March 13, 2023

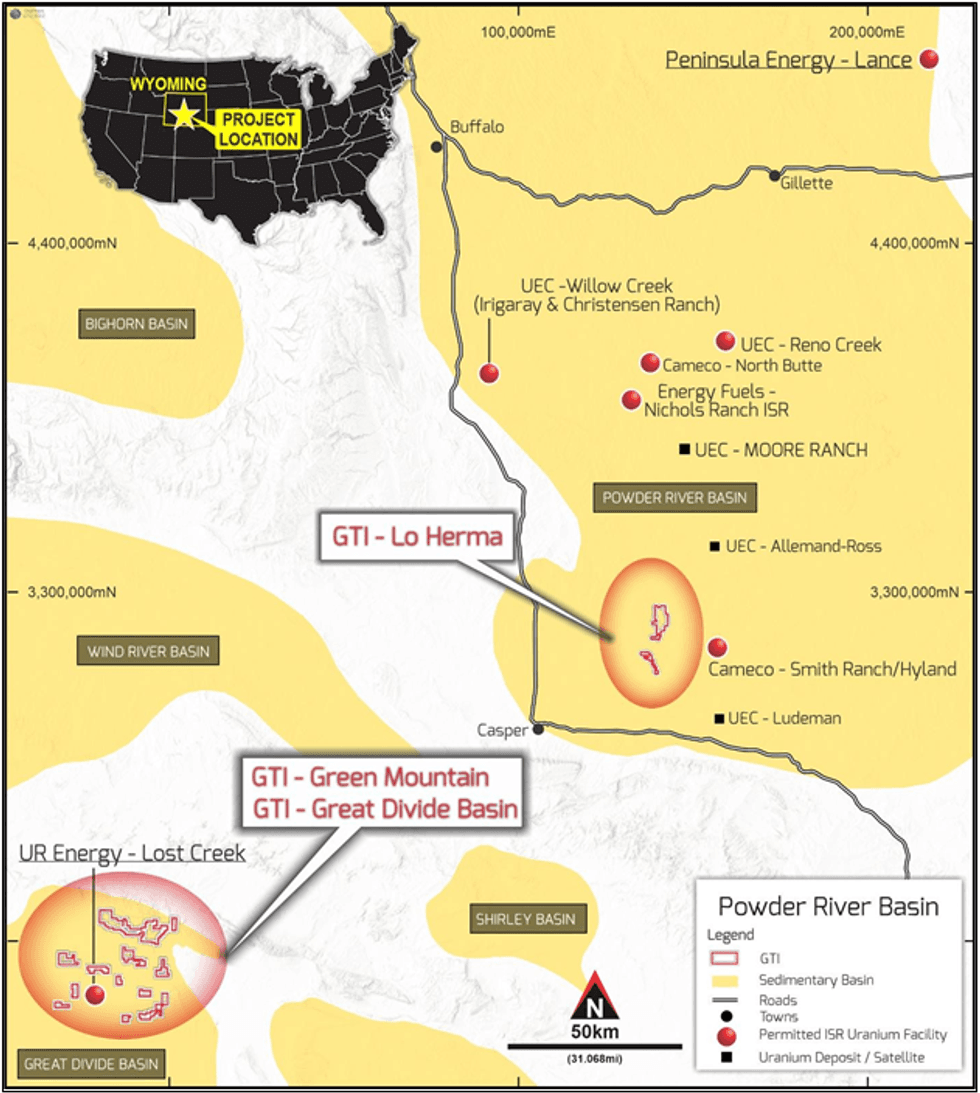

GTI Energy Ltd (GTI or Company) is pleased to advise that it has secured a material historical data package (the Data) for its newly staked Lo Herma Project, in Wyoming’s prolific Powder River Basin uranium district (Figures 1 & 2) (Lo Herma or Project).

Highlights

- Historical drilling data with an estimated replacement value of ~$15million1 acquired for Lo Herma including drill logs for 1,445 drill holes (~530,000 ft) representing 7 x the holes, & ~5 x the footage, drilled by GTI to date in Wyoming

- Drill logs acquired demonstrate sandstone hosted uranium mineralisation with economic potential in the Powder River Basin’s productive Fort Union formation

- GTI believes sufficient historical data may exist to report an inferred mineral resource for Lo Herma by the end of Q2, without further drilling

- Lo Herma is a significant land position with ~8,000 acres in Wyoming’s prolific Powder River Basin, ISR uranium district

- Project is located 10 miles from Cameco’s Smith Ranch-Highland ISR uranium plant (largest production site in Wyoming) & within 100 miles of Peninsula Energy (PEN) & Ur-Energy (URE) who both plan to be back in production by April 2023

- 5 permitted ISR uranium production facilities & several satellite uranium deposits are located within ~50 miles of Lo Herma

- Commitments received for a $2.3m placement to fund Lo Herma’s development

LO HERMA PROJECT – LOCATION & BACKGROUND

Lo Herma is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock (WY) and within ~50 miles of five (5) permitted ISR uranium production facilities. These facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant (Figure 1). The Powder River Basin has extensive ISR uranium production history and has been the backbone of Wyoming uranium production since the 1970s.

