- WORLD EDITIONAustraliaNorth AmericaWorld

What Was the Highest Price for Silver?

What Was the Highest Price for Gold?

4 Platinum Uses for Investors to Know

Overview

Nevada is a well-established and stable mining jurisdiction that’s known for its excellent infrastructure. Unsurprisingly, mining is one of Nevada’s top export categories due to its significant deposits of gold, silver, copper and molybdenum. In 2020 alone, the state produced 5,082,682 ounces of gold and 6,722,622 ounces of silver.

Nevada is home to several active gold mines, including Barrick Gold (TSX:ABX) and Newmont’s (TSX:NGT) Nevada Gold Mines, the single largest gold-producing complex in the world. Also in Nevada is Hecla Mining (NYSE:HL), with several operations including the Midas mine and mill, the largest known silver-gold epithermal deposit along the Northern Nevada Rift in the Midas mining district. As such, gold exploration companies in Nevada may present an intriguing opportunity for investors.

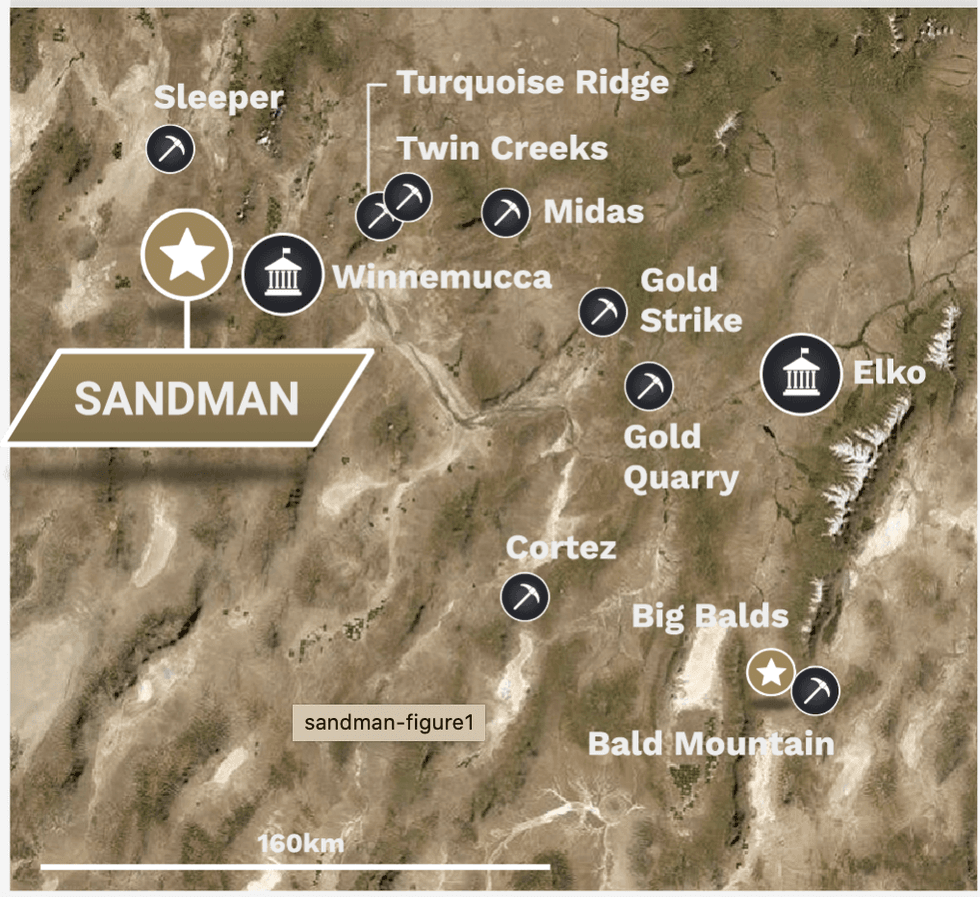

Also located in the prolific Northern Nevada Rift is Gold Bull Resources’ Sandman Project. Gold Bull Resources (TSXV:GBRC, OTC:GBRCF, FRA:A2V5) is a mineral exploration company focused on developing a portfolio of highly prospective gold assets in Nevada. The company is fully permitted and fully funded to advance its two fully-owned projects that are located within prolific gold trends. Gold Bull Resources’ operations are guided by its core ESG values that emphasize environmental responsibility and commitment to stakeholders.

