April 29, 2022

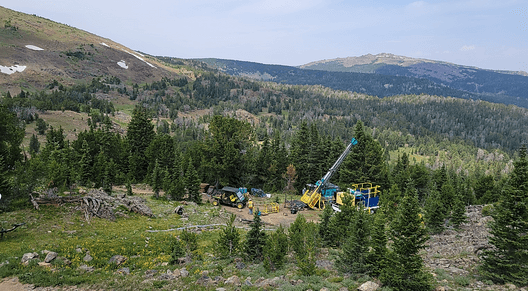

Group Ten Metals (TSXV:PGE, OTCQB:PGEZF, FWB:5D32) is a Canadian mineral exploration company focused on advancing its large-scale flagship Stillwater West platinum, palladium, nickel, copper, cobalt and gold project in Montana, USA.

The project is located in the iconic Stillwater Complex of Montana, USA, a rare world-class magmatic system that is geologically similar to the Bushveld Complex in South Africa, which hosts the Flatreef, Mogalakwena, and Waterberg deposits, as well as numerous high-grade platinum deposits within the Merensky and UG2 reefs. Group Ten Metals holds additional district-scale secondary assets which it is seeking to monetize. The company recently announced an earn-in deal on its Black Lake-Drayton project, a high-grade gold project located in Ontario, Canada. Black Lake-Drayton is situated in the Rainy River gold district which hosts major mines and projects in an area that has expanded rapidly since the 1990s including several recent discoveries.

Company Highlights

- Group Ten Metals has the second-largest landholding in the Stillwater Complex in Montana, USA, adjacent to Sibanye-Stillwater’s mine complex.

- The company’s 100 percent-owned flagship Stillwater West project is district-scale in size, covering a rare and world-class magmatic system that hosts five minerals that are listed as critical by the US government.

- The Stillwater West project features Platreef-style deposits of battery and precious metals with exceptional expansion potential, and also high-grade gold.

- Stillwater West has a significant inferred NI 43-101 mineral resource estimate of 2.4 million ounces of palladium, platinum, rhodium and gold as well as 1.1 billion pounds of nickel, copper and cobalt.

- Group Ten Metals recently announced a deal whereby Heritage Mining may earn a 90% interest in the company’s Black Lake-Drayton gold project in the prolific Rainy River gold district in Ontario, Canada, by meeting specific exploration, development, and payment requirements.

- The company’s wholly-owned Kluane project is a district-scale, highly prospective platinum-group element, nickel and copper project located beside one of the largest undeveloped PGE-Ni-Cu deposits in the world in the Kluane mafic-ultramafic belt in Yukon, Canada.

- Group Ten Metals’ exploration and development team has extensive experience in top-tier districts such as the Stillwater and Bushveld districts.

- The company is well capitalized and fully permitted, with no debt.

The Group Ten Metals company profile is part of a paid investor education campaign.*

PGE:CA

The Conversation (0)

20 January

Top 3 ASX Cobalt Stocks (Updated January 2026)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to demand for EVs. The EV market may be facing headwinds now, but the... Keep Reading...

19 January

Cobalt Market Forecast: Top Trends for Cobalt in 2026

Cobalt metal prices have trended steadily higher since September of last year, entering 2026 at US$56,414 per metric ton and touching highs unseen since July 2022. The cobalt market's dramatic reversal began in 2025, when it shifted from deep oversupply to structural tightness after a decisive... Keep Reading...

19 January

Top 5 Canadian Cobalt Stocks (Updated January 2026)

The cobalt market staged a dramatic turnaround in 2025, lifting sentiment across equity markets after years of oversupply and near-record price lows. Early in the year, the Democratic Republic of Congo’s (DRC) decision to suspend cobalt exports sparked a major price rebound, with benchmark metal... Keep Reading...

13 January

Cobalt Market 2025 Year-End Review

The cobalt market entered 2025 under pressure from a prolonged supply glut, but the balance shifted sharply as the year unfolded, due almost entirely to intervention from the Democratic Republic of Congo (DRC).After starting the year near nine year lows of US$24,343.40 per metric ton, cobalt... Keep Reading...

31 October 2025

Top 5 Canadian Cobalt Stocks (Updated October 2025)

Cobalt prices regained momentum in the third quarter of 2025 as tighter export controls from the Democratic Republic of Congo (DRC) fueled expectations of a market rebound. After languishing near multi-year lows early in the year, the metal surged to US$47,110 per metric ton in late October, its... Keep Reading...

27 October 2025

Top 3 ASX Cobalt Stocks (Updated October 2025)

Cobalt is used in a wide variety of industrial applications, with lithium-ion batteries for electric vehicles (EVs) and energy storage systems as the largest demand segment. As an important battery metal, cobalt's fate is tied to EVs. While EV demand may be facing headwinds now, the long-term... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00