July 31, 2022

Results of up to 1.91% Li2O just 4km from Pilbara Minerals’ Pilgangoora lithium-tantalum mine; Drilling being planned for September

Kairos Managing Director, Dr Peter Turner said: “The high-grade lithium results, combined with the confirmation of spodumene mineralogy, is a very exciting development.

Highlights

- Five pegmatite samples from the Lucky Sump prospect at Mt York have returned exceptional assays including:

- 1.91% Li2O & 103 ppm Ta (MYR393)

- 1.56% Li2O & 115 ppm Ta (MYR401)

- 0.58% Li2O & 167 ppm Ta (MYR396)

- The spodumene-bearing pegmatite samples were discovered during routine earthmoving activities next to the flagship Mt York gold deposit

- The spodumene pegmatites are part of a larger interpreted dyke swarm at Mt York

- Planning underway to RC drill-test large area of Lucky Sump

“In light of these exceptional results, we plan to expedite planning to drill all of Lucky Sump. We intend to test the entire interpreted pegmatite dyke swarm, which is under cover, with the first RC drilling anticipated in September.

“We are in a Tier 1 destination for spodumene pegmatite projects with two world-class Li-Ta deposits (ASX:PLS, ASX:MRL) in the neighbourhood and we have demonstrated that we have the right fertile geology for significant Lithium-Caesium-Tantalum (LCT) pegmatite discoveries”.

Figure 1. Kairos Geologist Campbell Watts holding a piece of spodumene-bearing pegmatite (MYR393 – 1.91% Li2O) discovered at ‘Lucky Sump’ during routine earth moving activities.

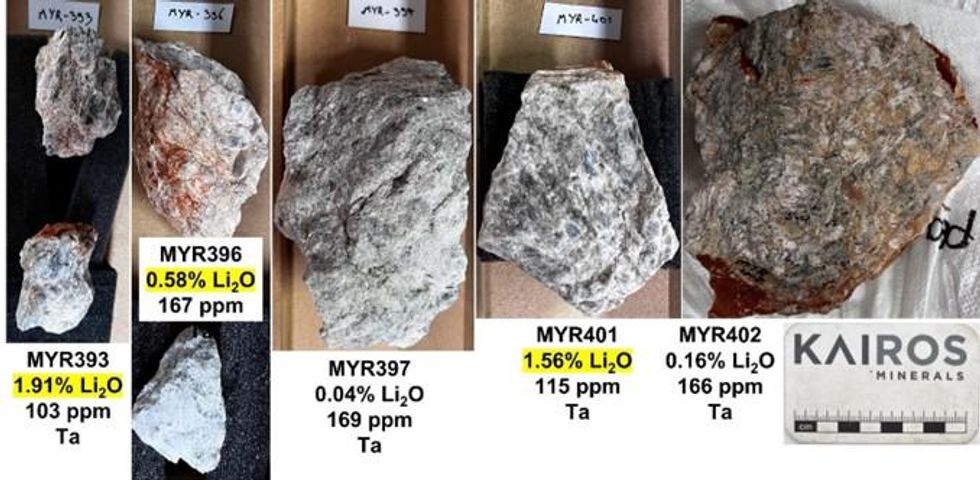

Five samples of pegmatites that were analysed by hyperspectral and XRD methods confirming the presence of spodumene mineralogy (see KAI Announcement dated 12 July 2022), were submitted to NAGROM Laboratories in Perth for chemical analysis. Photographs of the pegmatites are shown in Figure 2.

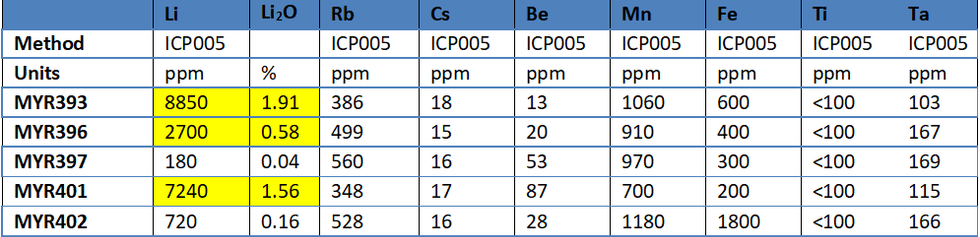

The samples were crushed and pulverised and a 200g subsample selected for Na-peroxide fusion with hydrochloric acid digestion. This method was selected as it is considered to be a complete dissolution of all resistate minerals they may contain the selected elements of interest. The analysis of the samples was conducted using inductively couple plasma mass spectrometry (ICP-MS) with the elements Li, Rb, Cs, Be, Mn, Fe, Ti and Ta selected. The results are shown in Table 1.

Table 1. Assay results from NAGROM Laboratory, Perth. Conversion of Li ppm results to Li2O involves a two-step process to divide the Li ppm result by 10,000 (conversion to Li %) and multiplying Li % by 2.153 to obtain the Li2O equivalent. Method ICP005 refers to NAGROM’s Inductively coupled plasma mass spectrometry analysis code.

Figure 2. Lucky Sump pegmatite samples showing lithium and tantalum results.

Click here for the full ASX Release

This article includes content from Kairos Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

KAI:AU

The Conversation (0)

14 February 2022

Kairos Minerals

Developing Highly Prospective Gold Projects in a World-Class Gold District

Developing Highly Prospective Gold Projects in a World-Class Gold District Keep Reading...

18h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

18h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

21h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00