Cameco’s Smith Ranch-Hyland operation (with mineralisation hosted in the Fort Union Formation) has been the largest uranium production contributor, by a significant margin, in recent times (see ASX release 21 February 2023).

GTI Executive Director Bruce Lane commented “We are delighted that we have secured a comprehensive historical drilling data package for the Lo Herma Project. The project area was extensively drilled during the 1970’s and we estimate that it would cost GTI around $15 million and take a number of drilling seasons to replicate. The data will vastly improve our understanding of the project and is likely to dramatically accelerate progress towards reporting a uranium resource at Lo Herma – we believe that an inferred JORC mineral resource estimate may be reported at Lo Herma, without drilling, before the end of June this year. This would set GTI up for verification drilling during the Wyoming summer. We’re excited by the prospect of potentially being able to deliver a uranium resource in Q2 at the Project in Wyoming’s most prolific production district. This is in addition to the resource definition work underway at our Great Divide Basin project, which is on track for a maiden resource report by the end of Q1. This comes at` a time when market fundamentals for uranium continue to improve, especially for Wyoming producers”.

LO HERMA HISTORICAL DATA SUMMARY

The Data was a product of drilling conducted by Pioneer Nuclear, in joint venture with Texas Gulf, during roughly a decade between 1970 and 1980. The Data was acquired for US$950,000 from an independent 3rd party, not related to GTI, and consists of:

- 1,800 paper drill logs (~657,000 feet of drilling), 1,445 (~530,000 feet) of which are assessed to pertain to the Lo Herma Project area, variously including downhole geophysical and lithological logs with geophysical probe calibration for all logs. The package also includes some gamma calculation records and some downhole deviation drill hole deviation data;

- drill maps including overall maps at 1”=2,000 ft scale maps with historic claims. There are also 1”=200 ft scale drill maps with hole locations for the areas drilled and 1”=50 ft scale maps for areas of close spaced drilling with mineralized intercepts posted;

- a single report, prepared by Pioneer Nuclear in 1979, on ground water hydrology that includes maps showing the projected water table for the C1, C2, & C3 mineralised horizons. The report includes a summary table of estimated mineral resources; and

- Some limited data on radiometric equilibrium and some core assay sheets identified by sample number rather than hole number and depth.

The available Data is original and GTI believes that it includes the necessary information to develop a drill database suitable for preparation of a current mineral resource estimate.

The Data is believed to be of sufficient quality to potentially allow for interpretation of the data via digitization of the original logs and converting the counts per second (CPS) analog data to equivalent uranium grade (eU3O8).

Preliminary due diligence indicates that, if the drill Data were current, the drill spacing and continuity could potentially allow for resource estimation in modern categories of indicated and inferred mineral resources. Initially, if any mineral resources are able to be estimated, the resources would most likely need to be reported as inferred given the historic nature of the data. If subsequent verification is completed, by re-logging (if possible) or twinning a representative number of drill holes, this could allow re-classification of the mineral resources based on drill spacing and continuity as appropriate. The Company acknowledges that any potential resource estimate is qualified by the current deficiencies in the Data including but not limited to a lack of disequilibrium data, location surveys, & definition of the ground water regime – GTI’s initial plans are to generate this data during the coming months through further fieldwork & potentially drilling.

LO HERMA DATA PACKAGE NEXT STEPS

GTI has commenced taking the steps necessary to convert the drill data to a modern electronic database including scanning and digitization of the drill logs before converting the digital data (½ foot data in CPS) into equivalent uranium grade eU3O8. The geophysical logs will also be correlated with the lithological information to separate the ½ foot data into correlatable mineralized horizons. In addition, drill maps will be scanned & digitized to estimate drill hole coordinates & digital elevation models (DEM) will be acquired from public sources to project elevations for the drill holes. Field verification will follow by surveying a representative number of the drill holes.

The Company also plans to complete a drill verification program in the future, including coring and analyses to determine disequilibrium conditions. This program is also expected to incorporate a hydrological investigation of the project focusing on the hydrostatic head available for each mineralized horizon and an ariel geophysics survey.

The Company will provide further updates on progress in evaluating the data in due course.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

4h

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00