets — Burbanks and Boorara (combined resource of 914,000 oz).

- Horizon is also progressing with other projects, including the Cannon and Penny’s Find underground mines, and bringing the Boorara open pit into production.

- Amidst the current record gold prices, Horizon seeks to capitalize on this opportunity by advancing its substantial resource endowment towards development, thereby generating cash flow.

This Horizon Minerals profile is part of a paid investor education campaign.*

Click here to connect with Horizon Minerals (ASX:HRZ) to receive an Investor Presentation

HRZ:AU

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

21 August 2025

Horizon Minerals

Emerging stand-alone gold producer in Western Australia

Emerging stand-alone gold producer in Western Australia Keep Reading...

25 February

Share Purchase Plan

Horizon Minerals (HRZ:AU) has announced Share Purchase PlanDownload the PDF here. Keep Reading...

18 February

Successful A$175M Capital Raising

Horizon Minerals (HRZ:AU) has announced Successful A$175M Capital RaisingDownload the PDF here. Keep Reading...

17 February

Studies Support Standalone Gold Development in WA Goldfields

Horizon Minerals (HRZ:AU) has announced Studies Support Standalone Gold Development in WA GoldfieldsDownload the PDF here. Keep Reading...

17 February

Gold Ore Reserve Update

Horizon Minerals (HRZ:AU) has announced Gold Ore Reserve UpdateDownload the PDF here. Keep Reading...

16 February

Trading Halt

Horizon Minerals (HRZ:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Horizon Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00