Gold Bull Resources’ methodology using Leapfrog 3D Software and QGIS integrates all the previous generations of work, and Gold Bull CEO Cherie Leeden shared, “We're stepping back and looking at things a little differently.” Leeden says that this concept of basement targets has enabled success in finding nearby deposits in Nevada yet this zone has never been drilled at the Sandman property before. Fortunately for Gold Bull, the company inherited Newmont’s Plan of Operation allowing for comprehensive exploration access and expanding drill targets across 500 acres without having to apply for additional permits.

Since acquiring the Sandman project from Newmont in October 2020, Gold Bull Resources has significantly updated the resource in the project which now has an indicated resource of 18,550,000 tonnes at 0.73 g/t of gold for contained gold of 433,000 ounces, as well as an updated inferred resource of 3,246,000 tonnes at 0.58 g/t of gold for contained gold of 60,800 ounces. The maiden drill program at the Abel Knoll resource intersected 144.8m at 1.67 g/t gold, including 6.1m at 10.75 g/t gold.

Gold Bull Resources’ other project, Big Balds, is 100 percent owned and located at the intersection of two prolific gold trends –– the Carlin and Bida Trends. Although the project has never been drilled, the company believes that it is prospective for the world-class mineralization typically seen in the Carlin and Bida Trends.

Gold Bull Resources’ assets leverage strategic positioning near multiple operating mines. The Sandman project is located near the Sleeper mine that was operated by AMAX Gold from 1986 to 1996 and produced 1.66 million ounces of gold and 2.3 million ounces of silver. Meanwhile, the Big Balds project is located less than 10 kilometers west of Kinross Gold’s (TSX:K) Bald Mountain operating mine which features 300 million tonnes at 0.6 g/t for 5.5 million ounces of gold.

The company has recovered exceptional metallurgical results, including an average of 88 percent of gold recovered from oxide material with a maximum of 97 percent of gold recovered from a bottle roll leach test on a target at Sandman. The results also identified recovered silver that revealed potential upside for the element. The metallurgical results are consistent with prior historical tests which are encouraging for future yields.

“We’re not looking to mine the market, we’re looking at projects that we can get into production,” said Gold Bull Resources CEO Cherie Leeden.

Currently, the company is focused on advancing its Sandman project. Gold Bull plans to increase the existing resource at the Sandman project through a 4,000 meter RC drilling program that is already underway. Gold Bull Resources is also progressing its project pipeline with plans for the maiden drill program on the Big Balds project with minimal capital investment for high risk and high reward. The company is also exploring the potential for new low-cost mergers and acquisitions that contain additional existing gold resources.

The company is led by an elite management team with a track record of successful acquisitions, mine discovery and mine development. Gold Bull Resources’ team consists of several former management members of multiple major mining companies, including Rio Tinto, BHP, Newcrest and Barrick Gold. The company’s team also boasts local knowledge of the area with the resources needed to bring its assets into production.

Company Highlights

- Gold Bull Resources (TSXV:GBRC, OTC:GBRCF, FRA:A2V5) is developing a portfolio of fully-owned and highly prospective gold assets in Nevada, USA.

- The company is fully permitted and fully funded to advance its flagship Sandman project in the prolific Northern Nevada Rift and its Big Balds project in the prolific Carlin and Bida Trends.

- The Sandman project has an updated indicated resource of 18,550,000 tonnes at 0.73 g/t of gold for contained gold of 433,000 ounces.

- The company released the results of the Sandman Scoping Study on September 12, 2022, which has identified a stand-alone, low-cost, start-up heap leach gold opportunity, and has filed an independent preliminary economic assessment on October 27, 2022.

- Gold Bull Resources’ assets are positioned near multiple gold-producing mines with multi-million-ounce resources, including the AMAX Gold Sleeper mine and Kinross Bald Mountain mine.

- The company has a tight share structure, compelling valuation and no debt.

- The company is led by an elite management team consisting of several former management members of multiple major mining companies, including Rio Tinto, BHP, Newcrest and Barrick Gold.

Get access to more exclusive Gold Investing Stock profiles here